You may have found that closing a bank savings account is not that simple in india. For Opening, the process requires a video KYC at home, and your account will be opened. However, for closing, the process is not the same.

Imagine this: You open your mobile banking app and see a minus (-) ₹420 in your account.

The account has been inactive for months, but charges continue to increase. You decide to close it—but quickly realise there’s no “Close Account” button anywhere. You call the customer care helpline, and they tell you to visit your home branch.

Just like that, if you are closing your savings/current account for any reason, the process involves mostly filling out forms at the branch. But it depends on bank to bank. Let’s check out the exact process that can save you both time and money.

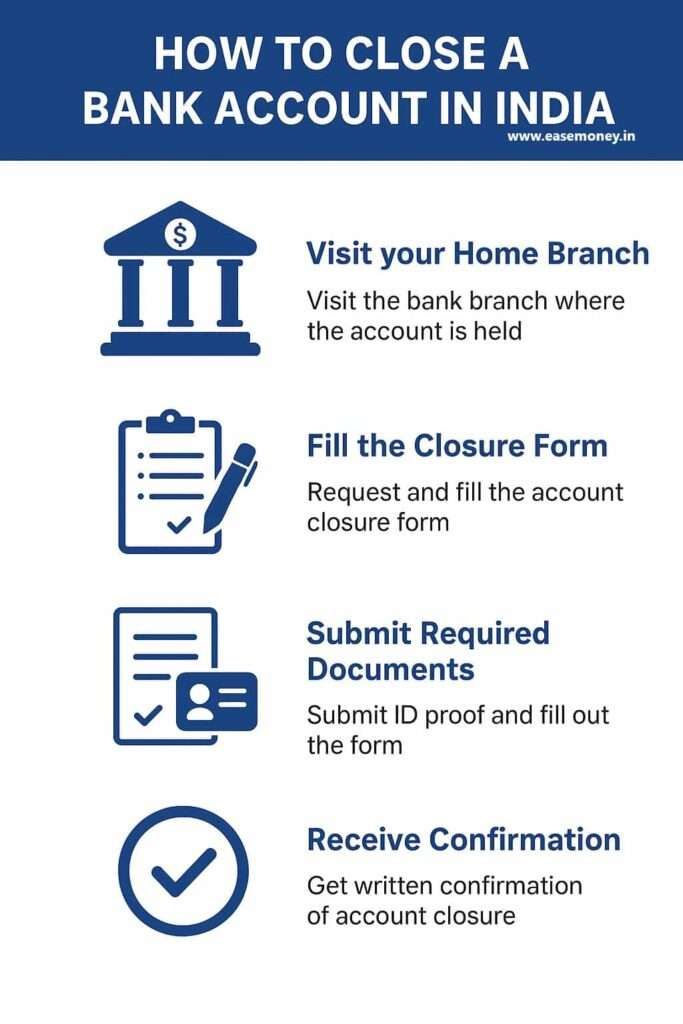

Primary method: How to Close a Bank Account in 2025

1. Check balance & linked services

First, log in to your NetBanking and mobile banking accounts to check your current balance, active EMIs, pending debts, and linked credit cards. Also check other Info of the Demat account, SIP, insurance premium, subscription, and utility auto-debits.

2. Stop the linked services or transfer funds

If an EMI is linked to this account, update your repayment instructions to your new bank or just close the EMI first. Unlike your other services, such as a credit card, SIPs, and stop auto-pay from subscription apps such as NETFLIX.

- Now transfer any balance on your account to the new account.

- If your account balance is in the negative or on hold, read below on the negative balance issues section.

3. Download the PDF or collect the closure form at the counter

- Downloading Process – Simply visit your bank’s official website, go to the footer, and find the form centre. Now, just search for “Savings/current account balance closure form PDF” You can print it or just download and use a PDF editor to fill it up.

- Visit the Branch – Just visit your home branch, tell the issue to the help desk and ask for the application form paper for closure.

4. Documents Required

You will need documents such as –

- Your closure form is filled with details.

