Why PNB Sends You Locked PDF Statements Every Month

This happens because PNB — like all Indian banks — follows the Reserve Bank of India (RBI) guidelines to protect your financial data. That’s why your e-statements are always PDF password-protected, whether you ask for them via email, app, or WhatsApp.

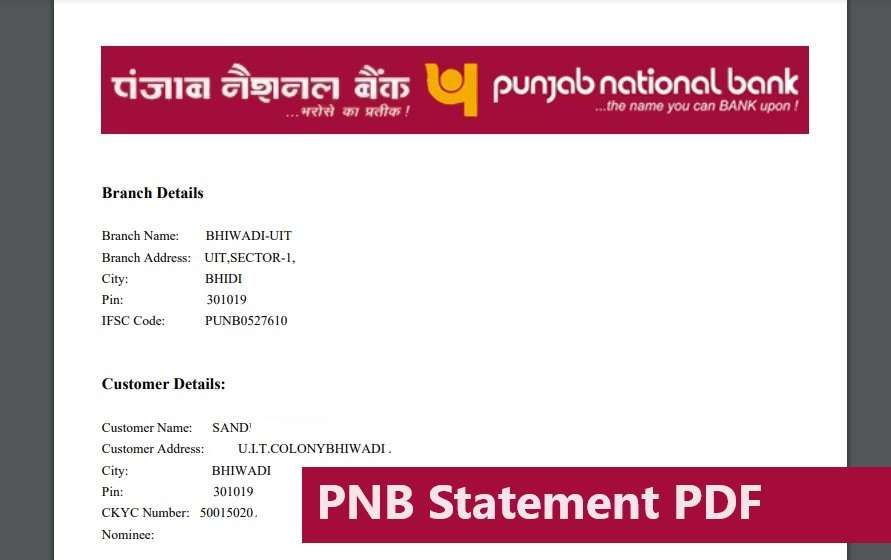

The E-statement is a digital way to view your account information, including transactions, account balance, Branch Address, and other banking details.

It will be password-protected. Let’s move to your main concern of unlocking the statement with the correct format.

Steps to Open Your PNB Bank Statement PDF

Use either of the two formats below:

Option 1: Use Your Account Number

To unlock your PNB account e-statement PDF, the bank uses the simple password format as your 14 to 16-digit Account Number.

Let’s take an example. If your bank account number is 9876543331234, then this is your password. Enter it exactly as it is.

Option 2: Use Your 9-digit Customer ID (CIF Number)

Alternatively, you can use your PNB 9-digit Customer ID (CIF Number) as your password.

Example: If your PNB Customer ID is 932293945, then enter 932293945 as the password (digits only). or sometimes, CIF look like this – IB9322939P, you have to enter words also.

How to find the PNB Account Number

If you don’t remember your account number, few tips for you –

- Old Physical or e-statement: You can view your account number in your old monthly statement. It is usually mentioned in the header section.

- UPI Apps: You can simply use any of the UPI apps like Paytm, Phonepe, and Google Pay. Navigate to my account and tap on View Details to access the account number.

- Bank Documents: Check your PNB passbook and Chequebook. It is usually printed on the first page of the book.

- PNB One App: Enter your 4-digit MPIN to log in, and navigate to account overview to access your statement.

Forget Customer ID, where to find?

- Visit the PNB Internet banking portal.

- Click on “Know Your User ID”—your User ID is the same as your customer ID.

- You have to enter your 16-digit account number, along with your PAN number and your registered mobile number.

- You will receive an OTP; enter it to verify.

- After entering the OTP, your customer ID will be displayed.

Where You Can Get Your PNB Statement (Even Without Net Banking)

You don’t need to rely only on internet banking. PNB offers multiple ways to access your bank statement:

| Method | Requirement |

|---|---|

| Email Statement | Registered Email ID |

| PNB One App | MPIN / Registered Mobile |

| WhatsApp Banking | Saved Number + Registered Mobile |

| ATM Mini Statement | ATM Card & PIN |

| SMS Mini Statement | Phone with SMS balance |

Follow the steps to activate it using the PNB One app –

- Download the PNB One App: Install the app from your smartphone’s app store.

- Login Using a 4-Digit MPIN: If registering for the first time:

- Enter your CIF number.

- Select your SIM and get the OTP.

