What Are LIC Fixed Deposit Schemes & How Do They Work?

Let’s start with facts. LIC Housing Finance Ltd launched its SANCHAY Deposit Scheme in May 2007. Since then, this scheme has remained active for nearly 19 years and continues to carry a CRISIL AAA and Stable rating.

It means they hold the highest possible safety rating for any deposit-taking company in India. This “AAA” designation signifies the highest level of safety regarding the timely repayment of both principal and interest.

It is available to a wide range of investors, including individuals, NRIs, HUFs, and trusts.

In 2026, LIC Housing Finance accepts deposits through three structured deposit schemes under the SANCHAY framework. These deposits are widely used across India. especially in Tier-2 and Tier-3 cities, where families prefer fixed monthly income and capital safety over market-linked products.

As per the business standard, the recent survey revealed that 95% of Indian families still preferred bank FDs, in compared to less than 10% for mutual funds and stocks at the time.

One important thing must be clear from the start: LIC of India does not offer traditional bank Fixed Deposits directly.

But their subsidiary, All LIC Fixed Deposit products are offered through its daughter company, LIC Housing Finance Ltd (LIC HFL). Let’s find out what they offer –

What are the LIC Fixed Deposit Schemes Available in India

As of Last Jan 2026, LIC Housing Finance offers three deposit schemes, which are live and available on their website or portal –

| # | Scheme Name | Who It Is For |

|---|---|---|

| 1 | Sanchay Public Deposit (primary audiences) | Individuals (All regular customers), NRIs, HUFs, Trusts |

| 2 | Corporate Deposit Scheme | Specially for Companies & Institutions |

| 3 | Sanchay Green Deposit | Resident Individuals only (Support green) |

Each scheme has a different purpose and structure, and is designed for categories of customers, as we already talked about. Let’s talk about the oldest and most popular Sanchay Public Deposit, the primary audience scheme.

1. Sanchay Public Deposit – Main LIC Fixed Deposit for Individuals

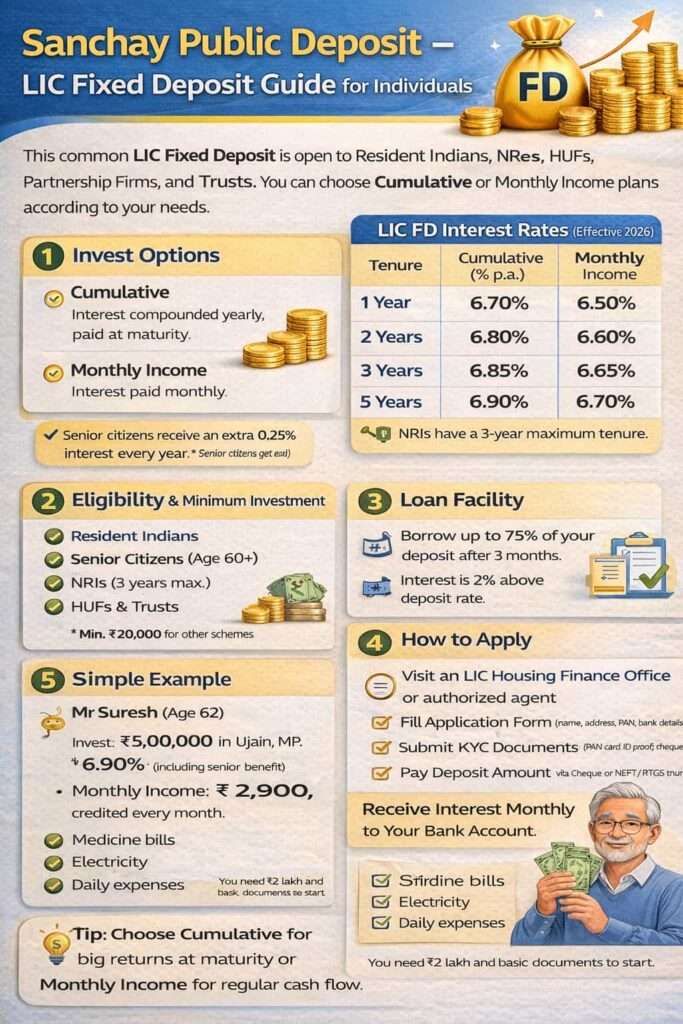

This is the most common LIC Fixed Deposit used by the public. The target is individual resident Indians, NRIs, Hindu Undivided Families (HUFs), partnership firms, and Trusts. You can apply this online or offline.