- Valid KYC ID proof, Scanned copy only (PAN, Aadhaar, Driving License)

- Passbook, cheque book, debit card (if issued)

- Application letter (some banks ask in addition)

- Joint account holders’ signatures, if applicable

- For NRI only – passport, embassy attestation.

- Proof of new account (if you request NEFT transfer of balance) cancelled cheque, or account statement of the receiving bank. (mostly, smaller banks or india Post savings scheme)

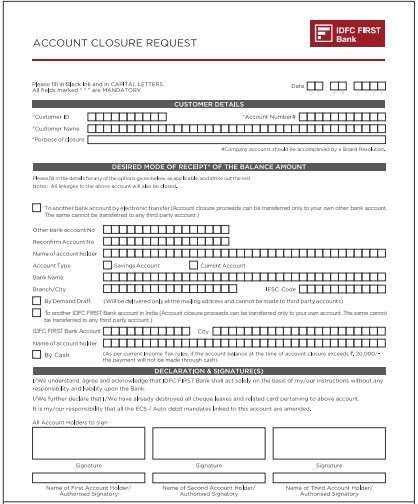

5. How to Fill the Account Closure Form

- You have to use a simple blue or black ink pen, and start with the top-branch name, date, your account number and name.

- After that, write down your customer ID and tick the reason for closure, such as a branch location that is far from home.

- In the mode of payment section, this is basic. You have to provide your other bank account number and details for any transfer of an amount. Even if your balance is zero, still mandatory.

- You can choose payout in cash, but only Rs. 20,000 OR just select a Demand draft, which will be sent to your registered address.

- Now, give your signature and Attach Documents in a scanned copy.

6. Surrender physical items (optional)

If you have any physical documents that came out in your welcome kit, just hand over the passbook, unused cheques, and cut the debit card across the chip before submission if the bank asks.

7. Submit at the branch / get acknowledgement

Ask for a receipt/acknowledgement slip with a closure request number and expected processing timeline. You will get an SMS on your phone once it is closed completely.

What are the regular charges for Account Closure?

The charges on closing are not universal for banks. However, the charges are free but few conditions, such as your account must be 1 year old.

In some cases, private banks such as ICICI or Axis impose a charge after 30 days and before 12 months. It usually depends on your account type and activities; the basic charges are 500 Rs or lower for a savings account.

- Zero Balance Accounts: Usually free.

- Regular Savings Accounts: ₹150–₹500 if closed within the first year.

- Current Accounts: Higher charges, sometimes up to ₹1,000.

- Dormant Accounts: Closure is free after KYC, but dues must be cleared.

How Long Does It Take?

Timing varies by bank type:

- Private banks: 2–4 working days (some close within 48 hours).

- Public sector banks: 5–7 working days, sometimes longer if multiple verifications are needed.

- Payments banks: 1–3 working days, usually faster since there’s no cheque book/passbook return.

- Dormant accounts: Additional time needed because you must first reactivate with updated KYC.

Pro tip: Always plan for at least a week, especially if the account has been inactive.

Why Banks Don’t Allow Mobile Banking Account Closure Button

In India, the majority of people now love digital banking; they ask If I can open an account online, why can’t I close it online? If banks let you close your account with one tap, millions of accounts would vanish overnight. That’s not in their interest. But the real reasons behind Banks’ avoiding an “in-app closure” button are –

- Verification & Fraud Prevention – Closure permanently severs the banking relationship. Banks want a physical signature match and face-to-face confirmation to avoid misuse.

- Cross-selling opportunity – When customers visit the branch, staff try to retain them by offering fee waivers or alternative products.

- Outstanding Dues or Negative Balance – The bank must first confirm there are no pending EMIs, credit card dues, or negative balance charges.

- Regulatory Ambiguity – RBI has not made digital closure mandatory. Banks are free to design their own procedures.

This is why, even in 2025, branch visit remains the standard path to closure.

