Suryoday Small Finance Bank is slowly becoming popular for higher FD interest, even without forcing customers to lock money for a very long time. In 2026, the bank is giving fixed deposit interest between 4.00% to 8.00% per year for normal Indian residents. Final interest depends on how long you keep the money and which FD option you choose.

Suryoday Bank shows FD interest up to 8.00% per year, but this rate is only for 5-year deposits, including the Tax Saver FD. If you don’t want to lock money for the full 5 years, a mid-term FD like an 18-month deposit gives around 7.50% per year. These deposits are easier to break and have fewer rules compared to long-term lock-in FDs.

Senior citizens get little extra interest compared to normal customers. Tax-saving FD and long-term FD are kept as separate schemes, not mixed with normal deposits.

These FD rates are only for normal retail customers who keep deposits below ₹3 crore. These rates are valid from 03 December 2025. If the FD amount is ₹3 crore or more, the bank treats it as a bulk deposit and a different interest rate is applied. You can contact the bank for that.

What makes Suryoday Bank different is not only the 8% interest headline. The bank has given better returns on selected time periods, not just one long FD. Senior citizens get extra benefits, and some FD schemes are designed for people who want a fixed monthly or regular income, not for those only running behind the biggest interest number written on a poster.

- Last Deposit Reports- As per bank data or FY Results till 30 September 2025, Suryoday Small Finance Bank reported total deposits of ₹11,991 crore, including Fixed Deposits and RD. This shows a 35.5% growth compared to last year. Such growth means more people are keeping their money with the bank, and the deposit base has become stronger during the 2025 financial year.

How Suryoday Fixed Deposits Are Structured

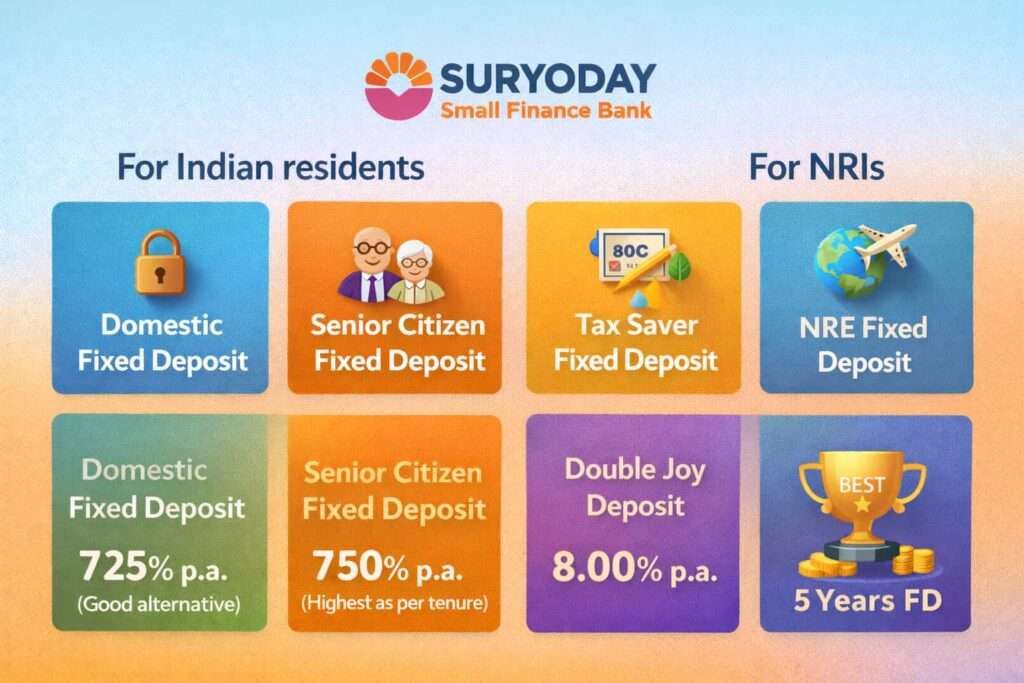

For Indian residents, Suryoday Bank has kept its FD options very clear. There are four types of fixed deposits, and each one is made for a different need:

- Domestic Fixed Deposit – this is the normal FD that most people do

- Senior Citizen Fixed Deposit – same FD, but senior citizens get extra interest

- Tax Saver Fixed Deposit – 5-year FD used for 80C tax saving

- Double Joy Deposit – long-term 22-year FD, mostly for future planning or children

For NRI customers, the bank has not complicated things. There are only two FD options:

- NRE Fixed Deposit – for money coming from outside India

- NRO Fixed Deposit – for income earned in India

Because of this clear separation, customers don’t get confused at the branch. Even people who don’t understand finance words properly can easily choose the right FD. Bank staff also explains faster, and the customer doesn’t feel lost while filling out the form.