This offers both Interest Payouts: You can get Cumulative (interest compounded yearly and paid at maturity) and Non-Cumulative (flexible options such as Monthly, Quarterly, or Yearly interest). The LIC Fixed Deposit Monthly Income Plan comes under the Non-Cumulative (Monthly) option.

- The truth about tenure: It is for 1 to 5 years only (NRIs are restricted to 3 years). There is no 10-year or 15-year LIC Fixed Deposit plan.

- Loan Facility: You can get up to 75% of the deposit amount, which can be borrowed after a 3-month lock-in period. But it has an interest rate 2% higher than the deposit rate.

Minimum investment required

| Option | Minimum Amount |

|---|---|

| Yearly or Cumulative | ₹20,000 |

| Monthly or Quarterly | ₹2,00,000 |

If you choose the below ₹2 lakh options, the monthly income option is not allowed.

Interest Rates Chart (Effective January 2026)

For normal people, if you invest up to ₹3 crore, these are the interest rates –

| Tenure | Cumulative (% p.a.) | Non-Cumulative (Monthly) | Non-Cumulative (Yearly) |

|---|---|---|---|

| 1 Year | 6.70% | 6.50% | 6.70% |

| 18 Months | 6.75% | 6.55% | 6.75% |

| 2 Years | 6.80% | 6.60% | 6.80% |

| 3 Years | 6.85% | 6.65% | 6.85% |

| 5 Years | 6.90% | 6.70% | 6.90% |

Note for You – Senior citizens get an extra 0.25% interest every year on deposits up to ₹3 crore. Because of this, for 5 years, the maximum interest rate is 7.15.

How to Make a LIC Fixed Deposit Monthly Income Plan (Step-by-Step Apply process)

A LIC Fixed Deposit Monthly Income Plan is done through LIC Housing Finance Ltd (LIC HFL) under SANCHAY Public Deposit – Non-Cumulative (Monthly) option. People use this plan when they want a monthly income and also want their main money to stay safe.

This plan is widely used by parents, retirees, and households needing a regular income.

How it works in real life

- You invest a lump sum once

- LIC HFL pays interest every month

- Your principal amount stays locked

- On maturity, the full principal is returned

This is your interest payout, not a withdrawal.

Broken-period interest (real detail)

- Deposit on or before the 15th → interest starts next month

- Deposit after 15th → first payment shifts to next cycle

No money is lost, only the date changes.

Step 1: Check Eligibility (Who Can Apply)

You can open an LIC Monthly Income FD if you are:

- Resident individual

- Senior citizen (age 60 years or above)

- NRI (allowed maximum tenure of 3 years). Also, payment rules may differ.

- HUF or Trust (through public deposit scheme)

Companies cannot use this plan (they have separate corporate deposits). You can read below.

Step 2: Minimum Investment Required (Very Important)

To get a monthly income, a minimum deposit of at least 2 Lakh Rs (minimum compulsory). So, choose a good amount to invest to get a good income.

Step 3: Decide These 4 Things Before Applying

Before filling the form, decide:

- Deposit Type → Sanchay Public Deposit

- Interest Option → Non-Cumulative (Monthly)

- Tenure → You can select from the chart, but not longer than 5 years.

- Bank Account → Where the monthly interest will come (It is credited automatically)

Step 4: Visit the LIC Housing Finance Office or Agent

In real life, most people apply offline.

