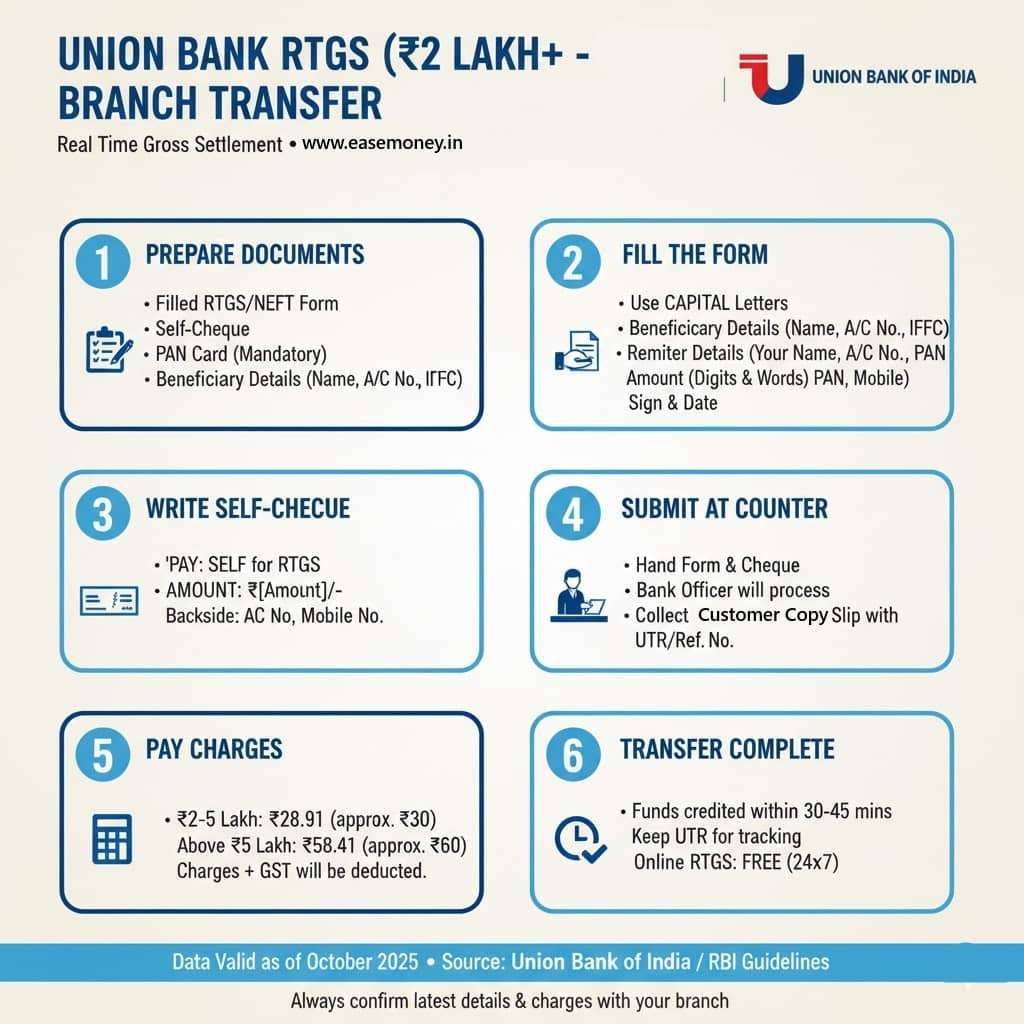

What Is the Right Union Bank Form for ₹2 Lakh+ Transfers?

When you visit union bank branch for any transferring any amount above 2 lakh, the bank branch asks you to fill up a RTGS Form. But most people got confused with form, there isn’t just one standard format.

Some branches use a short one, some use a long version, and others hand you a form that looks slightly different but works the same. The same RTGS/NEFT form is printed in various languages across states. You can also get in bilingual (English/hindi) and single seperated language such as Tamil.

Also, most questions people have, which documents need to carry, whether a self-cheque is required or not, let’s check it out –

