What Is an India Post Office Withdrawal Form?

The Post Office Withdrawal Form (SB-7) is the official slip provided by your Department of Posts. If you are an account holder in the Post Office, you can use it for –

- Withdrawing cash from your savings account

- Collect interest in cash from your invested schemes, such as TD, MIS, or SCSS.

- Also, you can get maturity payments from RD, NSC, or similar deposit accounts

Every time a depositor has to fill out this form before money can be paid out at the counter. It works as a written application instruction to the post office for requesting an exact payment from your account. The form also serves as proof that you have personally authorised the transaction.

Types of Accounts Covered by the Withdrawal Form

This SB-07 withdrawal slip is not only for work on a single product. It’s valid for almost every small-savings scheme offered by India Post. let check the list –

| Variants | Full Form | Description |

|---|---|---|

| SB | Savings Bank | Regular savings account for day-to-day deposits and withdrawals |

| TD | Time Deposit | Fixed-term deposit (1–5 years) with higher interest |

| MIS | Monthly Income Scheme | An investment option that pays monthly interest for five years |

| SCSS | Senior-Citizens Savings Scheme | High-return scheme for people aged 60 years or above |

| NSS / Others | National Savings Scheme (discontinued) or other postal savings products | Includes NSC, RD, PPF, KVP, and Mahila Samman Savings Certificate |

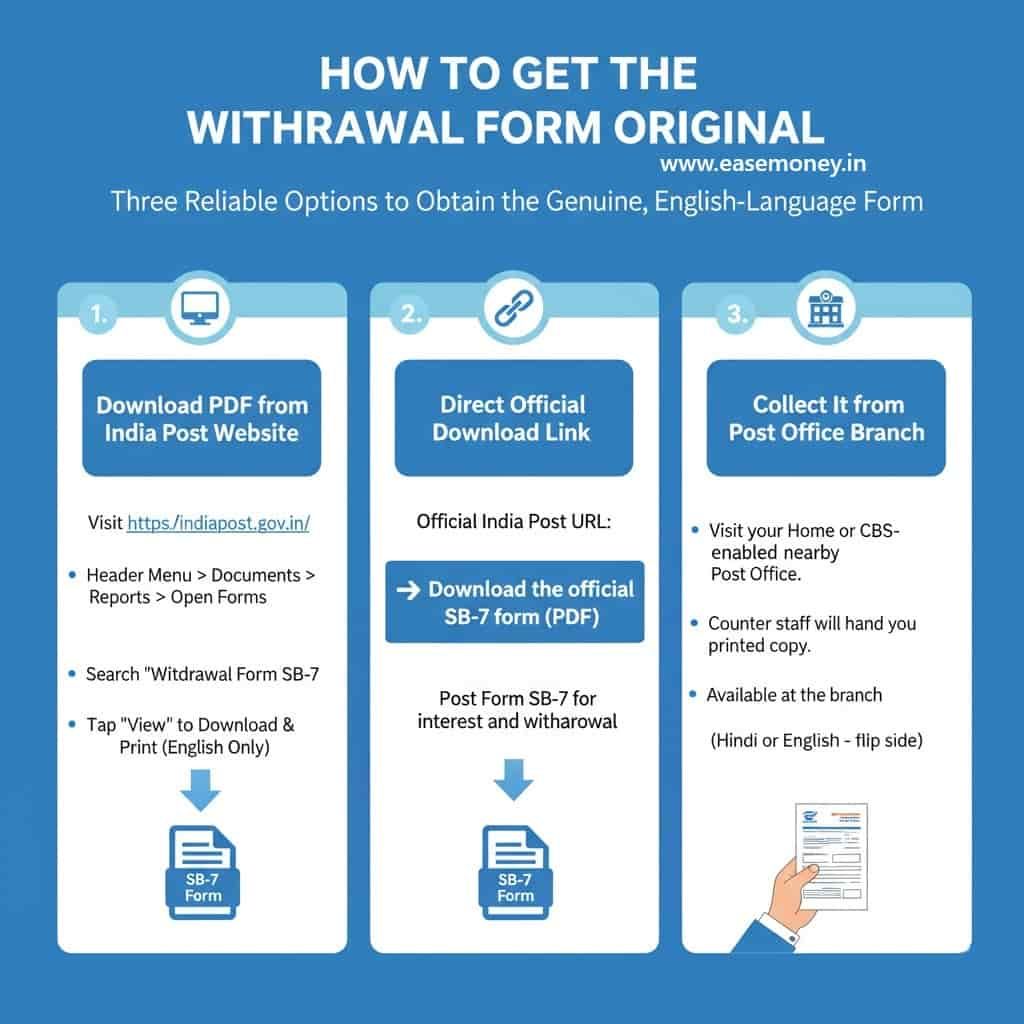

How to Get the Withdrawal Form Original

You have three reliable options to obtain the genuine, English-language form:

1. Download PDF from the India Post Website

- First of all, simply visit the official website – https://indiapost.gov.in/

- In the header menu, tap on Documents, select Reports and the Open Forms section

- Now, you have to search in the form box for the Withdrawal Form SB-7.