You can:

- Visit any LIC Housing Portal, go to the deposit option, select your scheme, enter your PAN Card number, mobile OTP, and register your account to process online. (best in 2026)

- Contact a LIC agent / LIC HFL executive, if the LIC HFL Branch near you (not a basic LIC branch), visit once. They provide you with the application form.

All LIC HFL offices accept FD applications.

Step 5: Fill the Application Form

Form filling is simple. You enter:

- Name, address, PAN

- Bank account details (for monthly income)

- Nominee details (important)

- FD amount and tenure

Time taken: 10–15 minutes only.

Step 6: Submit Required Documents (Basic KYC)

Normally required, here is the list of documents that are usually required for a regular FD in LIC:

- PAN card (mandatory)

- Aadhaar / Voter ID / Passport (address proof)

- 1 passport-size photo

- Senior citizen proof (age proof)

- Cancelled cheque

If you already invested earlier and have a folio number, documents may not be needed again.

Step 7: Make the Payment

Payment modes allowed:

- Cheque

- NEFT / RTGS / IMPS

- Cash not allowed for 2 lakh

Interest starts from the date LIC HFL receives your money.

Step 8: Monthly Income Starts

- Monthly interest comes on the 1st of every month

- Only in March, the interest is paid on 31st March

- Payment comes directly to your bank account

- Your principal money stays locked till maturity

How Much Monthly Income Do You Get (Simple Example)

Example: ₹5 Lakh Investment

Mr Suresh (Age 62) lives in Ujjain, MP.

- Investment: ₹5,00,000

- Option: Monthly Income (Non-Cumulative)

- Tenure: 3 Years

- Interest rate: ~6.90% (including senior benefit)

Monthly income: ~₹2,900

Interest credited: 1st of every month

Principal returned: ₹5,00,000 after 3 years

They are used for:

- Medicine bills

- Electricity

- Daily household expenses

To start a LIC Fixed Deposit Monthly Income Plan, you need ₹2 lakh, basic documents, and one visit to LIC Housing Finance — after that, money quietly comes every month.

2. Corporate Fixed Deposits by LIC Housing Finance

This scheme is not meant for individuals. It is also a “SANCHAY” brand, but selective investors such as –

- Public & Private Limited Companies

- Banks & Financial Institutions

- Statutory Boards, Corporations, Local Authorities

Key features

- A CRISIL AAA rating means your money and interest are considered very safe

- Minimum deposit is ₹20,000. After that, you can add money in multiples of ₹1,000

- FD period can be from 1 year to 5 years. You also get options like 15 months and 18 months

- Quarterly or annual interest payout

- Electronic payment only

- After 3 months, you can take a loan on your FD up to 75% of the deposit amount.

Corporate Interest Rates (Effective June 19, 2025 – Valid for 2026)

Interest rates depend on how much money you deposit and for how long. The rates are for the cumulative or yearly option –

| Tenure | Deposits Up to ₹5 Cr | ₹5 Cr to ₹10 Cr | ₹10 Cr to ₹20 Cr |

|---|---|---|---|

| 1 Year | 6.60% p.a. | 6.65% p.a. | 6.70% p.a. |

| 15 Months | 6.65% p.a. | 6.70% p.a. | 6.75% p.a. |

| 18 Months | 6.65% p.a. | 6.70% p.a. | 6.75% p.a. |

| 2 Years | 6.80% p.a. | 6.80% p.a. | 6.80% p.a. |

| 3 Years | 6.80% p.a. | 6.80% p.a. | 6.80% p.a. |

| 5 Years | 6.80% p.a. | 6.80% p.a. | 6.80% p.a. |

Corporate deposits are used to keep money for some time, not for getting monthly income. You can download the application from the portal to apply.

3. LIC Sanchay Green Deposit (FD) – RBI Green Deposit Framework

Sanchay Green Deposit by LIC HFL is a fixed deposit where money is used only for green projects like renewable energy and clean transport, as per RBI rules. Structurally, it works like a normal LIC FD.

