What Is the IDBI RTGS Form and Why Does It Matter

The RTGS Application form is an offline and physical method for initiating high-value money transfer at any IDBI Branch. Nowadays, even the Internet or mobile banking is rising, but this form remains important for:

- Those who do not use digital banking

- corporate clients uploading bulk RTGS payments

- Older/rural branches where online transfer is less used

- Fallback when digital channels face downtime.

- Someone wants immediate payment without waiting for the cooling period for the first time, adding a beneficiary online.

This form is bilingual, supports hindi or English and other languages, and it is also used for NEFT and Demand Draft (DD) transactions — you simply tick or ignore the relevant section.

Who Can Use the IDBI Application Form for RTGS

Only IDBI Bank account holders can use the RTGS facility. This includes: proprietorships, individuals, and it supports all accounts such as –

- Savings Account (SB) holders

- Salary Account holders

- Current Account (CA) or Corporate Account users

- Cash Credit (CC) and other operative accounts

Non-Account Holders — Not Eligible for RTGS

However, there is an option for a non-account holder in the form, but it does not work for RTGS.

- RTGS transactions must be debit-based, meaning funds are directly debited from an account holder’s bank account.

- As per the RBI, Cash-based RTGS is not allowed because RTGS’s minimum transaction value is at least ₹2 lakh, while non-account holders are restricted to ₹50,000 per cash remittance.

What Non-Account Holders Can Do Instead

- If you don’t have an IDBI account but want to transfer money, you can use NEFT (National Electronic Funds Transfer):

- Visit an NEFT-enabled bank branch

- Deposit cash up to ₹50,000 per transaction

- Fill the same bilingual DD/NEFT/RTGS form, but tick NEFT instead of RTGS.

How charges work in IDBI RTGS via Branch (Including GST)

In your IDBI RTGS form, it has a “Commission” section where service charges apply. This charge is required for making your transfer only using the IDBI branch. Before filling the form, let’s check the typical RTGS charge structure, including 18% GST:

| Transaction Amount | Base Charge | GST (18%) | Total Charge |

|---|---|---|---|

| ₹2 lakh – ₹5 lakh | ₹30 | ₹5.40 | ₹35.40 |

| Above ₹5 lakh | ₹55 | ₹9.90 | ₹64.90 |

| ₹50 lakh | ₹55 | ₹9.90 | It goes the same – ₹64.90 |

| ₹10 crore or higher | ₹55 | ₹9.90 | even in crores – ₹64.90 |

| Inward RTGS | Free | – | Free |

How to Download the IDBI RTGS Form

You can download or get a direct printed form in three convenient ways. Let’s find –

1: Source link to Get PDF

| Download link (Updated 2025-2026) |

|---|

| 🔗 IDBI RTGS / NEFT / DD Application Form (PDF) |

| Note – this is the official English and hindi version PDF file sourced directly from IDBI. You can print or make it editable or fillable using Sejda App or Canva. |

This single format form PDF works for Savings, Current, Corporate, and Cash Credit accounts. You don’t need to find any other version.

2: Find on the IDBI Bank Website (Latest)

- Go to the only official and latest URL of the IDBI bank portal – https://www.idbi.bank.in

- Tap on the “Apply Now” button.

- On mobile: Floating button in the bottom menu

- On desktop: You can find it floating in the right corner

- Scroll to the “Download Forms” section.

- You can use the search button or use the Ctrl + F key to find – Application Form for DD/NEFT/RTGS

- Tap and get the latest form.

3: From a Branch Counter

| Option | How It Works |

|---|---|

| Visit RTGS-enabled IDBI Branch | Locate via Branch Locator |

| Request the Form | Ask for “Application Form for DD/NEFT/RTGS” from the Branch staff or get it from the form table desk near the cash counter. |