How to Close a Bank Account Online in 2025

While most traditional government-owned and private banks still insist on a branch visit, a few banks in India have started offering partial or full online closure. Here’s how it works:

1. Net Banking / Mobile App Request

- Some private banks (like IDFC and Axis) allow you to raise a closure request through the mobile banking app.

- After submitting, if your account type is eligible, then you can close by filling online form. No need to visit the branch.

- Not an eligible account category. You still need to confirm via a branch visit or couriered signed documents.

2. Email to Customer Care

- Payment banks (like Paytm Payments Bank, Airtel Payments Bank, and Jio Payments Bank) accept closure requests via registered email.

- They usually send a link or ask for scanned documents via email.

3. Video KYC Process

- A few banks let you verify identity over video before account closure.

- Works mainly for payment banks and small finance banks.

4. Internet Banking Secure Inbox

- Certain banks have a “secure message” option in their internet banking portal where you can request account closure.

- The bank replies with forms that must be filled out and mailed back.

What the RBI Says About Closing Bank Accounts

RBI does not issue a step-by-step closure form for Banks and customers, but it mostly focuses on principles, such as –

- Right to Exit – Any customer can close their account at any time. You have the full right to close it anytime after opening, such as just after 24 hours.

- Charges – Banks can set closure charges if the account is closed shortly after opening (often within 1–12 months). Zero-balance savings accounts and Pradhan Mantri Jandhan Yojana (PMJDY) are generally exempt.

- Inoperative Accounts – As per the press release of Economic Times on 12 June 2025, RBI clarified in June 2025 that KYC for inoperative accounts can be updated through any branch, video KYC, or Business Correspondents. This indirectly helps in account closure, too.

- No Harassment: Banks are not allowed to delay closure if dues are cleared.

So, while the law gives you the right, the process depends on your bank’s internal rules.

- If the bank refuses or delays closure:

- Write to the branch manager and keep an acknowledgement.

- Escalate to the bank’s Nodal Officer.

File a complaint with the RBI Integrated Ombudsman Scheme (IOS) online.

How Public, Private & Payment Banks Differ

- Public Sector Banks (SBI, Bank of Baroda, PNB, etc.)

- Closure is almost always at the home branch.

- Processing is slower.

- Some charge ₹500 if closed within 12 months of opening.

- Private Sector Banks (HDFC, ICICI, Axis, YES, IDFC FIRST)

- More flexible, sometimes allows closure at any branch.

- Forms are downloadable from the website.

- Staff actively try to retain you.

- Payments Banks (Airtel Payments Bank, Paytm Payments Bank, Jio Payments Bank)

- Accounts are usually closed via email request + video verification.

- Some (like Jio) still insist on a branch/agent visit.

- No cheque book or passbook return needed, but wallet balance must be settled.

- India Post Payments Bank (IPPB)

- Closure at the post office branch.

- Requires Aadhaar & PAN submission.

Bank-wise Closure Resources

This table can be updated as new bank links are added:

| Bank or Type | Closure Form | Online Option | Special Notes |

|---|---|---|---|

| State Bank of India (SBI) | Not available on the official website. | Only customer care can generate a token | You have to visit the Home Branch. |

| Axis Bank | Yes (PDF) | Yes But limited | Must surrender all instruments |

| YES Bank | Limited | No | Closure within 12 months may attract charges |

| IDFC FIRST Bank | Yes (PDF) | Yes, but not for all | NRI account needs extra docs |

| Jio Payments Bank | Not required | Yes (in-app) | Fully digital, no branch visit |

| India Post Payments Bank | Form at the post office | No | QR card return required |

| Airtel Payments Bank | Email Form required | No app-based available | Close via call is the best option |

| HDFC Bank | Editable or fillable form available at the official site | Not really | You can book a closure process via phone banking |

| ICICI Bank | Available at the ICICI portal | Yes but limited | ICICI offer a very simple closure form application |

| Kotak Mahindra Bank | Upto 12 languages Closure form available at the Kotak official site | No | Kotak offer a single form for closing current, savings, and investment accounts. |

| Union Bank of India | Not available | Not available | You have to give a written application for closure with ID proof |

| Bank of Baroda (BOB) | Not for india branches | Not found | Handwritten application with the reason for closure |

