November 10, 2025 – Across India, more than ₹67,000 crore is sitting quietly in old bank accounts that people forgot about — or that belong to family members who are no longer around.

To help everyone find and claim this money, the Reserve Bank of India (RBI) has launched a special online platform called UDGAM.

What Is the UDGAM Portal?

UDGAM stands for “Unclaimed Deposits – Gateway to Access Information.”

It’s a simple RBI website where anyone can search old or inactive bank accounts that haven’t been used for 10 years or more.

When an account stays unused that long, the money gets moved to a special fund called the Depositor Education and Awareness (DEA) Fund.

But don’t worry — the money still belongs to you or your legal heir. The UDGAM portal just helps you find where it is.

| Detail | Information (as of Nov 2025) |

|---|---|

| Total unclaimed deposits | ₹67,000 crore+ |

| Banks connected | 30+ banks (~90% of deposits covered) |

| Time inactive | 10 years or more |

| Managed by | RBI (DEA Fund) |

| Awareness drive | Oct–Dec 2025 |

Unlike before — when you had to go to each bank one by one — UDGAM lets you search across multiple banks in one go.

How to Check and Claim Your Forgotten Money

You can check it yourself in three easy steps:

- First of all, go to the official website: https://udgam.rbi.org.in

- Register your mobile number, now, enter your full name, captcha, set a good password, and verify it with 6-digit OTP.

- Search your name or your family member’s name using any ID — PAN, Voter ID, or passport number.

If the system finds your name, it will give you a Reference Number (UDRN).

Then, you simply visit that bank’s branch with your valid ID (KYC), documents, photograph to claim the money.

If the account belongs to a family member who has passed away, the legal heir can claim it using documents like a death certificate and succession proof.

Why RBI Is Doing This Now

The RBI started a campaign called “Aapki Punji, Aapka Adhikar” — which means “Your Money, Your Right.”

It runs till December 2025 and includes awareness camps across India where bank officials are helping people find and reclaim old money.

Unlike earlier, when unclaimed deposits were just sitting silently in records, this campaign is active and people-focused.

It combines online access with real-world help — so everyone, even those not familiar with online searches, can get support.

Before vs Now — What’s Changed

| Feature | Before (Old Way) | Now (UDGAM Portal) |

|---|---|---|

| How to search | Visit each bank | One RBI portal for all |

| Awareness | Very low | National campaign |

| Claim process | Long and unclear | Clear 3-step process |

| Time to resolve | Weeks or months | A few days (with documents) |

| Access | Limited | Online + at awareness camps |

Before this, most people didn’t even know they had unclaimed money.

Now, the power is in your hands — you can search anytime, from anywhere and get help from RBI.

How Big Is the Problem?

It’s huge.

As of June 2025, more than ₹67,000 crore is still lying unclaimed across Indian banks.

In just one district — Prayagraj (U.P.) — ₹360 crore is lying in nearly 8.4 lakh inactive accounts.

Multiply that across the country, and the scale becomes clear — lakhs of people may have money waiting to be claimed.

Where the Money Lies — Mostly in Public Sector Banks

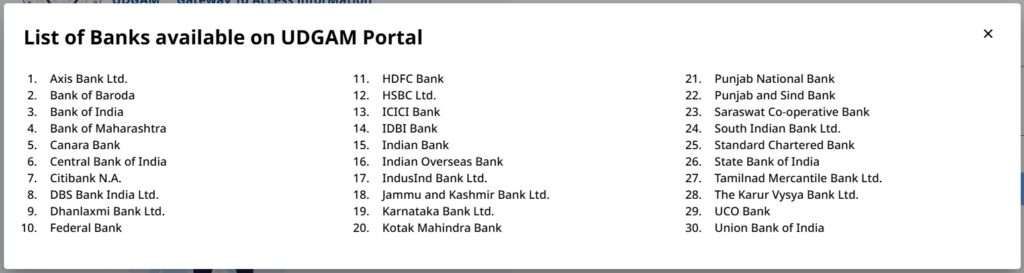

Out of ₹67,000 crore lying unclaimed, over ₹58,330 crore belongs to public sector banks. There are a total of 30 banks in the list.

| Bank | Unclaimed Deposit (Approx.) |

|---|---|

| State Bank of India (SBI) | ₹19,330 crore |

| Punjab National Bank (PNB) | ₹6,911 crore |

| Canara Bank | ₹6,278 crore |

| Bank of Baroda | ₹4,300 crore |

| Union Bank of India | ₹3,800 crore |

| Bank of India | ₹3,200 crore |

| Indian Bank | ₹2,900 crore |

| Central Bank of India | ₹2,400 crore |

| Others (Private & Cooperative Banks) | ₹8,670 crore |

So, almost nine out of every ten rupees lying unclaimed are with government-owned banks.

What Counts as an “Unclaimed Deposit”

RBI considers an account unclaimed when:

- Savings or Current Account: No activity (no deposit or withdrawal) for 10 years.

- Fixed or Term Deposit: Not claimed for 10 years after maturity.

- Transfer to RBI: After 10 years, banks move the money to RBI’s DEA Fund, where it stays safe until the rightful person claims it.

Even if your account has been moved to the DEA Fund, your right to that money never expires.

Final Thought

If you switched cities or states, changed jobs, or handled a family estate, take five minutes to check.

You might find money that’s been waiting for you for years.

Unlike earlier times when forgotten deposits were nearly impossible to trace, now it takes just one search.

Check it, claim it, and make your money work again — because as the RBI says,

“Aapki Punji, Aapka Adhikar.”

You can visit here for more information: https://udgam.rbi.org.in

Next News related to this – Most People in J&K Don’t Know This: Over ₹465 Crore of Public Money Is Just Sitting Idle in Banks — Could Any of It Be Yours?