Who can invest

- Resident Individuals only

NRIs and companies are not eligible.

Key Features

- Purpose: Your money is used only for green and environmentally friendly projects.

- Security: CRISIL AAA rated, which means high safety for interest and principal.

- Minimum Deposit: ₹20,000 for yearly/cumulative FD, ₹2,00,000 for monthly income FD.

- Tenure: Options available for 1, 1.5, 2, 3, and 5 years.

- Interest Payout: Choose cumulative (paid at the end) or non-cumulative (monthly or yearly).

Interest Rates For Green Deposit

| Tenure | Deposits Up to ₹3 Cr (Yearly) | Deposits Above ₹3 Cr (Yearly) |

|---|---|---|

| 1 Year | 6.60% p.a. | 6.50% p.a. |

| 18 Months | 6.65% p.a. | 6.55% p.a. |

| 2 Years | 6.70% p.a. | 6.70% p.a. |

| 3 Years | 6.75% p.a. | 6.75% p.a. |

| 5 Years | 6.80% p.a. | 6.80% p.a. |

In a non-cumulative option (monthly or yearly), interest rates are between 6.40% and 6.80%, depending on the FD period. Senior citizens get an extra 0.25% interest on deposits up to ₹3 crore.

How Tax Works on LIC Fixed Deposits (Reality)

- Interest is taxable: No matter what interest you earn from LIC HFL FD, it will be added to your income and taxed as per your slab (5%, 20%, or 30%).

- Tax is yearly: Tax applies on interest every year, not only at maturity.

TDS Rules

- Non-senior citizens: TDS applies if interest goes above Rs. 50,000 in a year

- Senior citizens (60+): TDS applies only after ₹1,00,000

- TDS rate:

- 10% if PAN is given

- 20% if PAN is not given

Tax Saving & Deductions

- 80C: Only a 5-year tax saver FD gives a deduction (up to ₹1.5 lakh). Interest is still taxable.

- 80TTB: Senior citizens can get up to ₹50,000 interest tax-free (old tax regime).

How to Avoid TDS (If Eligible)

- If your total income is below the taxable limit, submit:

- Form 15G (below 60 years)

- Form 15H (senior citizens)

This only stops TDS; you still need to show interest in ITR.

One Practical Tip For You – Always check Form 26AS or AIS and keep your interest certificate from LIC HFL while filing tax.

FAQs

Is the LIC Fixed Deposit Monthly Income really paid every month?

Yes. In most LIC HFL branches, monthly interest is credited on the 1st of every month via NACH. March interest comes on 31st March. Delays usually happen only during bank holidays.

Is there an LIC fixed deposit calculator available?

LIC HFL does not provide a full public calculator. Branch staff usually calculate manually. A simple rule: ₹1 lakh gives ~₹550–₹600 monthly interest, before tax, depending on tenure and rates.

Is there any LIC fixed deposit for 10 years?

No. LIC Fixed Deposits through LIC Housing Finance are available for a maximum 5 years only. Any 10-year LIC product you hear about is an insurance or pension plan, not a fixed deposit.

Is there any LIC fixed deposit for 15 years?

No. LIC Housing Finance does not offer 15-year fixed deposits. Such searches usually confuse LIC insurance policies with FDs. All LIC FDs are limited to 1–5 years only.

Will tax be deducted every month from my interest?

No. TDS is calculated yearly, not monthly. If total annual interest crosses ₹40,000 (₹50,000 for seniors), 10% TDS applies. Actual tax depends on your slab.

Is a LIC Fixed Deposit as safe as a bank FD?

It is AAA-rated, but it is a corporate FD, not a bank FD. There is no DICGC insurance. Safety depends on LIC HFL’s balance sheet, not government guarantee.

When will LIC fixed deposit money become double?

LIC fixed deposit money does not double fast. Normally, it takes around 10–11 years to become double because the interest rate is about 6.5%–7%. It is safe, but returns are slow.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.