Even in 2025-2026, when most people transfer money online, the HDFC RTGS request form continues to be one of the most important documents for customers who choose to process the transaction physically, directly from the branch only.

It feels safer side with proof of transactions with slips and receipts. When you submit the form, the bank stamps and returns the customer copy.

Most companies only use RTGS via physical because it has signed a hard copy for internal approval. Not all customers use online banking. Senior citizens, rural users, or individuals without digital access. For all requirements, you have to obtain the RTGS application form from HDFC. Fill out and give to the branch counter.

Intro: HDFC NEFT/RTGS Request Form

HDFC RTGS/NEFT form is a single-sheet Application; it is available in more than 10+ languages, enabling bigger transactions via RTGS and smaller transactions via NEFT mode. You can use it for both payments; no need for multiple forms.

You can get in –

- Assamese

- Bengali

- Gujarati

- Hindi

- Kannada

- Kashmiri

- Konkani

- Malayalam

- Manipuri

- Marathi

- Mizo

- Odia

- Punjabi

- Tamil

- Telugu

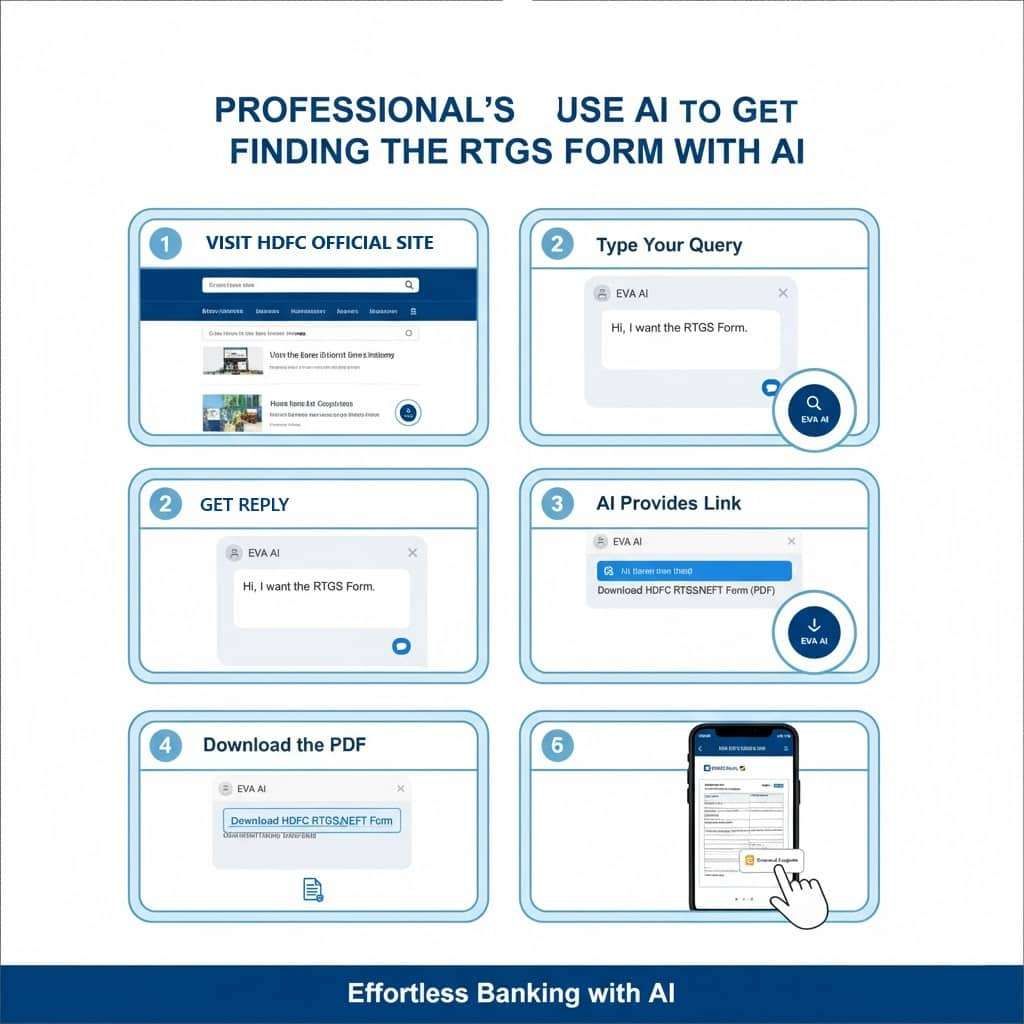

How to Use AI to Get the RTGS Form

HDFC makes finding the form online easier than ever — you can use AI EVA or chatbots to instantly generate or locate the HDFC RTGS/NEFT form. Here are the steps –

- First, visit the official HDFC Bank website → open the chatbot or search bar. (both powered by EVA AI)

- Now, type – Hi, I want the RTGS Form.

- The AI will provide you with the direct official downloadable link from the HDFC portal.

- Tap on the PDF, and now you can download it.

Other Ways to Download the HDFC RTGS Application PDF