- Just tap on “view” to download and print the PDF version for free in English only.

2. Direct Official Download Link

If you have a problem finding it, you can download the authentic PDF form instantly from this official India Post URL:

| File | Latest Active Link |

|---|---|

| India Post Form SB-7 for interest and withdrawal | 👉 Download the SB-7 form (PDF) |

3. Collect It from Your Post Office Branch

The official option is your home branch; simply visit your home or the CBS-enabled your nearby post office. The counter staff will hand you a printed copy of the SB-7 form, or you can get it from the branch paper desk. You can fill it there with help from the postal assistant if you’re unsure about any column. It is available in hindi or English, just flip to the reverse side.

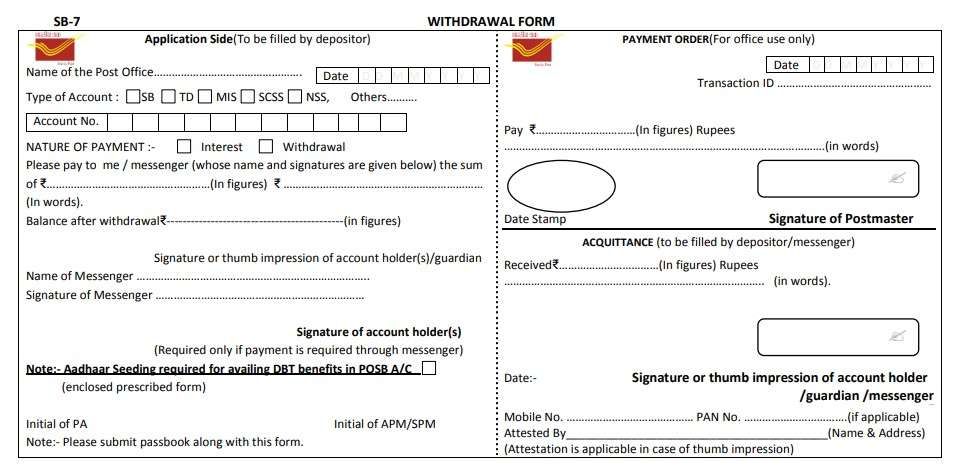

Fill up Process – Post Office Withdrawal Form

The form has three main sections, and only the first and last are filled out by you. The middle part is completed by the postal officials. You can use a regular blue or black ball-point pen and write neatly in capital letters only. Let’s go through each section.

1. Application Side — To Be Filled by the Depositor

This is the front part of the form where you state your request.

| Field | What to Write | Example / Notes |

|---|---|---|

| Name of Post Office | Your branch name | India Post – Delhi GPO |

| Type of Account | Tick or underline one: SB, TD, MIS, SCSS, NSS, Others | Tick SB if it’s a Savings Account |

| Nature of Payment | Choose “Withdrawal” or “Interest” | Most people select “Withdrawal” and interest for other investment schemes only |

| Amount (in figures) | The amount you want to withdraw | Such as – 5000 put “/-“ |

| Amount (in words) | Write clearly in words | Rupees Five Thousand Only |

| Balance after withdrawal | Leave blank | Postal staff will fill it |

| Signature or Thumb Impression | Sign exactly as in the passbook | Required for all withdrawals |

| Name & Signature of Messenger | Only if someone else collects | Leave blank for self-withdrawal |

| Date | Current date in simple format | 08/10/2026 |

| Account Number | Your complete account number | your 10 to 12 digit number – such as 805872265412 |

2. Payment Order — For Office Use Only

This middle section is usually filled by your post-office staff or teller after verifying your account and signature.

They add information:

- Transaction ID

- Authorised withdrawal amount (in figures and words)

- Date and official stamp

- Signature of the Postmaster only, not yours.

You should not write anything here, but if your branch asks to fill it out, you can simply repeat the withdrawal amount in words, digits and put the date.

3. Acquittance — To Be Filled by Depositor/Messenger

After the cash is handed over, you must sign here to confirm receipt.

| Field | What to Write |

|---|---|

| Amount Received (in figures & words) | Same as the amount withdrawn |

| Date | Date you received the cash |

| Signature or Thumb Impression | Sign again to acknowledge |

| Mobile No. | Optional but recommended |

| PAN | If the amount is higher |

| Attestation (if thumb impression) | Signature & address of a witness |

Important Rules for Cash Withdrawals in India Post

- PAN card requirement: If your amount is higher than Rs 50,000 in a single withdrawal at your branch, you must show your PAN card or put the number in the slip

- Passbook mandatory: You must have your passbook and form at the counter when applying for a withdrawal.

- Self-Cheque option: If you withdraw by cheque instead of the SB-7 form, your passbook is not required at that time.

- Sufficient balance: You cannot withdraw the full amount from your savings scheme leaves less than ₹500 in the account; otherwise, there are charges upto ₹50 for the minimum balance condition.

