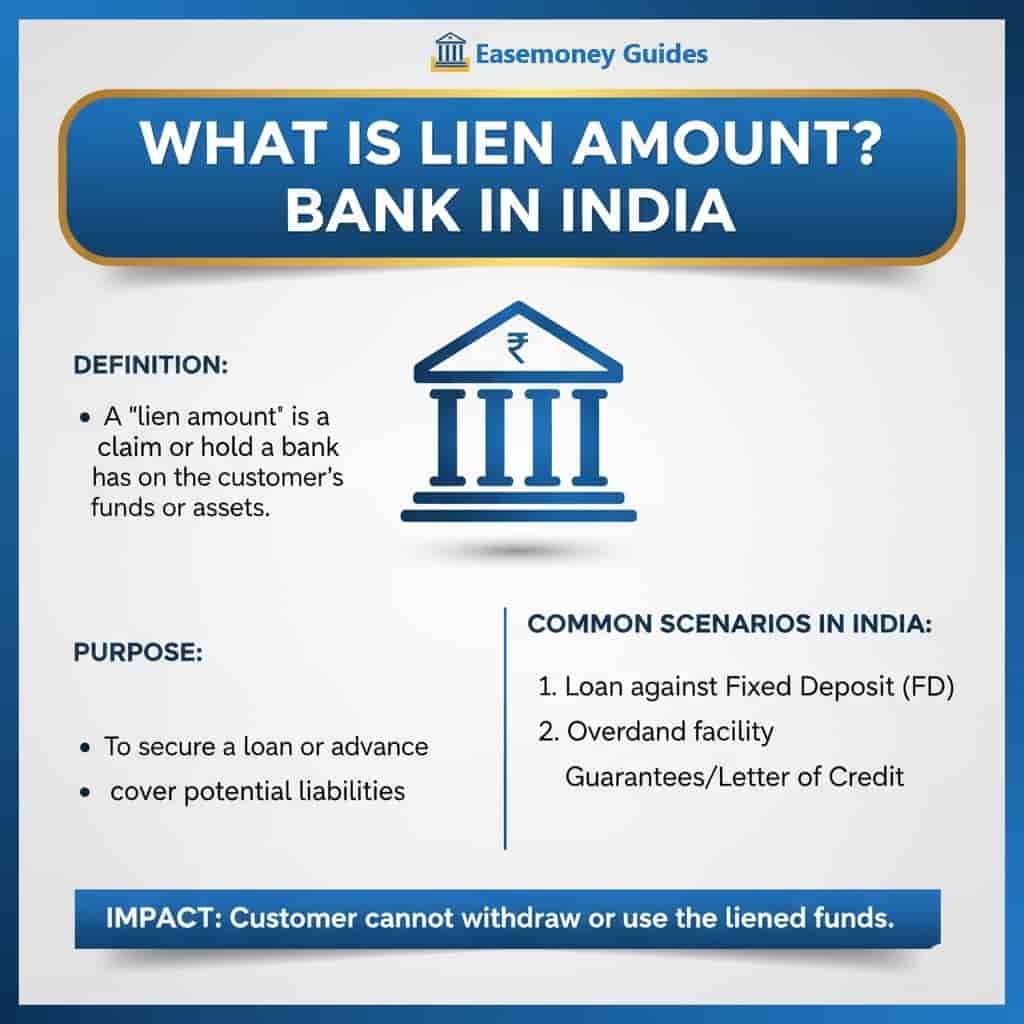

What Does Lien Marked Mean?

A lien on your bank account means the bank has temporarily blocked a particular amount of your deposit money for some reason. When you check your account statement or your mobile banking app, it shows your balance.

This lien amount does not work while you do a withdrawal, transfer, or purchase any items until the bank releases it. You may find a lien marked amount in the account overview section. where you check the balance casually.

However, the good news is that Lien is not a permanent deduction, and this money still belongs to you.

Once the issue is cleared, the bank releases the amount automatically, and you can use it again.

Real-Life Example: How Lien Works

This is the explanation in brief. Say you maintain a balance of ₹25,000 in your SBI savings account. You forgot an EMI instalment of ₹2,000 against a personal loan. The bank, after the due date, reflects this mark of lien of ₹2,000 in your savings.

Now, your account looks like this:

- Total Balance: ₹25,000

- Lien Amount: ₹2,000

- Available Balance: ₹23,000

You can’t use that ₹2,000 until you clear the EMI. As soon as you pay it, the lien will be removed, and your available balance will become ₹25,000 again.