1. Suryoday Bank Domestic Fixed Deposit: The Core FD Product

The Domestic Fixed Deposit is the FD that most people normally do. This FD is open for Indian residents, joint account holders, HUFs, small business owners, partnership firms, and even trusts. So it is not only for people with a salary; almost everyone can open it.

The minimum amount starts from just ₹1,000. This is important in districts and small towns, where many people prefer to make small FDs instead of locking big money at one time.

- FD time period options are very wide — from 7 days to 10 years. But honestly, most value comes in the 1-year to 5-year range.

- In this period, Suryoday’s interest rates are better than many big private banks, which is why people look at this option seriously.

Interest calculation is simple and follows normal bank rules:

- If FD is up to 6 months, the bank gives simple interest

- If FD is more than 6 months, interest is compounded every 3 months

For people who depend on FD for a regular income, Suryoday allows a monthly or quarterly interest payout. And for people who want to save for the future, a cumulative FD is more common, where interest gets added and paid at maturity.

Suryoday Bank Current Domestic FD Interest Rates (Below ₹3 Crore)

The FD interest rates shown in this chart are valid only for new FDs or renewals done on or after 03 December 2025. If your FD was already booked before this date, it will continue on the old interest rate till maturity. The bank does not change the rate in between, as per normal banking rules.

| FD Period | Interest Rate (p.a.) | Annualised Yield |

|---|---|---|

| 7 Days to 14 Days | 4.00% | 4.00% |

| 15 Days to 45 Days | 4.25% | 4.25% |

| 46 Days to 90 Days | 4.50% | 4.50% |

| 91 Days to 6 Months | 5.00% | 5.00% |

| 6 Months 1 Day | 6.75% | 6.92% |

| Above 6 Months to 9 Months | 5.50% | 5.61% |

| Above 9 Months to < 1 Year | 6.00% | 6.14% |

| 1 Year | 7.25% (Good alternative) | 7.45% |

| Above 1 Year to < 18 Months | 7.25% | 7.45% |

| 18 Months | 7.50% (The highest as per tenure) | 7.71% |

| Above 18 Months to 2 Years | 7.25% | 7.45% |

| Above 2 Years to 3 Years | 7.25% | 7.45% |

| Above 3 Years to < 5 Years | 6.75% | 6.92% |

| 5 Years | 8.00% (Highest) | 8.24% |

| Above 5 Years to 10 Years | 7.25% | 7.45% |

Ground reality at the branch level: Most customers do not go for 10-year FDs. In real branch discussions, maximum demand is for 1-year and 18-month FDs, because money stays flexible and returns are easy to track. The 5-year option is mainly chosen for Tax Saver FD, not as a normal investment, since money gets locked and benefits are limited only to tax savings. That is why people use a 5-year FD for 80C purposes, not for regular liquidity.

2. Senior Citizen Fixed Deposit (FD)

Senior Citizen FD is actually the same Domestic FD; the only difference is that people aged 60 years and above get a little extra interest. Even 0.20% extra rate matters when the FD amount is big or when interest is taken every month or quarter.

Most senior citizens usually choose two things:

- Quarterly interest payout, so it helps with pension or regular household expenses

- Or cumulative FD for 2 to 5 years, kept for medical needs or family work in future

Senior Citizen FD Rate Snapshot

| FD Period | Senior Citizen Interest (p.a.) | Final Yield |

|---|---|---|

| 7 Days to 14 Days | 4.20% | 4.20% |

| 15 Days to 45 Days | 4.45% | 4.45% |

| 46 Days to 90 Days | 4.70% | 4.70% |

| 91 Days to 6 Months | 5.20% | 5.20% |

| 6 Months 1 Day | 6.95% | 7.13% |

| Above 6 Months to 9 Months | 5.70% | 5.82% |

| Above 9 Months to < 1 Year | 6.20% | 6.35% |

| 1 Year | 7.45% | 7.66% |

| Above 1 Year to < 18 Months | 7.45% | 7.66% |

| 18 Months | 7.70% | 7.93% |

| Above 18 Months to 2 Years | 7.45% | 7.66% |

| Above 2 Years to 3 Years | 7.45% | 7.66% |

| Above 3 Years to < 5 Years | 6.95% | 7.13% |

| 5 Years (Tax Saver FD) | 8.00% (Highest) | 8.24% |

| Above 5 Years to 10 Years | 7.45% | 7.66% |

- Note: These FD rates are only for senior citizens who are 60 years or above. There is no extra benefit for super-senior citizens here, like what some PSU banks give. These rates apply only to new FD or FD renewal done on or after 03 December 2025. The FD amount should be below ₹3 crore.

