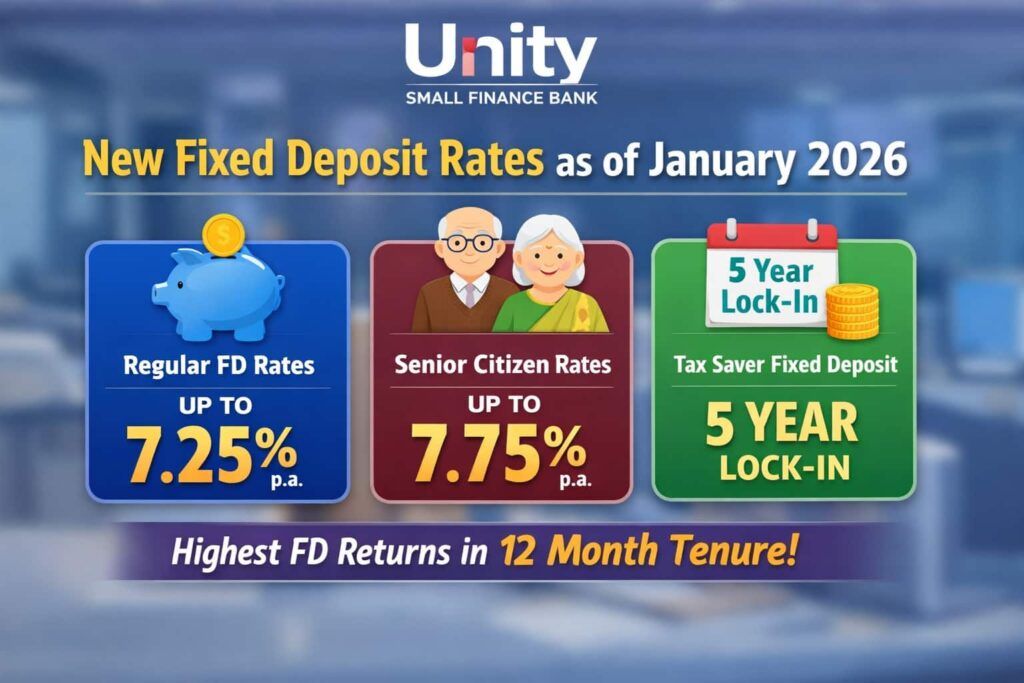

Unity Small Finance Bank has changed its fixed deposit interest rates on 20 January 2026. From this change, one thing is clearly visible. The bank is not pushing customers to keep their money locked for very long years. Instead of that, Unity Bank is giving better focus on useful and practical FD time periods.

So people don’t have to choose a very long FD just to get a higher interest rate. This is helpful for normal customers who want a safe return but also want their money available when needed.

For normal Indian residents –

- Unity Small Finance Bank is giving fixed deposit interest starting from 4.00% and going up to 7.25% per year.

- Senior citizens are getting extra benefits, with interest going up to 7.75% per year.

The best part is that the highest FD rate is around the 12-month period, which is the time most people usually like to invest their money. So customers don’t need to choose long-term FD just for a better return.

The final return depends on three things: First, how long your money is kept in an FD. Second is if the person is a senior citizen or not. Third is which FD type you choose while booking the deposit.

This update is not like normal small changes by banks. It is important because banks are now competing more to get deposits. People are clearly checking FD returns of PSU banks, private banks, and small finance banks before investing. Also, the Reserve Bank of India changed the repo rate to 5.25% on 5 December 2025. Because of this, the new FD rate chart of 2026 makes more sense, as banks are now adjusting rates based on the new RBI policy.

Latest Unity Bank Interest Rates Chart for FD (Retail Investors Below ₹3 crore)

Unity Bank has not mixed many schemes or made confusing slabs. The bank has released a clear fixed deposit rate card –

| Tenure | General FD Rate (% p.a.) |

|---|---|

| 7 – 14 Days | 4.00% |

| 15 – 45 Days | 4.00% |

| 46 – 60 Days | 4.75% |

| 61 – 90 Days | 5.00% |

| 91 – 164 Days | 5.00% |

| 165 Days – 6 Months | 5.50% |

| > 6 Months – 201 Days | 6.25% |

| 202 Days – 364 Days | 6.25% |

| 12 Months | 7.25% |

| 12 Months – 1 Day | 6.50% |

| > 12 Months – 500 Days | 6.50% |

| 501 Days | 6.75% |

| 502 Days – 18 Months | 6.75% |

| > 18 Months – 700 Days | 6.75% |

| 701 Days | 6.75% |

| 702 Days – 998 Days | 6.75% |

| 999 Days – 34 Months | 6.75% |

| > 34 Months – 36 Months | 6.75% |

| > 36 Months – 60 Months | 6.75% |

| > 60 Months – 120 Months | 6.00% |

Quick Points For You –

- If FD is broken before maturity, 1.00% penalty will be charged

- FD interest rates can change anytime, bank may not give prior notice

- The same FD rate card is also valid for selected RD periods

- NRE fixed deposits are allowed only for 1 year or above

- Senior citizen extra interest is not given extra interest to NRI customers

- No TDS on NRE deposits

- For NRO deposits, the DTAA benefit is applicable as per rules

Best FD option as per the above chart

If we look only at the normal FD rate chart, the best option is very clear.

