Jana Small Finance Bank gives different Fixed Deposit options for normal people, senior citizens and also NRI customers. The bank is not forcing people to lock money for a very long time, which is a good thing. FD tenures are practical and easy to understand.

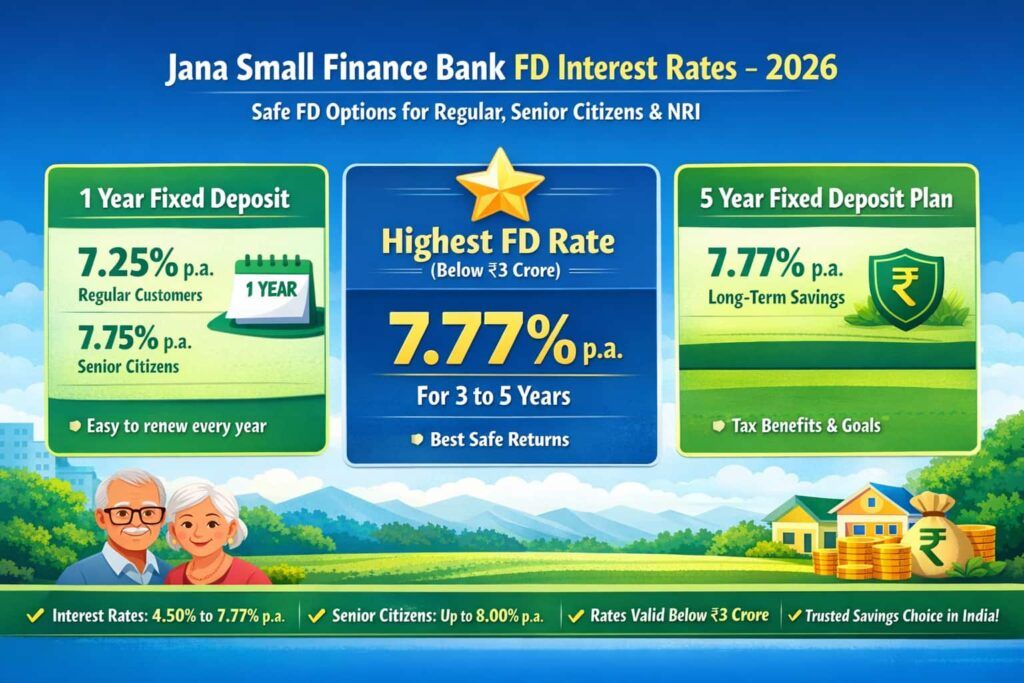

- For 2026, Jana Small Finance Bank FD interest rates start from 4.50% and go up to 7.77% per year for regular customers.

- Senior citizens can get up to 8.00% interest per year on an FD amount below ₹3 crore.

- The highest interest of 7.77% is available if the FD period is more than 3 years and up to 5 years.

Fixed Deposit is still one of the most trusted savings options in India. Even now also, many people from small cities, towns and villages like FD more than other things. The reason is simple – money is safe, no tension, and the return is already fixed. People know how much they will get after maturity. According to Business-Standard data of 2023, on average, one Indian household keeps around ₹4.25 lakh in fixed deposits. This shows that FD is still the first choice for normal middle-class families.

Most people never invest more than ₹3 crore. In real life also, almost 90% customers stay below this amount only. Big investors are very few. Normal people usually choose from just 5 main FD options in Jana Bank, depending on the time period and interest. That’s why FD plans below ₹3 crore matter most for common customers.

Most Popular FD Options Below ₹3 Crore (Normal People)

Normally, people who invest below ₹3 crore mostly choose only these 5 types of Fixed Deposits. These options are common and easy to understand, so normal customers go with these only.

- Regular Fixed Deposit (for Residents, NRI and NRO people)

- Senior Citizen Fixed Deposit

- Liquid Fixed Deposit (Liquid Plus)

- Sweep Fixed Deposit

- Tax Saver Fixed Deposit

Now, let us understand each FD one by one, in a simple way, without heavy bank language.

1. Jana Bank Regular FD (for Residents, NRI and NRO people)

The Regular Fixed Deposit is the foundation of Jana’s FD offerings. It is designed for investors who want steady growth without complexity.

