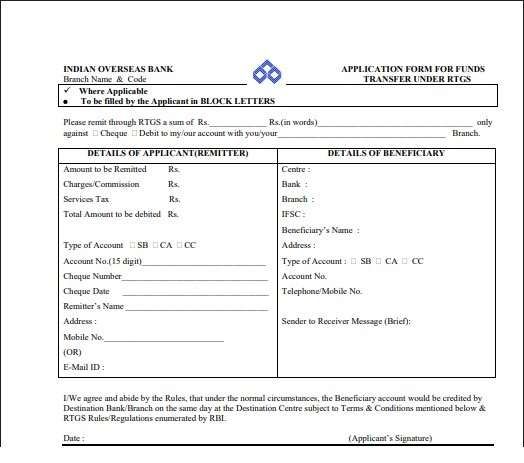

For RTGS money transfer via the Indian Overseas Bank Branch, you will need the RTGS application Form. It is a simple one-page document that allows you to transfer ₹2 lakh or more from your IOB account to any other bank securely.

Unlike most banks in india, such as HDFC, SBI, or Axis, they usually offer a combined form that offers RTGS/NEFT/IMPS all payment, where IOB stands out — it provides separate forms for RTGS and NEFT transactions.

This makes it cleaner, more specific, and easier to fill without confusion.

How IOB’s RTGS Form Is Different

| Feature | IOB RTGS Form | Other Bank Forms |

|---|---|---|

| Form Type | Separate RTGS-only form | mostly combined – NEFT + RTGS |

| Language | Original English version | Varies by branch (often bilingual) |

| Structure | Clearly divided for Remitter and Beneficiary | Usually merged into one block and left and right side formats |

| Acknowledgment Slip | Attached “Customer Record Slip” for your proof | Not always provided |

| Availability | Free download on the IOB website | Often branch-only |

Who Can Use the RTGS Facility + Upper Limits

Real-Time Gross Settlement is meant for only big transfers, plus, as per its name, it focuses on real-time transfers. Anyone holding an Indian Overseas Bank account can use it, whether you are:

- An individual sending funds to another person or firm

- A business owner making vendor or salary payments

- A company transferring funds to another branch

- You can transfer between these limits –

| Transaction Type | Minimum | Maximum |

|---|---|---|

| RTGS | ₹2,00,000 | No limit |

Note: There is no upper limit on the RTGS amount; however, your account type may have a lower transaction limitation, so please confirm with your branch before making a transfer. Some accounts, such as – student account or a BSBDA. For standard personal accounts, a bank may have daily online RTGS limits ranging from ₹10 lakh to ₹50 lakh. This facility is perfect for property payments, business settlements, and high-value transfers that need same-day credit.

Where to Get the IOB RTGS Form

You have three easy options to get the original English version of the form:

| Option | Description |

|---|---|

| 1. From Branch | Visit your nearest IOB branch and ask for the RTGS form at the helpdesk. It is also available near the cash counter. |

| 2. IOB Website – View Forms | Go to https://www.iob.bank.in → scroll down → click View Forms → find “Fund Transfer Under RTGS Form” |

| 3. Direct Download Link | 👉 Download IOB RTGS Form (PDF) – Original version, editable and printable. |

IOB’s form is also digitally editable or fillable. Once downloaded, you can fill it digitally using Sejda or any PDF editor, then print and sign before submitting.

Documents You Will Need

When visiting the branch, carry these items:

| Document | Purpose |

|---|---|

| Self cheque | For payment authorisation, if you are making a transfer via cheque |

| Photo ID proof | Aadhar, PAN, or driving license (if asked) |

| Beneficiary Details | This is for you, carry a printed document for filling in the beneficiary details in the form, you can ask photo of a cancelled cheque from your beneficiary. |

| RTGS form | Properly filled and signed – printed or branch collected |

| Passbook or Account Details | To verify your account number |

How to Fill the IOB RTGS Form (Step-by-Step Guide)

Your IOB RTGS form is divided into three parts: Remitter Details (your details) and Beneficiary Details (receiver’s details), and the customer copy. Use a regular black or blue pen and write only in block letters, use underlines and boxes for fill-up. Here’s how to complete it easily –