There are alternative options to get the HDFC RTGS/NEFT form:

| Option | How to Access | Details + Link |

|---|---|---|

| Official HDFC Website | Go to www.hdfcbank.com, on the footer, open the form centre for personal banking, navigate to the common request section, and get your form. | Download the combined RTGS/NEFT Request Form (PDF) |

| Hindi Version PDF | Ask with HDFC AI Chatbot, Or use this direct link – | HDFC Agency RTGS NEFT Application Form Hindi PDF |

| Branch Visit | Most branches only accept the RTGS-enabled branch-issued application form. You can visit your branch and get it from the counter or a bank officer. They also help with what additional documents you will need to attach. | Available in printed format for immediate use |

How to Get the HDFC Editable / Fillable RTGS Form (PDF)

If you are looking for a direct online editable RTGS Form, you can use this officially formatted and editable version –

| Type | File Name | Download Link |

|---|---|---|

| Editable PDF Form | HDFC_RTGS_NEFT_Fillable.pdf | Original HDFC RTGS Fillable PDF |

How to Use the Editable PDF

- First, just open it using the link.

- Tap the download icon or print button (top right) to make it editable for you.

- Once saved, open it in any web browser, such as Google Chrome or Microsoft Edge.

- You will see blue boxes where you can type your details directly.

- After filling, press Ctrl + P → Save as PDF to lock in your data. You can directly print it or save it.

- This editable format makes it easy to reuse the same document for future RTGS or NEFT transfers — just change the beneficiary name, amount, and date.

Note: You may need a PC or Laptop web browser to use it; most smartphone browsers do not support it. you can use Desktop Google Chrome for best use.