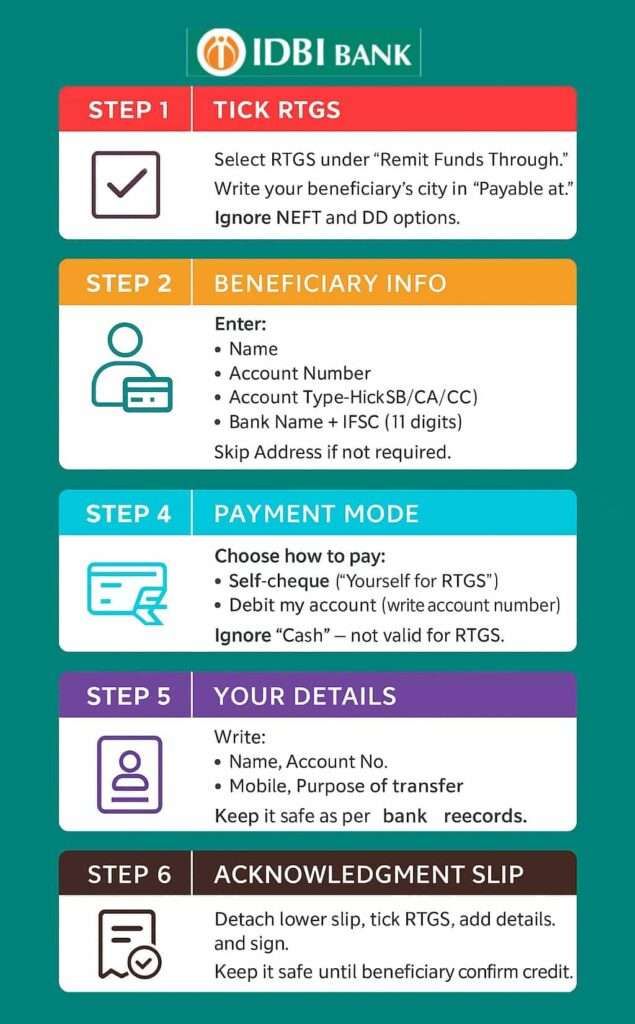

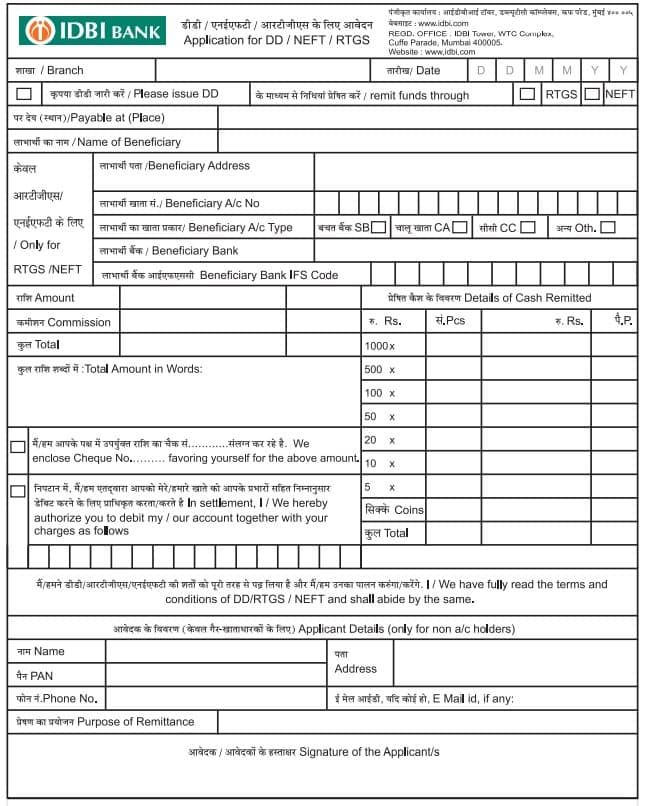

How to Fill the IDBI RTGS Form

The IDBI RTGS form can seem complex since it covers multiple payment types, but it’s easy if you follow these seven steps carefully.

1 Step – Tick the RTGS option

- First of all, use capital letters and give space to avoid any mistakes.

- Write the date and branch name (usually the same branch name where you are making the transaction)

- Under “Remit Funds Through,” simply (✔) tick RTGS.

- Payable at (Place) section – simply write the city/branch of the beneficiary’s bank (optional)

2 Step – Fill Beneficiary Details (Where your money will be credited)

| Field | What to Fill |

|---|---|

| Beneficiary Name | Full legal name |

| Address | Write quickly and basic (optional) |

| Account Number | Must match exactly |

| Account Type | SB / CA / CC / Other (simply tick it) |

| Bank Name | Beneficiary’s bank |

| IFSC Code | 11-digit code, no spaces |

Tip – Double-check the IFSC and account number to avoid rejection. You can request a passbook, bank statement, cheque leaf photo, or other relevant documents from your beneficiary, which will help you fill out this session more accurately.

3 Step – Enter Transaction Amount

- Write the amount in digits and words – example – (Rs. 5,00,000/-) put (/-) in the end.

- If filling the commission section, you can ask the branch for the charges after GST or leave it blank; the bank will deduct automatically from your account.

- Add your charges + sending amount for filling the = Total amount payable

4 Step – Payment Method

You have to tick any one –

- Self-Cheque: You have to fill in a cheque leaf.

- Write “Yourself for RTGS” in the pay section and write the amount in digits and words, same as the form.

