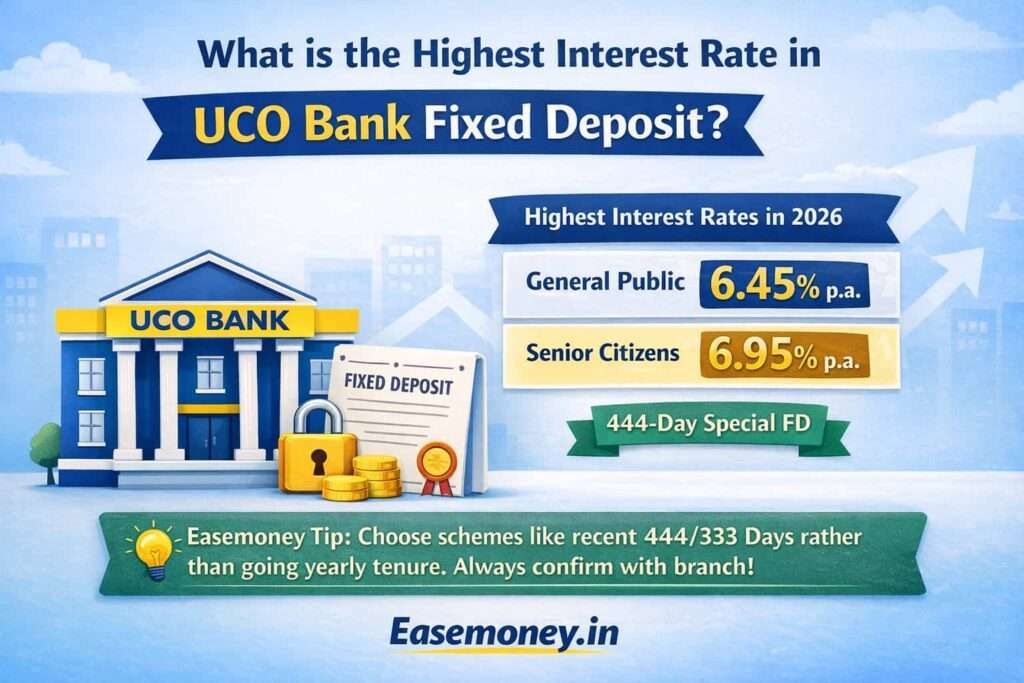

What is the highest interest rate in UCO Bank Fixed Deposit in 2026?

UCO Bank Fixed Deposit is a safe way to save money. In this, you deposit a one-time amount in the bank for a fixed time, from 7 days to 10 years. The interest rate is fixed when you open the FD, and it remains the same till maturity. As of January 2026, UCO Bank is giving higher interest rates in some special FD schemes.

- The highest fixed deposit interest rate in UCO Bank is 6.45% per year for the general public.

- Senior citizens get a higher interest rate of 6.95% per year on their fixed deposits.

If you want this much interest, you have to go with the UCO 444-day Special Fixed Deposit Scheme. Also, you can choose a Green deposit. UCO Green Deposit is a special FD option where the bank gives 0.20% extra interest compared to normal FD rates. This extra interest is available for selected time periods like 12 months, 1000 days, and 2000 days.

This is important because in December 2025, the Reserve Bank of India (RBI) reduced the repo rate to 5.25% to support the economy. When the repo rate goes down, banks usually cut their FD interest rates also. But as per the UCO Bank official site, they have still kept their special FD rates attractive, especially for the 444-day FD, which is a good option for you looking for better returns.

Insight: Unlike normal 1-year or 2-year fixed deposits, the 444-day FD offers better returns even when interest rates are coming down. However, while choosing this option, investors should always go through the officially provided special schemes and avoid booking any regular or direct FD by mistake.

