Let’s start with the most important part that you want to know before closing – the charges.

As per the last Schedule of Charges effective 1st June, 2025, on the Yes Bank savings account:

- If you close your YES Bank account within 30 days of opening, there’s no charge.

- If you close it after 1 year of opening, again, no charge.

- But if you close it anywhere between 30 days and 1 year, you will need to pay a ₹500 closure fee, and the bank may even reject your form request.

- You have to take the signature of the Branch manager on the form of Annexure 1, section, if your account falls within this time frame.

This applies to most savings accounts, including YES PRO Savings Account and YES Digital Savings Account. For current accounts or special categories, the charges may differ, but for a regular savings account, these are the rules you will face.

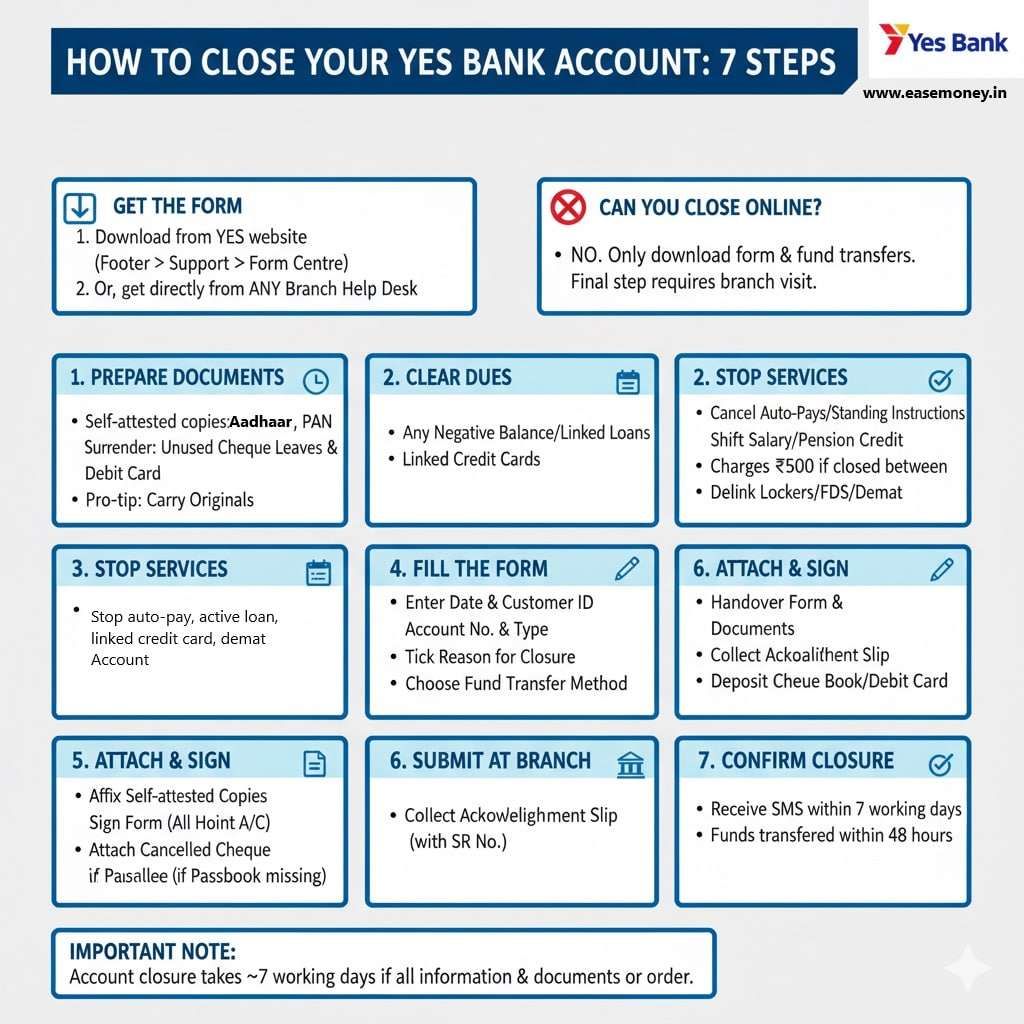

Can You Close a YES Bank Account Online?