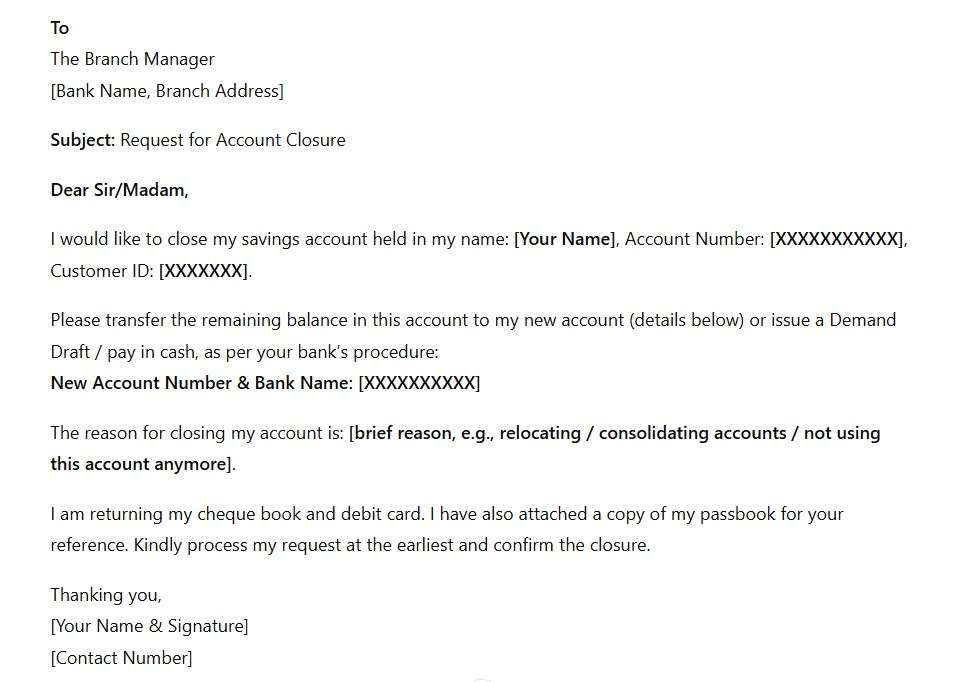

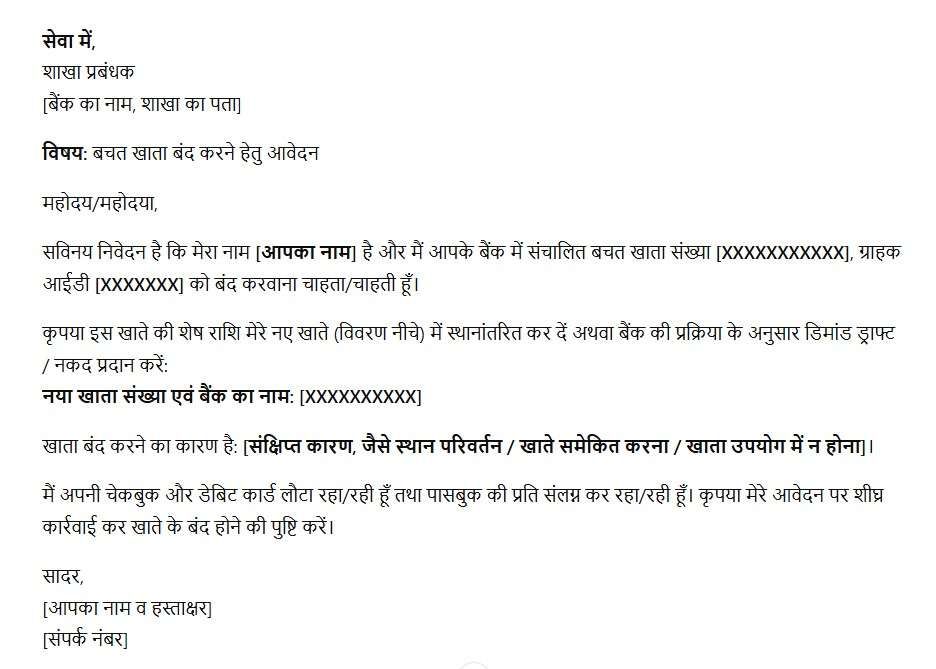

How to Write an Application Letter for Closure

In India, not every bank has a pre-printed closure form. Many regional, co-operative, and even some private banks simply ask you to submit a handwritten or typed application letter for account closure. In some cases, banks may ask for both—the official closure form plus a supporting letter.

It is mostly required to record your formal request and confirm your identity. If you don’t know how to write a simple application letter for bank account closure, you can check this as an example format for both –

English –

Hindi –

Special Situations Closure Request

1. Dormant & Inoperative Accounts

- If your account is inactive for 2 years, it becomes inoperative.

- To close it, you must first update KYC via the home branch, Video KYC or doorstep banking.

- Only after reactivation can the closure request be accepted.

2. After Account Holder’s Death

- If nominee exists: submit death certificate + nominee ID + closure form.

- If no nominee: legal heirs must provide a succession certificate or a court order.

- Banks must release funds within 30 days after receiving complete documents.

3. Joint Accounts

- All holders must sign the closure request.

- If one holder disagrees, the account cannot be closed.

4. Minor Accounts

- The guardian who opened the account must close it.

- Once the minor turns 18, they can do it independently.

5. Negative Balance Accounts

- Banks won’t close until the dues are settled.

- If charges seem unfair, first talk with your branch manager, then raise a grievance with the bank, and then the RBI Ombudsman.

Still Questions, Check here –

Can I close my bank account without visiting the bank branch?

Some banks, mainly payments banks, allow online closure via email or video KYC, but most traditional banks still require a branch visit. However, you can choose the courier option with your home branch if you are not available in your city. It may take 7 working days to close completely. Confirm with your home branch first.

What are the disadvantages of closing a bank account?

You may lose your long account history, linked services like SIP auto-debits will fail, and new accounts may require fresh KYC documentation.