1. Enter Basic Details

| Field | What to Write | Example |

|---|---|---|

| Branch Name & Code | Your IOB branch name (the branch you are using for RTGS, not your home branch) | “IOB – Anna Nagar (Code: 1234)” |

| In the please remit section, Amount (Figures & Words) | Enter both | ₹2,50,000 (Rupees Two Lakh Fifty Thousand Only) |

| Payment Mode | Tick or write “By cheque” or “Debit to account” | Debit to account |

2. Applicant (Remitter, This is your details) Section

| Field | Example | Notes |

|---|---|---|

| Type of Account | SB / CA / CC | Tick the correct box |

| Account Number | 123456789012345 | Must be 15 digits |

| Cheque Number | 025671 | Mention if paying by cheque |

| Cheque Date | 21/10/2026 | Current date |

| Remitter Name | Rahul Mehta | As per the account, check your passbook |

| Mobile / Email | 98765XXXXX / rajubank@email.com | For confirmation SMS/email |

Note: You may leave the Charges/Commission and Service Tax rows blank, OR confirm with your branch about the charges in the commission section. Here are the current charges in IOB for RTGS via the Branch –

| Transaction Amount | Base Charge | GST (18%) | This is your full commission – |

|---|---|---|---|

| If Amount between ₹2 lakh to ₹5 lakh | ₹25 | ₹4.50 | ₹29.50 |

| Any amount than ₹5 lakh | ₹49 | ₹8.82 | ₹57.82 |

Quick tip – Online RTGS via net banking or mobile app is completely free.

3. Beneficiary Section

| Field | Example | Notes |

|---|---|---|

| Beneficiary Name | beneficiary a company or individual – Ramesh Traders Pvt Ltd | Must match exactly with the account |

| Account Number | 987654321001234 | Double-check twice |

| Bank Name | State Bank of India | Receiver’s bank |

| Branch & City | MG Road, Bengaluru | Receiver’s branch |

| IFSC Code | SBIN000XXXX | Essential for RTGS |

| Type of Account | CA | Current Account |

| Sender to Receiver Message | “Invoice Payment – Oct 2026” | Optional message |

4. Declaration and Signature

In the “I agree about rules section”, put down your signature the same as you do on other bank documents. After signing, submit it to the RTGS counter along with your self-cheque or account debit instruction.

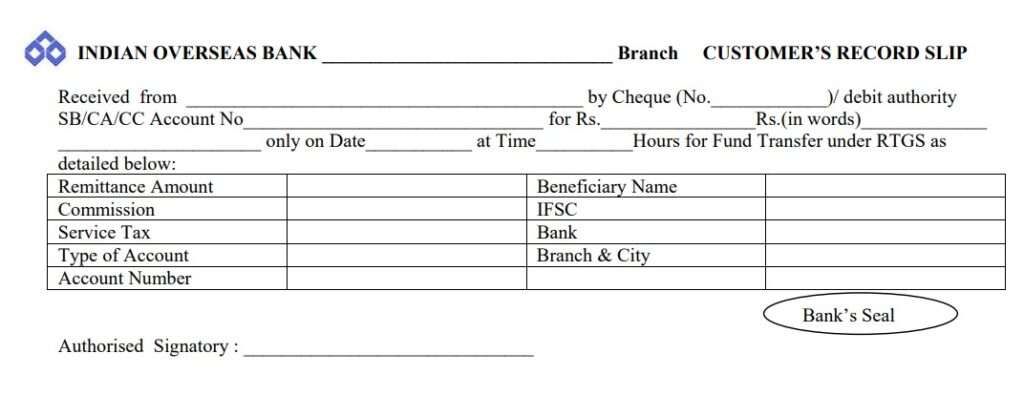

You will get a Customer Record Slip — your official acknowledgement containing details like:

- Amount

- Beneficiary name

- IFSC

- UTR number (for tracking)

Note – Ignore the “For Bank Use only” section; this is for bank officers. No need to fill anything.