UCO Bank FD Interest Rates Chart (Below ₹3 Crore)

| FD Tenure | General Public | Senior Citizen |

|---|---|---|

| 7 – 14 days | 2.90% | 3.15% |

| 15 – 29 days | 2.90% | 3.15% |

| 30 – 45 days | 3.00% | 3.25% |

| 46 – 90 days | 3.50% | 3.75% |

| 91 – 180 days | 4.25% – 4.75% | 4.50% – 5.00% |

| 181 – 332 days | 5.00% | 5.25% |

| 333 days (Special FD) | 6.30% | 6.55% |

| 1 year | 6.10% – 6.50% | 6.35% – 7.00% |

| 444 days (Special FD) | 6.45% | 6.95% |

| 2 – 5 years | 6.00% – 6.15% | 6.50% – 6.65% |

| Above 5 years | 6.00% | 6.50% |

Note – This report and rates were updated on 31/12/2025 after repo rates.

Features & Benefits You Will Get

UCO Bank Fixed Deposit is mainly chosen because it is safe and easy to understand. Many salaried people, senior citizens and rural investors prefer UCO Bank FD as they don’t want risk and want a fixed return without any headache.

- Decent Interest Rates, Better Than Normal FDs – UCO Bank FD gives good interest rates compared to many other government banks. But you have to ask the branch for any recent or new schemes. Higher rates are mostly available on special time periods like 333 days and 444 days.

- FD Time Period Options Are Very Flexible – UCO Bank allows you to open an FD for a short time as well as a long time. You can go with

- Short period: 7 days, 15 days, 3 months

- Medium period: 333 days, 444 days

- Long period: Up to 10 years

- Loan Facility Without Breaking Your FD – If you need money urgently, UCO Bank gives a loan or overdraft against your FD. You can get a loan of up to 90% of the FD amount. This is helpful because you don’t need to break your FD, and interest keeps coming normally.

- Senior Citizens Get Extra Interest Benefit – Senior citizens above 60 years get extra interest on FD. They got an extra 0.25% to 0.50% interest over normal rates. That’s why many retired people use UCO Bank FD for safe income and peace of mind.

- Tax Saving FD Option Is Also Available – UCO Bank also has a 5-year Tax Saver FD. You can claim a tax deduction up to ₹1.5 lakh under Section 80C, but the FD lock-in period is 5 years. One thing to remember here, interest earned on this FD is still taxable.

- Partial Withdrawal Option Under CAPS GAIN Scheme – Under the CAPS GAIN FD scheme, you are allowed to make a partial withdrawal in ₹5,000 multiples. The remaining FD will continue earning interest. This is useful when you need some money but don’t want to close a full FD.

- Safety, Nomination and Auto Renewal – UCO Bank FD comes with basic safety features.

- Auto-renewal option is available for both.

- Nomination facility for family members

- FD is insured up to ₹5 lakh by DICGC

- Also, UCO Bank is a government bank, so many people trust it for long-term savings.

What is a UCO Bank FD, and All Different Types Currently

A Fixed Deposit means you keep a one-time amount in the bank for a fixed time period, and the bank gives you fixed interest on it. The return is guaranteed, so there is no market risk if you choose alternative shares or mutual funds.

UCO Bank offers different types of FD options. These schemes are designed based on how you want to receive interest and what your personal need is, for example, you want a regular income or long-term savings. let’s start with the most popular one –

1. UCO 444 & UCO 333 Special Schemes

UCO Bank has two special fixed deposit options for people who want a little higher interest than a normal FD, but without taking any risk. These are called UCO 444-day FD and UCO 333-day FD.

Both these FDs are useful for those who don’t want to put money in shares or mutual funds and still want a better return than a regular 1-year FD. Since UCO Bank is a government bank, safety is also not a problem.

Who can invest in these FDs?

- If you are an Indian resident, you can invest in these schemes.

- If you are a senior citizen, you can also invest and get extra interest.

- Even if you have an NRE or NRO rupee FD, you are allowed.

But one condition is there — the total FD amount should be less than ₹3 crore.

FD time period – which one should you choose?

UCO Bank has kept it simple. There are only two options.

- 444 days FD, if you can keep the money for a little longer

- 333 days FD, if you want money back a bit early

So if you don’t need money urgently, a 444-day FD makes more sense. But if you feel you may need money sooner, then a 333-day FD is a safer choice.

