What is the LIC NEFT Form and Why Is It Required?

LIC NEFT is the method LIC uses to send your policy money straight to your bank account, without cheques or branch visits. Whenever a payment is due — maturity, a part-payment like a survival benefit, or a nominee claim — LIC credits it digitally through the NEFT system used by all major banks. To enable this, LIC asks you to submit one simple NEFT mandate form with your correct account details. Once registered, every future payout reaches you smoothly, securely, and on time.

When You Need the Form

You must submit (or update) the NEFT form in these situations, such as –

- Policy maturity

- Survival benefits

- Loan disbursement

- Policy surrender

- Death claim (nominee)

- Pension or annuity

- Extra premium refund

- Bank account change

- Bonus or special additions

Basically, if money is coming from LIC to you, this form becomes compulsory.

What NEFT Means

NEFT is the RBI’s way of moving money securely between banks. It works quietly in the background, it works in batches and takes 3 to 4 hours, but what it does for you is simple:

LIC releases payment → RBI system processes it → Your bank account gets the credit → You receive an SMS with the UTR number.

It removes delays, avoids lost cheques, and ensures that your payout reaches the correct account every time.

How to Download the LIC NEFT Form (Direct Links)

Here are the official PDFs — safe to use and straight from LIC:

| Form Name | Language | Download Link |

|---|---|---|

| LIC NEFT Mandate Form | English | https://licindia.in/documents/d/guest/neft_mandate_form__format |

| LIC NEFT Original Form PDF | Marathi | https://licindia.in/documents/d/guest/neft_mandate_form |

| LIC NEFT Application Form | Hindi + English | https://licindia.in/documents/d/guest/neft-application-form |

If Download Links Don’t Work — Alternate Official Method

Sometimes, LIC changes the file location. If a PDF does not open, follow this path:

- Step 1: Firstly, Open LIC’s official website: www.licindia.in

- Step 2: Scroll to the footer section.

- Step 3: Tap on “Download Forms”.

- Step 4: Scroll until you find the section “IPP ECS Mandate Form”.

- Step 5: Inside it, you will see NEFT forms in multiple languages. Tap PDF, Get Download → you can print as well, also, you can collect it at any nearest LIC branch.

This route always works, no matter where LIC shifts the PDF.

