About the RTGS and IndusInd Bank Application Form

The simple meaning of RTGS is that it enables the transfer of money above ₹2 lakh between banks. Unlike NEFT, which works in batches, it works in real-time, mostly within 30 minutes. If you transfer funds via a branch, you will need to complete the RTGS form.

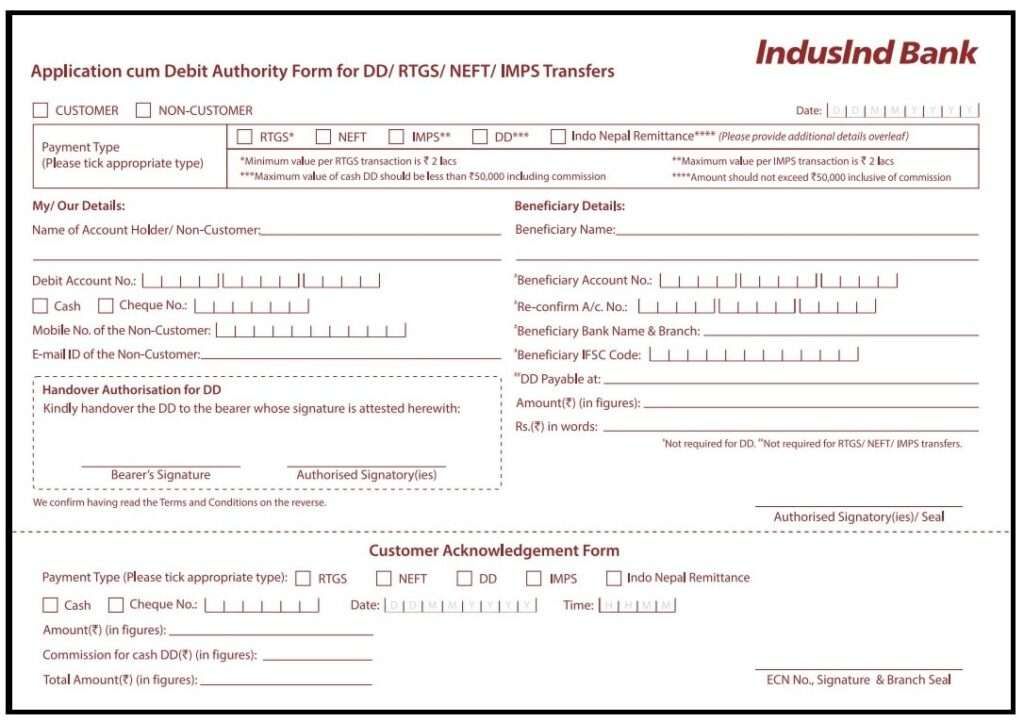

Among all banks, IndusInd Bank provides one of the most versatile and user-friendly RTGS systems — with a single Application cum Debit Authority Form that supports DD, NEFT, IMPS, RTGS, and even Indo-Nepal remittance.

It’s an all-in-one fund transfer form, available in both English and Hindi.

What makes it special is that it supports:

- All domestic payment types (DD, NEFT, RTGS, IMPS)

- Indo–Nepal remittance

- Both customers and non-customers

No other private or public sector bank (not even HDFC or SBI) offers this level of coverage in a single form.

Where You Can Use RTGS in IndusInd Bank

| Channel | Availability | Timings | Access Mode |

|---|---|---|---|

| Branch (Offline) | Yes | Bank working hours | Fill form + submit cheque |

| IndusNet (Retail Internet Banking) | Yes | 24×7×365 | Online transfer |

| IndusMobile (App) | Yes | 24×7×365 | Mobile transfer |

| IndusDirect (Corporate Internet Banking) | Yes | 24×7×365 | For businesses |

Direct Download Links

You can get this form directly from the IndusInd Bank official website. The process is also very simple –

- Go to any search engine you like, such as Google or Bing.

- Open the IndusInd Bank portal and go to the personal section, and tap on transfer funds.

- Open the RTGS option and tap on the Hindi or English form.

Alternatively, you can download it directly below –

| Language | Form Name | Download Link |

|---|---|---|

| English | Application cum Debit Authority Form for DD/RTGS/NEFT/IMPS | Download English Version PDF |

| Hindi | आरटीजीएस/एनईएफटी/आईएमपीएस/डीडी प्रपत्र | Download Original Hindi PDF |

RTGS Transfer Limits

| Channel | Minimum Limit | Maximum Limit |

|---|---|---|

| Branch | ₹2,00,000 | No upper limit (subject to account type & bank discretion) |

| IndusNet (Individual) | Rs. 2 Lakh | ₹10,00,000 |

| IndusNet (Non-Individual) | ₹2,00,000 | ₹25,00,000 |

| IndusDirect (Corporate) | Rs. 2 Lakh | ₹25,00,000 per transaction (cumulative limits apply) |

How to Ready a RTGS form in IndusInd Bank for Transfer via Branch

The filling process is simple if we divide the form into multiple sections, just avoid overwriting and use capital letters for easy understanding. Let’s start with the top –

1 Step – Tick the Correct Payment Option

- On the Top side of the form, Tick RTGS (Real Time Gross Settlement).

- Cash deposits are not allowed for RTGS. Use a cheque or account debit.

2 Step – Tick Customer / Non-Customer

- If you have an IndusInd account → Tick Customer.

- If you are from another bank → Tick Non-Customer. (Confirm with your branch how much RTGS limit you can do)

- Non-customers must attach a cheque from their own bank to fund the RTGS transaction.

