Online payments have become a daily habit — from buying groceries to paying utility bills — but the convenience comes with its own set of risks. And unlike what many people assume, fraud usually happens not because the system failed, but because a small oversight opened the door.

According to the Indian Cybercrime Portal, more than 70% of reported digital fraud cases start with simple mistakes like clicking unknown links, getting back SMS or sharing sensitive details on online forms.

That’s why staying alert matters. A single wrong tap, one message you trust too quickly, or one suspicious link you open can turn into financial loss or even identity theft.

In this guide, we break down practical, easy-to-follow payment safety habits that help you stay secure every time you shop, transfer money, or pay online — without making it feel complicated.

Best Practices for Secure Online Payment

Here are some of the best practices you should follow while paying online:

1. Use Verified and Trusted Apps or Websites

Always make payments using official apps from the Google Play Store or Apple App Store. Avoid downloading apps from random links or unknown websites — they can be unsafe.

For websites, do one quick check before paying:

- ✔ The link should start with “https”

- ✔ The website should look genuine, not suspicious

This small habit alone can save you from many online scams.

No genuine bank, UPI app, or wallet service will ever ask for your PIN, CVV, OTP, or full password. If someone asks for these details over a call, message, or email, it’s most likely a scam. Always keep this information private and do not share screenshots of transactions unless necessary and safe.

Using a reliable best UPI app in India can also help reduce the chances of falling for fraudulent requests.

3. Avoid Public Wi-Fi for Transactions

Free Wi-Fi at cafés, airports, malls — it feels convenient, but it’s not made for money matters. On these open networks, anyone sitting nearby can try to peek into what you’re doing online.

- So if you need to make a payment, it’s better to wait.

- Use your mobile data or your home Wi-Fi — it’s safer, and you stay in control.

A small delay is always better than taking a risk with your money.

4. Enable Two-Factor Authentication (2FA)

Two-factor authentication sounds fancy, but it’s honestly just one extra step for safety. When you log in or make a payment, you get a small OTP on your phone — that’s it.

And this tiny step makes a big difference whenever you log in to any app or online banking.

Even if someone somehow gets your password, they still can’t do anything without that OTP.

For example:

- Let’s say your password gets leaked somewhere — it happens with so many apps these days.

- Without the OTP, the person trying to log in will just get stuck.

- Only you get the OTP, so they can’t move forward.

Almost every bank and payment app already has this option.

If yours hasn’t turned it on yet, just switch it on once — and you’re sorted.

5. Regularly Monitor Your Bank Statements

Most people check their statements only when something goes wrong — but by then, it’s usually too late.

Instead, make it a small habit to quickly look through your bank or credit card statement once in a while. It hardly takes a minute.

Sometimes you will spot tiny charges you don’t remember making — and that’s usually the first sign of something fishy.

If you see anything that doesn’t look right, just call your bank immediately. Catching it early makes the fix a lot easier.

6. Use Strong and Unique Passwords

Your password is the first thing that protects your money and accounts.

If you use the same password everywhere, it becomes easy for scammers — one leak, and all your accounts become risky.

A clear fact:

A recent report in The Times of India says that, in India, most people use common passwords like “123456” and “India@123” are still widely used, and password reuse is linked to almost 80% of account breaches.

(This means most hacks happen because people use the same or weak passwords.)

So here’s the simple fix:

- Use a different password for each important account

- Make it a mix of letters, numbers, and symbols

- Don’t use your name, birthday, or mobile number

A strong password may take a minute to create, but it protects you for a long time.

7. Update Apps and Operating Systems

Most of us think updates are only for new buttons or new designs. But the real reason apps push updates is security.

They fix small bugs that scammers try to exploit — things you’ll never see, but they matter.

A clear India-focused fact: CERT-In (India’s official cyber agency) reported that many recent mobile fraud cases happened because users were running older app versions with known security issues. Simply updating the app could have blocked those scams.

So if your phone or payment app is outdated, it’s basically like leaving a small window open in your house. Everything looks fine — but anyone can slip in.

The easy fix? Just keep auto-update on or check for updates every 2 or 3 weeks.

8. Be Cautious of UPI Collect Requests

As per the recent SBI awareness report, scammers often send fake UPI collect requests to trick you into sending them money. If you get a request you did not expect, reject it without a second thought. Also, take some time to learn about the different types of UPI fraud. The more you know, the safer your transactions will be.