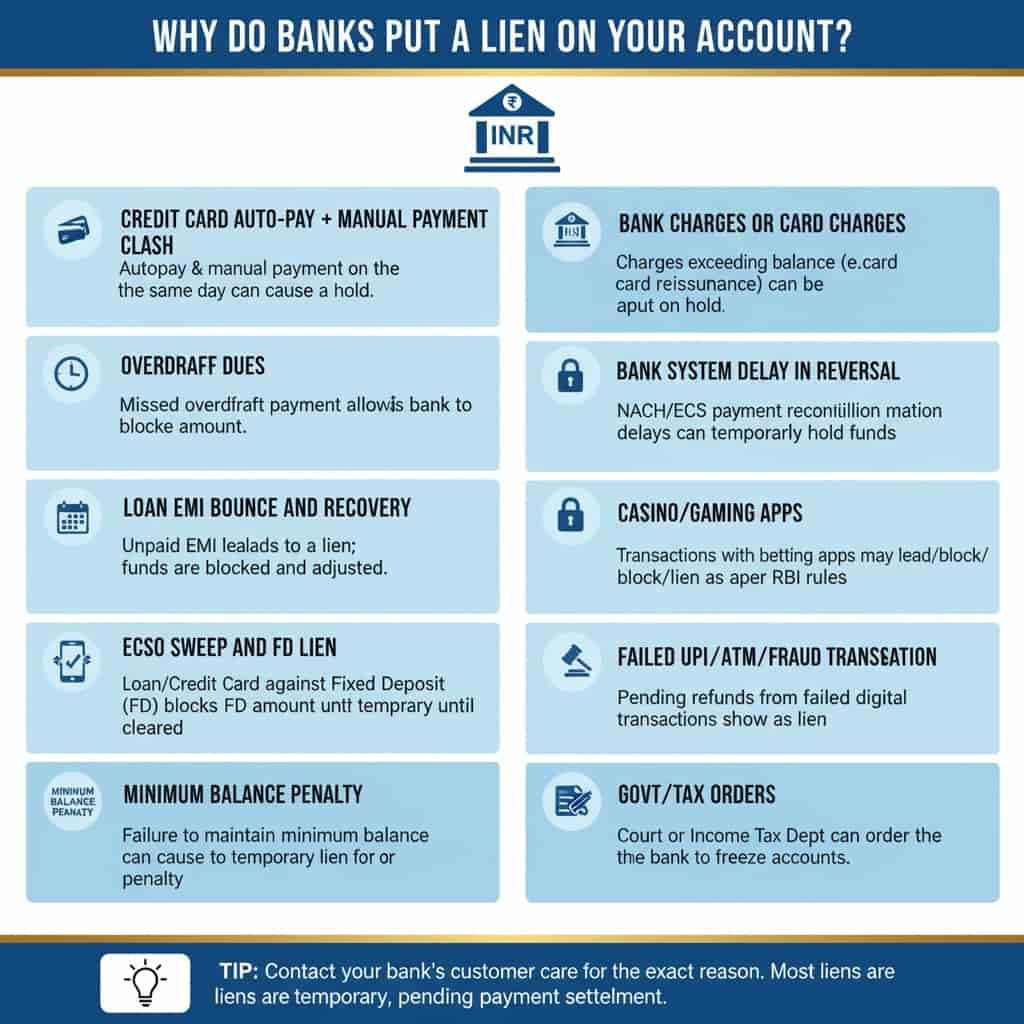

Why Do Banks Put a Lien on Your Account?

- Credit card Auto-Pay + Manual Payment Clash

- If you pay manually on the due date.

- Autopay still triggers on the due date = it clashes, and the bank finds that your autopay has not been settled. So, put your savings amount into a lien.

- Overdraft Dues

- If you linked your savings account to an overdraft facility and missed the payment, the bank can automatically block that due amount.

- Loan EMI Bounce and Recovery

- If EMI is not paid on time, your bank may mark a lien on your account.

- Your funds are blocked and later adjusted for dues.

- ECS Bounce or Auto Debit Failure

- If you an any active Auto-debit facility on your account, but when the due date it fails for any reason, such as insufficient balance, the bank may temporarily block the amount to ensure the next debit succeeds.

- Auto Sweep and FD lien

- If you take a loan or a credit card against your FD, the FD amount is counted as a lien.

- Cannot break it until the loan is cleared.

