Why FASTag KYC is More Important in 2026

Your Car Fastag is no longer just a toll sticker; now it has become your regulated prepaid instrument under the RBI and NPCI’s new guidelines.

In simple words, now every user must complete Know Your Customer (KYC) to keep their tag valid.

In 2025, a new rule requires users to not only complete Full KYC once but also perform Re-KYC and Re-KYV every three years. If skipped, your FASTag can be blocked, balance restricted, or the tag hotlisted at toll plazas.

So, now even existing full KYC customers have to resubmit details to keep their FASTag active. First, let’s understand KYC for Fastag step by step –

Timeline of how KYC works

| Step | Stage | KYC Type | Actions / Requirements |

|---|---|---|---|

| 1 | Buy FASTag | Minimum KYC | Provide mobile number, vehicle RC, and basic details |

| 2 | Initial Usage | Limited KYC | Wallet limited (₹10,000), tag works at tolls |

| 3 | Upgrade to Full KYC | Full KYC | PAN + Aadhaar/Address proof + Photo, Video KYC or branch submission |

| 4 | Full KYC Active | Full KYC | It gives unlimited top-ups and a higher limit |

| 5 | 3-Year Re-KYC | Re-KYC | Update documents (PAN, Aadhaar, address), Video KYC or branch |

| 6 | Re-KYV | Vehicle Re-verification | Upload RC + vehicle photos + FASTag on windshield |

| 7 | Post Re-KYC/Re-KYV | Full KYC | Wallet and tag are fully active again |

Why FASTag KYC is Important

- Prevents misuse of wallets.

- Ensures the tag belongs to a genuine owner and vehicle.

- Required by RBI for all prepaid accounts.

- Without it, FASTag may stop working after 24 months.

- Helps in fund transfers and higher top-up limits.

What is Full KYC in FASTag?

Full KYC is the initial, one-time verification of your identity and address when you get a FASTag.

- Benefits:

- You will get a wallet limit of up to ₹1,00,000

- No monthly or annual top-up cap.

- No restrictions on recharge or usage.

- If you closed your account, the remaining balance will be returned to your bank account.

Without Full KYC, you are stuck with the minimum KYC mode ( low limit only ₹10,000, valid only 24 months); however, it is not bad at all for average driving.

