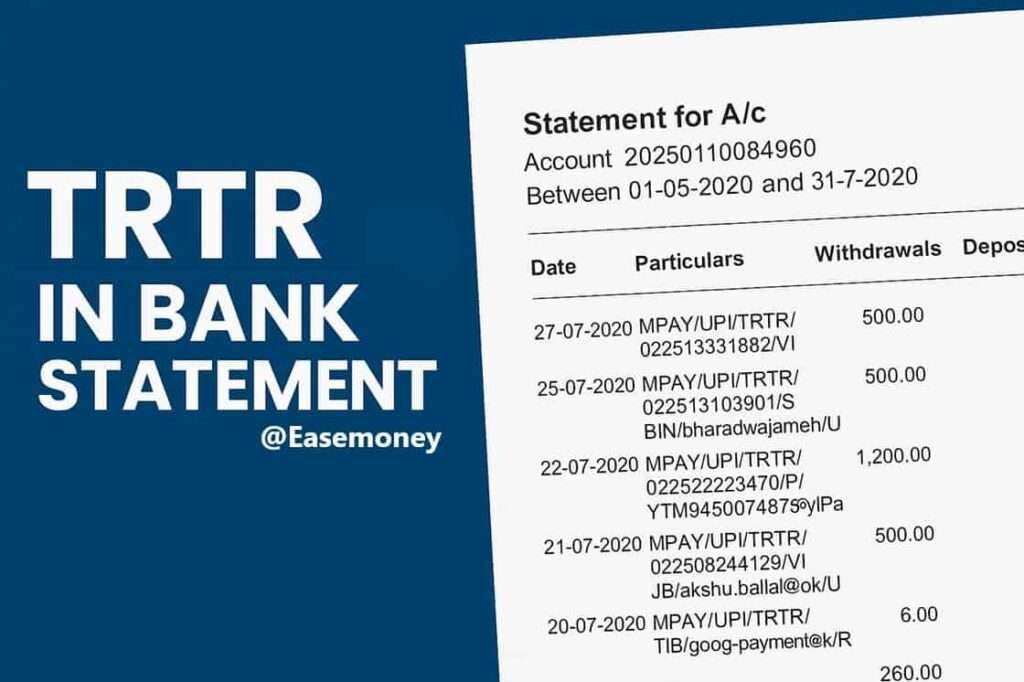

Why TRTR Appears in a Bank Statement

Usually, Banks use a transaction short code in the account statement to save space and provide better clarity to the user. It is also one of the abbreviations which printed. The TRTR full form is Transfer Transaction, that used when money is transferred from one account to another.

It is a widely used standard code in most of the banks in india, especially, Public sector banks (Government-owned banks) such as UCO Bank, Canara Bank, Union Bank, and PNB.

When you do any small or big money transfer with your account through UPI, NEFT, IMPS, Debit card, or an internal bank transfer, the system labels the entry with TRTR.

It helps customers to find the difference between money, transfers, ATM withdrawals (NWD), card payments (POS), hidden charges, and account usage charges.

What TRTR Means in Banking Terms?

It has a simple meaning for you – TRTR = Transfer Transaction.

It is neither a hidden fee nor a penalty. Instead, it is a simple tag that shows the nature of a transaction. It is a widely used abbreviation for fast printing upto crores of statements each month. As per RBI, All indian banks need to provide a Digital or physical statement copy every month to the account holders.

- TRTR Debit: Money moving out of your account.

- TRTR Credit: Money moving into your account.

This makes it easier to scan a statement and quickly know whether the transaction was a transfer, deposit, or withdrawal.

Where You Usually Find this

TRTR is most commonly visible in:

- Mini statements from ATMs (ATM receipt)

- Passbook updates at bank branches

- SMS Banking and WhatsApp Banking received 5 or 10 last transactions (also known as mini statements)

- Online banking statements in PDF format

- SMS alerts from banks for transactions

Most Private banks like HDFC or ICICI often show more detailed tags such as UPI/IMPS/NEFT, but India govt-owned banks frequently shorten them to TRTR. Likewise, they used short codes for other transactions such as – BSBD WDL TXN CHG, DCARDFEE, and more.

Example of Entries in Real Statements

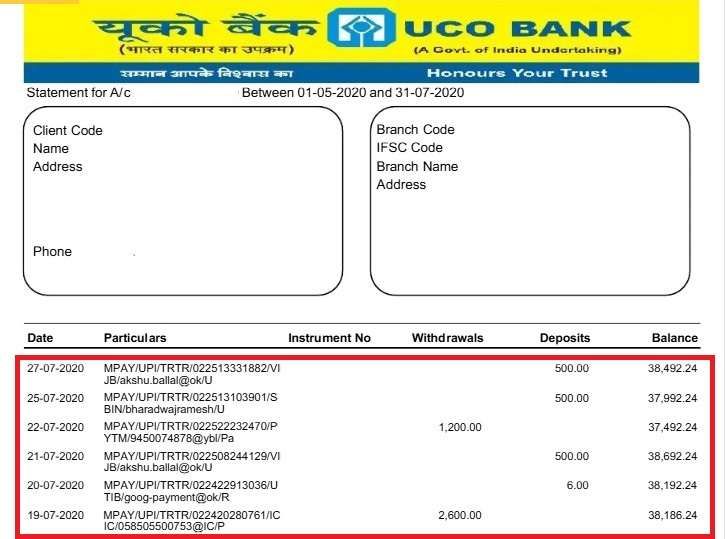

Let’s simply decode an actual statement snippet from UCO Bank to understand deeply how it works –