- Easemoney insight: For retired people, 18-month FD and 5-year FD make more sense than very long deposits. Money does not stay blocked for too long, liquidity risk is lower, and interest rates are still good enough for a stable income.

3. Tax Saver FD (Fixed Deposit)

Suryoday Tax Saver FD is only for Section 80C tax saving. This FD is not flexible, and that is done on purpose. If flexibility is given, the tax benefit will not be allowed.

Important points to know:

- Lock-in period is fixed for 5 years

- Minimum deposit is ₹1,000

- The maximum deposit is ₹1.5 lakh in one financial year

- This FD is allowed only for resident individuals and HUF

- Senior citizens get extra interest if the age criteria are met

In this FD, there is no premature withdrawal, no loan against FD, and no auto-renewal. These rules are strict because the government gives tax benefits only when money stays locked for the full 5 years.

If an FD is opened in a joint name, then only the first account holder can claim the 80C tax deduction. The second holder does not get any tax benefit.

Tax Reality (Most People Get This Wrong)

Many people think Tax Saver FD means tax-free money. This is not true.

Here is the simple truth:

- Only the amount you invest gets an 80C tax benefit

- Interest earned is fully taxable every year

- TDS is deducted if interest crosses the limit, as per Income Tax rules

- Tax Saver FD benefit works only in the old tax regime, not the new one

Real-life example (easy to understand)

Suppose Shyamlal deposits ₹1,50,000 in Suryoday Tax Saver FD.

- He can claim ₹1,50,000 deduction under 80C

- After 5 years, suppose the total interest earned is ₹55,000

- This ₹55,000 interest is taxable, as per his income slab

- If TDS is applicable, the bank will cut TDS automatically

So, tax saving is on investment, not on interest.

Local behaviour (ground reality)

In small towns and district areas, many people still choose Tax Saver FD. The reason is very simple. They trust the bank more than the market. Even if ELSS or mutual funds give a higher return, people feel safer keeping money locked in a bank, with fixed interest and no daily tension.

4. Double Joy Deposit: Long-Term FD

Double Joy Deposit is not a normal FD. It should not be compared with regular fixed deposits. This is a long-term income planning scheme, not a short-term savings option.

How the structure works

- First 11 years → you put money every month

- Next 11 years → bank pays you money every month

- Total time period → 22 years

- The interest rate is fixed at 6.36% per year.

Money is invested monthly, like RD:

- Minimum deposit, you can do ₹1,000 per month

- Maximum deposit → ₹1,00,000 per month

After completing 11 years, you stop paying. From then on, the bank starts a monthly payout for the next 11 years, which works like a fixed monthly income.

Interest is calculated on the daily balance and added every 3 months (quarterly compounding).

Missed Contribution Rules (Very Important – most people ignore)

This scheme is strict, and the rules are not flexible.

- If you miss 6 instalments in the first 3 years, the deposit is automatically closed

- If you miss 6 instalments between year 3 and year 11, the plan stops, and money gets locked till maturity

- Late payment attracts 1% per month penalty

There is no partial withdrawal in between. Premature closure is allowed, but a penalty will be charged.

However, the bank gives some relief: Overdraft up to 90% of the total contribution is allowed, if needed

Who actually uses this scheme (ground reality)

This product is mostly used by salaried, middle-income families who want a long-term monthly income. Many parents also use it for future expenses of their children, like education or marriage. It is chosen by people who are disciplined and can commit to monthly payments for many years.

What are the NRI Fixed Deposits: Simple Two-Option Model

Suryoday does not complicate NRI deposits.

1. NRE Fixed Deposit

- Minimum amount: ₹10,000

- Minimum tenure: 1 year, yes – this must be above.