- 12-month Fixed Deposit at 7.25% per year

This is the highest interest rate available for regular retail customers, without forcing people to lock money for many years, without going into the bulk FD category, and without choosing any special or conditional scheme.

In real life, this FD makes sense for most people. One-year lock-in feels comfortable and not risky. Interest calculation is easy to understand. Money is not stuck for a long time, so the liquidity problem stays low. Also, every year, people can decide again whether to renew the FD or use the money.

At the branch level, the reality is the same. Most customers of Unity Small Finance Bank usually choose 12-month or near one-year FDs. Very few people go for 7 to 10-year deposits.

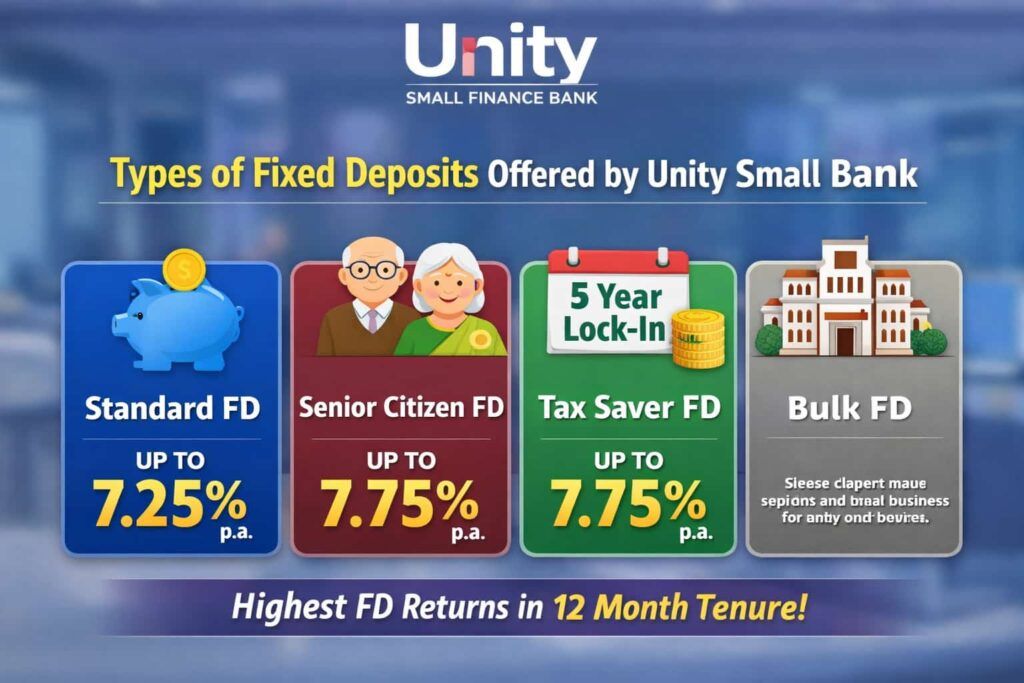

What Types of Fixed Deposit Schemes Does Unity Bank Offer?

Unity Small Finance Bank keeps things very simple. Only 4 fixed deposit schemes are offered for Indian resident customers in India.

1. Unity Bank Regular Fixed Deposit (Standard)

This is the main FD product of Unity Small Finance Bank. It is a simple lump-sum FD where money is kept safe and gives a fixed, stable return for the chosen time.

Main features:

- Minimum deposit amount: you can start at ₹1,000

- FD tenure available from 7 days to 10 years

- Interest can be taken monthly, quarterly, or cumulatively

- A loan or overdraft facility is allowed on this FD

- Premature withdrawal is allowed, but a penalty will apply

You can check the first chart above to see the exact interest rates.

2. Senior Citizen Fixed Deposit

Senior Citizen FD is not a separate product. It is the same regular fixed deposit. The only difference is, customers who are 60 years and above get extra interest on it.

Even an extra 0.50% interest matters a lot when the FD amount is big or when interest is taken monthly or quarterly.

In real life, most senior citizens usually choose a quarterly interest payout for daily household and living expenses. Some also keep a 1 to 3-year cumulative FD for medical needs or family support.

Senior Citizen FD Rate Chart (Retail < ₹3 crore)

| Tenure | Senior Citizen Rate (% p.a.) |

|---|---|

| 7 – 14 Days | 4.00% |

| 15 – 45 Days | 4.00% |

| 46 – 60 Days | 5.25% |

| 61 – 90 Days | 5.50% |

| 91 – 164 Days | 5.50% |

| 165 Days – 6 Months | 6.00% |

| > 6 Months – 201 Days | 6.75% |

| 202 Days – 364 Days | 6.75% |

| 12 Months | 7.75% (Highest For Senior people) |

| 12 Months – 1 Day | 7.00% |

| > 12 Months – 500 Days | 7.00% |

| 501 Days – 5 Years | 7.25% |

| > 5 Years – 10 Years | 6.50% |

3. Tax Saver Fixed Deposit (5-Year Only)

Unity Small Finance Bank also offers a Tax Saver FD for people who want to save tax under Section 80C. This FD is mainly for tax benefit, not for using money in between.