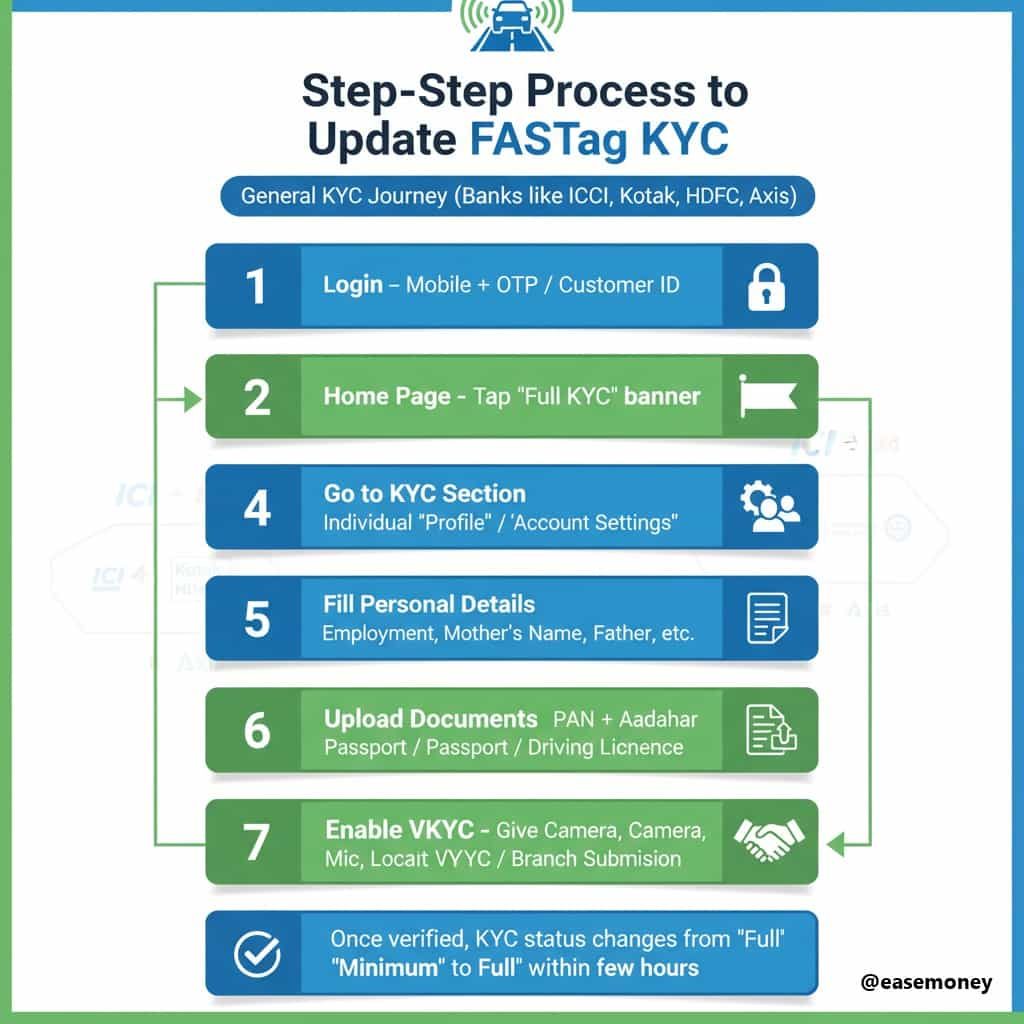

Step-by-Step Process to Update FASTag KYC

Mostly, your banks, such as ICICI, Kotak, HDFC, and Axis, may find the portal different, but the general KYC journey looks like this:

- Login – Use mobile + OTP or customer ID.

- Home page – Most banks put a floating banner in front of the dashboard to encourage you to do Full KYC now. Simply tap on it, or just.

- Go to the KYC Section – Usually in “Profile” or “Account Settings.”

- Select Account Type – Individual or Corporate.

- Fill Personal Details – Employment type, mother’s name, father’s name, maiden name, etc.

- Upload Documents – PAN + Aadhaar/Passport/Driving Licence as proof.

- Enable VKYC – Done your Video Call, about 5 5-minute process.

- Complete Verification – Either via VKYC or branch submission.

Once verified, your KYC status will change from “Minimum” to “Full” within a few hours.