- Whole rupee transactions only: Paise won’t work for withdrawal; put the full amount only in rupees.

- Messenger withdrawal: If someone else collects your money, both you and the messenger must sign the form. The messenger must also show valid ID proof.

- Aadhaar seeding: To receive government subsidies via DBT (Direct Benefit Transfer), your account must be linked to your Aadhaar number.

Withdrawal Limits and Rules (2026 Updated)

The withdrawal limits depend on where and how you withdraw your money. Here is the list –

| Mode / Branch Type | Daily Withdrawal Limit | Notes |

|---|---|---|

| Home Branch (Source Post Office) | No limit | Inform the branch in advance for large withdrawals first + branch’s availability of cash |

| Other CBS Post Offices | ₹25,000 per day | For withdrawals from a CBS branch other than your home branch |

| Branch Post Office / Gramin Dak Sevak (Doorstep Service) | ₹25,000 per day | Cash limit per account per day at rural or doorstep locations |

| ATM – Daily Limit | ₹25,000 | Total daily limit using a POSB or IPPB ATM card |

| ATM – Per Transaction Limit | ₹10,000 | Per single transaction limit |

| Online IPPB Transfer | ₹1 lakh per day | If the linked POSB account and KYC limits |

| Minimum Withdrawal Amount | ₹50 | Whole rupees only; no paise allowed |

Rules for Major Post Office Schemes

- Recurring Deposit (RD): You cannot make any type of withdrawal before your RD’s full maturity, but after 12 months, you can take a loan up to 50 % of your deposits; a full withdrawal is only after 5 years. The interest rate is 2%.

- Time Deposit (TD): You can only make a premature withdrawal after 6 months of deposits. If closed between 6 and 12 months, you earn only the Savings Account rate.

- Monthly Income Scheme (MIS): The tenure is 5 years, you can get monthly interest via an SB account or withdraw using the slip at the branch, just tick on interest.

- Senior-Citizens Savings Scheme (SCSS): The interest is paid quarterly. You can withdraw cash using the same slip. Also, Premature closure is allowed after 1 year with a 1–1.5 % penalty.

- Public Provident Fund (PPF): You can make one withdrawal every year after 5 financial years (excluding the year of opening). Maximum = 50 % of the balance of the 4th primary year or the previous year.

- Mahila Samman Savings Certificate (2023): 40 % of the balance can be withdrawn after 1 year from account opening.

- National Savings Certificate (NSC): Encashment before 5 years is allowed only on death, court order, or forfeiture by pledgee.

Post Office Additional FAQs

Can I fill out the post office withdrawal form in regional languages?

Yes, most branches accept forms in English and Hindi, as long as the details are clearly written and readable. Also, other local regional language depending on your post office location.

Can a family member submit the India Post withdrawal form on my behalf?

Yes, you can authorise a messenger to collect cash for you by writing their name and signature in the form. You may need to provide ID proof. However, most branches only allowed for senior citizens or incapacitated individuals.

How do I correct a mistake made while filling out the Post Office withdrawal form?

Never use a whitener or overwrite. Simply ask for a new slip from the counter, use neat and clean Capital words, and you can use a passbook while entering the information, such as Account number, type, and more.

Can I use one SB-7 withdrawal slip for multiple accounts together?

No. One SB-7 slip works for only one account number. Even if two accounts are in the same branch, the staff will reject combined slips. Always take separate forms per account.

What is the most common reason a post office rejects a withdrawal slip?

Around 6 out of 10 rejections happen due to a signature mismatch. Tip: carry your latest passbook, and sign slowly, matching the original signature stored during account opening.

Is it faster to withdraw cash in the morning or the afternoon at post offices?

Morning withdrawals (10:00–12:00 PM) are faster. After 2:00 PM, cash counters often slow down due to settlement work. For amounts above ₹20,000, visit before noon.

Can I withdraw interest and principal together using one SB-7 form?

Yes, but only for schemes like MIS, TD, or SCSS. Tick both clearly and mention the total combined amount. Staff usually reconfirms verbally before processing—listen carefully.

What happens if I forget to write “Only” in the amount in words?

Usually accepted, but risky. Some branches return slips without “Only” for safety. Smart tip: always end with “Only” to prevent manual alteration and avoid second visits.

Do rural and small post offices verify withdrawals more strictly?

Yes. Branch Post Offices (BPOs) often double-verify ID and passbook, especially above ₹10,000. Carry Aadhaar and avoid sending messengers unless genuinely required.

How much advance notice should I give for large cash withdrawals?

For amounts above ₹50,000, inform the branch 1 working day earlier. Many post offices don’t hold excess cash daily, especially non-GPO branches—advance notice saves rejection.

Is it safer to withdraw via SB-7 or a cheque at the post office?

SB-7 is safer for walk-in cash withdrawals. Cheques may take 1–2 days for clearing. For urgent cash needs below ₹25,000, SB-7 is always faster.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.