- Interest: Tax-free in India

- Fully repatriable

- Suitable for foreign income

NRE FD Rates in 2026 –

| FD Period | NRE Interest Rate (p.a.) | Final Yield |

|---|---|---|

| 1 Year | 7.25% | 7.45% |

| Above 1 Year to < 18 Months | 7.25% | 7.45% |

| 18 Months | 7.50% | 7.71% |

| Above 18 Months to 2 Years | 7.25% | 7.45% |

| Above 2 Years to 3 Years | 7.25% | 7.45% |

| Above 3 Years to < 5 Years | 6.75% | 6.92% |

| 5 Years | 8.00% (Highest) | 8.24% |

| Above 5 Years to 10 Years | 7.25% | 7.45% |

Important – These NRE FD rates are applicable only for deposit amount below ₹3 crore. Rates are valid for new FDs or renewals done on or after 03 December 2025.

2. NRO Fixed Deposit

- Minimum amount: ₹1,000

- Minimum tenure: 7 days

- Interest is taxable

- TDS applicable

- Used for Indian income like rent, pension, dividends

NRO FD Rates Trending –

| FD Tenure | Interest Rate (p.a.) |

|---|---|

| Up to 6 Months | 4.00% – 5.00% |

| 6 Months to < 1 Year | 5.50% – 6.75% |

| 1 Year | 7.25% |

| 18 Months | 7.50% |

| 2 to 3 Years | 7.25% |

| 3 to < 5 Years | 6.75% |

| 5 Years | 8.00% (Highest) |

| Above 5 Years | 7.25% |

NRO FD rates are the same as normal FD rates. The difference comes in tax and repatriation, not in interest.

Who Can Open a Domestic Fixed Deposit?

These people and entities can open a normal Domestic FD:

- Resident Indian individuals

- Single name

- Joint name

- HUF (Hindu Undivided Family)

- Small business owners

- Proprietorship

- Partnership firms

- Trust accounts

If you fall into any of these, you are eligible.

Documents You Need (Simple List)

The bank follows normal KYC rules. Mostly, they ask for:

- PAN card (must)

- Aadhaar card or any valid ID + address proof

- KYC verification, if you are a new customer

That’s it. No extra paperwork in most cases.

How to Book or Apply Fixed Deposit Online (Easy Steps)

1. If You Are Already a Suryoday Customer

This is the fastest method.

- Step 1: Login – Enter your registered mobile number

- Step 2: Choose FD details – Select how much money you want to deposit and for how long

- Step 3: Confirm with OTP – Enter the OTP sent to your mobile

- Step 4: FD Done – FD receipt is generated instantly

No branch visit needed.

2. If You Are a New Customer

You can apply fully online.

Visit this link: https://applyonline.suryoday.bank.in/suryoday-ntb-fd/

Before starting, keep these ready:

- PAN card number

- Aadhaar card number

- Mobile number linked with Aadhaar

- Working email ID

- Phone or laptop with internet and a camera

- Location access enabled in the browser

Basic eligibility:

- Must be a resident Indian

- Age should be 18 years or above

- No political exposure

Once digital KYC is completed, your FD gets booked successfully.

FAQs

Is Suryoday Small Finance Bank FD safe?

Yes. Suryoday Small Finance Bank is RBI-regulated, and all fixed deposits are insured by DICGC up to ₹5 lakh per depositor per bank, including principal and interest, as of January 2026.

Which bank gives 8% interest in an FD in 2026?

In 2026, select small finance banks like Suryoday offer up to 8.00% FD interest, usually on specific tenures such as 5 years, not across all flexible or short-term deposits.

What is the highest FD rate offered by Suryoday Bank?

Suryoday Small Finance Bank’s highest FD rate is 8.00% p.a., available only on 5-year deposits, including Tax Saver FD, with an annualised yield of approximately 8.24% due to quarterly compounding.

Is the 8% FD rate available on regular flexible FDs?

No. The 8.00% rate applies only to fixed 5-year tenures. Popular flexible tenures like 18 months earn a lower 7.50% p.a., but allow premature withdrawal and loan facilities.

Should senior citizens choose Suryoday FD in 2026?

Senior citizens may consider Suryoday FDs for higher rates up to 8.00% on 5 years or 7.70% on 18 months, balancing income needs, lock-in comfort, and DICGC insurance limits.

How to calculate returns using the Suryoday FD calculator?

Use the FD calculator on Suryoday’s official website by entering the deposit amount, tenure, and payout type. Returns vary based on quarterly compounding, tenure length, and cumulative or payout selection.

How does Suryoday FD compare with big private banks?

Compared to big private banks, Suryoday usually gives higher FD interest, but mostly on specific or longer time periods. Mid-term FDs also give decent rates, but liquidity and branch availability depend on your city or town. In some areas, branch access is limited, so that also matters before booking.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.