Key Features of Regular FD

- The minimum amount is just ₹1,000, so anyone can start, no tension

- Time period is flexible, from 7 days to full 10 years

- You can choose how interest comes:

- Cumulative FD – money grows, payout at the end

- Non-cumulative FD – monthly, quarterly, half-yearly or yearly income

- This FD is open for:

- Normal resident Indians

- NRE account holders

- NRO account holders

- You can make a premature withdrawal, but charges apply (1% penalty)

- Existing account holders can apply via internet banking or the mobile banking app. For new customers, you can visit the official website.

Jana Bank Regular FD Interest Rates (Below ₹3 Crore)

Last updated by the bank: functional from 10th January 2026

| FD Tenure | Regular Customer (p.a.) | Senior Citizen (p.a.) |

|---|---|---|

| 7 Days – 14 Days | 4.50% | 4.50% |

| 15 Days – 60 Days | 5.25% | 5.25% |

| 61 Days – 90 Days | 5.25% | 5.25% |

| 91 Days – 120 Days | 5.77% | 5.77% |

| 121 Days – 180 Days | 6.00% | 6.00% |

| 181 Days – 270 Days | 6.50% | 7.00% |

| 271 Days – 365 Days | 7.00% | 7.50% |

| Above 1 Year – 2 Years (730 Days) special FD | 7.25% | 7.75% |

| Above 2 Years – 3 Years (1095 Days) special FD | 7.50% | 8.00% |

| Above 3 Years – Below 5 Years | 7.77% (Highest) | 7.77% |

| 5 Years (1825 Days) | 7.77% (Tax savings) | 7.77% |

| Above 5 Years – 10 Years | 6.50% | 7.00% |

- Best rate: 7.77% per year

- Best period: Above 3 years to 5 years

Why Regular FD Is So Popular

- Simple FD, no special condition

- Works for a short time and also long time

- Good for people who want a fixed income or safe growth

- Unlike other special FD types, this one fits almost everyone

Because of this, Regular FD is the default FD choice, especially for NRIs, unless someone needs tax saving or an easy withdrawal option.

2. Senior Citizen Fixed Deposit

Senior Citizen Fixed Deposit is basically the same as Regular FD, nothing new or separate. The only difference is, bank gives a little extra 0.5% interest to senior citizens for selected tenure only. This FD is very useful for retired people and those who don’t want any risk, because money stays safe and the interest is slightly higher.

Who Can Open a Senior Citizen FD

- Resident Indian only

- Age should be 60 years or above

- A joint account is allowed, but the senior citizen must be the first holder

Key Points You Should Know

- The interest rate is higher than the normal FD, but only for some time periods

- FD can be opened as:

- Cumulative – money grows, paid at the end

- Non-cumulative – monthly or quarterly income

- Good option if you want:

- Monthly income for expenses

- Quarterly pension-type cash flow

- Safe place to keep the main capital

Senior Citizen FD Interest Rates

Effective from: 10th January 2026

| FD Tenure | Senior Citizen Interest Rate (p.a.) |

|---|---|

| 7 Days – 14 Days | 4.50% |

| 15 Days – 60 Days | 5.25% |

| 61 Days – 90 Days | 5.25% |

| 91 Days – 120 Days | 5.77% |

| 121 Days – 180 Days | 6.00% |

| 181 Days – 270 Days | 7.00% |

| 271 Days – 365 Days | 7.50% |

| Above 1 Year – 2 Years | 7.75% |

| Above 2 Years – 3 Years | 8.00% |

| Above 3 Years – Below 5 Years | 7.77% |

| 5 Years | 7.77% |

| Above 5 Years – 10 Years | 7.00% |

Important Limitation (Very Important)

- Senior citizen extra interest does NOT apply to NRE or NRO FDs

- This rule is from the RBI side, not Jana Bank’s decision

- No extra 0.50% benefit for:

- 7 days to 180 days

- Above 3 years to 5 years

- Interest is calculated based on the actual number of days

- Premature closure has 1% penalty

- If FD is closed within 7 days, no interest is paid

3. Liquid Fixed Deposit (Liquid Plus FD)

Liquid Plus Fixed Deposit is a new type of FD for people who want quick money access. If you need cash, you don’t have to break a full FD. You can take part amount, and the remaining FD keeps running. That’s why this FD is useful for people who want safety but also some flexibility.