Types of RTGS Forms Used in Union Bank

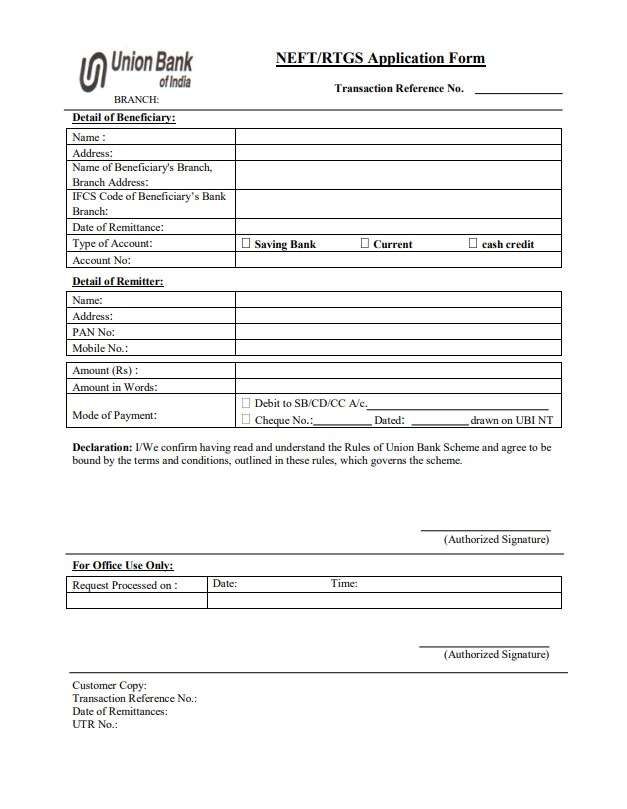

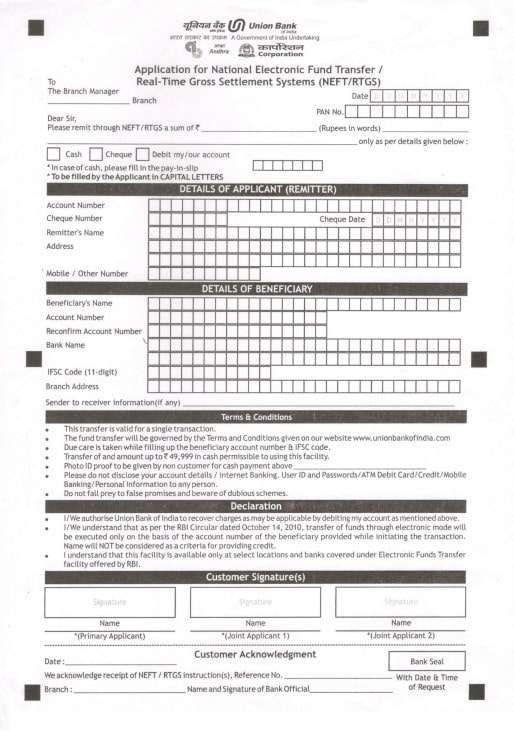

As of now, Union Bank of India uses two most popular variants of the RTGS/NEFT form. Both variants have the same fill up, here the details –

- Short RTGS/NEFT Form – A single page Compact version, it only required basic information, remitter’s name, account number, amount, beneficiary’s details, and IFSC code. It’s often used in smaller branches or for quick NEFT or small-value transfers, but some branches also accept it for RTGS if every field is filled correctly.

- Full RTGS/NEFT Form – it is detailed form, options to tick, section for joint account holder signature, cheque number, and acknowledgment slip.

Where to Get or Download the Form

The simplest option yet, You can collect a printed RTGS phyiscal application form directly from any Union Bank RTGS enabled branch only. But if you want to filling it out in advance, you can download it and print it yourself.

Currently, Union Bank’s official website doesn’t host digital form online, but the same forms used in branches are available through few trusted sources. Below are the links you can use immediately.

| Form Type | Direct Download Link | Format |

|---|---|---|

| Short RTGS/NEFT Form | 🔗 Union Bank RTGS Short Form | |

| Full RTGS/NEFT Form | 🔗 Union Bank Full Form Original | |

| Editable Word Form | 🔗 MS Word or Google Docs – Editable Version | DOCX Fillable (MS Office or Web-based) |

How to Fill the Form Using Microsoft Word OR Google Docs

If you download the Word version, you can type everything neatly before printing. Here’s how:

- Open the link → click

File > Download > Microsoft Word (.docx). - Open the downloaded version file in MS Word or Google Docs.

- Type your details in each blank space:

- Your name, account number, PAN

- Beneficiary’s name, account number, IFSC

- Amount and transaction date

- Review everything carefully for spelling or number errors.

- Print the filled form, sign it with a black pen, and attach your self-cheque.

Tips – Typing your details instead of handwriting makes your form cleaner and easier, but firstly, you have to confirm with your branch, does they accept editable PDFs. Sometimes, banks only accept particular branch seal forms.

Documents You will Need Before fill up

Here’s a quick checklist of what to carry with you to the branch:

- RTGS/NEFT form – You can use any version, until branch have sets few rules for it.

- Photo ID proof (if requested by the bank)

- PAN card (mandatory for large transfers)

- A cancelled cheque or bank statement of Beneficiary details for self-use only (it better idea, it helps to fill up the form correctly and avoid any mistake)

- A cheque book or leaf for self cheque (As per RBI, The remitter need not use a physical cheque or a demand draft but if branch still ask for)

How to Write the Self-Cheque for RTGS (if required)

It authorizes the bank to debit your account for the amount being transferred.

