RTGS Charges at IDFC FIRST Bank

Among all top banks in india, IDFC First stands out as one of the only banks that allows you a zero-fee RTGS transfer even through a physical branch. Unlike most traditional banks that charge ₹30–₹60 with taxes for branch-based RTGS.

No service charge, no GST, but it is for existing customers only. Whether you are an individual customer or a business account holder, you can do RTGS online or offline. If your transfer amount is higher than ₹20,00,000 per day, you can choose Branch Banking, and you must fill out an IDFC FIRST RTGS Application Form.

| Mode of RTGS Transfer | Applicable Fee |

|---|---|

| At Branch (Physical Form) | ₹0 (Free) |

| Internet Banking / Mobile App | Free |

| Corporate Account (Business) | Zero |

| Personal Account (Savings) | ₹0 |

Language of the Form

The Fund Transfer Form (Applicable for Existing Customers) is entirely in English. You must fill it in black ink and in capital letters. However, you can ask for a bilingual form from any RTGS-enabled IDFC branch; it is currently not available on the IDFC portal.

Where to Download or Get the IDFC FIRST RTGS Form

You can obtain the form either physically at the branch when you visit for RTGS transfer or digitally from the official website.

| Method | Description | Link |

|---|---|---|

| Any RTGS-enabled Branch | You can request the Fund Transfer Form (RTGS/NEFT) from a branch officer or collect it near the cash counter. | Locate a Branch → |

| Direct Download (PDF) | The official version of the IDFC RTGS form is available for download on IDFC FIRST Bank’s website. | Download Original PDF |

| Editable/Fillable Version | This version, you can use for writing details digitally on your laptop or computer before printing. You can use Google Chrome or Firefox to edit it. | Download Fillable PDF |

If the above direct links do not work, how can to download directly from the IDFC website

- Go to the official site only → www.idfcfirstbank.com

- In the top menu, select “Personal” (or “Business” for corporate accounts).

- From the menu, go to Payments → Tap on Fund Transfer.

- Choose RTGS.

- Scroll down to the “Branch” section.

- Tap on “Download Form” to get the official RTGS/NEFT Application Form (PDF).