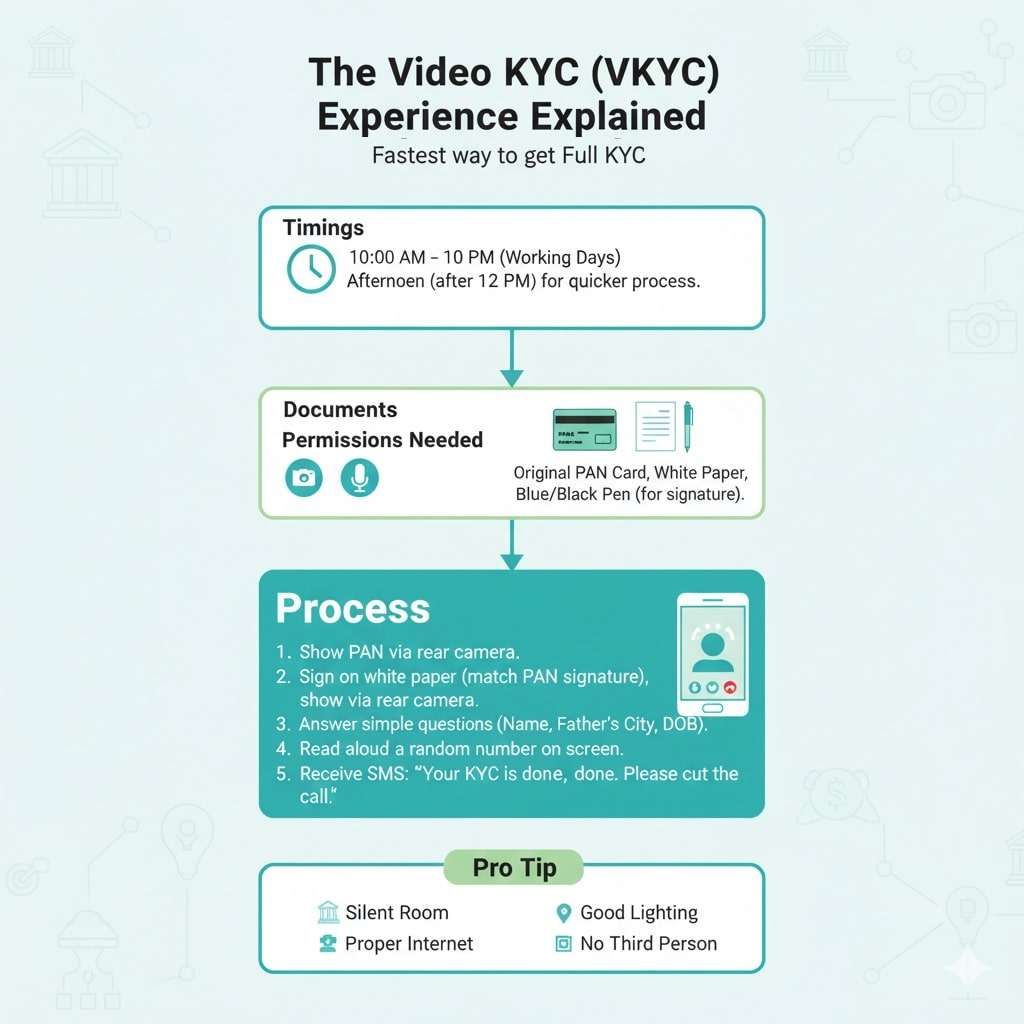

The Video KYC (VKYC) Experience Explained

VKYC is now the fastest way to get full KYC. Here’s what to expect in 2026:

- Timings: The basic timing is between 10:00 AM – 10:00 PM for working days only, you can do it in the afternoon after 12 for quick.

- Permissions Needed: You may have to give access to the camera, microphone, and location.

- Documents: Just take your Original PAN card, a simple white paper and a regular blue or black ink pen for signature.

- Process:

- The officer asks you to show your PAN from the rear camera.

- Sign your name on white paper, the same as a PAN Card, and show it on the rear camera only.

- Answer simple and random questions: name, father’s name, city, DOB.

- They may ask a read something that is available on display, such as A random digit number.

- Done, you will get display SMS, your KYC is done, please cut the call.

Pro tip for you: Keep your room silent, use good lighting, a proper internet and no third person in the room for a fast process.

Alternative Ways to Complete FASTag KYC

If VKYC failed or you find it too complicated, you still have options:

- Branch Visit / POS Counter: Simply visit your nearest highway POS Centre, do your KYC manually, submit physical PAN, Aadhaar, and vehicle RC.

- Aadhaar OTP e-KYC: If Aadhaar is linked with a mobile, you can complete basic e-KYC instantly.

- Business Correspondents (BCs): In rural areas, banks send local agents to collect and verify documents.

- IHMCL/NHAI FASTag – If you have a direct wallet fastag from IHMCL, you don’t need to do Video KYC; you can simply upload documents via the portal.

FASTag KYC Across Different Issuers

| Issuer / Bank | KYC Update Method | Time to Process | Special Notes |

|---|---|---|---|

| IHMCL (NHAI) | fastag.ihmcl.com | 2–7 days | Only for IHMCL tags, not bank tags |

| ICICI Bank | Online portal + Video KYC | 1–3 days | Corporate accounts take longer |

| HDFC Bank | NetBanking / Branch visit | 2–5 days | Supports DigiLocker fetch |

| SBI Bank | YONO app / FASTag portal | 2–4 days | Aadhaar OTP eKYC supported |

| Axis Bank | FASTag web portal / branch | 2–5 days | Requires PAN & Aadhaar both |

