YES Bank’s retail FD rates currently active in 2026 were revised on 1 December 2025 and have continued into 2026 without further changes.

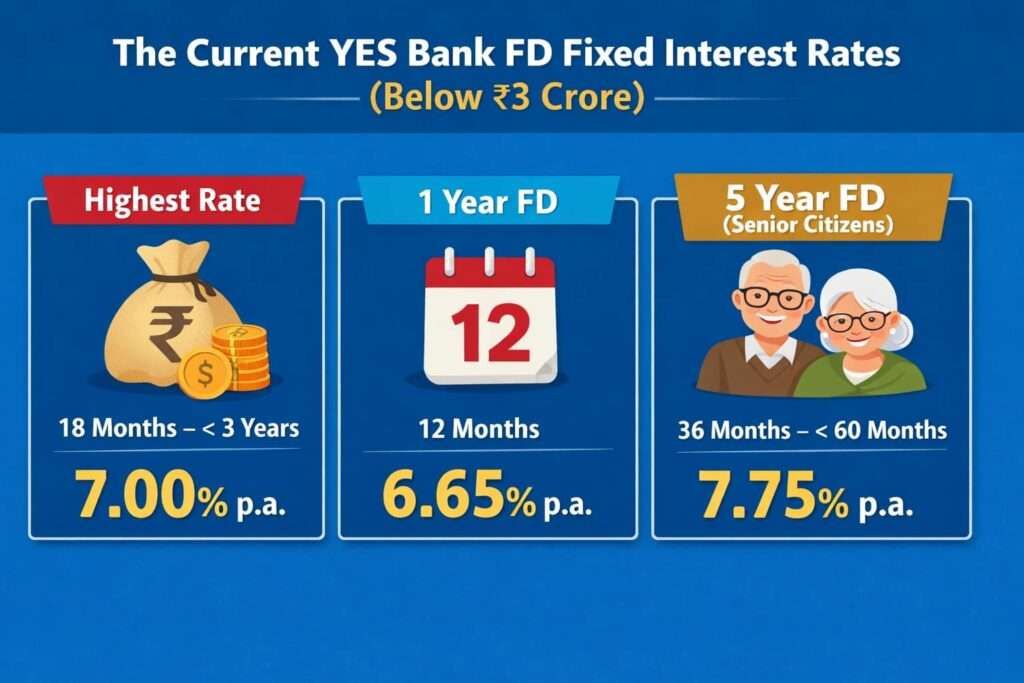

In 2026, YES Bank is giving FD interest from 3.25% to 7.00% per year for normal people. For senior citizens, the rate is a little higher, starting from 3.75% and going up to 7.75% per year.

These FD rates are for 7 days to a 10-year time period. The deposit amount should be below ₹3 crore.

- If you are a normal customer, the highest FD rate is 7.00% per year.

- This rate you will get if you keep money for 18 months 1 day to less than 3 years.

For senior citizens, the best rate is 7.75% per year. This is for the FD time period of 3 years to less than 5 years.

In simple words, longer Fixed Deposit = better interest, and senior citizens get an extra benefit.

The Current YES Bank FD Fixed Interest Rates (Below ₹3 Crore)

This is work for both – Individual & Non- Individual.

| Tenure | General Public | Senior Citizen |

|---|---|---|

| 7 – 14 days | 3.25% | 3.75% |

| 15 – 45 days | 3.50% | 4.00% |

| 46 – 90 days | 4.50% | 5.00% |

| 91 – 120 days | 4.75% | 5.25% |

| 121 – 180 days | 4.75% | 5.25% |

| 181 – 271 days | 6.00% | 6.50% |

| 272 – 335 days | 6.25% | 6.75% |

| 336 days – < 12 months | 6.50% | 7.00% |

| 12 months | 6.65% | 7.15% |

| 12 months 1 day – < 18 months | 6.75% | 7.25% |

| 18 months – < 24 months | 7.00% (Highest) | 7.50% |

| 24 months – < 36 months | 7.00% | 7.50% |

| 36 months – < 60 months | 7.00% | 7.75% (Highest For senior) |

| 60 months & above | 6.75% | 7.50% |

Important note:

- These interest rates apply to all other FD types of YES Bank below 3 crores. But this does not apply to Floating Rate Fixed Deposit. This is not a floating rate.