3 Step – Fill “My/Our Details” (Remitter Section)

| Field | What to Enter |

|---|---|

| Name | Your full name (as per account/cheque) |

| Account Number | Account to be debited |

| Payment Mode | Tick Cheque (enter cheque number) |

| Mobile Number | Mandatory for non-customers |

| Email ID | Optional, but helps receive transaction alerts |

- For customers: You only need to mention the account and cheque number.

- For non-customers: You must provide your name, contact info, and a cheque from your bank. You also have to provide PAN and a Valid ID proof in some cases.

4 Step – Fill Beneficiary Details (Where the money will be credited: Individual or Company)

Keep a cancelled cheque or bank statement/photo of beneficiary passbook handy to avoid mistakes.

| Field | What to Enter |

|---|---|

| Beneficiary Name | Full name of person/company receiving funds |

| Account Number | Enter twice to confirm accuracy |

| Bank Name & Branch | As printed on the beneficiary cheque/passbook |

| IFSC Code | 11-digit code (such as INDB0001234) |

| Amount | Write in digits and words |

| DD Payable At | Simply, ignore it (for RTGS not needed) |

5 Step – Customer Copy Section

After submission, fill in the Customer Copy at the bottom of the form:

- Payment Type: RTGS

- Cheque Number

- Date and Time

- Amount (in figures)

- Total Amount (with charges)

Keep this copy for your records. The bank will seal it.

6 Step – Design a Self-Cheque

For RTGS via a branch, IndusInd requires a self-cheque. You can confirm with your branch does they allow debit directly to an account without a cheque. Here few steps to ready a check –

- Write in the pay section “Yourself for RTGS” on the cheque.

- Enter the exact amount to be transferred.

- Sign the cheque the same as you did on regular cheques.

- On the back side, write the beneficiary’s name, account number, and IFSC code.

- Attach the cheque with the filled form and submit it to the teller.

7 Step – Indo–Nepal Remittance Section

The IndusInd RTGS form also has a dedicated Indo–Nepal remittance section, which works for cross-border payments. You can ignore this unless specifically making a remittance to Nepal.

Possible Delay or Failure Reasons

Though RTGS is real-time, small delays may happen due to:

- Wrong account number or IFSC code (reverse is)

- Beneficiary bank not RTGS-enabled

- Network or technical downtime

- Branch cut-off for physical submissions (it may settle on next working day)

In case of failure, funds are automatically reversed—usually within 24 hours.

| Service | Details |

|---|---|

| Helpline | 1860 267 7777 |

| Email (Retail) | reachus@indusind.com |

| Email (Corporate) | corporatecare@indusind.com |

| Visit | Simply use your customer copy with your UTR Number at the branch to help and track. |

What are the RTGS Charges for ₹25 Lakh in IndusInd Bank?

If you are transferring ₹25 lakhs through RTGS at an IndusInd Bank branch, the good news is that the charge remains exactly the same as for any transfer above ₹5 lakh.

IndusInd Bank doesn’t increase the fee with transaction size. Whether you send ₹5 lakh, ₹50 lakh, or ₹1 crore, the RTGS fee is capped at ₹50 plus GST, which comes to about ₹59 in total.

So, if you are sending ₹25 lakh, the total debit from your account will be roughly:

₹25,00,000 + ₹59 = ₹25,00,059.

Here’s a simple breakdown for clarity:

| Transaction Amount | Base Charge (Excl. GST) | GST (18%) | Total Charge (Approx.) |

|---|---|---|---|

| ₹2 lakh – ₹5 lakh | ₹25 | ₹4.50 | ₹29.50 |

| Above ₹5 lakh (even ₹1 crore) | ₹50 | ₹9.00 | ₹59.00 |

Tip: If you use IndusNet (online banking) or IndusMobile, RTGS transfers — even for ₹25 lakh— are completely free of cost.

FAQs

How long does it take for an RTGS transfer to reflect?

Usually, RTGS transfers reflect instantly. In rare cases of technical delay, it may take 30 minutes or 1 hour before appearing in the beneficiary account. If you apply after the cut-off branch timings, it may settle next working day.

What happens if I enter the wrong IFSC code in RTGS?

If the IFSC is invalid, the transaction will fail and funds will auto-reverse. If valid but incorrect, funds may credit to the wrong account — contact the IndusInd immediately.

What is the UTR number in RTGS?

The UTR (Unique Transaction Reference) number is a 22-character code assigned to every RTGS transaction, used for tracking and verifying payments.

Is RTGS available on Sundays and bank holidays at IndusInd?

Yes, RTGS through online modes (IndusNet or IndusMobile) works 24×7, including Sundays and holidays. Branch-based RTGS works only during banking hours. The current hour is 9:30 to 5:00 AM.

Is the same RTGS form used for NEFT, IMPS, and RTGS in IndusInd Bank?

Yes. IndusInd Bank uses a single “Application-cum-Debit Authority” form. You just tick RTGS, NEFT, or IMPS, which avoids confusion and reduces the chances of using the wrong form.

Can a non-IndusInd customer submit an RTGS at the branch?

Yes, but with conditions. Non-customers must attach a cheque from their own bank, provide PAN and mobile number, and limits depend on branch approval and internal risk checks.

Is a self-cheque compulsory for RTGS at IndusInd branches?

In most branches, yes. A self-cheque acts as debit authorisation. Some branches allow direct account debit, but you should always carry a cheque to avoid rejection or delay.

What should I do if RTGS is debited but not credited?

Wait 30–60 minutes first. If still pending, contact IndusInd with the UTR. Most failed RTGS transactions auto-reverse within 24 hours without manual follow-up.

Does sending ₹25 lakh attract higher RTGS charges?

No. IndusInd follows a flat cap model. Any RTGS above ₹5 lakh costs ₹50 + GST (≈₹59), whether you send ₹25 lakh or ₹1 crore.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.