Interest rates you will get

| Special Scheme | General Public (% p.a.) | Senior Citizens (% p.a.) |

|---|---|---|

| UCO 333 Days | 6.30% | 6.55% |

| UCO 444 Days | 6.45% | 6.95% |

Note: These rates are current as of the latest revision on December 11, 2025

How much can you invest

You don’t need a lot of money to start.

- Minimum amount is ₹10,000

- The maximum should be below ₹3 crore

So even small savers can use these FDs.

Real-life example – a common person

Rajesh Verma is 45 years old and runs a small electrical shop in a district town. He had around ₹2 lakh in savings. He wanted a safe investment, but he also wanted a bit more return than a normal FD.

If he had chosen a normal 1-year FD, the interest would be less. But since he did not need money urgently, he went with UCO 444-day FD.

- Deposit: ₹2,00,000

- Interest: 6.45% per year

Now he is earning extra interest without any risk. And if someday the shop needs money, he can take a loan against the FD instead of closing it.

Simple suggestion

- If you can keep money for a longer time and want maximum return, a 444-day FD is better.

- But if you want money faster with decent interest, a 333-day FD is a good choice.

2. Kuber Yojana (Reinvestment Fixed Deposit)

Kuber Yojana is a long-term fixed deposit scheme for people who want safe and steady wealth growth. In this FD, interest is added back to the deposit every three months, so your money keeps growing automatically. You get the full amount only at maturity, which helps in creating a bigger corpus.

Key points in simple:

- You can do minimum deposit of ₹1,000

- FD period can be from 6 months to 10 years

- Interest is compounded quarterly

- The full amount (principal + interest) is paid at maturity

Best suited for:

- Children’s education

- Retirement planning

- Long-term wealth creation without risk

This scheme is good if you don’t need a regular income and want your money to grow safely over time.

Interest rates:

The interest rate under UCO Kuber Yojana FD depends on how long you keep the money. As per the latest update on 11 December 2025, interest rates range from 5.00% to 6.10% per year for the general public. Senior citizens get slightly higher rates, from 5.25% to 6.60% per year, based on the FD tenure.

| FD Period | General Public | Senior Citizens |

|---|---|---|

| 6–11 months (181–332 days) | 5.00% p.a. | 5.25% p.a. |

| Exactly 1 year | 6.10% p.a. | 6.35% p.a. |

| Above 1 year up to 443 days | 6.10% p.a. | 6.60% p.a. |

| 445 days to 2 years | 6.10% p.a. | 6.60% p.a. |

| Above 2 years to 3 years | 6.00% p.a. | 6.50% p.a. |

| Above 3 years to 5 years | 6.00% p.a. | 6.50% p.a. |

| Above 5 years (up to 10 years) | 6.00% p.a. | 6.50% p.a. |

3. UCO Tax Saver Fixed Deposit (2006)

- Lock-in: 5 years

- Eligible for Section 80C tax deduction

- Maximum investment: ₹1.5 lakh per year

- Interest is taxable

Tax example: If you invest ₹1.5 lakh and fall under 30% tax slab → ₹45,000 in tax saved.

4. UCO Green Deposit Scheme (Simple Explanation)

UCO Green Deposit is a special type of fixed deposit where your money is used for environmentally friendly and green projects. The interest rate is a little lower than some special FD schemes, but the return is safe and stable. So if you want a tension-free income and also want your money to be used for a good cause, this FD can be a good option.

These rates are for domestic deposits below ₹3 crore.

| FD Period | General Public | Senior Citizens |

|---|---|---|

| 12 months | 6.30% p.a. | 6.55% p.a. |

| 1000 days | 6.20% p.a. | 6.70% p.a. |

| 2000 days | 6.20% p.a. | 6.70% p.a. |

| 3000 days | 6.20% p.a. | 6.70% p.a. |

Senior citizens get an extra 0.25% to 0.50% interest, depending on tenure.

Important things to know

- FD money is used for eco-friendly projects

- Interest includes 0.20% extra over normal card rates

- Minimum deposit starts from ₹10,000

- Interest payout option: monthly or quarterly

- Premature withdrawal and nomination are allowed

But keep in mind: This FD does not have auto-renewal, and the loan facility is not available.

