Definition: A Bank statement is a summary of your savings or current account activity for a specific period. In India, most banks provide a monthly or quarterly bank statement.

It can be physically (paper statement) or digitally (PDF or online). It is your official document that shows a detailed record of all transactions, money credited and debited.

These statement helps you to track finances, charges, expenses, verify payments, and maintain financial records. Think of it as a financial diary.

When you open a bank account, the bank asks for your email or residential address to send you a monthly statement. In India, you can opt for only a single type of format; however, you can request duplicate physical copies as needed.

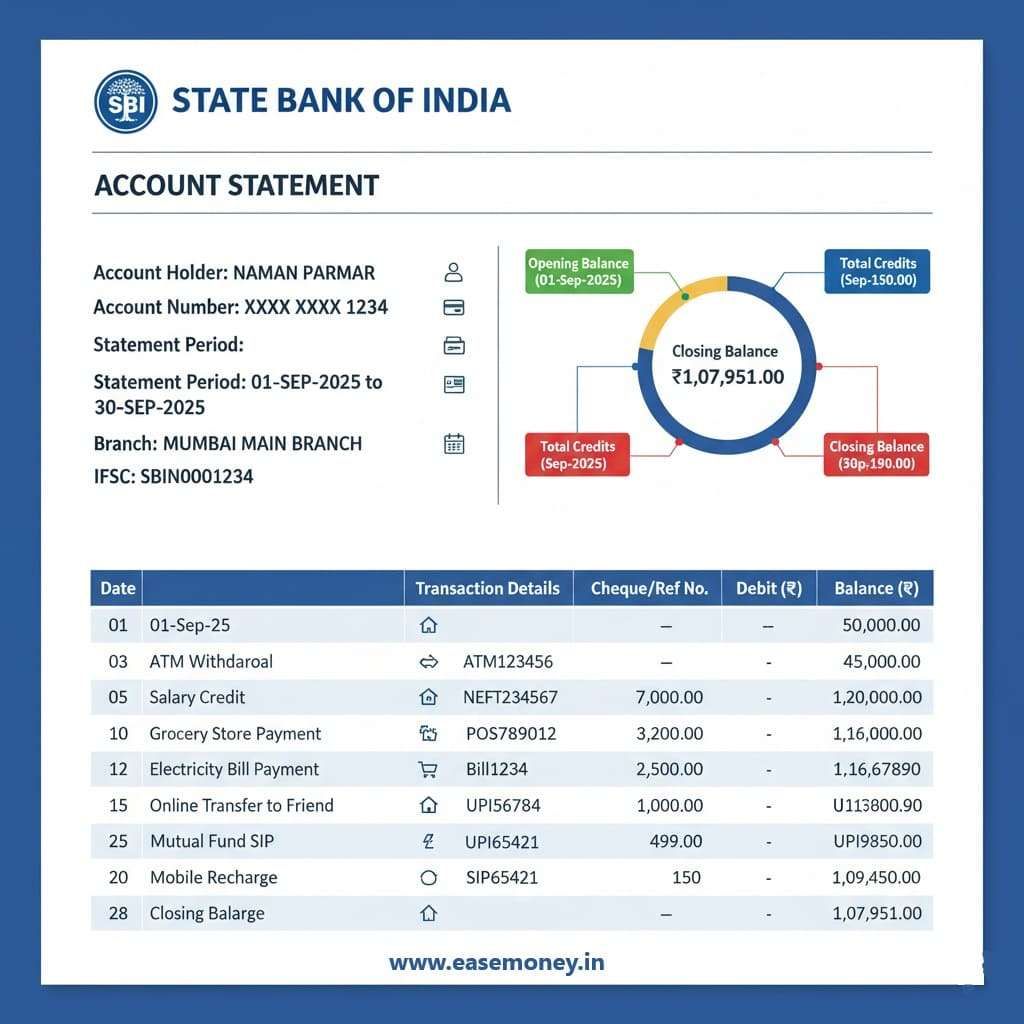

Example of a Bank Statement Layout

| Date | Transaction | Cheque/Ref No. | Debit (₹) | Credit (₹) | Balance (₹) |

|---|---|---|---|---|---|

| 01-Sep-25 | Opening Balance | — | — | — | 50,000.00 |

| 03-Sep-25 | ATM Withdrawal | ATM123456 | 5,000.00 | — | 45,000.00 |

| 05-Sep-25 | Salary Credit | NEFT234567 | — | 75,000.00 | 1,20,000.00 |

| 10-Sep-25 | Grocery Store Payment | POS789012 | 3,200.00 | — | 1,16,800.00 |

| 12-Sep-25 | Electricity Bill Payment | Bill1234 | 2,500.00 | — | 1,14,300.00 |

| 15-Sep-25 | Online Transfer to Friend | UPI567890 | 1,000.00 | — | 1,13,300.00 |

| 20-Sep-25 | Mutual Fund SIP | SIP987654 | 5,000.00 | — | 1,08,300.00 |

| 25-Sep-25 | Cashback Credit | — | — | 150.00 | 1,08,450.00 |

| 28-Sep-25 | Mobile Recharge | UPI654321 | 499.00 | — | 1,07,951.00 |

| 30-Sep-25 | Closing Balance | — | — | — | 1,07,951.00 |