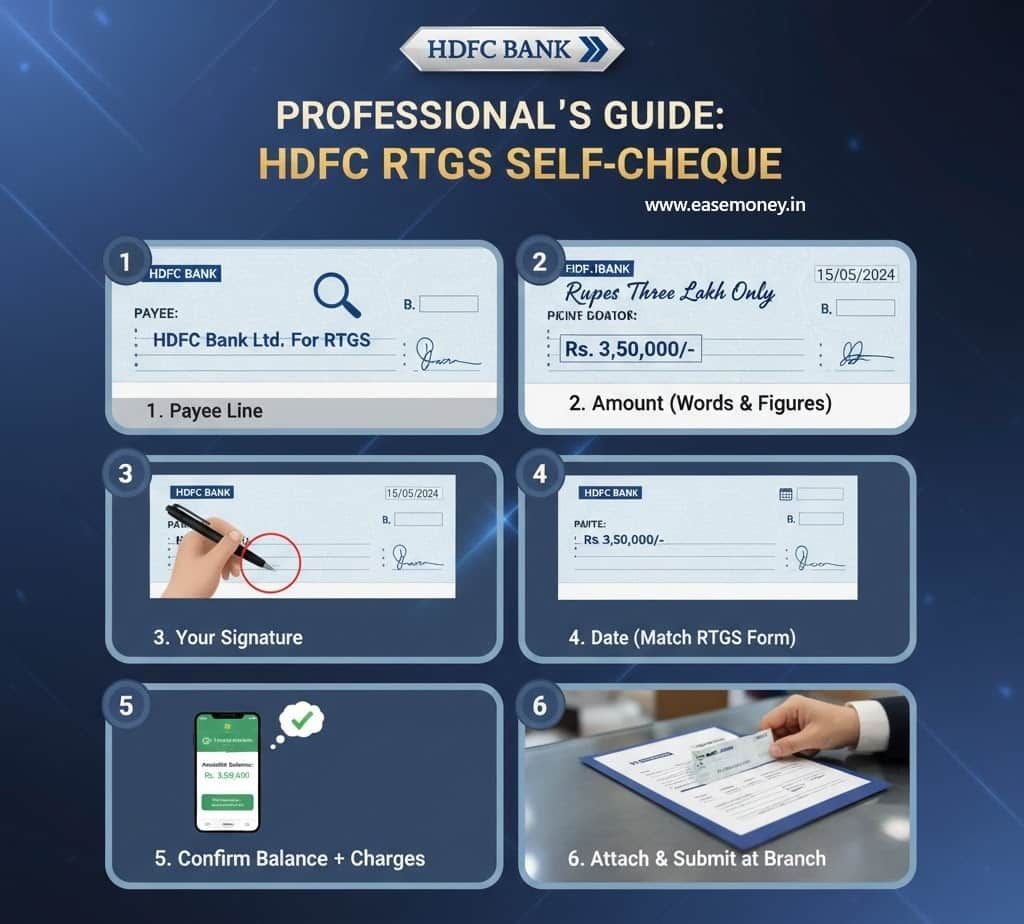

How to Write a Self-Cheque for RTGS

Before filling up the RTGS Form, you may need a cheque leaf. Most HDFC branches require a self-cheque along with your RTGS form — this allows the debit of funds from your account.

Steps to Write a Self-Cheque for HDFC RTGS –

- On the Payee line, write down: → “HDFC Bank Ltd For RTGS”

- Write the amount in words and figures (such as “Rupees Three Lakh Only” + “Rs. 3,50,000/-“).

- Now, put Sign at the bottom right with your registered signature.

- Mention the same date as on the RTGS form.

- Confirm first that your account has the required balance + additional charges and GST.

Attach this cheque to the RTGS form when submitting it at the branch counter.

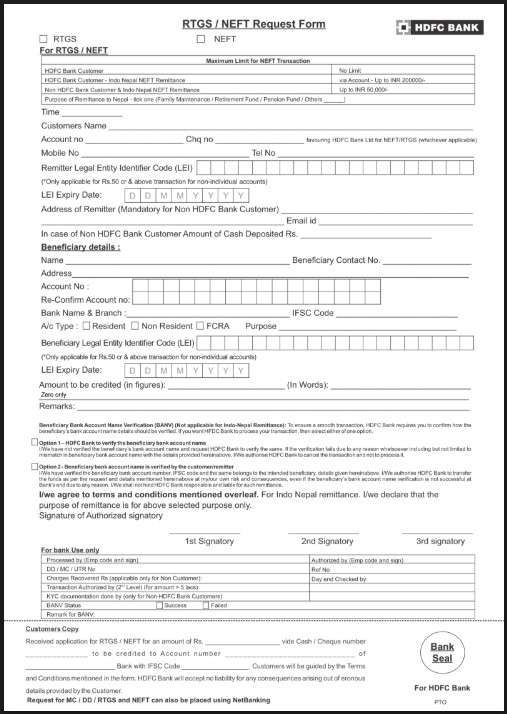

How to Fill RTGS Application Form at HDFC Branch

To make it simple, we divide the form into 6 parts + plus a “For Bank Use Only” section.

You just have to use CAPITAL WORDS using a Blue or Black regular pen, Put details patiently for no overwritten mistakes, and just follow each table that explains what to write, how, and gives examples + pro tips.