Can a bank refuse to close my account?

Banks cannot legally refuse closure if your all dues are cleared and settled; however, they can delay or pause your request if there are pending EMIs, negative balance charges, or incomplete KYC.

Do banks close accounts with zero balance automatically?

Most banks don’t automatically close zero-balance accounts. Rather, they mark them inoperative after 2 years of no transactions until KYC is updated.

Do closed accounts hurt my credit score?

Savings account closures do not impact CIBIL or Credit score, but a negative balance account can hurt your credit score, so first, pay a negative amount and request closure.

How do I remove all subscriptions before closing my account?

You can use Netbanking and the UPI autopay section to find any active payment, just cancel the Mandates and remove your account. Alternatively, you can use your subscription company app and change your primary account.

Do banks close accounts on the same day of request?

Rarely. Most banks need internal verification, signature matching, and balance settlement. Same-day closure happens only in simple cases with zero balance and no linked services.

Can I close a bank account from a different branch?

Sometimes. Many private banks allow closure at any branch, while public sector banks usually insist on the home branch where the account was originally opened.

What happens if I don’t close an unused bank account?

Unused accounts may attract minimum balance charges, turn inoperative, or create KYC issues later. Closing unused accounts prevents silent charges and future complications.

Can banks force me to keep my account open?

No. Once dues are cleared and KYC is complete, banks cannot force you to keep an account. This right is protected under banking principles.

What proof should I keep after closing a bank account?

Always keep the acknowledgement slip, closure reference number, and final SMS or email confirmation. These documents help if any future dispute or incorrect charge arises.

Who regulates rules related to bank account closure in India?

Account closure practices follow customer-protection principles and KYC norms issued by the Reserve Bank of India, while banks design their own procedures.