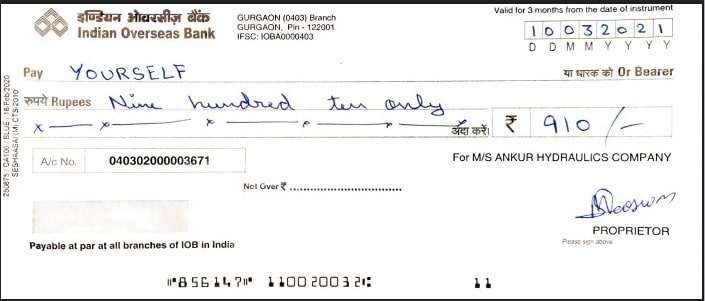

Quick Steps to Fill the Self-Cheque

If you choose to transfer via self-cheque or the branch recommends you to use it, here are the quick 5 steps to fill up a cheque –

- Write “YOURSELF” in the Pay field.

- Mention the same amount as in the RTGS form.

- Write “RTGS transfer to [beneficiary name]” in the Remarks area or back side of the cheque.

- Sign it the same way you do for withdrawals.

Processing Time & Confirmation

Once submitted, your RTGS is processed almost instantly:

- Within 30 minutes during working hours, but sometimes RTGS servers and cut-off timing, it may take 2 hours.

- You will receive an SMS alert if your number is registered.

- You can also ask the staff for the UTR number to track the transfer.

If the destination bank is closed or facing downtime, the transaction will reflect on the next working day.

When RTGS Is Available (IOB Branch Timings)

| Day | Working Hours | Note |

|---|---|---|

| Monday | 10 AM – 5 PM | Regular hours |

| Tuesday | 10 AM – 5 PM | Lunch may differ |

| Wednesday | 10 AM – 5 PM | Hours may differ |

| Thursday | 10 AM – 5 PM | Hours may differ |

| Friday | 10 AM – 5 PM | Regular hours |

| Saturday | Closed | Weekly holiday |

| Sunday | Closed | Weekly holiday |

FAQs

Can I transfer ₹20 lakhs through IOB RTGS?

Yes, you can transfer ₹20 lakhs easily using RTGS via a branch, and the charges are the same. There’s no upper limit, only a minimum of ₹2 lakh per transaction.

Can I cancel an RTGS after submission in the IOB?

No, you cannot cancel after submitting the form at the branch or online. This is a rule by the RBI that applies to all banks, including the Indian Overseas Bank (IOB). Once the funds are debited and the Unique Transaction Reference (UTR) number is generated, the settlement is considered final and irrevocable.

Is RTGS available on Saturdays in IOB?

IOB branch offices are not open for RTGS transactions on the 2nd and 4th Saturdays of every month, but you can use IOB Mobile or netbanking, which is available 7 days a week.

Do I need to visit my home branch for RTGS in IOB?

No. You can submit the RTGS form at any Indian Overseas Bank branch. Just ensure your account is active and you carry a self-cheque or debit authorisation for faster processing.

What happens if I write the beneficiary’s name slightly wrong?

If the account number and IFSC are correct, most RTGS credits still succeed. However, IOB may reject the transfer if the mismatch is large. Always match the name from a cancelled cheque.

Is PAN or Aadhaar compulsory for RTGS at the branch?

Generally, no for existing customers. However, for large-value transfers above ₹10 lakh, some branches may request PAN or Aadhaar for internal compliance and audit verification.

Can I submit multiple RTGS forms on the same day?

Yes. You can submit multiple RTGS forms in one day, provided your account balance allows it. Each form is treated as a separate transaction with individual UTR numbers.

Why do some IOB branches insist on a self-cheque?

A self-cheque acts as payment authorisation proof, especially for high-value RTGS. It reduces signature disputes and speeds up verification, which is why many branches prefer it over debit instructions.

How long should I keep the RTGS customer record slip?

Keep it for at least 3–6 months. It contains the UTR number, which is mandatory if you raise a complaint, request tracking, or need written confirmation for property or business payments.

What should I do if RTGS is debited but not credited?

First, wait 2 hours. Then contact your branch with the UTR. In 99% cases, delayed RTGS credits automatically or gets reversed by end of the same working day.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.