1 Part — Transaction Type and Limits

| Field | What to Do / Select | Example / Tip |

|---|---|---|

| Tick Transaction Type | Choose one: ☐ RTGS or ☐ NEFT | (✔) Tick RTGS if the amount is more than 2 lakh; otherwise, choose NEFT |

| For RTGS / NEFT Maximum Limit | (Bank section only) | Just for info: • HDFC Customer – No Limit • Indo Nepal via A/c – ₹2,00,000 • Non-HDFC Customer – ₹50,000 |

| Purpose of Remittance to Nepal | If applicable, tick reason (optional) | Family Maintenance / Pension Fund / Others (write) |

| Time | Write the time of submission, OR you can leave it (optional) | such as – “11:35 AM” |

2 Part — Remitter (Sender) Details

| Details | What to Write | Example | Tips |

|---|---|---|---|

| Customer’s Name | Your full legal name | Ramesh Kumar | Match with the bank account name |

| Account No. | Your HDFC 14 to 16-digit account number | 50100256789012 | Check your passbook or HDFC mobile app |

| Cheque No. | If paying via cheque | 268451 | You can find it on the cheque leaf bottom |

| Mobile No. | Active and account-linked mobile number only | 773747XX99 | For transaction alerts |

| Tel No. | Optional | Leave blank if not applicable | |

| Email ID | Valid and account-linked email only | ramesh.k@example.com | Optional but useful |

| Amount of Cash Deposited (Non-HDFC) | If depositing cash | ₹0 (if HDFC a/c holder) | Only fill if not an HDFC customer |

| LEI Code (for ₹50 Cr+ corporate Transfer) | Legal Entity Identifier | — | Only for large corporate remittances |

| LEI Expiry Date | — | — | Leave blank unless required |

3 Part — Beneficiary (Receiver) Details

| List | Put Down | Example | Tips |

|---|---|---|---|

| Name | Receiver’s full name | Priya Singh | You can ask for a cancelled cheque from the beneficiary, which helps to put in only the correct details. |

| Contact No. | Receiver’s phone | 9123456789 | |

| Address | Receiver’s address | 21 Church Street, Bengaluru | same as cancelled cheque or passbook |

| Account No. | Beneficiary account number | 123456789012 | Double-check carefully |

| Re-confirm Account No. | Repeat above | 123456789012 | Must match exactly |

| Bank Name & Branch | Receiver’s bank & branch | SBI, Indiranagar Branch | Be precise |

| IFSC Code | Bank IFSC code | SBIN0000456 | Verify online |

| Account Type | Tick: ☐ Resident ☐ Non-Resident ☐ FCRA | Tick Resident | |

| Purpose | Why Payment is sent | Rent / Salary / Fees / Invoice | Use clear description |

| Beneficiary LEI (for ₹50 Cr+ txns) | Optional | — | Corporate use only |

| LEI Expiry Date | — | — | Leave blank |

| Amount (Figures) | Amount to send | ₹75,000 | Numbers only |

| Amount (Words) | Write in words | Seventy-Five Thousand Only | Must match figures |

| Remarks | Optional note | Rent for Oct 2025 | Mention the purpose clearly |

4 Part — Beneficiary Account Name Verification (BANV)

| Option | Meaning | Tip |

|---|---|---|

| Option 1 – HDFC to verify | Bank verifies beneficiary name; may cancel if a mismatch | Recommended for safety |

| Option 2 – Verified by customer | You confirm details are correct, at your own risk | Use only if 100% sure details are accurate |

Write “Option 1 selected” or tick the Option 1 box.

5 Part — Declaration and Signatures

| Field | What to Write | Example / Tip |

|---|---|---|

| Authorized Signatories | Sign as per the bank record | If the joint account, all must sign in all available area |

| Date | Current date | 13/10/2025 |

| Place | City name | New Delhi |

| Indo-Nepal Declaration | Tick if applicable | Only if sending to Nepal |

6 Part — Customer Copy (Your Acknowledgment slip)

| Field | Example Entry |

|---|---|

| Amount | ₹75,000 |

| Cheque / Cash No. | Cheque No. 268451 |

| Beneficiary A/c No. | 123456789012 |

| Beneficiary Bank & IFSC | SBI, SBIN0000456 |

| Bank Seal | Filled by HDFC |

| Signature / Stamp | Provided by the HDFC officer |

Note – This is given back to you after the bank processes your request using the form. Please keep this stamped slip as proof of the transaction. You can also ask for the UTR or the Reference number, just to track the transaction if there are delays.