5. UCO Bank Motor Accident Claim FD (MACTDA)

UCO Bank MACT Deposit is a special fixed deposit made only for motor accident victims or their family members. This account is opened when a court or tribunal orders compensation after an accident. The main aim of this FD is to keep the compensation money safe and give it slowly every month, so it is not misused or spent at once.

| Thing | Simple meaning |

|---|---|

| Interest rate | As per normal UCO Bank FD rates, based on the court order |

| FD period | Usually 3 to 10 years, as decided by the court |

| Interest type | Simple interest for the first 6 months, then compounded quarterly |

| Deposit amount | No limit, depends fully on the court’s compensation amount |

| Who can open | Accident victim or legal family member |

UCO Bank FD vs Other PSU Banks (January-Feb-March 2026 Comparison)

| Bank | Peak Rate (General) | Peak Rate (Senior) | Tenure |

|---|---|---|---|

| Central Bank of India | 7.50% | 8.00% | 1111 / 3333 days |

| Indian Overseas Bank | 7.30% | 7.80% | 444 days |

| Bank of Maharashtra | 6.65% | 7.15% | 400 days |

| Punjab & Sind Bank | 6.70% | 7.20% | Special |

| UCO Bank | 6.45% | 6.95% | 444 days |

| Bank of Baroda | 6.45% | 6.95% | Special |

| Canara Bank | 6.50% | 7.00% | Special |

Key insight: Almost all banks give the highest FD rate on odd-day tenures, not exactly 1 year.

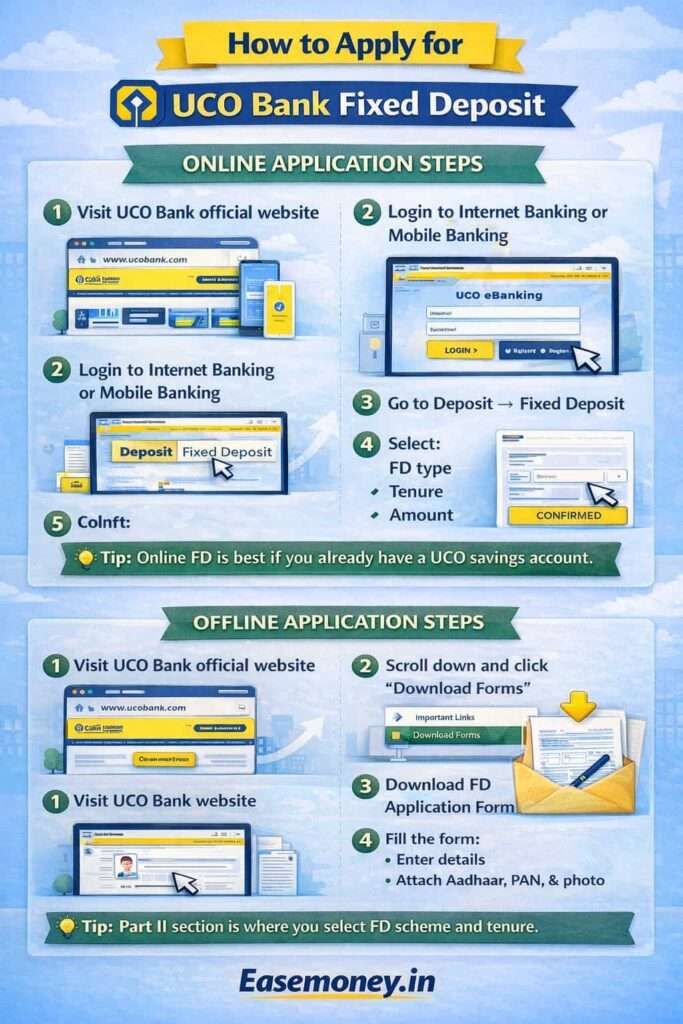

How to apply for UCO Bank Fixed Deposit (Online)

Step-by-step online process

- Visit the UCO Bank official website

- Log in to Internet Banking or Mobile Banking

- Go to Deposit → Fixed Deposit

- Select:

- FD type (Term / Reinvestment)

- Tenure (333 or 444 days for best rate)

- Amount

- Confirm and submit

- FD receipt is generated digitally

Online FD is best if you already have UCO savings account.

