Why Does IPPB Use a Customer ID?

As of now, according to the press release on the PIB Portal, India Post Bank has opened 9.88 crore accounts across India as of 1st September 2024. To keep track of each customer uniquely, IPPB uses something called a CIF number, or Customer ID.

- This Customer ID is a unique 9 to 10-digit number.

- Example: 1234567890

- It acts as your permanent identity in the bank’s system, separate from your account number or IFSC code.

What Is the Importance of your Customer ID?

India Post Payments Bank (IPPB) is a modern, fully digital bank. Instead of traditional passbooks, they offer QR cards, and most of the services are digital and smartphone-friendly, which requires your customer ID to access. Let’s explore where it is typically required for banking –

- Activating mobile banking

- Logging into the IPPB app or NetBanking

- Checking pre-approved loan offers

- Filing complaints via email or customer care

- Updating KYC or contact details

So, if you just opened an account, you need your customer ID to access mobile banking, so let’s look at all the trusted, easy ways you can retrieve it –

How to Get Customer ID via Mobile Number

The latest and active method to find your IPPB CIF number and bank account number is just using your registered mobile number –

1. Via SMS Banking

- Open your SMS app and tap on the Write New SMS.

- In the “To send” section, enter the 7738062873 phone number.

- Type SMS – GETCIF DDMMYYYY (your date of birth in DDMMYYYY format)

- Send it from your registered mobile number.

- Within 1 minute, you will get a reply from India Post Payments Bank, which includes your full 9-digit Customer ID and your Full Account number.

This method is super handy for people older than 70 or those using feature phones.

Note: sometimes, SMS can be delayed or not respond due to the server and weekends, try again after 24 hours on working days.

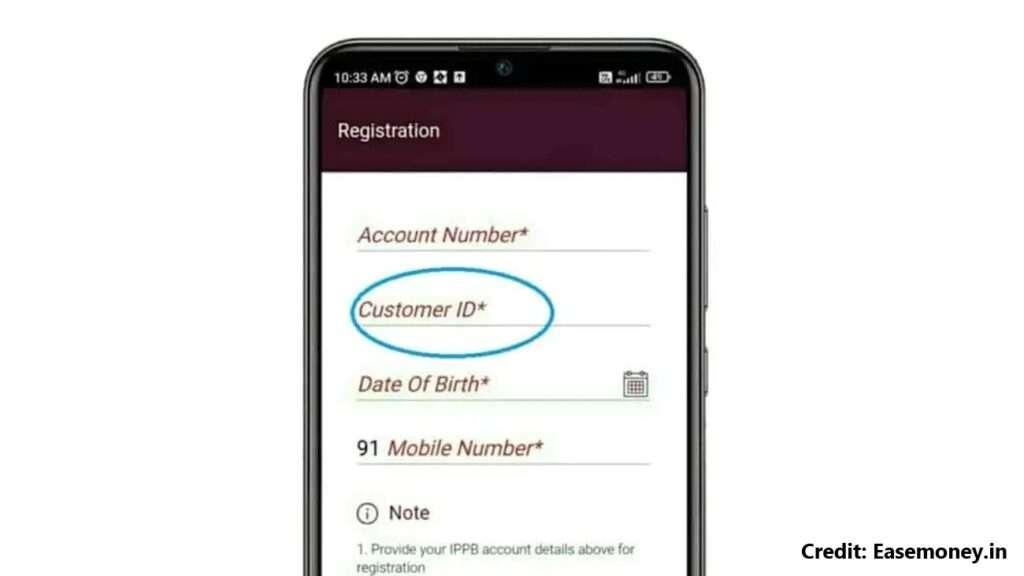

2. IPPB Mobile Banking App

- Simply visit the Play Store or App Store, download the IPPB Mobile Banking App.

- Open the app, tap on Send SMS to verify.

- Once verified, look for the ‘Get Account and CIF Number’ option.

- Tap on it to check the instructions given by the bank.

If you have already logged in to the IPPB mobile banking app and have a 4-digit m-pin, then follow the steps –

- First, open the App and enter your 4-digit mpin to access the dashboard.

- On the dashboard, navigate to the account overview.

- Your Customer ID is typically found in the profile management option.