Latest HDFC RTGS Charges (2025)

HDFC Bank’s latest branch RTGS charges (as of October 2025) are:

| Transaction Amount | RTGS Charges (No-GST) | With 18% GST (Total) |

|---|---|---|

| ₹2,00,000 – ₹5,00,000 | ₹20 | ₹23.60 |

| Above ₹5,00,000 | ₹45 | ₹53.10 |

Important Notes:

- Charges apply only if you choose branch-initiated RTGS/NEFT transactions. However, online, there is no fee.

- Inward RTGS (receiving money) is completely free.

- The GST + charges are automatically calculated and debited separately. For example, if you send 3 lakh, your balance must be 3 lakh 25 Rs in the account, the receiver gets the full 3 lakh, no cut.

- The total cost includes both base fee + GST (e.g., ₹20 + ₹3.60 = ₹23.60).

- For senior citizens and premium account holders, some charges are waived or less.

RTGS & NEFT Timings – Best Time to Visit HDFC Branch

RTGS operates only during the working hours of the branch. Here are the typical timings:

| Transaction Type | Timing (Monday–Saturday) | Note |

|---|---|---|

| RTGS | 9:00 AM – 4:30 PM | Real-time processing for ₹2 lakh and above |

| NEFT | 9:00 AM – 6:00 PM | Works in half-hourly batches |

| Best Visit Time | Before 11:00 AM | Early submission ensures same-day processing |

| Important point | Daily maintenance cut-off period from 11:30 PM to 12:30 AM on all HDFC Branches for RTGS | confirm with your branch. |

| Cut-off time | 3:00 PM is the cut-off time in most branches. However, the RTGS window is open until 4:00 PM | Late requests after THE cut-off time are processed the next working day. |

Additional Questions

Can I submit an RTGS form in any HDFC branch?

Yes, you can submit the RTGS/NEFT form at any HDFC branch across India, just make sure it is RTGS-enabled and carry basic documents – a self-cheque, ID proof, and PAN. (if required)

Can I avoid RTGS charges in HDFC Bank?

Yes, you can use HDFC NetBanking or Mobile Banking, It is free of cost + available 24/7, You can open Netbanking account using your HDFC customer ID.

How can I make the HDFC RTGS form editable in Excel or PDF?

You can download a PDF version, use an online PDF editor such as SEJDA or Adobe to edit it, or you can convert the PDF file into Excel using any legal software. It is just for practice only.

Why do companies still prefer HDFC RTGS via a branch instead of online?

Because branch RTGS gives signed, stamped proof. Many companies need physical records for audits. Online transfers don’t provide branch-verified acknowledgement slips, which finance teams often demand.

What is the biggest mistake customers make on the HDFC RTGS form?

Not reconfirming the beneficiary account number. HDFC asks you to write it twice for a reason. One digit mismatch leads to rejection before processing, saving money but wasting time.

Is the editable HDFC RTGS PDF accepted at every branch?

Yes, if printed clearly and signed. However, some branches still insist on branch-issued forms for large amounts above ₹10–₹15 lakh, especially for first-time beneficiaries.

Does HDFC always require a self-cheque for RTGS?

Almost always. Self-cheque acts as a debit authorisation. Without it, most branches won’t process RTGS, even if the form is perfect and the balance is sufficient.

Why does HDFC ask for PAN on RTGS even if the amount is small?

PAN helps track high-value transaction patterns, not tax deductions. It’s a compliance step. Leaving PAN blank may delay processing or trigger extra verification by branch staff.

Can joint account holders face RTGS rejection in HDFC?

Yes. If mandate is “Jointly”, both signatures are compulsory. Many rejections happen because only one holder signs the RTGS form or cheque.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.