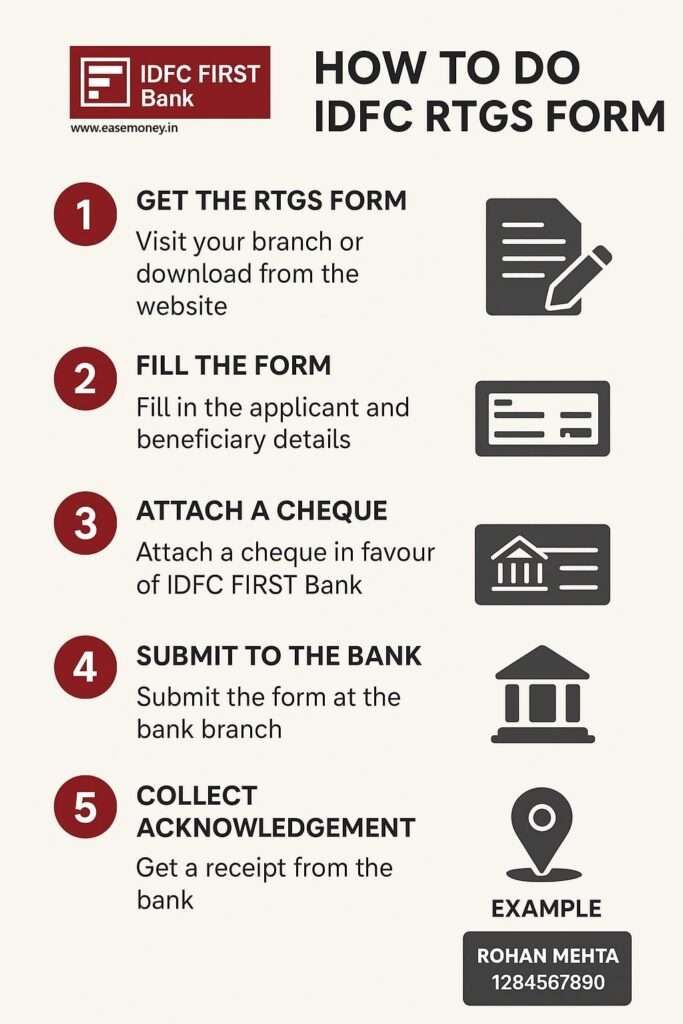

How to Ready and Fill the IDFC FIRST RTGS Form

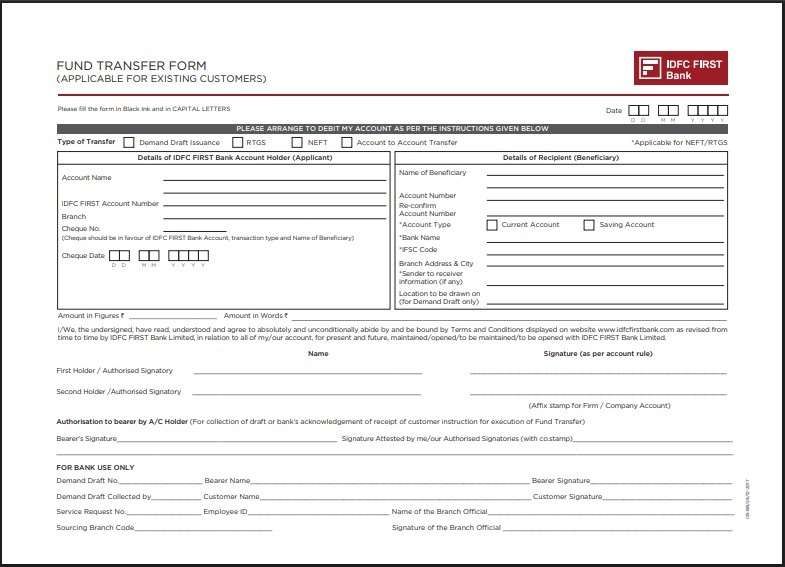

The RTGS Form is a single sheet of paper; it supports multiple payment options such as DD/RTGS/NEFT/Account to Account. If we divide this into four parts, it becomes so easy to fill up.

1 Section – Type of Transfer sections (The Top)

- Write the date in the header boxes. You can simply put like 15-08-2026.

- Tick RTGS from the options — “Demand Draft Issuance / RTGS / NEFT / Account to Account Transfer”.

2 Section – Details of IDFC FIRST Bank Account Holder (Your Information)

- Firstly, put your Full name, the same as your bank records.

- Enter the 10 to 11-digit account number in the box.

- Your cheque number. (if the branch asks for a self-cheque)

- Enter the cheque date in the box.

- Put down the Amount in digits in the box. such as Rs 2,25,000/-

- Same amount now written in words, such as Two lakh twenty-five thousand.

- LEI Number and Expiry Date (only if the amount is 50 Crore or higher)

3 Section – Details of Recipient (Beneficiary)

This section is most important, write slowly and correctly each point –

- Name of Beneficiary (if the company puts the full name, for example, Asian Finance Pvt Ltd)

- Account Number

- Re-confirm Account Number

- Bank Name

- Branch Address & City

- Account Type (Current / Savings)

- IFSC Code

- Sender-to-Receiver Information (optional)

- Amount in Figures ₹ _____

- Amount in Words ₹ _____

4 Section – Declaration & Signature (as per account rule)

- This section for agree that your written information is 100% correct and we accept the bank terms and charges.

- In the first holder section, put down your primary account holder OR Affix a stamp for firm/company accounts.

- If a joint account, all account holders must have to sign in each signature section.

Note – You can ignore other sections such as For Bank Use Only and Authorisation to Bearer, the bank staff will handle it and give you a UTR number for tracking purposes.

Cheque Requirement — Is It Mandatory?

While a self-cheque is not always mandatory, however, it is recommended in certain situations — especially for first-time RTGS transactions or very large transfers.

The form mentions:

“Cheque should be in favour of IDFC FIRST Bank Account, transaction type and Name of Beneficiary.”

This means your cheque must include:

- Payee Line: “IDFC FIRST Bank Account RTGS [Beneficiary Name]”

- Amount: The exact transfer amount

- Signature: Same as your account signature

Let’s take an example:

If your amount is 5 lakh to Mr Rohan Mehta or Asian Paints Pvt Ltd (your beneficiary), your cheque should be written as:

- Pay: IDFC FIRST Bank Account RTGS to Mr Rohan Mehta OR Asian Paints Pvt Ltd

- Amount: ₹5,00,000

However, in most cases, the bank can directly debit your account without requiring a cheque, as long as you have filled out and signed the RTGS form correctly.