For Example, this Transaction –

27-07-2020 | MPAY/UPI/TRTR/022513331882/VI JB/akshu.ballal@ok/U | 500.00 | 38,492.24

- First entry: Debit of ₹500 via UPI to “akshu.ballal@ok”.

- Second entry: Debit of ₹500 to “Bharadwajramesh”.

- Third entry: Debit of ₹6 through Google Pay (UTIB = Axis Bank tag).

All three carry this code to show they were transfer transactions.

Which Banks Commonly Use

Different banks follow different coding styles as per the requirements –

- UCO Bank → Regularly prints “MPAY/UPI/TRTR/…” in mini-statements.

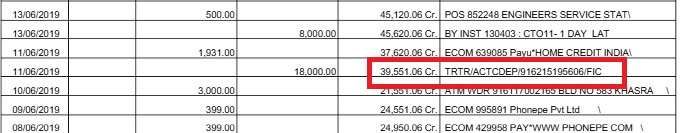

- PNB (Punjab National Bank) → Shows “TRTR/ACTCDEP/…” for deposits or credits.

- Canara Bank, Indian Bank, Union Bank → Frequently use this short code in physical statement copies, E-statements, and passbooks.

- SBI → Often uses TRF (Transfer) as an alternative, but TRTR still appears in some UPI-linked records.

So, if you are an account holder in a government bank, you are more likely to encounter TRTR in your statements.

How does it create confusion among customers?

TRTR codes can confuse people when:

- They assume TRTR indicates charges.

- They see only limited text in a mini statement without context and explanations.

- They don’t recognise UPI IDs or reference numbers.

- They mistake TRTR entries for unauthorised debits.

This is why it’s important to match the amount, date, and reference ID with your transaction history before worrying.

How ACTCDEP in PNB Statements works

PNB customers often see entries like:

TRTR/ACTCDEP/91621595606/FIC

Let me explain for you –

- TRTR → Transfer Transaction.

- ACTCDEP → Account Deposit (credit entry).

- FIC → Financial Inclusion Channel (often branch or system code).

In simple words, it means money was credited into your account as a deposit, not withdrawn. It could be a cheque clearing, cash deposit, or inward fund transfer.

Expert Tips to Understand TRTR Transactions Clearly

- Always double-check the sign of the transaction, what it is telling you:

- Minus (–) or entry in Withdrawals = Money out.

- Plus (+) or entry in Deposits = Money in.

- Match the transaction reference ID with the UPI app or bank SMS.

- If still unclear, download a detailed statement instead of a mini statement.

- Cross-check with notifications from UPI apps like Google Pay, PhonePe, Paytm.

- Contact the branch only if the reference ID doesn’t match any transaction you performed.

Additional Questions from Customers

What does DRC Host TRTR mean on my bank statement?

DRC Host TRTR usually tells you a debit transfer processed by the bank’s host system, which simply means your funds have been deducted during a transaction.

Why do banks use TRTR in transaction descriptions?

To save the time of customers, it helps customers quickly recognise digital fund movements without reading long transaction notes.

Is TRTR a bank charge or penalty deducted from my account?

No. TRTR is not a charge. It only means Transfer Transaction. If money moved via UPI, NEFT, IMPS, or internal transfer, banks tag it as TRTR for classification.

Why does TRTR appear even for small amounts like ₹10 or ₹50?

Banks tag all transfer sizes, even ₹1 or ₹10, as TRTR. The amount doesn’t matter. Tip: always match the date and reference number with your UPI or SMS alert.

How do I know whether TRTR is a debit or a credit?

Check the column position or sign. If TRTR appears under withdrawals or with “–”, money went out. If under deposits or “+”, money came into your account.

Which banks most commonly use the TRTR code?

TRTR is most common in government banks like PNB, Canara Bank, UCO Bank, Union Bank, and Indian Bank. Private banks usually display longer descriptions like UPI or IMPS.

When should I worry about a TRTR entry?

Only if the amount, date, or reference ID doesn’t match any action you took. In that case, contact your bank within 3 working days for faster trace and resolution.

Can TRTR appear for failed or reversed transactions?

Yes. Sometimes TRTR appears first as a debit, then again as a credit if reversed. Tip: look for the same amount, same date, opposite entry—that confirms a reversal.

What does TRTR/ACTCDEP mean in PNB statements?

It means Transfer Transaction – Account Credit Deposit. In simple words, money was credited into your PNB account, usually via cheque clearing, branch deposit, or inward transfer.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.