- Total Credits (Sep-2025): ₹75,150.00

- Total Debits (Sep-2025): ₹17,199.00

- Opening Balance (01-Sep-2025): ₹50,000.00

- Closing Balance (30-Sep-2025): ₹1,07,951.00

Understanding the Details of Your Bank Statement

Every bank account statement follows a similar format and mostly similar private information, but the exact layout can differ depending on your bank, such as a Private or government bank.

You will get all the transactions in chronological order, from top to bottom. Here’s what you will typically find:

- Your Account Details (Top Header)

- Your name and address

- Bank account number

- Your type of account (such as savings, current, salary, or credit card)

- Branch name, IFSC code, MICR Code

- Customer ID or CIF

- Mobile Number or Email ID

- Statement Period

- Even if you download for 6 months, each page covers the month, such as the start and end dates of the period covered (Quick example – 1 April 2025 – 30 April 2025).

- Opening and Closing Balances:

- Your balance at the beginning of the period

- Balance at the end of the period (end of the month or days)

- Transaction List: As I told you, here is your chronological list –

- Date: When the transaction happened

- Description: What the transaction was (for example, salary credit, ATM withdrawal, UPI payment)

- Credit: Amount added to your account

- Debit: Amount deducted from your account

- Balance: Remaining balance after each transaction

- Other Details:

- Interest credited (for savings accounts)

- Bank account and card charges or penalties

- Reversal data (if a transaction was cancelled or refunded, credited)