Important points to know:

- Lock-in period is 5 years compulsory

- Minimum deposit starts from ₹1,000

- The maximum tax saving benefit is ₹1.5 lakh in a year

- Interest earned on this FD is fully taxable

- No premature withdrawal is allowed

- Loan or overdraft is not allowed on this FD

Many people get confused about this FD. The tax benefit applies to the amount you invest, not to the interest you earn. So this FD is useful only for saving tax, not for liquidity or emergency use.

In short, this FD is good only if your main goal is tax saving, not regular income or quick access to money.

4. Bulk Fixed Deposit (₹3 Crore and Above)

If one single FD amount is ₹3 crore or more, it is treated as a bulk fixed deposit.

- The interest rates for bulk FD are different from normal retail FD. You can check the rates here in Unity bank Latest Bulk rates chart 2026. Unity Bank update the rates for bulk FDs on 19 August 2025.

- In bulk FD, both callable and non-callable options are available.

This type of FD is mostly used by companies, corporations, and institutions. - For normal retail investors, a bulk FD is not useful or relevant.

How to Apply for a Fixed Deposit in Unity Bank

Documents you will need

- PAN card (must, without this, FD is not possible)

- Aadhaar card or any valid ID and address proof

- Mobile number linked with Aadhaar

- Recent photo (only needed if you visit the branch)

Steps to apply (Online / App / Branch)

- Visit the official website or the mobile app of Unity Small Finance Bank

- Click on the Fixed Deposit option

- Enter your mobile number and basic details

- Choose FD type – Regular, Senior Citizen, or Tax Saver

- Enter the FD amount you want to invest

- Select FD time period (tenure)

- Choose interest payout option – monthly, quarterly, or cumulative

- If you are a new customer, complete KYC

- Upload documents or finish Video KYC

- Transfer money online or deposit via branch

- FD receipt gets generated

- Confirmation comes via SMS and email

Small thing to note

If you are already a customer of Unity Bank, FD booking is much faster because your KYC is already done. This whole process is simple and does not take much time, even for first-time FD users.

Unity Small Finance Bank Deposit Growth & Trust Factor (FY25)

As of 31 March 2025, Unity Small Finance Bank reported total deposits of ₹11,952 crore. This clearly shows the bank’s deposit base has grown fast in a short time.

Deposit growth numbers:

- FY24 total deposits were around ₹6,505 crore

- FY25 total deposits increased to ₹11,952 crore

- Year-on-year deposit growth is nearly 84%, which is very strong

Deposit mix tells real story:

- Around 80% of deposits come from retail term deposits and CASA

- This means money is coming mainly from normal customers, not only big institutions

Ground-level clarity (important):

- In 2022, some sources and Unity Bank Press release were talking about FD rates going up to 9.00% per year in late 2024 or early 2025

- That rate is not active in 2026.

- Currently, the highest retail FD rate is 7.75%, and that too for senior citizens only.

Trust factor on the ground:

- Unity Bank is now operating from 330+ locations across India

- Steady deposit growth shows that trust is increasing, especially among FD investors who want safe and fixed returns

Overall, this deposit growth looks real and backed by retail customers, not just numbers on paper.

Question Answers

Which bank gives 9.5% interest on fixed deposits in India?

As of January 2026, no RBI-regulated bank is giving 9.5% FD interest to normal retail customers. Such high rates usually come from NBFCs, cooperative banks, or old, expired offers. Always be careful with these claims. Banks regulated by the Reserve Bank of India are currently offering much lower rates.

How much interest will ₹1 lakh FD earn in 1 year?

If you invest ₹1 lakh for 12 months at 7.25%, you will earn around ₹7,250 before tax, assuming a cumulative FD and no early break. After tax, the amount will be slightly lower.

What is a 12-month FD, and why do people like it so much?

A 12-month FD means your money is locked for one year at a fixed interest rate. People like it because the return is clear, risk is low, and every year you can decide again whether to renew or use the money.

Is Unity Bank FD safe for normal investors?

Yes. Unity Small Finance Bank is regulated by RBI. Also, deposits up to ₹5 lakh per person are insured by Deposit Insurance and Credit Guarantee Corporation. So within limits, FD is reasonably safe.

What is 444-day FD? Does Unity Bank offer it?

444-day FD is a special short-term FD some banks use to give better rates. As of 2026, Unity Bank does not offer any 444-day special FD scheme.

How much FD is needed to earn ₹2 lakh per month?

To earn around ₹2 lakh every month at about 7.25% yearly interest, you will need roughly ₹3.3 crore FD amount. This is before tax and assumes regular interest payout.

How to calculate Unity Small Finance Bank FD returns accurately?

Use Unity Bank’s official FD calculator by entering deposit amount, tenure, and payout type. Always compare maturity value after tax, especially if annual interest exceeds ₹40,000.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.