Most banks in India treat RTGS as a routine counter service, but RBL Bank approaches it differently. While others hand over a single standard form, RBL offers two separate RTGS forms. Both form work for the same but accept multiple fund transfers.

If you choose offline, RTGS through RBL Bank branches can be done during the set hours:

- Monday to Saturday: 10 AM to 4 PM

- 2nd & 4th Saturday: the branch is usually shut down

- Sunday and Public Holidays: Week off

If you request for transfer after 4 PM at the branch, you may find that your transfer will settle the next working day. Make sure there is no holiday.

Tip for You – RTGS is available 24/7 as per the RBI’s system. You can use RBL netbanking or mobile banking for that.

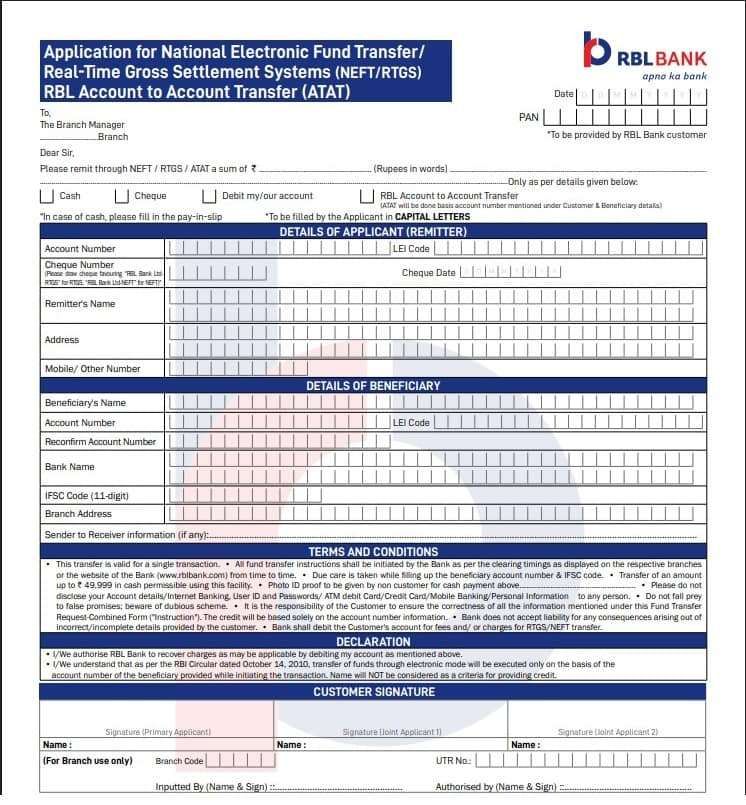

Types of RBL RTGS Forms and Latest Download Links

| Form Type | Supports | Funding Method | Languages | Direct Download Link |

|---|---|---|---|---|

| Fund Transfer Request Form – RTGS/NEFT/RBL Account to Account (ATAT) | RTGS, NEFT, ATAT | Cash (less than ₹49,999), Cheque, Debit My Account | English + Regional (varies by branch) | RBL ATA, RTGS, NEFT PDF Form |

| Application Form for Funds Transfer through RTGS/NEFT | RTGS, NEFT | Self-Cheque only | English & Hindi | Direct PDF |

You can use any form from these; both are acceptable at all branches of RBL. Some regional branches may also offer versions in Marathi, Tamil, or Bengali, depending on the location.

How to Obtain the RBL RTGS Form

You can get the RTGS form in two ways: from your nearest RBL branch, you can use the RBL Branch locator to find it out, or you can visit your home branch. You can also get it PDF version via its website.

1. From the Branch

Visit any RBL Bank RTGS-enabled branch and ask for the counter officer, or collect the form from the cash counter near the desk.

- Just say I want – RTGS Fund Transfer Request Application Form

Some older branches may still provide the RTGS/NEFT-only form, which doesn’t include ATAT. Both forms are valid, but the funding options differ.