| Paytm FASTag | Paytm app (Profile → FASTag) | 1–2 days | 100% online eKYC |

| Others | Via issuer portals/branches | 2–7 days | Similar RBI rules apply |

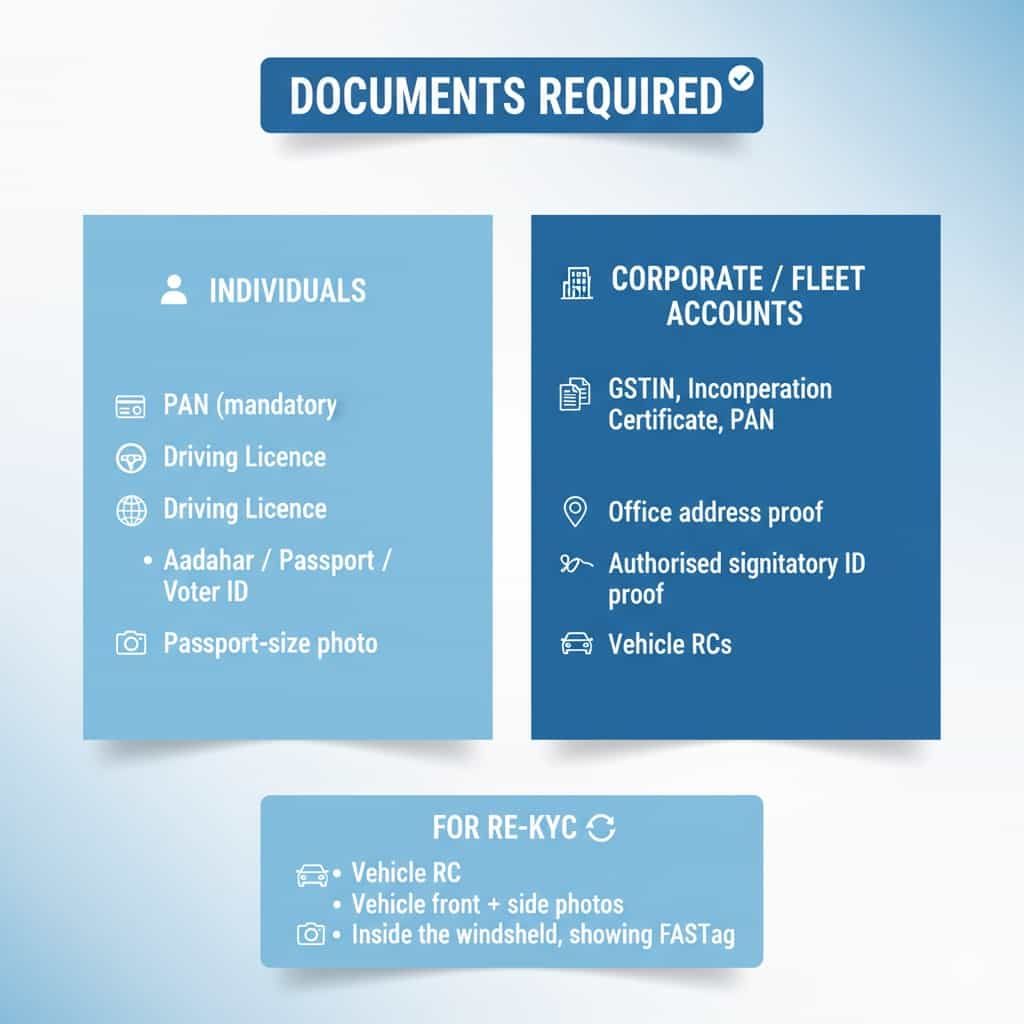

What are the Documents Required

Individuals:

- PAN (mandatory)

- Driving Licence

- Aadhaar / Passport / Voter ID

- Passport-size photo

Corporate / Fleet Accounts:

- GSTIN, Incorporation Certificate, PAN

- Office address proof

- Authorised signatory ID proof

- Vehicle RCs

For Re-KYV:

- Vehicle RC

- Vehicle front + side photos

- Inside the windshield, showing FASTag

New RBI Rules for FASTag KYC in 2025

As per the RBI official website, they recently updated their KYC Master Directions in 2025 with changes that directly affect FASTag holders like you:

- Extended timelines – By this, now, Customers classified as “low-risk” get up to one year from the due date or until June 30, 2026 (whichever is later) to complete periodic KYC.

- Video KYC and Aadhaar e-KYC allowed – Now, RBI allow to use of Video Call for quick KYC at home, so no need to visit anywhere. Just use your mobile banking or website portal.

- KYV for vehicles – Along with your normal KYC, now, most banks such as ICICI also ask for vehicle verification (photos + RC + FASTag affixed photo) must also be updated every three years. (No Video KYC required)

- Business Correspondent (BC) model allowed – Banks may use agents/partners for in-person KYC collection, useful in rural areas.