Key Features of Liquid Plus FD

- The minimum amount is ₹10 lakh, so this is not for small savings

- The maximum retail amount is below ₹3 crore

- Money can be taken the same day (T+0) if needed

- Partial withdrawal allowed, full FD break not required

- No 1% penalty for early withdrawal

- You can also take an overdraft loan against this FD

How This Is Different from Regular FD

- Regular FD is mainly for better returns.

- Liquid Plus FD is mainly for easy access to money.

Here interest is recalculated if you take money early. So penalty is not there, but the higher interest slab may be lost. That’s the trade-off.

Who Usually Uses Liquid Plus FD

- HNI customers

- Business owners

- Trusts and NGOs

- People parking money for a short time

This FD is good when you want safety but don’t want money to get stuck.

4. Sweep Fixed Deposit (App-Based)

Sweep FD is not like a normal FD that you go and open. It is already connected with your savings account. You don’t even feel it working; the bank does it automatically in the background.

How Sweep FD Actually Works

- The bank keeps one limit in your savings account

- If money goes above that limit, the extra amount moves to the FD by itself

- When you swipe ATM or transfer money, the bank breaks only the FD part and puts the money back

What Is Good in This FD

- Instead of low savings interest, extra money earns FD interest

- Money is available anytime, not locked

- Penalty is there, but only on the part that comes back, not full FD

- This works only for a Resident savings account, NRI cannot use

Who Should Use Sweep FD

- Salary people whose money stays unused after the salary credit

- Business or professional people

- Anyone keeping a big balance and thinking “paise toh pade rehte hain”

Sweep Deposit Interest Rates

Effective from: 10th January 2026

| FD Period | Sweep-30 Days | Sweep-90 Days | Sweep-180 Days | Sweep-365 Days |

|---|---|---|---|---|

| 7 – 14 days | 4.50% | 4.50% | 4.50% | 4.50% |

| 15 – 60 days | 5.25% | 5.25% | 5.25% | 5.25% |

| 61 – 90 days | — | 5.25% | 5.25% | 5.25% |

| 91 – 120 days | — | — | 5.77% | 5.77% |

| 121 – 180 days | — | — | 6.00% | 6.00% |

| 181 – 270 days | — | — | — | 6.50% |

| 271 – 365 days | — | — | — | 7.00% |

Explanation

- Sweep FD interest depends on how many days the money stays in the FD

- Longer sweep period = better interest

- If a dash (—) is there, that period is not available for that sweep option

- Interest same as regular FD rates, but the money stays liquid

5. Tax Saver Fixed Deposit (5 Years)

Tax Saver FD is there for only one reason – to save tax under Section 80C. Nothing else. If tax saving is not your goal, this FD is not very useful.

Core Features (Simple)

- You can put a maximum of ₹1.5 lakh in one financial year

- Lock-in period is 5 years, compulsory, money is stuck

- No early withdrawal, whatever happens

- This FD is only cumulative, no monthly income

- Interest you earn is fully taxable

Who Can Invest

- Resident Individuals

- Resident HUFs

Who Should Avoid This FD

- NRIs

- People who need money anytime

- People looking only for high returns

Tax Saver FD is a tax-saving tool, not a return-making product. You choose it to reduce tax, not to make a big profit.

What are the FD Options for NRI Customers

NRIs usually invest through NRE or NRO Fixed Deposit, depending on where the money is coming from. Foreign income and India income are treated differently, that’s why two types exist.

1. NRE Fixed Deposit (For Foreign Income)

NRE FD is best when money is earned outside India, and you want tax-free income here.

Key Features

- Minimum amount is ₹10,000

- Minimum lock-in is 1 year; less than that is not allowed

- Interest and principal are both fully repatriable

- Interest earned is tax-free in India

- Available in cumulative and regular payout options

Very Important Rule

If you break NRE FD before 1 year, the bank will pay zero interest. So this FD is good only if money can stay locked for at least one year.

2. NRO Fixed Deposit (For India Income)

NRO FD is used for money earned inside India, like rent, pension, dividends, etc.

Key Points

- Minimum deposit is ₹10,000

- Interest rate is the same like normal Regular FD

- Interest is taxable in India

- TDS will be deducted by the bank

- Money can be sent abroad, but FEMA rules apply

Simple Difference

NRO FD works like a Regular FD, but the tax rules are totally different. That’s the main thing NRIs should remember.