2. Online via RBL Website

To download the form directly:

- Visit the official website only – https://www.rbl.bank.in

- Scroll to the bottom and click on Important Links, tap on Other Forms from the list.

- Tap on the PDF link titled: “Fund Transfer Request Form”

- For other languages, tap on vernacular fund transfer forms.

- Here, you will get upto 11 languages in PDF version, including Hindi.

RTGS Transaction Limits at RBL

- Minimum Transfer: ₹2,00,000

- Maximum (Branch): No upper limit (subject to account balance & KYC)

- Cash Deposit Limit: ₹49,999 (with valid PAN & ID proof) – RTGS does not work in cash.

- Online RTGS Limit: Up to ₹15 lakh per day (combined with NEFT cap)

Step-by-Step: How to Fill the RBL RTGS Form

The form is quite simple, just use the capital word and use boxes for each word. We divide this into 5 sections to make it easy for you. Follow these steps –

1 Section – Transferring amount and Payment method (Top header)

- PAN – simply First, enter your PAN Card 10-digit number.

- Date – enter the same date when you make this transfer.

- Branch – To the Branch Manager option, enter the branch name. (same branch where you are doing this RTGS)

- Sum – Enter the Amount you want to transfer, must be Rs. 2 Lakh Above. example – Rs 2,20,000/-

- Sum in words – simply, enter that amount in words, example – Two lakh twenty thousand only.

- Payment mode – You have to tick debit my account or Cheque only, the Cash and ATAT do not work for RTGS.

How to Write a Self-Cheque for RTGS

If you choose to transfer via cheque, you have to write a self-cheque first. Here are the quick steps –

- Take a leaf from your RBL cheque book.

- On the “Pay” line, write exactly as instructed on the form: “RBL Bank Ltd RTGS” (for RTGS)

- Cross the cheque with two parallel lines and write “A/C Payee Only.”

- Write the exact amount (in figures and words) that you want to transfer.

- Sign the cheque as per your account signature.

- On the reverse side, write:

- “For RTGS transfer to Beneficiary Name (company or individual)”

- Beneficiary Account Number

- IFSC Code

- Your contact number

2 Section – Applicant (Remitter) Details

- Your full name and Address (your communication bank registered)

- Your RBL Account Number

- 6-digit Cheque Number and Date (if using a cheque)

- Your mobile number (Account linked only, it’s good for SMS about deduction or settlement)

- LEI Number only if your amount is more than 50 Crore. (for companies)

3 Section – Beneficiary Details (Important, where your money will be credited)

- Beneficiary’s Name

- Account Number (write twice for confirmation): RBL credits funds purely based on the account number

- Bank Name

- Branch Name and Address

- IFSC Code

- Purpose or Remarks (optional but helpful) example – School fee or Invoice 021 for the deal

Ask for a cancelled cheque, bank statement, or any valid documents for beneficiary account details; It may delay your payment if any info incorrect.

4 Section – Terms and conditions, declaration and customer signature.

- Simply, read the terms and conditions, which usually confirm that we will deduct charges as per the amount. The approximate charges are written below.

- accept the declaration.

- Put down your signature in the primary applicant section. If a joint account, you will need both account holders’ signatures in the joint applicant section.

RBL Bank RTGS Charges + GST

| Amount Range | Branch Transaction (₹) | Online RTGS (₹) | GST (18%) | Total After GST (₹) |

|---|---|---|---|---|

| Any Payment amount you wish between ₹2 lakh to ₹5 lakh | ₹20 | Free | ₹3.60 | ₹23.60 |

| Above ₹5 lakh. such as 20 Lakh, 50 Lakh, or even 50 Crore. | ₹40 | Free | ₹7.20 | ₹47.20 |

| Inward RTGS (Receiving Funds) | Free | Free | – | Free |

GST @18% applies only for branch-based transactions.