This is where a lot of customers like you got confused. While YES Bank offers strong digital banking through its mobile app and netbanking, you cannot fully close your account online. There is no account closure button available on the mobile app.

But here’s what you can do online:

- Download the account closure form in advance.

- Transfer money out of your account before closure.

- Cancel standing instructions like bill payments, Auto-pay, subscriptions, active loans, or SIPs through internet banking.

But when it comes to the final step – actually closing the account – you still need to visit the branch. Almost every bank in india follows the same process.

The reason behind it, the bank requires physical signatures, surrender of your cheque book and debit card, and ID verification to end your KYC and stop your customer ID.

Where to Start – Get or Download the official Closure Form PDF

To close your account, you need the official closure form. The good news is that YES Bank makes it easy for you to get a PDF. Here are quick steps –

- As always, visit the official website of Yes Bank and on the header menu, tap on the “(?)” support button, which is available just side of the login button.

- Under the Support section, click on Download Forms.

- Make it simple for you, just press Control + F, and type “closure”

- Now, you can download the form in any language you want, from hindi to Tamil, select any language you like and tap on download PDF.

- You can use online PDF editors to edit it, or just print it out on A4 paper.

Best Alternative – If you don’t have a printer, don’t stress. Just walk into your home branch and ask at the enquiry desk — staff usually keep printed copies of the closure form handy.