Here’s how to write it correctly:

| Field | What to Write |

|---|---|

| Pay line | “SELF for RTGS” |

| Amount (in figures) | Example, ₹3,00,000/- |

| Amount (in words) | “Three lakh only” |

| Date | Current date |

| Signature | As per your bank records or PAN |

| Back-side of cheque | put beneficiary account number & IFSC. |

Step-by-Step: How to Fill the Union Bank RTGS Form

writing by pen or typing by keyboard, the details stay the same. Use capital words and write in boxes, Follow these steps carefully:

- Transaction Reference no. – Your Bank Branch will write it for you.

- Branch – simply put branch name where you doing this payment.

- Details of Beneficiary – unlike other forms, it start with receiver. You have to fill out the bank details who will money got. A company or individual.

- Name – enter full name of your beneficiary. Put correct name only as per there cancel cheque or provided document.

- Address – A basic address details, fill it up.

- Branch address – If you don’t know branch address, use beneficiary IFSC Code to find details online. Just search IFSC using google.

- IFSC Code – Enter 11 digit IFSC Code. (it is mandatory)

- Date of remmitance – enter the date when you doing RTGS.

- Type of Account – Tick the beneficiary account type if individual tick savings if a company tick current.

- Account no. – Enter full account number and double check it, this is most important part.

- Details of Remitter – This seciton is yours, you can use passbook to fill it up correctly.

- Name – Put your full name same as self cheque or Bank recorded.

- Address – Write down your communication address same as registered with your branch.

- PAN – Enter your 10 Digit PAN Number. It mostly required if amount higher than account type set limit.

- Mobile number – Put down your mobile number, linked with your account.

- Transaction Section –

- Amount in digits – enter the amount, you transfering via RTGS. Example 2,25,000/- (read the charges below)

- Amount in words – Same amount put in numbers, example – two lakh twenty five thousands only.

- Mode of payment – Tick any one – Debit to SB/CD/CC and enter your account number or Tick cheque and enter your 6 digit cheque number + enter same date as written on cheque.

- Signature – In the authorized signature, put your signature same as cheque.

- For office use section – Leave it blank, bank will handle it.

- Branch counter – Hand the form and self-cheque to the teller. The officer will process it, and you will receive a confirmation slip with a UTR number or Transaction Reference no. for tracking.

- RTGS Timing – After submit at counter, your payment will settle within 30 to 45 minutes window, if you submit after 4:00 PM, it settled next working day. 2nd & 4th Saturday, Sundays, and public holidays: Branches are closed, if it between a holiday, you may have to wait for long.

Note – This top to bottom steps followed as per RTGS Short application form of Union Bank.

In-Branch RTGS Charges (Effective April 1, 2025)

| Amount Range | Bank Charge (Excl. GST) | With 18% GST |

|---|---|---|

| ₹2 lakh – ₹5 lakh | ₹24.50 | ₹28.91 (simply put 30 Rs.) |

| Above ₹5 lakh | ₹49.50 | ₹58.41 (put 60 Rs. bank deduct automatic) |

| Online RTGS | Free | Free |

These charges apply automatically when the transaction is processed.

Top Questions

Can I fill the Union Bank RTGS form in Hindi or regional language?

Yes, you can ask a hindi or english seperated forms application form, The format and validity remain the same across all Union Bank branches. Bank usually provides bilingual forms, you have to fill up only hindi section, ignore english parts.

Is it mandatory to attach a cheque with the Union Bank RTGS form?

You need to provide a cheque leaf from your own account to get the transaction authorised, but you do not need to attach a cheque from the beneficiary.

Can I use the Union Bank RTGS form for NEFT transactions too?

Yes. The same form is used for both RTGS and NEFT. Just tick the NEFT Section, you can do any transfer from Rs. 1000 to 25 Lakh using NEFT at the Union Bank branch.

What should I do if I make a mistake on the RTGS form?

Simply, cancel the form and rewrite it clearly using clean writing. Corrections with overwriting or ink changes are usually not accepted for security reasons.

Why do some Union Bank branches reject downloaded RTGS forms?

Many branches accept only branch-issued forms with pre-printed codes. Downloaded or Word-filled forms may be rejected to avoid fraud, unless the manager explicitly allows externally printed formats.

Is PAN compulsory for Union Bank RTGS even if my amount is just above ₹2 lakh?

Yes, PAN is usually required for RTGS above ₹2 lakh. Even if not written on the form, the teller may verify PAN internally before processing high-value transactions.

Can Union Bank staff change beneficiary details after form submission?

No. Once the form reaches processing, no corrections are allowed. Any mismatch means cancellation and refilling. Tip: double-check the IFSC and account number twice before submission.

Does Union Bank allow RTGS without a cheque if I tick “Debit My Account”?

Technically, yes, but practically, many branches still demand a self-cheque for authorisation, especially for amounts above ₹5 lakh or accounts with older signature records.

Can Union Bank RTGS fail due to insufficient balance despite having the exact amount?

Yes. RTGS charges plus 18% GST are deducted separately. Always keep ₹60–₹100 extra balance to avoid “low balance” rejection at the counter.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.