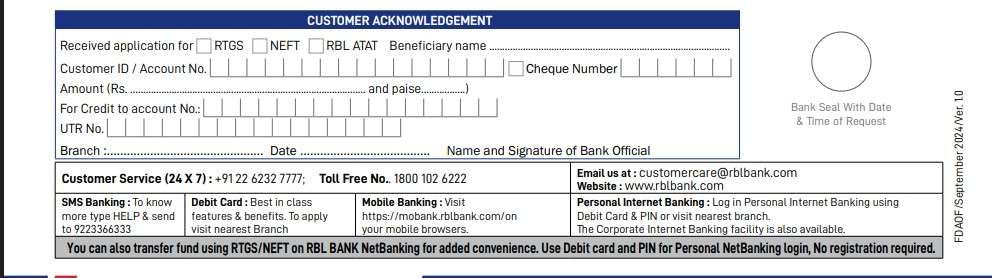

5 Section – Customer Copy

- This is the bottom part of your form. Usually, banks have to fill this out, but a branch may ask you to fill it out. You have to repeat the information on the slip.

- Tick RTGS and enter the beneficiary name.

- Enter the beneficiary account number and cheque number.

- Enter the same amount as above.

- Credit account – enter your account number also.

- Your RBL branch officer will seal it, enter the UTR Number, and give it back to you.

- You can use this slip and UTR number to track your request.

- Your payment is usually settled within 30 to 1 hours. If delayed more than that in working days, simply send SMS – “HELP” to 9223366333, RBL Customer care will call you back.

ATAT – RBL’s In-House Instant Transfer

- ATAT (Account to Account Transfer) is RBL’s internal fund transfer mode for moving money between two RBL Bank accounts.

- It’s instant, free, and available under the same form (ATAT/RTGS/NEFT).

- If both accounts are with RBL, choose ATAT instead of RTGS — it settles within seconds and doesn’t involve RBI’s clearing network.

FAQs

How can I transfer ₹10 lakh in one day through RBL Bank?

You can transfer ₹10 lakh using RTGS via RBL Bank branch or NetBanking. There’s no upper limit for branch RTGS; online mode allows up to ₹15 lakh per day.

Can RTGS be done only from the home branch of RBL Bank?

No, RTGS, you can do visiting any RBL RTGS-enabled branch, not just your home branch. Carry a valid ID and cheque details.

Can I use the same RBL RTGS form for NEFT or ATAT?

Yes. The combined form supports RTGS, NEFT, and ATAT, while some older branches issue RTGS/NEFT-only versions.

Is RBL RTGS available 24×7?

Yes, online RTGS via NetBanking or Mobile App is available 24×7. Branch RTGS operates from 10 AM to 4 PM on working days.

What is the safest time to submit an RTGS form at an RBL branch?

The safest time is before 2:30 PM on working days. Submitting early avoids queue delays, cheque verification lag, and same-day cutoff risk, especially on Fridays or month-end rush days.

Does RBL reject RTGS forms if the handwriting is unclear?

Yes, branches often reject forms with unclear figures or overwritten account numbers. Always write in capital letters, use boxes properly, and rewrite the form instead of correcting mistakes to avoid rejection.

Why does RBL ask for PAN even for RTGS above ₹2 lakh?

PAN helps RBL comply with income-tax reporting rules and large-value transaction monitoring. Even salaried customers may be asked again if PAN isn’t properly linked or verified in branch records.

What should I do if RBL RTGS is delayed beyond one working day?

Keep the UTR slip safe and SMS “HELP” to 9223366333. RBL usually calls back within a few hours. Branch follow-up with UTR speeds up resolution significantly.

Can joint account holders submit RTGS with only one signature?

No. If the account mandate is “Jointly”, both signatures are mandatory. RBL strictly follows mandate rules; missing signatures automatically delay or reject high-value RTGS transactions.

How long does RBL RTGS actually take after form submission?

In most branches, RTGS settles within 30 minutes to 1 hour. Delays usually happen due to cheque clearing, incorrect IFSC, or submissions close to the 4 PM branch cutoff time.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.