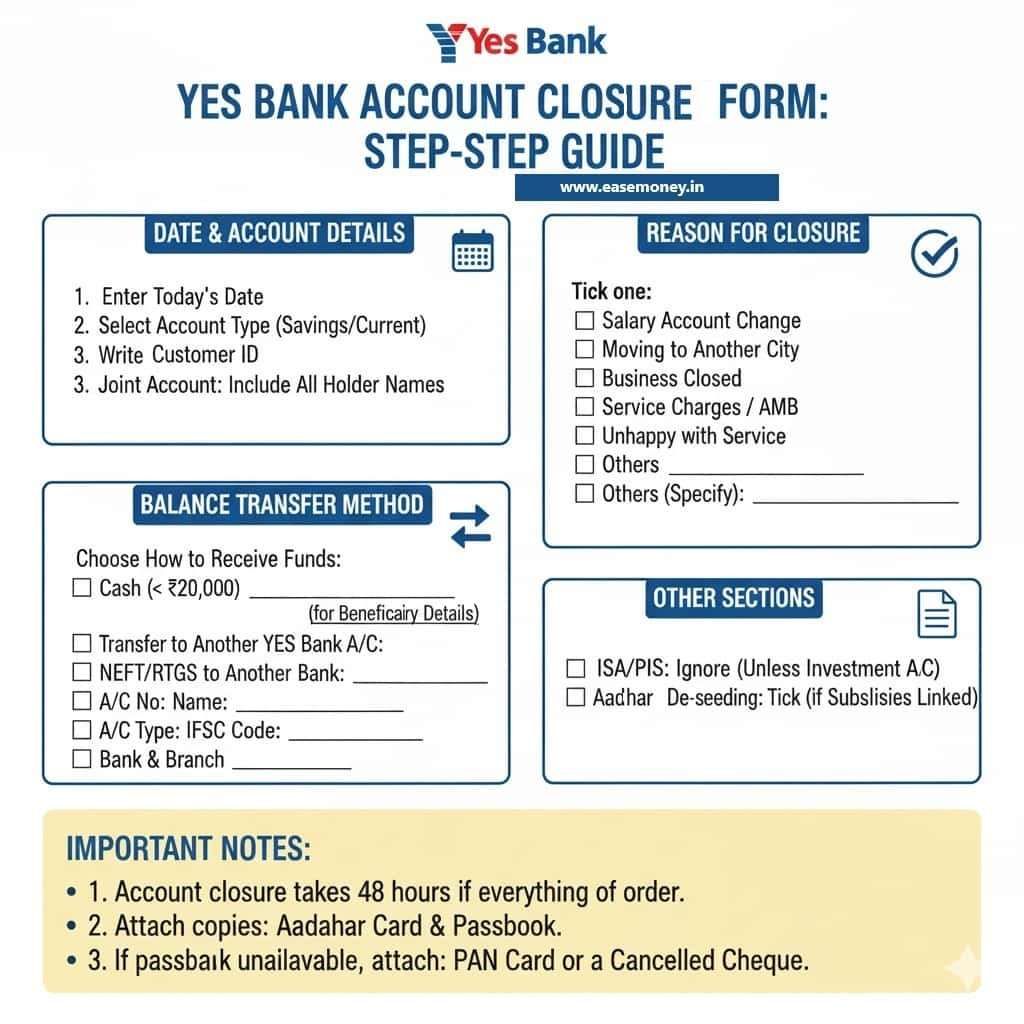

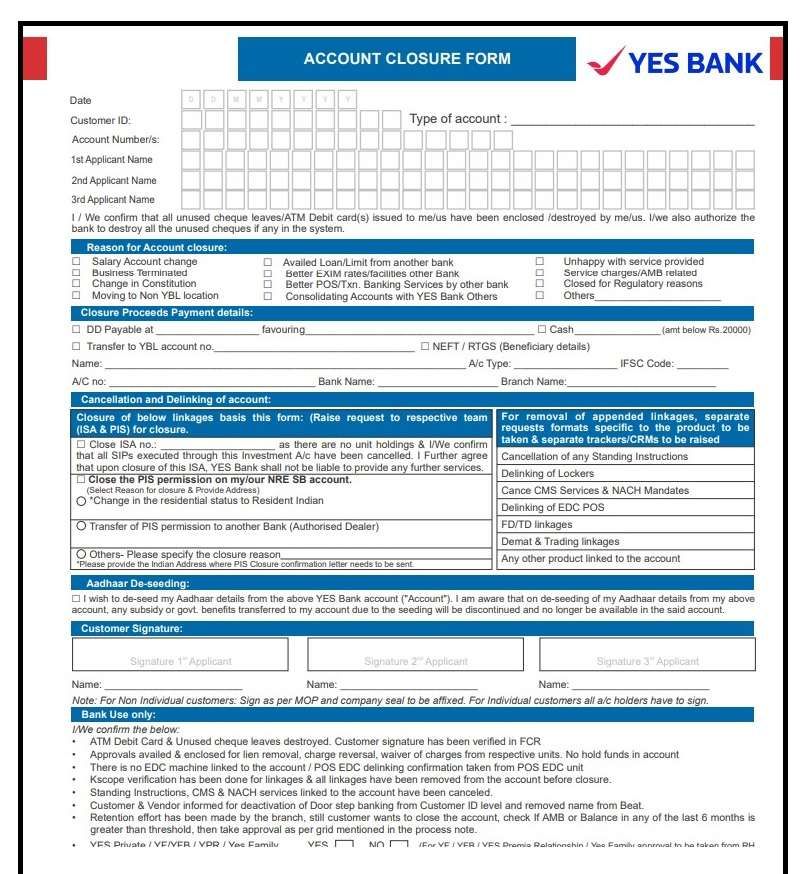

How to Fill the Account Closure Form by Blue Pen

Once you have the form, here’s how to fill it without overthinking:

- Date and Account Details –

- Enter today’s date.

- Fill in your Customer ID (printed in your passbook or statements).

- Select the account type (Savings or Current).

- Write your account number. If it’s a joint account, include all account holder names.

- Reason for Closure – The form gives you a list — just tick one:

- Salary account change

- Moving to another city (non-YES Bank location)

- Business closed

- Service charges or AMB (average monthly balance) related

- Unhappy with the service

- Others (write your own reason if needed)

- How You Want Your Balance Transferred (select anyone)

- Cash: As per RBI rules, only allowed if the balance is less than ₹20,000.

- Demand Draft (DD): Write beneficiary details.

- Transfer to another YES Bank account: Just provide that account number.

