What Is the Right Way to View Your SBI e-Statement Securely?

The bank has more than 50 crore customers, including outside of India. One major reason for its dominance is its great digital and secure services, such as E-statement.

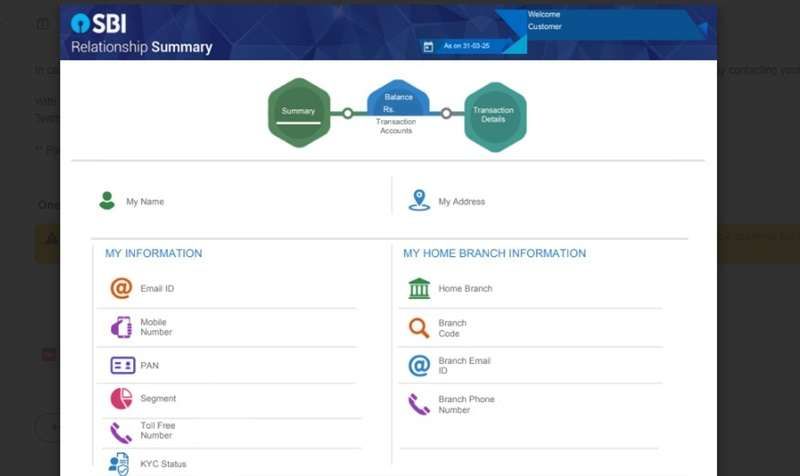

A digital statement PDF is an online version of your bank statement that you receive via email or the YONO app. It includes transaction history, personal banking details, balance, EMI amount, and bank charges.

These files are password-protected for your privacy and include your complete account activity. Understanding where it came from (email or app) is important, as each has its own password rules.

Where to Find Your SBI Statement in Email or App

Depending on your selected method, locate your statement:

If Received by Email

- Search your inbox or spam folder for emails from the SBI e-statement

- Open the email and download the PDF attachment

- Check for instructions about the password at the bottom of the email

If Downloaded from YONO

- Go to Accounts > Transactions > Filter by Date

- Tap Download or Email PDF

How to Unlock SBI Account Statement PDF (Email Version)

To unlock the e-statement that was received via email, the SBI sets a password as your last five digits of your registered mobile number and date of birth (DOB) in DDMMYY format registered with the Bank.

Let me give you a simple example: if your mobile number is XXXXX12345 and your DOB is 16th January 2000, then your password will be 1234516012000.

Tips to Avoid Password Issues

- Use Adobe Acrobat Reader, Google PDF Viewer, or similar apps to open it.

- Check your passbook for DOB/mobile number accuracy

- Don’t include any spaces or symbols while entering the password.

How to Open YONO SBI Bank Statement PDF

If you received your SBI statement via YONO, you will notice the email title mentions “YONO” — that’s how you know it’s sent through the app.

Now, here’s how to download it manually from the YONO app in case you did not get the mail or just want a new copy:

Steps to Download Your SBI Statement from YONO:

- Download and open the YONO SBI app.

- Enter your 6-digit MPIN to log in

- Go to Accounts (homepage section)

- Tap on your Savings A/C option

- Tap Transactions in the menu

- Tap Filter to choose the month you want, such as 1, 3, 6 or mini statement just for 10 days.

- Tap the Download or Email icon to get the PDF.

- Enter the password to open it.

To open the Yono e-statement, the SBI bank set a password format as your DateofBirth@Last4Digits of bank-registered Mobile Number.

Let me show you an example:

- Your Date of birth is 14/05/1980

- Your Full Mobile Number: 9876543210

- So, your Password will be: 1405@3210

A few tips:

- Your DOB is in DDMM format (not DDMMYYYY)

- You use the last 4 digits of your registered mobile number

- There are no spaces or letters.

How to Register for SBI e-Statement Online

In case you are not getting any emails from SBI, including statements, so, you have to activate it. Follow the steps:

1. Using SBI Online

- Go to the SBI Online Login Portal via Google.

- Log in with your username, password, captcha, and Mobile OTP.

- Navigate to My Accounts/Profile

- Select the e-statement in the left side menu, and tap on enable.

- Update your new email ID in the Profile menu.

- Enter the mobile OTP to activate it.

2. Using the YONO SBI App

- Log in with your 6-digit MPIN or face unlock.

- Go to Menu (left corner) > Service Request > Profile Update.

- Enter a new email ID.

- Verify with mobile OTP, and you’re done!

Once you start receiving e-statements via email, now, move to the important part to understand the latest password format set by the State Bank to unlock it

Troubleshooting Statement Issues and Solutions

- Wrong password error – Please, Double-check DOB format and mobile digits. Also, verify where the PDF comes from (Yono or monthly Email from the SBI official).

- Download file not found – please re-download and select a blank folder on your device to find easily.

- Statement missing data – Try downloading from YONO instead

- File not opening on mobile – Use a laptop or Adobe Reader app on PC. Remember to always update your PDF software first, then open the PDF for safety and avoid damaging the file.

- Mismatch in DOB or Mobile Number – Visit the branch or use SBI phone banking to update records

When Should You Request a Physical SBI Statement?

If you need a printed copy for a visa, loan, or legal purposes:

- Call SBI Phone Banking: 1800 1234

- Request a duplicate physical statement

- Charges: ₹44 + GST (as of July 2025)

Or, visit your home branch and request in person.

What to do if a Technical issue is found?

You can complain online at contactcentre@sbi.co.in. Also, attached a screenshot of the issue.

- You can call the Toll-free number: 1800 1234 / 1800 2100

- SBI WhatsApp Banking: save 9022690226 and send hi for help.

What to Do If Your Mobile Number or DOB Is Incorrect

If the password doesn’t work because your mobile or DOB isn’t correct:

- Visit your nearest SBI Branch

- Request a profile update for mobile or date of birth

- Carry your Aadhaar, PAN, and Passbook

- You can also call 1800 1234 for remote assistance

Reading FAQs

How to open an SBI account statement PDF without a password?

You have to go to SBI Online, log in using your username and password, go to Account > Account Statement, choose dates, tap View as a PDF and tap on Download to open without of password.

What is the password for the SBI credit card statement?

To open the SBI Card statement, the password is DOB in DDMMYYYY + the last 4 digits of a credit card. Check the full steps to open the SBI Card Statement PDF.

How to disable SBI e-statement?

Simply, log in to SBI Online using your username and password,> e-Statement > Tap Disable > Remove email ID. If it doesn’t work, visit a branch for support.

How can I get my SBI account statement for last month?

Just log in to SBI Internet Banking or YONO, go to your account, select the month, and download the PDF — no branch visit needed.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.