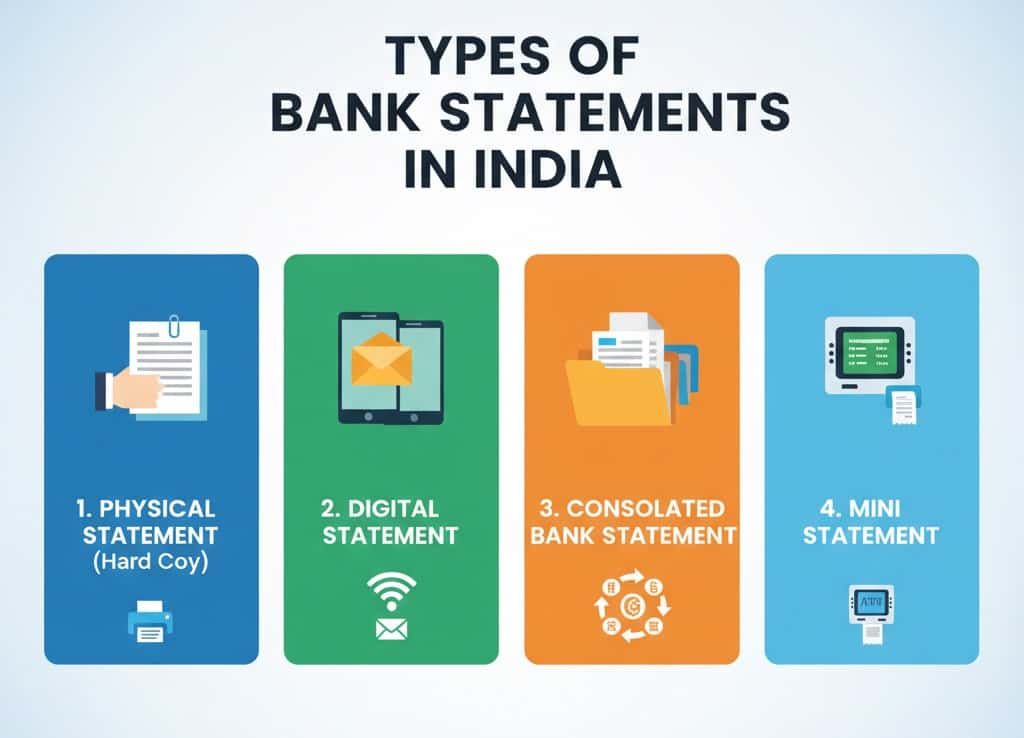

Types of Bank Statements in India

Banks in India usually provide two types of account statements: A Hard copy (Physical) via courier, OR an E-statement via Internet banking and Email ID. Both are used for the same purpose, but they differ in how to use them –

1. Physical statement (Hard Copy)

Your physical statement is printed and a paper version, it is easily available at your branch, or you can request it via customer care, and it will be delivered via post.

These statements are used for official purposes such as property deals, legal cases, and visa applications, because they are printed on the bank’s letterhead and usually include a stamp and signature.

Key points –

- Few indian banks provide one free physical statement per year, but duplicate copies cost ₹50–₹100 + GST per statement. You can confirm with your bank.

- Available only during banking hours and might take 1–7 days if sent by post.

- In 2025, you can request via mobile banking apps.

2. Digital Statement

A digital statement is an electronic version of your account statement. Now, it is the most common type used in India, because it is free, secure, and goes to your registered email address only. Furthermore, you can download directly from net banking or a mobile banking app.

Key points –

- It is sent automatically every month.

- It is available in PDF, Excel, CSV, and XLS.

- Can be printed if a hard copy is needed.

- Now accepted everywhere, such as government agencies, private institutions, banks, NBFCs, and more.

- You can register it just by adding your email ID to your bank account using the mobile app or application form.

3. Consolidated Bank Statement

Some banks also offer a consolidated statement, such as HDFC, ICICI, and SBI. NSDL and CDSL also offer it. It covers and combines information from multiple accounts or products under the same customer ID, for example, if you have a Fixed deposit, savings account and an active Mutual fund, in a single document.

Key points –

- Very useful for businesses and the self-employed

- You can request it online and available in physical or digital form

4. Mini Statement

Mini Statement is a short transaction detail slip (digital slip and physical both). It contains only the last 5 to 10 transactions. It is just for a quick overview of recent activity; This slip does not work as an official document.

- You can get it using an ATM, SMS Banking, WhatsApp or Mobile apps.

- Most gramin banks and co-operative banks often provide.