How to apply offline (Download FD form from website)

If you don’t use internet banking:

- Visit UCO Bank website

- Scroll down, before the footer, and go to the Important Links section.

- Click on “Download Forms”

- Download Application Forms for Savings, Current & Term Deposit (FD) Accounts (PDF)

- Take printout, you can use A4 Paper. or you can ask from branch.

How to fill the UCO Bank FD application form (Very important)

Part I: Customer Information (CIF)

- Name (as per Aadhaar/PAN)

- Date of birth

- Mobile number

- Address

- PAN / Aadhaar

- Photo + signature

Existing customers can skip some details.

Part-II: FD Account Details (Main confusion part, Go to section Fixed Deposit)

In the form, you will see options like:

- TERM DEPOSIT

- TERM DEPOSIT (REINVESTMENT)

- ANNUITY DEPOSIT

- TAX SAVING SCHEME

- CAPS GAIN (TDR)

What to select (Correct mapping)

| UCO FD Scheme | What to tick in the form |

|---|---|

| UCO 444 / 333 FD | TERM DEPOSIT |

| Kuber Yojana | TERM DEPOSIT (REINVESTMENT) |

| Monthly / Quarterly Income | ANNUITY DEPOSIT |

| Tax Saver FD | TAX SAVING SCHEME |

| Flexi FD | CAPS GAIN (TDR) |

Senior citizen FD has no separate option. Just mark senior citizen in personal details.

Other important sections

- Write the FD amount

- Select tenure

- Choose the interest payout option

- Fill nominee details

- Sign with a black pen

Submit form with:

- Aadhaar

- PAN

- Photograph

Premature FD closure penalty (Know before investing)

| FD Amount | Penalty |

|---|---|

| Below ₹15 lakh | 1% lower interest |

| ₹15 lakh – ₹1 crore | 1% lower |

| Above ₹1 crore | 2% lower |

How to get the highest interest in UCO Bank (Smart tips)

- Always check special FD tenure, confirm with UCO Bank Customer Care for any latest offer for you. depending on account type, they provide different schemes.

- Senior citizens must select senior category

- Choose reinvestment option for higher maturity

- Avoid premature withdrawal

- Keep PAN updated to avoid higher TDS

FAQs

Does UCO Bank offer special FD rates to senior citizens?

Yes, UCO Bank gives senior citizens extra interest, usually 0.25% to 0.50% more than regular rates. This benefit applies across most FD tenures, including special schemes like 444-day deposits.

What is the interest rate for UCO Bank senior citizen FD in 2025?

In 2025, UCO Bank senior citizen FD rates go up to 6.95% per year, depending on tenure. Special period FDs like 333 or 444 days generally offer better returns than normal one-year FDs.

How can I download my UCO Bank fixed deposit certificate?

You can download the FD certificate through UCO Internet Banking or the mobile app. If online access is not enabled, visit your home branch with a passbook and ID, and they provide it instantly.

Is a UCO Bank FD certificate required for a loan or tax purposes?

Yes, FD certificate is often needed for loan against FD, income proof, or tax records. Keep a digital copy saved because branches may charge a small fee for repeated printouts.

Does UCO Bank have a fixed deposit calculator?

UCO Bank offers an FD calculator on its official website. It helps you check maturity value by entering amount, tenure, and interest rate. Always cross-check special FD rates manually.

Is UCO Bank 10-year fixed deposit a good option?

UCO Bank 10-year FD suits people who want long-term safety, not maximum returns. Rates are stable but usually lower than special tenure FDs. Senior citizens benefit more due to extra interest.

Should I choose special FD or 10-year FD in UCO Bank?

If your goal is higher return in shorter time, choose special FDs like 444 days. But if you want discipline and long-term parking, 10-year FD works better. It depends on cash need.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.