- NEFT/RTGS to another bank: Fill in beneficiary name, account number, account type, IFSC, bank and branch name.

- Other Sections

- Ignore the ISA/PIS tick boxes unless you have investment or portfolio accounts.

- Aadhaar de-seeding – tick only if subsidies or DBT are linked and you want them removed.

Also, tick in the Bank only section, Tick on delinked loans and alternate bank details for ECS debts.

- Signatures

- Put your signature at the bottom.

- If a joint account, all account holders must sign.

That’s it from your side. The rest of the form (verification, approvals, and branch seal) is for the bank staff to handle.

What documents will you need?

After filling the form, you have to attach a few documents –

- Self-attested copy of your Aadhaar card

- Your passbook scanned front page copy (if not have, not mandatory)

- Self-attested copy of your PAN card (if asked)

- Passport (mandatory if you’re an NRI)

- Voter ID (optional, but good to have)

- On the back of each photocopy, sign once.

- Return your unused cheque leaves and debit card. (optional, you can ignore that)

How Long Does It Take closed permanently?

- Once you submit the closure request, it usually takes only 48 hours; sometimes, it can extend to 7 working days for YES Bank to close the account permanently with NOC.

- The money left in your account is transferred to the new account you provided, normally within 48 hours.

- Once it officially closes, you will get an SMS on your phone.

The acknowledgement slip you get from the branch, it works as proof with the SR number; you can use this if you want to check the status later by calling the Yes Bank support team.

Rules You Must Follow Before Closing

Closing an account is not just signing a form and submitting it – you have to maintain a month of payments that are linked to your account sometimes, such as –

- Clear Any Negative Balance – If your account has gone into a minus because of AMB charges or penalties, clear it first. The bank won’t close the account until the balance is settled. Most of the real reason in 2026, people are asking for a zero-balance account. If you are eligible, you can request to switch your account to a zero balance at Yes Bank; no need to close it. Ask about the PMJDY accounts and guidelines at the branch.

- Delink Other Services – Ask the bank to delink lockers, fixed deposits, demat accounts, or POS machines (for businesses) connected with your account.

- Shift Your Salary or Pension Credit – If this is your salary account, inform your HR team or employer about your new account details before closing. For pension accounts, notify the pension disbursing authority.

- Settle Linked Loans or Overdrafts – if you have an active loan EMI, you can transfer it to another account before you submit the closure request. Otherwise, the bank won’t allow closure.

Special Add-on FAQs

What is the notice period for YES Bank?

Usually, the notice period for customers purchasing to close their YES BANK accounts remains 30 days, while the bank may also terminate accounts, with or without notice, for improper conduct or in abnormal circumstances.

What happens if my YES Bank account has an active auto-debit?

In case you close the YES Bank account with active auto-debit instructions, payments may be refused, and you could be penalised by YES Bank and the merchant or service provider. To be safe, cancel all auto-debits manually before closing the account.

When is the ₹500 YES Bank account closure charge applied?

The ₹500 charge applies only if you close the account between 30 days and one year of opening. Within 30 days or after one year, there’s no fee.

Why does YES Bank ask for branch manager signature on closure form?

If your account falls between 30 days and one year old, manager approval is mandatory. Without this signature, branches usually reject the closure request immediately.

Can YES Bank reject my closure request even after submitting the form?

Yes. Requests are rejected if balance is negative, documents are incomplete, auto-debits remain active, or required manager approval is missing for charge-applicable accounts.

How long does YES Bank take to close an account permanently?

Usually 48 hours, but some branches take up to 7 working days. You’ll receive SMS confirmation once closure is completed and remaining balance is transferred.

Is returning debit card and cheque book compulsory at YES Bank?

Not always compulsory, but recommended. Some branches insist on surrender to avoid misuse. If unavailable, staff usually mark it as “lost” during processing.

Is closing a YES Bank account better than converting it to zero-balance?

Not always. If eligible, converting to a zero-balance account avoids closure hassle and future penalties. Branch staff often suggest this instead of permanent closure.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.