Common Online Payment Threats to Watch Out For

Online payments are quick and convenient, but they come with their own risks. Here are a few common threats you should keep an eye on while making transactions.

1. Phishing Scams & Fake Links (The “Click and Lose Money” Trick)

This is one of the most common frauds in India right now.

Scammers send messages that look exactly like your bank or UPI app — same logo, same style — and ask you to click a link to “update KYC”, “verify account”, or “unlock services”.

Real India fact:

According to the Indian Cybercrime Portal, over 50% of online payment fraud cases in 2024 started with phishing links.

Simple example:

You get an SMS saying:

“Dear customer, your bank account will be blocked today. Click here to update KYC.”

You click. A fake website opens. You enter details.

Boom — your data is gone.

How to stay safe:

- Don’t tap links from unknown SMS or WhatsApp messages

- Always check the sender — scam messages usually have random IDs

- If you’re unsure, open the official app yourself instead of clicking

2. OTP & Password Theft (Scammers Pretending to Be Officials)

This is the oldest trick, yet people still fall for it because scammers sound very convincing.

They say things like:

- “I’m calling from your bank. Share your OTP to update KYC.”

- “Sir, your refund is ready. Tell me the OTP.”

- “Madam, we are verifying your UPI Please give PIN.”

Real fact:

CERT-In reported that OTP sharing is linked to nearly 70% of money-loss complaints received on Helpline 1930.

Simple example:

You receive a call about a refund for something you actually bought last week.

You think it’s real because the timing matches.

They ask for your OTP “to verify the refund”.

Once you share it, the scammer logs in and empties your account.

Golden rule:

No bank, no UPI app, no wallet will EVER ask for OTP or PIN.

If someone asks → it’s 100% a scam.

3. Public Wi-Fi Risks (Free Wi-Fi Comes With a Hidden Cost)

Public Wi-Fi in cafés, airports, railway stations, malls — it feels like a bonus, but it’s not meant for payments.

Real India fact:

A report by the Data Security Council of India found information about that. The key point is that public Wi-Fi is one of the easiest places for hackers to capture login and card details.

Simple example:

You’re sitting at the airport, connected to free Wi-Fi, paying a bill.

Someone else on the same network can track the data going through the connection.

You won’t even know it happened — but your details get stolen.

What to do:

- Avoid making any payments on public Wi-Fi

- Use mobile data instead — it’s much safer

- If you have no choice, use a trusted VPN

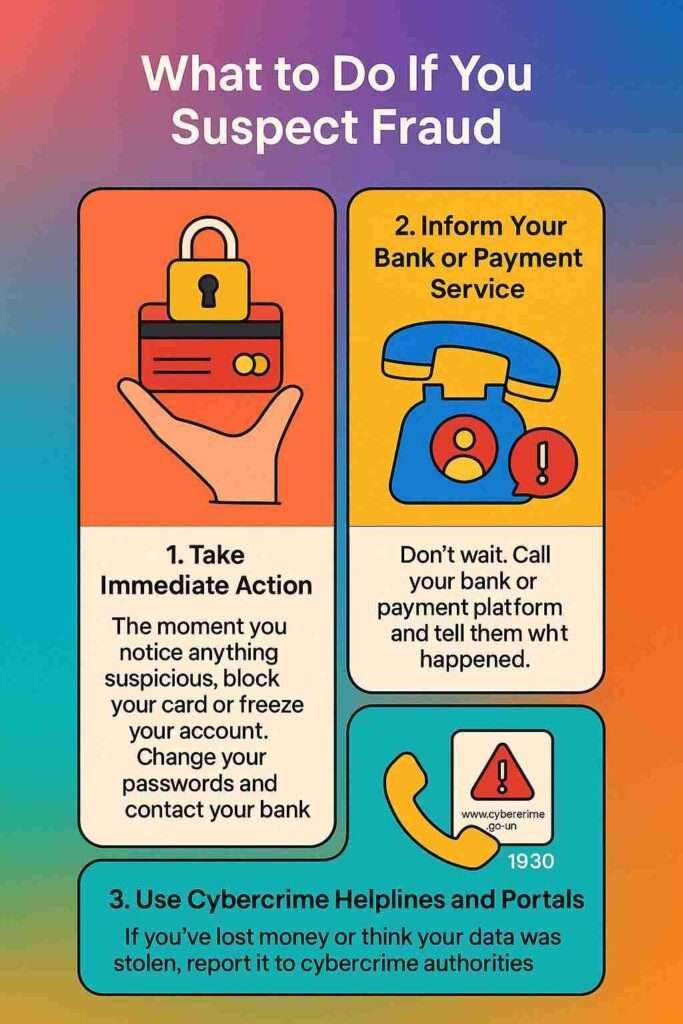

What to Do If You Suspect Fraud

Even with precautions, things can go wrong. Here’s what you should do if you think you’ve been tricked or scammed.