- For individual customers, a cheque is optional.

- For business accounts, a cheque or debit authorisation with the company seal is preferred.

RTGS Transaction Limits

| Type of Account | Minimum Limit | Maximum Limit |

|---|---|---|

| Individual / Savings Account | ₹2,00,000 | No upper limit |

| Business / Corporate Account | ₹2,00,000 | No upper limit |

| Online RTGS (Net/Mobile Banking) | ₹2,00,000 | ₹20,00,000 per transaction or per day |

| NEFT (for comparison) | ₹1 | No upper limit |

Important Rules and Limitations

| Rule | Details |

|---|---|

| Credit Validation | Credit is based only on the account number — the beneficiary name is not verified. |

| Cheque Requirement | Optional but useful for large transfers or first-time RTGS. |

| IMPS Restriction | IMPS is not available via branch (only digital channels). |

| Reversal | Once processed, RTGS cannot be reversed or cancelled. |

| ID Proof | Carry Aadhaar, PAN, or any valid ID if requested. |

| Authorization | Corporate accounts must attach the company stamp and the signatory’s signatures. |

| KYC Compliance | Full KYC required before initiating large transfers. |

RTGS Timings (For Branch Transactions)

| Day | RTGS Submission Window | Remarks |

|---|---|---|

| Monday – Friday | 10:00 AM – 3:30 PM | Same-day processing if before cutoff |

| Saturday (working) | 10:00 AM – 1:00 PM | Processed same day |

| Sunday / Public Holiday | Branch closed | Use Internet Banking instead |

Processing & Delay Rules

- Within branch hours: If you submit the application before any cut-off hour, Your RTGS will settle Real-time (2–10 minutes).

- After 3:30 PM cutoff time at branch: Executed next working day.

- While RTGS is technically available 24×7, including Sundays and holidays but only online, physical branch transactions depend on working hours.

- Any RTGS Transactions you made between 11:54 PM and 11:59 PM are processed on the next working day.

- RTGS or NEFT above ₹50 lakh during non-banking hours will be debited instantly, but credited the next working day.

Additional Questions

Can RTGS take 1 hour?

RTGS in IDFC is usually credited instantly or within 30 minutes only, but in some rare cases, you may find it takes up to 1 or 2 hours due to beneficiary bank delays or the RBI settlement queue.

Can I transfer ₹20 lakhs through RTGS?

Yes. You can transfer ₹20 lakhs or more through RTGS easily — there’s no maximum limit for branch-based transactions at IDFC FIRST Bank.

What are the risks of using RTGS?

The only major risk is entering the wrong beneficiary account details; funds are credited solely on the account number. Always double-check beneficiary information before submission. You can ask for a cancelled cheque or a bank statement while entering it.

Is RTGS really free at IDFC FIRST Bank branches?

Yes. IDFC FIRST Bank offers zero-fee RTGS at branches for existing customers. No service charge, no GST — even for high-value transfers like ₹25 lakh or ₹1 crore.

Who is eligible for branch RTGS at IDFC FIRST Bank?

Only existing IDFC FIRST Bank customers can use branch RTGS. Non-customers are not allowed. Your account must be active, KYC-compliant, and sufficiently funded at the time of submission.

Is a cheque compulsory for RTGS at IDFC FIRST Bank?

Not always. For individuals, RTGS usually works with direct account debit. However, for first-time or large transfers, branches may request a self-cheque for extra debit confirmation.

What is the safest daily limit reason to visit a branch?

Online RTGS is capped at ₹20 lakh per day. If your transfer exceeds this — like property payments or bulk business payouts — branch RTGS is the safest and unlimited option.

What time should I submit RTGS at an IDFC branch?

Submit before 3:00–3:30 PM on working days. Late submissions may miss branch cut-off and get processed the next working day, even though online RTGS runs 24×7.

What is the most common RTGS rejection reason at IDFC?

Incorrect beneficiary details, especially account number or IFSC mismatch. Since RTGS credits are account-number driven, even a single wrong digit can delay or auto-reverse the transaction.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.