Deposits Above ₹3 Crore: A Different Category Altogether

Once the FD amount goes above ₹3 crore, it is no longer treated like a normal retail FD. From here, pricing changes completely. Rates are not fixed on the card. They are negotiated, depend on tenure, and are usually handled by bank relationship managers. This zone is mainly for big-ticket investors, not for common customers.

1. Bulk Fixed Deposit (₹3 Crore & Above)

Bulk FD is for big money, not for retail people. Once the amount is ₹3 crore or more, the FD comes under the bulk category.

Key Features (Simple)

- Bulk FD starts when the amount is ₹3 crore or more

- FD can be closed before time, but a penalty will be there

- You can choose a short period or a long period; both options are available

Reality Check (Important points)

- Anything below ₹3 crore is a normal retail FD, not a bulk

- In bulk FD, the time period matters more than the size of the money

- Don’t think more money always means a better rate, that’s not how it works

- Most people keep bulk FD for 6 months to 2 years only

- If FD is broken early, 1% penalty is charged

- If FD is closed within 7 days, bank gives zero interest

- No senior citizen extra benefit for NRE or NRO bulk FD

- NRO bulk FD interest is taxable, TDS will be cut

- NRE bulk FD must complete 1 year, otherwise no interest paid

Bulk FD is mainly used to park big money safely for short to medium-term. It is flexible, but not self-service. Usually bank relationship team handles everything.

2. FD Plus (Non-Callable Fixed Deposit)

FD Plus is for very big surplus money where owner is sure money will not be touched before maturity. Once booked, that’s it — no breaking, no adjustment.

Core Reality –

- Minimum amount starts from ₹25 crore

- No premature withdrawal allowed, money is fully locked

- No auto-renewal, FD ends on maturity

- Rates look good only for short to medium time

- Long-term rates are kept intentionally lower

This FD is mainly for treasury teams, institutions, and big corporates, not for normal retail investors.

FD Plus Interest Rates chart

| FD Tenure | ₹25–<50 Cr | ₹50–<75 Cr | ₹75–<100 Cr | ≥₹100 Cr |

|---|---|---|---|---|

| 181 – 365 Days | – | – | – | 7.00% |

| >1 – 2 Years | 7.25% | 7.25% | 7.25% | 7.25% |

| >2 – 3 Years | 7.25% | 7.25% | 7.25% | 7.25% |

| >3 – <5 Years | 6.25% | 6.25% | 6.25% | 6.25% |

| 5 Years | 6.25% | 6.25% | 6.25% | 6.25% |

| >5 – 10 Years | 6.25% | 6.25% | 6.25% | 6.25% |

Effective from: 12th January 2026 (Non-Callable – No early withdrawal)

How to Apply for Jana Bank Fixed Deposit

- You can go to the Jana Small Finance Bank branch nearby or use the mobile banking app if you already have an account

- Carry PAN card and Aadhaar card for KYC (Old customers usually don’t need to do KYC again)

- Select which FD you want: Regular FD, Senior Citizen FD, Tax Saver FD, or NRI FD

- Enter how much money you want to keep and choose the FD period

- Select interest option: monthly, quarterly, or cumulative (lump sum at end)

- Put money through a bank transfer or cash/cheque at the branch

- FD receipt gets generated immediately

- You will get a confirmation SMS and email also

FAQs

How can I calculate the exact returns on Jana Bank FD before investing?

Use the official Jana Bank FD calculator to check maturity value, monthly income, and total interest based on amount, tenure, and payout type. Link: https://www.jana.bank.in/fd-calculator/

Which FD tenure gives the best return in Jana Bank as of January 2026?

As per rates effective 10 January 2026, the best return is 7.77% for 3–5 years. This suits long-term savers who don’t need frequent withdrawals.

Does this FD rate table apply to NRE and NRO customers also?

Yes, the same rate table applies. But NRE FDs need minimum 1-year tenure and are tax-free, while NRO FDs attract TDS as per income tax rules.

Where can existing customers get the Jana Bank FD application form?

Existing customers can download the official term deposit application form here and submit it at branch: https://www.jana.bank.in/images/PDF/Account-opening-form-for-Existing-Customer–Term-Deposit-30-SEP-2024.pdf

What is one practical FD tip normal people usually miss?

Most customers earn better flexibility by choosing 1–2 year FDs and renewing yearly. This avoids long lock-ins and helps adjust savings if rates change later.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.