What are the Official documents to find your customer ID

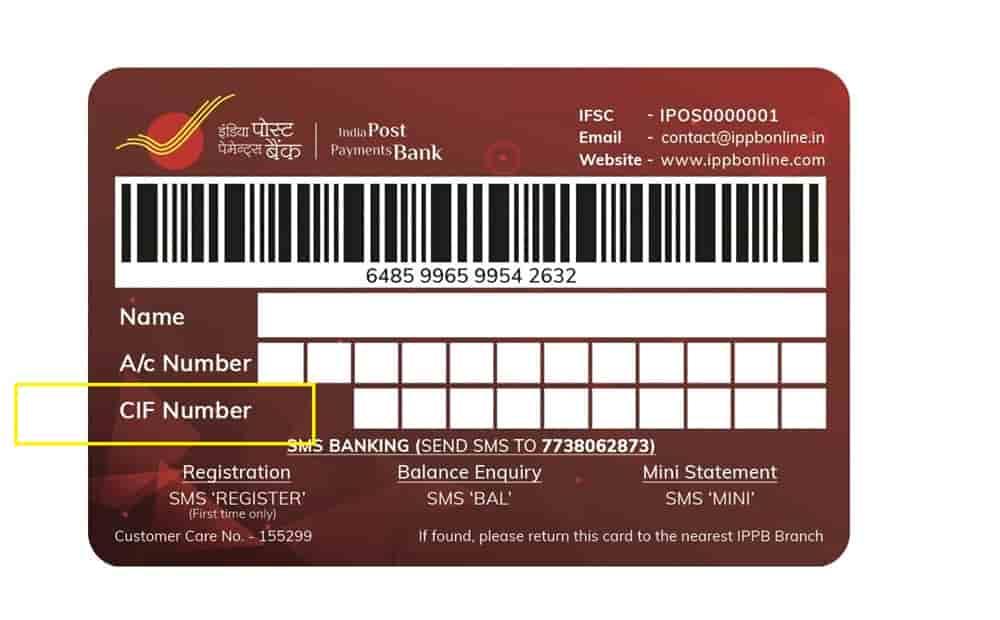

1. Your QR Card: The First Place to Find

As I already said, IPPB is a digital bank; they do not provide a physical passbook or statements. Instead, they offer a QR Card for a customer account overview and money transfer.

To find your Customer ID, all you need to do is, just flip your QR Card. The bank often provides your Customer ID as the name of the CIF no. printed below your name and account number. If it’s not there, don’t worry — just use the next step.

Visit Your Home Branch

Take your QR card and visit the nearest post office that offers IPPB services.

- Hand the card to the banking assistant.

- They will scan it and provide your Customer ID.

- Note it down for future use.

Lost your IPPB QR card?

Here, you have to provide a few documents to the bank. Also, you can apply for a new QR Card by calling the 155299 phone banking.

- PAN Card

- ATM Card (if issued)

- Account Number

- This helps them verify your identity.

2. Check the IPPB General documents that received just after opening the Account

- Welcome Letter – check any welcome letter you got from the bank after completing your full KYC. Check your Email and old files.

- Chequebook (if applied) – if you applied for any cheque book with IPPB, please check the first page of it. It is usually printed as CIF No.

- Physical Account Statement– In past, if you applied for any physical duplicate statement, look top of it, you got your CIF ID mentioned there.

- ATM Kit (less common in IPPB) – Most banks offer a Customer number on the back of the ATM Card and ATM paperwork; check it out.

What To Do If You Just Opened Your IPPB Account

If you’re a new customer and don’t yet have access to the app or QR card:

- Call IPPB Customer Care: 155299 or 1800 180 7980 (24/7 Toll-free)

- Follow the IVR menu for Account Services or Customer Support.

- Talk to a representative.

- Provide details like:

- Registered mobile number

- Date of birth

- Account number

- Ask them to share your Customer ID.

- Note it down carefully.

Tip – Save your Customer ID digitally on your phone or cloud storage (secure and encrypted).

Take a look at these FAQs

How do I retrieve my Customer ID if I’ve changed my registered mobile number?

First, you need to visit the bank to update your new mobile number, it’s just a few-minute process. After updating, use the SMS method to get your Customer ID, Also, same time, you can ask Customer ID from the bank staff.

How can I find my IPPB account number?

Quite simple, just send

GETCIF <DOB>SMS to 7738062873 from your registered number. The bank will provide you with both your full account number and Customer ID.I lost my QR card. Can I still get my Customer ID?

If your QR Card is lost or theft, you have to visit the nearest indian post office for help. Also, carry valid proof, such as an ATM Card and a PAN Card. The bank staff helps you to get a CIF number and a New QR Card.

Can I get my Customer ID via an IPPB missed call?

For now, the India Post Payments Bank does not provide the forget Customer ID services via missed call banking. Try the SMS method.

Can I find my IPPB Customer ID inside the mobile banking app?

Yes, once logged in. After MPIN entry, go to account overview or profile section. Customer ID is shown there, but you need the ID initially to activate digital access.

I just opened my IPPB account. What if I don’t have the QR card yet?

Call IPPB customer care at 155299 with your registered mobile number and DOB. After verification, executives usually share your Customer ID verbally during the same call.

Where is the Customer ID printed on IPPB documents?

Most commonly, it’s printed on the back of your IPPB QR Card below your name. It may also appear on welcome letters, cheque books, or any physical statement requested earlier.

Can senior citizens or non-smartphone users retrieve their Customer ID easily?

Absolutely. SMS banking is designed for this. Many elderly customers rely on the GETCIF SMS method, which works without apps, internet, or visiting a post office.

Is SMS really the easiest way to get my IPPB Customer ID?

Yes. From real branch guidance, sending GETCIF DDMMYYYY to 7738062873 from your registered mobile instantly returns both your Customer ID and account number, even on basic feature phones.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.