- Single FASTag per vehicle rule – NHAI mandates that each vehicle can only have one active FASTag linked with completed KYC. But find any Duplicate or unverified tags, it may be blocked.

In short, RBI wants all FASTags to move toward full KYC compliance while offering flexible, digital ways to update.

How to Know If Your FASTag is Active

- Portal/App: Simply check your status shows Active / Inactive / Blocklisted on your mobile app.

- Toll plaza: Green beep = active, red beep = blocked.

- SMS: Notifications for successful transactions.

- Customer Care: Live status verification.

Understanding Re-KYC

After three years, when you open the portal or you get an SMS on your fastag account-linked mobile number, it will show:

“Your KYC has expired — update now to continue using FASTag.”

This Re-KYC prompt is similar to Full KYC in process, but serves to renew your verified details.

- Process: Same as Full KYC — upload documents, provide updated personal info, complete Video KYC if required (depends on banks).

- Purpose: Ensure your details are current and prevent tag misuse.

- Timing: It takes around 3 to 5 working days.

Tip: Re-KYC is mandatory even if your wallet balance hasn’t expired. Skipping it may block your FASTag.

What is the FASTag Validity?

Your sticker life goes upto 5 years physically, but for KYC, your wallet validity is just 24 months for mini-KYC and after Full KYC, it goes for 3 years.

How to Check FASTag KYC Status

- First of all, open your bank/issuer FASTag portal. and log in using your mobile number.

- Go to My Profile → KYC section.

- Status may show:

- Pending – Documents uploaded but not verified.

- Approved – Full KYC complete.

- Rejected – Wrong/mismatched docs.

- Expired – Minimum KYC expired.

How Much Time Will the FASTag KYC Update Take?

- Aadhaar e-KYC: It takes around 24 hours.

- Video KYC: mostly within the same day, or if delayed, it takes within 2 business days.

- Manual/physical document verification: between 3–7 working days

- Corporate / transport accounts: may take 5–8 working days due to extra checks

If your issuer or banks are running a bulk KYC drive (as many do in 2025), processing can slow; however, it takes upto 7 days if no issues are found.

Fastag Questions

Can I complete FASTag KYC for multiple vehicles using a single account login?

Yes, you can link multiple FASTags under one account, but each vehicle still requires its own KYV verification. Full KYC with your single-linked account, so you don’t need a separate Full KYC for each vehicle, just the vehicle-specific verification.

Does changing my vehicle require a new Full KYC or only a KYV update?

Only a KYV update is required when you change your vehicle. You just need to upload your new vehicle’s RC, photos, and proper FASTag is correctly affixed. Full KYC remains valid for your account.

What happens if I don’t complete FASTag Full KYC?

Your FASTag may get blocked or hotlisted, even with balance. As per updated guidelines, minimum-KYC tags work only 24 months. Tip: complete Full KYC before expiry to avoid toll rejections.

Is FASTag KYC a one-time process or recurring?

It’s not one-time anymore. Full KYC must be renewed every 3 years (Re-KYC). Skipping it can restrict wallet usage. Many users assume it’s permanent and face sudden blocks.

What is the fastest way to complete FASTag KYC today?

Video KYC (VKYC) is the fastest—usually done within 5–10 minutes and approved the same day. Tip: Use daylight, a stable internet, and an original PAN card to avoid rejection.

What documents cause the most FASTag KYC rejections?

Blurry PAN, mismatched name on Aadhaar, or old RC copies. Around 70% rejections happen due to document mismatch. Always match spelling exactly as on PAN to clear KYC smoothly.

Can I use one KYC for multiple FASTags or vehicles?

Yes, one Full KYC per user, but each vehicle needs KYV (RC + photos). Example: two cars under one login still need separate vehicle verification for each FASTag.

How long does FASTag Re-KYC usually take?

Re-KYC takes 2–5 working days depending on issuer load. During bulk drives, it may take up to 7 days. Tip: don’t wait for expiry SMS—update early.

Will my FASTag balance be lost if KYC expires?

No, balance isn’t lost, but access gets restricted. You may be unable to use or withdraw funds until KYC is updated. Some issuers allow refund only after Full KYC.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.