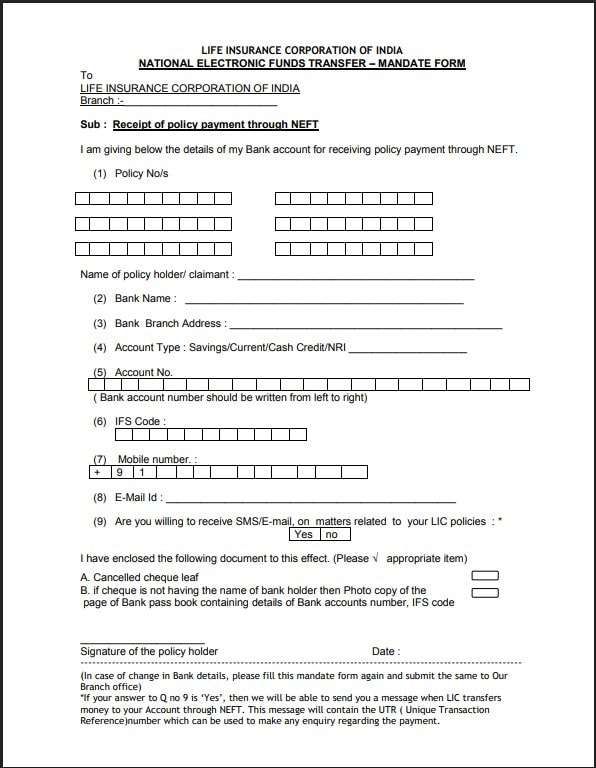

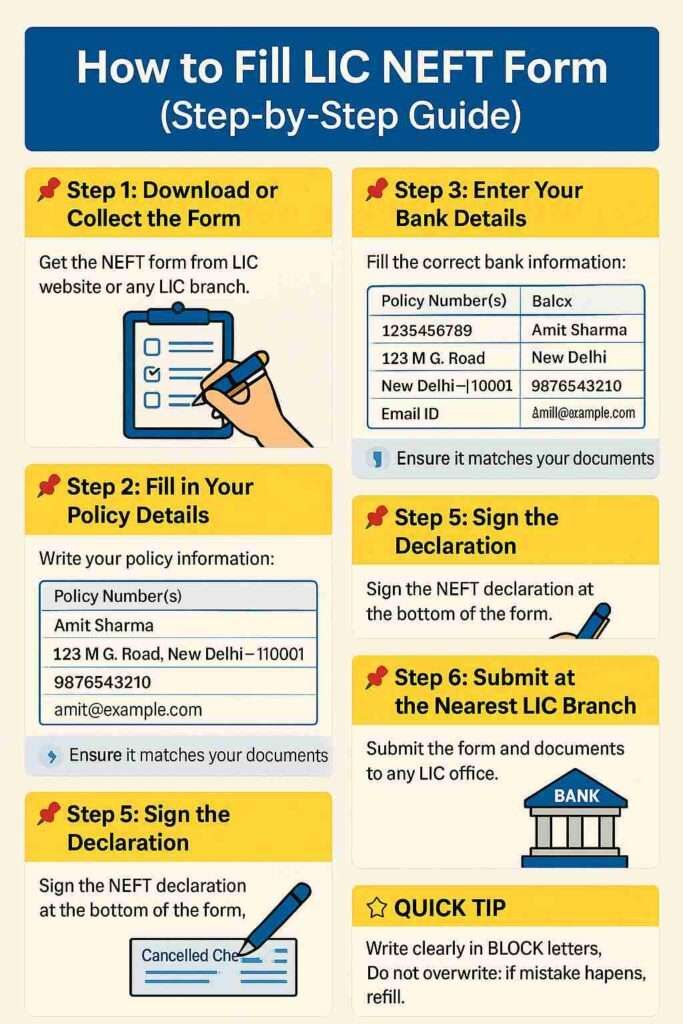

How to Fill up the LIC NEFT PDF — Step-by-Step

You can write using a blue or black pen, and use Capital words only. Also, avoid overwriting. If a box doesn’t apply, write “NA”.

- Your Branch: First of all, write down your LIC Branch name. You can check the LIC policy paper for details.

- Policy Number: Enter your 9-digit Policy number. You can add up to 6 policies which you want NEFT activation.

- Quick example for you:

789456123

- Quick example for you:

- Name of Policy holder: Write your name exactly as it appears in your bank account. Your name must match, or the mandate gets rejected.

- Bank Name: Write down the complete bank name — no short forms. such as:

State Bank of India - Branch Address: Simply, put your bank branch name + locality as per the cancelled cheque book.

- For example:

Main Branch, Ellisbridge, Ahmedabad

- For example:

- Account Type: Now, here select your account type, such as – Savings/Current/Cash Credit. – tick savings simply.

- Account Number: You have to enter your full 10 to 15 digits left to right bank account number. Double-check it and match with your passbook or mobile banking app. Example:

012345678901 - IFSC Code: 11 characters; simply, you can copy from a cancelled cheque or passbook. One wrong character rejects the form.

- Mobile number: enter your full 10 digits (you may add +91). LIC may send SMS with UTR. (Account must be linked with your mobile no.)

- Email ID: optional, but useful for alerts.

- SMS/E-mail consent: tick YES to receive transfer alerts.

- Select document: add one document cancelled cheque or a bank passbook front page photocopy.

- Signature & Date: Sign exactly as in bank records. If the nominee signs in a claim, follow the LIC claim rules.