- Mention the cheque number on the form

- Write note beneficiary details, such as A/C, name, IFSC and your signature on the back

- Account Debit Instruction:

- Tick “Debit from my account” and write your account number. If your amount is bigger for transfer, your branch may ask for a self-cheque and your PAN.

- Cash Denomination box: It won’t work for RTGS.

5 Step – Applicant Information

- Do your signature the same as a self-cheque and bank records.

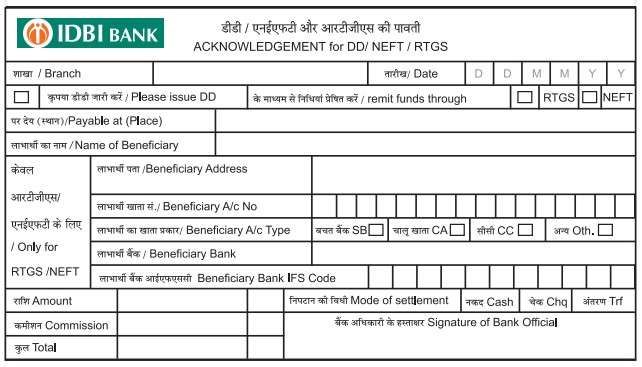

6 Step – Acknowledgement Section

The lower part of the form is your customer copy.

- Tick RTGS

- Note the beneficiary name, amount, and UTR (Unique Transaction Reference) once processed

- Keep this slip safe until the credit appears

7 Step – Ignore Unused Sections

- Skip NEFT and DD fields.

- Ignore the applicant details section – your PAN, mobile, this section is only for Non-IDBI A/C holders.

- Ignore the cash Denomination section.

How to submit the RTGS Form at the IDBI Branch counter

Step 1: Submit Form and Cheque

Hand over the filled form and self-cheque (if applicable). Some branches may request ID proof for verification such as Aadhaar or PAN or Voter ID.

Step 2: Bank Processing

- Teller verifies signature and account details

- Amount debited or cheque cleared

- You receive a stamped acknowledgement with the UTR number

Step 3: Track and Keep Record

The UTR number helps you trace or confirm transaction completion via IDBI customer support.

IDBI RTGS Timings, Branch-based

| Day | Transaction Window (RTGS) | Branch Hours |

|---|---|---|

| Weekdays | 9:00 AM – 4:15 PM | 10:00 AM – 4:00 PM |

| Saturday | 9:00 AM – 1:00 PM | 10:00 AM – 1:00 PM |

Tip – For fastest same-day processing, visit the branch before 3:00 PM.

How Long Does RTGS take, and how to complain if delay?

RTGS transaction usually takes just 5–30 minutes if everything is clear. If submitted close to the cut-off time, processing may shift to the next working day. If your transaction is delayed or fails, you can contact IDBI Bank directly.

- Toll-Free Numbers: 1800-209-4324 / 1800-22-1070

- Non-Toll-Free (India): 022-67719100

- For Customers Outside India: +91-22-67719100

- File a Complaint Online portal – Visit: CRMS Online By IDBI

- Then select:

- Complaint Type: New

- Customer Type: Existing Customer

- Nature of Complaint: Remittance → RTGS

- Fill all required fields and submit the form.

- The bank will contact you and settle your issue.

FAQs

Can I use IDBI RTGS for loan repayment or property payments?

Yes, RTGS is only for large-value money transfers such as property payments, vendor dues, or business settlements. Plus, IDBI allows RTGS through both mobile and internet banking for registered users, so you can pay any big amount even at night. It is now 24/7 using the IDBI mobile app.

How can I confirm if my RTGS transaction was successful?

You can confirm an IDBI RTGS transaction using your IDBI Mobile or NetBanking. After settling, you will get an SMS on your account-linked mobile number. which is also your proof.

My IDBI RTGS didn’t reach the beneficiary. What should I do?

Wait a upto 24 hours first — sometimes it’s a delay at the receiver’s bank. If not credited by evening, call IDBI customer care and use service request number to trace it.

I used a new IDBI account, and RTGS didn’t go through. Why?

Fresh accounts may not have RTGS activated yet. Visit your branch and request activation of RTGS/NEFT services — it’s a one-time process.

The branch said, “System down, come later.” What does that mean?

It means IDBI’s RTGS link with RBI’s central system is temporarily offline. Transactions are paused — go after some time or the next day to avoid pending entries. You can try online IDBI netbanking for RTGS.

I had ₹5,00,000 in my account, but RTGS failed, saying low balance.

You likely forgot the service charge and GST. You have to add ₹100 extra to cover fees when sending large transfers.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.