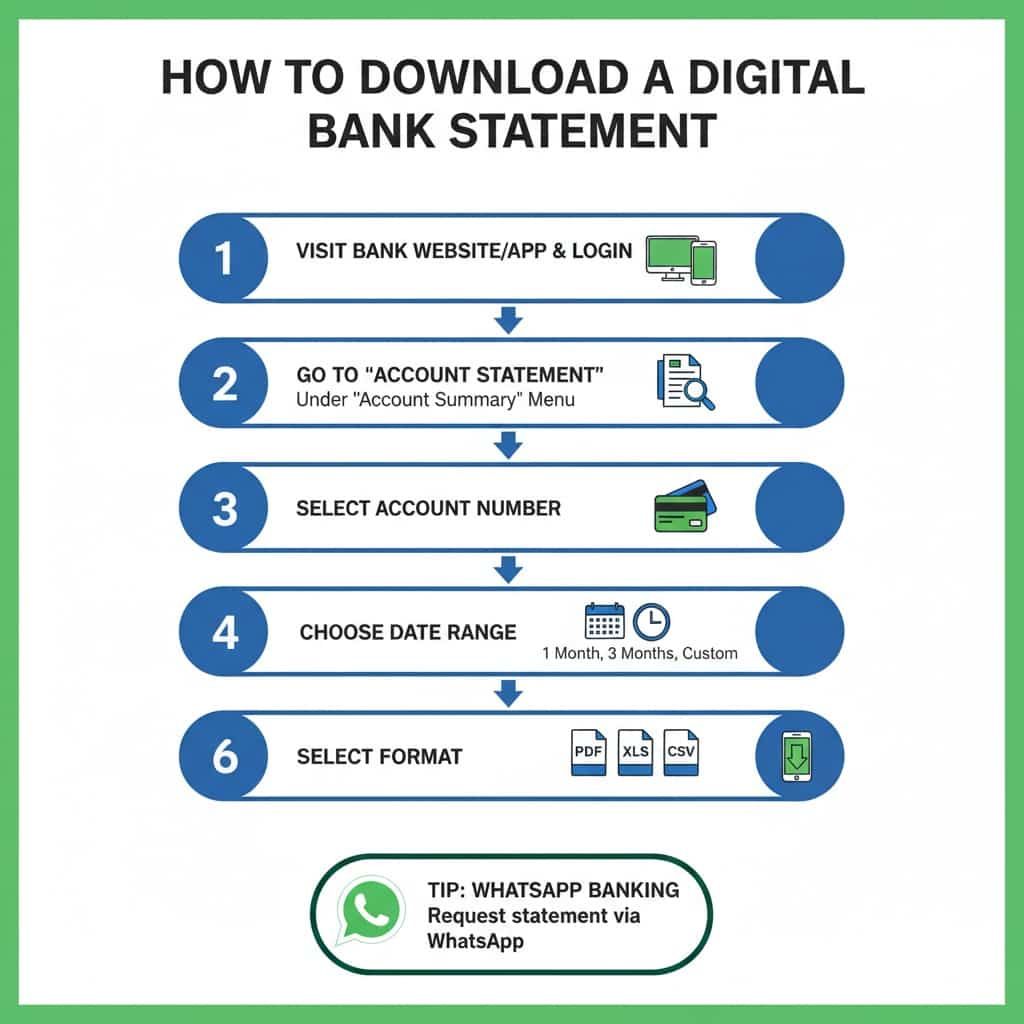

How to Download a Digital Bank Statement

Almost every Indian bank offers online access to account statements. The process is similar across most banks:

- First of all, visit your bank website and tap on the Log in button. You can also use the mobile app.

- Go to the ‘Account Statement’ section under the Account summary menu.

- Select the account number (if you have more than one).

- Choose the date range — for example, one month, three months, or you can set your own date as well.

- Choose Which Format you want – PDF, XSL, CSV.

- Click Download Statement and save it to your phone’s file manager.

Tip: It is also available on WhatsApp banking, just find your bank number and send a request for a statement.

Password Protection for Digital Statements

After downloading it as a PDF, you cannot open it. For security reasons, most Indian banks put password protection on it. It is an RBI rule to prevent unauthorised access and cybercrime. In simple words, Digital Banking products need a password for safety.

The password is usually really simple. Banks use different password formats, which include your combination of your name, account number, mobile number, or date of birth. This information is only for the real account holder. To know the exact password format with an example of your bank –

Read this – All Bank Digital Statement Password

RBI and Banking Regulations on Statements

In India, the RBI holds the power to regulate all banks. The Reserve Bank of India have strict guidelines when issuing statements. These include:

- Every bank must provide Electronic statements, which must be free and easily available, so you can check your account anytime online.