What Documents Must Be Attached

You have to attach one of these:

- Cancelled cheque (best option)

- Passbook copy showing name, account number, and IFSC

Also keep these available:

- PAN card (for ID verification)

- Aadhaar Card (if required)

- Policy papers (if the branch asks)

- Maturity form (if applicable)

- Death or medical certificate (only for claim cases)

Make sure your copies are clear and readable. LIC rejects faded or unclear scans.

Important Instructions LIC Wants You to Follow

To avoid delays, keep these points in mind:

- Your bank account must be NEFT-enabled.

- The name on the policy and the bank account must match exactly.

- LIC does not accept NRI bank accounts for NEFT payouts.

- Submit the form only at a branch that services your policy.

- Every time you change your bank, submit a fresh NEFT mandate.

- Keep a photocopy of your form + documents for future reference.

- If the payout doesn’t arrive, contact LIC with the UTR number.

- Always recheck your account number and IFSC before submitting.

How Long Does LIC Take After Submitting the NEFT Form

This is the real timeline LIC follows:

1. Standard Maturity Payments

If all documents are submitted earlier, the payment is credited on the due date.

2. New NEFT Submission (Normal Cases)

LIC usually processes and credits the funds in about one week.

Sometimes it comes earlier (2–3 working days), but LIC officially works on a week-long cycle.

3. Cases Requiring Verification

If LIC needs extra checks (especially death claims or policy disputes), the time can extend:

60 days to 6 months or more, depending on the case.

4. If Payment Is Delayed

- Contact LIC customer care at: +91-022 6827 6827

- Services are available 24×7.

You can also visit your servicing branch on Monday to Friday: 08:00 AM to 08:00 PM and request the UTR number to track the transaction with your bank.

Additional FAQs

Can I submit the LIC NEFT form online?

To register for LIC’s NEFT facility online, you have to log in to your customer portal via the official LIC of India website. Open the home and navigate to the ‘Service Request’ section. Tap on ‘NEFT Registration.’ Now, you have to enter your bank details – such as IFSC and full account number- and upload the signed NEFT mandate form and a cancelled cheque. It allows LIC to securely credit payments directly to your account online, with no need to visit anywhere.

Does the maturity form also need to be submitted along with the NEFT form?

Yes, for maturity payouts LIC usually asks for the discharge form plus the NEFT form. Together they confirm your identity and your bank details.

Do nominees also need to submit the LIC NEFT form?

Yes, nominees must submit their own NEFT form during death claims so LIC can credit the settlement amount to their bank account directly.

Is a cancelled cheque mandatory for LIC NEFT registration?

If your cheque shows your name, it’s the easiest option. If not, you can attach a passbook copy instead. LIC only needs clear proof of your bank details.

Can one LIC NEFT form be used for multiple policy payouts?

Yes. One NEFT mandate can cover up to six LIC policies if the bank account remains the same. This avoids repeated submissions and speeds up future maturity, bonus, or survival benefit credits.

What is the most common reason LIC rejects NEFT forms?

Name mismatch. Even a missing middle name or spelling difference between policy and bank records causes rejection. Tip: match exactly as per the bank passbook, not Aadhaar or PAN.

Can I submit the LIC NEFT form at any LIC branch?

No. Submit only at your policy servicing branch. Other branches may accept it, but internal transfer delays processing by 5–7 working days in most real cases.

Is NEFT registration required again if I already received one payout?

No. Once registered, NEFT stays active for future payouts. You need to resubmit only if the bank account, IFSC, or policy ownership changes later.

How can I track LIC NEFT payment if the credit is delayed?

Ask your LIC branch for the UTR number. With it, your bank can trace the transaction instantly. Without UTR, banks can’t investigate NEFT delays properly.

Is a joint bank account allowed for LIC NEFT credit?

Yes, joint accounts are accepted if the policyholder is one of the holders. Third-party accounts are rejected unless it’s a nominee claim with proper documentation.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.