- Minimum Balance Penalty and charges

- If you have an average monthly balance account and you don’t maintain a set amount, instead of a negative balance, a few banks temporarily put a lien temporarily. When you put money on it, they deduct and settle it for a penalty. In this case, your lien settles automatically when you just deposit it.

- Bank Charges or card charges

- If your account has an active debit card and other products, such as a cheque book, a passbook, if a charge is higher than the available balance on your account, banks usually put that charge on hold.

- Reissuing of debit card, passbook, and physical statement has charges.

- Bank System Delay in Reversal

- Sometimes, Autopay is slowly reconciled, mostly if NACH/ECS Payments happen, your amount gets held under lien for 2/3 working days, even if you already paid the amount manually.

- Casino/gaming apps

- If you linked your account with any type of betting apps, the RBI have very strict guidelines for that.

- If you transact there, the bank may block/lien that amount, sometimes freeze your account.

- CyberCrime and Fraud prevention

- Rare, but if your bank finds any suspicious transactions, the bank can freeze your account and put a lien mark.

- Failed UPI/ATM/POST transaction

- In most cases, when you swipe your card or do just QR scan via UPI, if payment fails but your money is blocked.

- It may show as a lien until the refund happens.

- Govt/Tax orders

- It is also a rare case, if the income tax department or court orders to bank to freeze your account and lien all your account balances. It happens in legal events; you will need a lawyer to settle it.

Tip for you: The exact reason is always random; you still have to contact your bank’s customer care to clear the reason. Majority of cases, your money is put on hold for account charges, pending transactions, and your money will be released after your payments are settled by the bank’s internal system.

Do I Have to Pay the Lien Amount?

The answer is not fixed; lien does not always mean something you have to “pay”. It depends on which type of lien affects you.

Types of lien situations

- Auto-pay + manual payment failure.

- Slow settlement delay

- Someone put money in your account due to the wrong account number (in this case, you will see that amount, but you cannot use it)

- Cyber fraud

- Suspicious complaint under review.

Here, you don’t have to pay anything. The bank will release or refund your lien after settlement and will have completely processed the investigation.

- Missed EMI or loan Dues

- Pending credit card bill after the due date

- Minimum balance penalty

- Bank charges on product – debit card, cheque bounce, withdrawal fee, and failure of NACH.

Here, this situation counts as a bank funds recovery lien; the bank has already blocked the money to adjust dues. If you don’t pay, the bank will use the lien amount to recover.

Bank-Wise Lien Balance Overview

Here’s a quick look at how major Indian banks handle lien balances and their typical removal times:

| Bank | Where It Shows | Removal Time |

|---|---|---|

| SBI | YONO app or NetBanking | 24h – 7 days |

| HDFC Bank | Statement in the mobile app | 24h – 5 days |

| ICICI Bank | iMobile and Customer Care | 1 – 7 days |

| Axis Bank | Axis Insta help portal | 2 – 5 days |

| Kotak Mahindra Bank | Kotak netbanking and help centre to resolve | 2 – 7 days typically |

| Bank of Baroda | NetBanking / Branch | 3 – 10 days |

Tip: Always first check and confirm your “Available Balance” — not just your “Total Balance” — before making any payments.

How to Remove a Lien Amount from any bank: Step-by-Step Guide

This is one of the most common questions customers ask; however, you can generate a request to remove my lien, but the bank only removes it once the reason for the lien is resolved, and the timing depends on bank to bank. Here steps to remove it –

1 Step: Check the Reason

First, you have to find out why the lien was applied to my account. You can do this by –

- logging into your NetBanking or mobile app (SBI YONO, or HDFC mobile app)

- Check your bank statement and recent SMS or email notifications

- On the back side of your ATM card, use that number to call your bank’s customer care helpline during working hours.

- Visit your home branch directly

Note: The best you can talk to customer care

2 Step: If the due on the system hold

No payment required, just patience for a few days, if your customer care tells you it is a system hold, because we find –

- Failed payments

- Unsettled amounts

- Suspicious activity

- Manual Cash payment

- Auto-Pay failure

Here, you have to raise a complaint ticket and request for reversal faster.

3 Step: If it’s due to bank charges or a loan

If your bank says to you, you have pending payments, charges, a minimum average balance penalty, or an FD-based issue.

You have to first clear the outstanding dues to request a lien removal receipt from the bank.