- Set your 4-digit MPIN and 4-digit TPIN.

- Access the E-Statement Registration:

- Once logged in using MPIN, scroll down to the “Services” section.

- Go to “Others” and select “E-Statement Registration.”

- Enter or update your email ID to receive monthly e-statements.

How Can I Get an Email Statement via PNB WhatsApp Banking?

- Save the PNB WhatsApp Banking number +91-9264092640 to Your Contacts.

- Send a “Hi” or “Hello” message from your registered mobile number.

- Tap on “All Services” and select “Account-Related Services.”

- Enter the OTP to access account services.

- From the menu, choose “Account Statement.”

- Select the desired time frame (last month, last week, or a custom duration).

- After selecting the statement message, you will receive.

- Tap on the save button to download it.

Through WhatsApp, PNB lets you download up to 6 months of account statements in a single PDF – super useful if you need it for visa, credit card, or loan applications

Not Receiving Your PNB E-Statement via Email?

You registered, but still nothing? Try this checklist:

- Check spam/junk/promotions folder

- Re-register your email via PNB One

- Add care@pnb.co.in to your safe sender list

- Still stuck? Send an email to:

Subject: “PNB E-Statement Not Received”

To: care@pnb.co.in

They usually reply within 24–48 hours.

What if the PDF is not working?

- PDF Corrupt: If you encounter an error message when opening the PDF file, please re-download the Statement using PNB One, WhatsApp Banking, or Email.

- Update Your PDF Reader: As I already said, use the latest version only. Navigate to your smartphone app store and update your existing PDF reader.

- Contact PNB for Assistance:

If the above steps don’t resolve your issue, you can reach out to the PNB Bank customer care.

- Phone Support: You can call the latest working customer helpline numbers 1800 180 2222 or 1800 103 2222 (24/7 helpline.

Bonus: Smart Tips to Save and Organise Your Statements

Digital clutter is real. Here’s how to organise your e-statements like a pro:

- Create a folder:

PNB_Statements_2026 - Rename PDFs as:

PNB_March_2026.pdf,PNB_July_2026.pdf - Upload to: Google Drive / Dropbox for easy access anytime

- Set a calendar reminder every 1st of the month to download new ones

The PNB PDF says “Wrong Password” even though I’m sure it’s correct. What should I do?

Try this checklist:

- Type the password manually (no copy–paste)

- Make sure you’re using the full 16-digit account number

- Confirm you’re entering numbers only, no spaces or dots

- Try opening it on another device or a PDF reader

- If it still fails, call PNB Customer Care or visit your branch and ask them to resend the statement.

FAQs

What is the Customer ID in PNB?

Your PNB Customer ID (CIF Number) is a 9-digit unique code assigned when you open an account. You’ll need it for net banking, e-statements, and other services.

Can I get my PNB statement without net banking or the app?

Yes! Try these offline methods:

SMS Banking: Send “STAT <Account Last 4 Digits>” to 5607040.

ATM: Generate a mini-statement at any PNB ATM.What if I registered for e-statements but stopped receiving them?

First, check your spam/junk folders. If it’s not there:

Re-register your email via the PNB One App (Services → E-Statement) or contact Email care@pnb.co.in with “E-Statement Issue” in the subject.Is my PNB e-statement valid for loans, credit cards, or visa?

Yes. A PNB e-statement downloaded from official channels (Email, PNB One, WhatsApp, Net Banking) is treated as a valid bank statement. Many lenders accept it directly in PDF form.

Can I stop physical statements after activating e-statements?

In many cases, once you successfully register for e-statements, the bank may stop sending physical statements by default. If you still need physical copies, you can request duplicate statements at your home branch (charges may apply).

Does PNB use the same PDF password format for WhatsApp and email statements?

Yes. PNB keeps the password format identical across email, WhatsApp, and app-generated PDFs. The delivery channel changes, but the account number or CIF logic stays the same.

Why does PNB sometimes accept an account number but reject CIF as a password?

Because older statements may be mapped only to account numbers. CIF-based passwords work mainly on newer digital templates, not on legacy-format PDFs.

What’s the safest way to remember my PNB statement password?

Avoid screenshots. Best method: note the last 6 digits of account number + bank name in a password manager or offline diary—branches recommend this to reduce repeat requests.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.