1. Take Immediate Action (Every Second Counts)

If you see anything odd — a message about a payment you didn’t make, a sudden debit, or a login alert — don’t wait to “check later”.

Do this instantly:

- Block your card or freeze your account from your banking app

- Change your passwords

- Log out from all devices

Why so fast?

Because once scammers get access, they move money within minutes.

Example:

If ₹5 gets deducted randomly, many people ignore it.

But scammers often test your account with small amounts first.

Blocking early can stop a bigger loss.

2. Inform Your Bank or Payment App (They Can Stop the Chain)

After securing your account, call your bank or the payment app you used (UPI, wallet, card provider).

Tell them everything clearly — even the smallest detail helps.

Why this matters:

Banks can:

- Stop further transactions

- Flag your account

- Trace suspicious activity

- Initiate reversal requests (if possible)

Most banks today have a fraud department that acts faster if they are alerted early.

Example: If someone tries to add a new device or change your UPI PIN, banks can immediately block the attempt once you inform them.

3. Use Cybercrime Helplines & Portals (India’s Fastest Recovery Route)

If money is already lost, don’t panic — just act quickly.

Where to report:

- Helpline: 1930

- Website: www.cybercrime.gov.in

- Banking Safety: RBI Sachet

Real India fact: The Ministry of Home Affairs has said that reporting within the first hour gives the highest chance of stopping the money before it reaches the scammer’s account.

Provide all details — screenshots, messages, call numbers, timestamps.

This helps authorities freeze the fraudulent transaction before the scammer withdraws it.

Example:

Many people recovered money because they called 1930 within 15–20 minutes. One of our clients, Miss Meenakshi, lost Rs. 50,000 via Telegram link fraud. She called within 24 hours; however, she was late, but still got 40% back of her deducted amount. Delay is the main reason recoveries fail.

Closing Thoughts

Online payments have become as routine as buying milk or recharging your phone — and that’s exactly why staying a little alert makes all the difference. You don’t need big tech knowledge or complicated tools.

Simple habits like using trusted apps, ignoring strange links, keeping phones updated, and acting fast when something feels off can save you from big headaches later.

At the end of the day, safe payments aren’t about doing more — they’re about doing the small things right.

FAQs

Why do scammers first deduct very small amounts like ₹1 or ₹5?

This is a testing trick. Fraudsters check if your account is active. Once unnoticed, they attempt bigger debits within minutes. Always block cards or UPI immediately after even a tiny, unknown deduction.

Is saving card details on apps actually safe in India?

Mostly yes on trusted apps, but risk still exists. Use saved cards only on RBI-regulated apps with tokenisation. Avoid saving cards on shopping sites you use once or twice a year.

How fast should I act after noticing online payment fraud?

Ideally within 30–60 minutes. As per Indian cyber recovery data, complaints raised within the first hour have the highest chance of fund freezing before scammers withdraw money.

Are scam refund calls more dangerous than fake links?

Yes. Refund scams feel “expected,” so people trust them easily. Scammers exploit recent purchases. Remember: no bank, UPI app, or merchant ever needs OTP or PIN to process refunds.

Can screen-sharing apps lead to payment fraud?

Absolutely. Once screen sharing is active, scammers can watch OTPs and navigate apps. Never install AnyDesk, TeamViewer, or similar apps on the advice of unknown callers—this is a major fraud trigger.

Does changing passwords alone fully secure my account after fraud?

No. Also log out from all devices, reset UPI PINs, block cards, and inform your bank. Password change without account freeze still leaves a short window for misuse.

What’s the safest habit to reduce online payment risk long-term?

Use one dedicated bank account for UPI and online payments with limited balance. Keep savings separate. This simple separation limits losses even if fraud happens unexpectedly.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.