- As per RBI and tax regulations, Banks must keep records for at least 8 years, so you can refer back if needed.

- In case of any mismatch found, the account holder has the right to raise a complaint with their bank and the RBI ombudsmen, and banks must investigate and respond within 30 days.

- Charges for physical statements must be reasonable and disclosed in advance.

- Deposit insurance information should be included, especially for co-op banks.

- Every Bank statement must be easy to read and understand, without confusing jargon.

How to Read and Analyse a Bank Statement

You might be confused with short words of statements; your Bank statements usually come with abbreviations and codes. These terms are used for bank fees, regular transaction details, withdrawals, and more.

Here is are list of the top popular terms used by banks (Govt-banks or Private) –

- CR (Credit): It means your money is added to your account (For example, salary, refund, or transfer received).

- DR (Debit): Money deducted from your account (e.g., bill payment, ATM withdrawal).

- NWD (Non-Home Withdrawal): Cash withdrawal from an ATM (especially from a non-home branch).

- TRTR (Transfer Transaction): A transaction involving the transfer of funds — like NEFT, IMPS, or UPI.

- EXC PYMT DUP (Excess Payment Duplicate): An overpayment or duplicate payment made, which may be refunded or adjusted.

- INT CR: Interest credited to your account by the bank.

- REV CR/DR: Reversal of a previous transaction (either credit or debit).

- BSBD Wdl Txn Chg: It means Basic Savings Bank Deposit Withdrawal Transaction Charges.

- POS DR: Debit transaction at a point of sale (like a card payment at a store).

- Debit Card AMC: It tells how much Annual Maintenance Charge is levied on your Account-linked ATM card.

Once you understand these terms, it becomes so simple for you to read a statement.

Additional Comment Answers

Yes, you can share with trusted institutions or for official purposes, but they genuinely need it for legitimate works, such as a rental application, a loan application; however, never share it with an unknown person, email, or WhatsApp, to prevent any fraud, because it contains very sensitive information.

How to edit a bank statement?

You cannot edit it; it is a legal and official document issued by the bank. Nowadays, AI can detect Edits to PDFs easily, which may count as fraud if you use an edited PDF at any official portal.

How to Remove a Password from a PDF Bank Statement?

If you want your PDF statement password-free, first of all, you have to open it using a password, then tap on Control + P, select Save as PDF, and now your new PDF version does not have any protection.

How to Get a 6-Month Bank Statement PDF

You can use netbanking or mobile app for quick download, simply, Log in and select a custom date range of six months. Download the statement as a PDF.

How to apply for a bank statement?

You have to visit your home branch and ask for a customer request form. If you want a physical statement, tick on duplicate statement, write the date range, your signature, and your bank counter will issue a physical statement for you. But for the Digital statement, you have to update your email ID.

How often should I check my bank statement as a beginner?

Ideally, once a week and mandatorily once a month. Weekly checks catch fraud early; monthly reviews help track charges, EMIs, and subscriptions before money quietly leaks from your account.

Is a digital bank statement legally valid in India?

Yes. RBI allows PDF e-statements for loans, visas, tax, and rentals. Tip: download directly from net banking and keep the original password-protected file for authenticity checks.

Why does my balance look correct, but money still feels missing?

Because charges, EMIs, or auto-debits hide in descriptions. Check Debit Card AMC, BSBD charges, SIPs, and reversals. Many beginners lose ₹300–₹800 yearly just in unnoticed fees.

What should I verify first when reading a bank statement?

Always verify opening balance, total credits, total debits, and closing balance. If these four numbers don’t logically match, dig deeper—errors usually surface within the first 10 lines.

How many years of bank statements should I keep?

At least 8 years. Banks keep records, but having your own copies helps in tax notices, old loan disputes, or visa checks. Best practice: store yearly PDFs in cloud folders.

What’s the biggest beginner mistake with bank statements?

Ignoring small deductions. A ₹20 charge repeated monthly becomes ₹240 a year. Tip: search your statement for “CHG”, “FEE”, or “AMC” once every month.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.