4 Step: If it any other reason

- Check notice from GST, Court, and Income tax

- Clear dues with the authority

- Go to the branch and request a removal with proof.

5 Step: Contact the Bank

If you’ve already paid or the lien seems incorrect, contact your bank and request that they remove it. They might ask for proof of payment or confirmation.

You can contact them via:

- Customer care helpline

- Email support

- Visiting the nearest branch

6 Step: Wait for Confirmation

After you have done your part, the bank will verify the payment or resolution and remove the lien. Once removed, the lien amount becomes part of your available balance again.

When Will the Lien Amount Be Credited Back?

Usually, it takes 1 to 7 working days for the lien amount to be settled once the issue is fixed. In some cases (like legal, cyber fraud, GST pendings, or court orders), it might take longer, upto 15 days or a month.

The basic time frame for different reasons –

- System error or slow payments – it may take just 48 hours, but it can take 5 working days in some cases.

- If it’s linked to a loan or credit card: Once the EMI or credit card bill is cleared, the lien will be lifted within 3 days.

- Unpaid charges for a Negative balance: it is not refundable, money will be adjusted on the deposit. It takes 48 hours.

FD-Based Lien (Fixed Deposit Lien)

A lien does not just work only on your savings account, but it can also be set on fixed deposits. This usually happens in two cases:

- Loan or overdraft against FD: If you take a loan on your FD amount, the FD itself is marked with a lien as security. You will continue earning interest on that, but you cannot prematurely withdraw or break the FD until the loan is repaid.

- Credit card issued against FD: If you have a secured credit card based on your FD. In such cases, a portion (say 75-85%) of your FD is marked under lien. If you default on your card bill, the bank can recover the dues directly from that lien.

Example:

- FD amount: ₹1,00,000

- Credit card issued: ₹80,000 limit

- Lien marked: ₹80,000 on FD

You still own the FD, but you cannot close or withdraw the lien amount until your dues are settled.

What happens if the lien balance is not paid?

- For Loan/EMI/Cards – You Bank will use your lien amount to adjust the outstanding. Your credit score drops, + late fees + recovery notices for the remaining balance.

- Temporary lien – it will adjust as per the bank’s timeframe; you don’t need to do anything, no credit score impact.

- Penalty and charges – for just a minimum balance penalty, banks usually don’t go legal, but for big loans, they take legal action only. If you try for a loan in future, if your account is linked with PAN, you may find difficulties.

Add on account holder Q/A

Can a lien amount affect my UPI payments?

Yes, your blocked amount will not work on UPI and any other payment mode.

How Lien Works When the Account Has a Zero Balance?

Even if your account has a ₹0 balance, a lien still exists in the bank system. Suppose you have ₹1,400 due for loan EMI It’s like a note in the system: “Once money is deposited, collect ₹1,400.”

Lien vs Hold – Are They the Same?

In most day-to-day banking situations, “lien” and “hold” mean the same thing: money that is temporarily blocked by the bank. The simple difference is that a lien is a legal term, and hold is used as an operational result.

Can a lien be placed even if I didn’t take out any loans or credit cards?

Yes. Around 40–50% lien cases come from charges, failed autopay, or system holds. Tip: Don’t assume loan issues—always ask customer care for the exact lien reason code.

Why does my balance show money, but every transaction fails?

Because banks show the total balance, not the usable balance. A lien reduces “available balance.” Many users miss this and think the app is faulty. Always check the “withdrawable” or “available” amount.

Does the lien automatically disappear if I ignore it?

Sometimes yes, mostly no. System-related liens clear in 2–5 days. Recovery or charge-related liens stay active until adjusted. Ignoring them delays access and may trigger auto-debit later.

Can banks recover lien money without my consent?

Yes, legally. Under banker’s general lien rights, banks can auto-adjust dues once funds arrive. That’s why lien amounts sometimes reduce silently without debit alerts.

Will a lien affect my credit score directly?

The lien itself doesn’t hit CIBIL. But if it exists due to missed EMI or card dues, those underlying delays are reported. Tip: clear dues first, then request lien removal proof.

How long should I wait before escalating a lien issue?

If the lien doesn’t clear in 5 working days after payment or clarification, escalate. First customer care, then nodal officer, then RBI CMS. Waiting silently is the biggest customer mistake.

What’s the safest way to prevent lien issues in future?

Maintain minimum balance, avoid manual + autopay overlap, track EMIs, and review account charges quarterly. One small missed fee often creates unnecessary lien confusion later.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.