- The annualised return looks higher because YES Bank adds interest every three months. This is called quarterly compounding.

YES Bank showed good deposit growth in 2025.

By the end of September 2025, as per the Mint report, total deposits of YES Bank reached around ₹2.96 lakh crore.

This means deposits grew by about 6.9% compared to last year.

- Later, by the end of December 2025, total deposits were around ₹2.92 lakh crore.

- At this time, deposits were also higher by around 5.5% year-on-year.

People are still keeping money in YES Bank, and the deposit base is stable and growing.

Quick FD Fact About YES Bank (Repo-Rates)

On 1 January 2026, the RBI repo rate stands at 5.25%. This repo rate does not directly impact YES Bank’s normal FD rates.

YES Bank offers five different FD products, but only one FD type is linked to the RBI repo rate. The remaining FD options work on fixed interest logic, meaning the RBI repo rate does not change your return once the FD is booked.

Many people assume every FD rate moves with the repo rate. In YES Bank’s case, this is not true.

Different Types of FD Options Offered by YES Bank

In 2026, YES Bank is offering five different FD options. These FD options are available for Indian residents as well as NRI customers. The Bank has normal FD, tax saver FD, floating rate FD, and also special FD schemes for senior citizens. So customers can choose FD as per their needs and comfort.

1. Normal Fixed Deposit (Retail FD – Below ₹3 Crore)

This is the normal Fixed Deposit of YES Bank, and most people choose this option. Once you book this FD, the interest rate is fixed. Even if the RBI changes the repo rate later, your FD rate will not change till maturity.

This FD is for a deposit amount below ₹3 crore. It is good for people who want safe money and a fixed return, without any risk or tension.

Top Benefits

- Multiple deposit options available – YES Bank gives different choices as per your money needs, like:

- Fixed Deposit (FD)

- Flexigain Deposit

- Recurring Deposit (RD)

- Tax Saver FD (separate FD option)

- We can say this is a more flexible option for you. You can access using the mobile app or NetBanking, or you can visit your branch.

- 2-in-1 Savings + FD benefit (Sweep Facility) – Extra money in your savings account is automatically moved to FD. This way, you earn higher interest and still get easy withdrawal.

- Overdraft/loan up to 90% of FD amount – You can take a loan or overdraft up to 90% of your FD value, subject to bank rules and account linking.

- YES Rewardz on online FD booking – You can earn 250 or more YES Rewardz points when you book an FD through:

- YES Online (Net Banking)

- IRIS Mobile App

- YES Robot

- WhatsApp Banking

Key Features

- You can start FD with a minimum ₹10,000

- The maximum FD amount should be below ₹3 crore

- FD time period starts from 7 days and goes up to 10 years

- Interest can be taken monthly, quarterly, or at maturity, as per your need

- The reinvestment option is also there, where interest is added every 3 months

- This quarterly compounding helps money grow a little faster

- Nomination facility is available for family safety

- Auto-renewal option is also there if you don’t wantthe FD to break after maturity

Senior Citizen Benefit

- YES Respect Fixed Deposit – Additional 0.50% for tenure below 3 years

- YES Respect Plus Fixed Deposit – You will get Additional 0.75% for tenure of 3 years and above

- Benefit is only for resident senior citizens

- No premature withdrawal penalty for senior citizen FDs booked after 16 May 2022

2. Yes Bank Floating Rate Fixed Deposit (Repo-Linked FD)

This FD option works on a floating interest rate mechanism, unlike normal FDs. The interest rate is linked to the RBI repo rate and changes automatically.

Interest rate is calculated using the formula: FD Interest Rate = RBI Repo Rate + Fixed Mark-up

- RBI Repo Rate (effective 5 December 2025): 5.25%

- Markup is fixed at the time of booking

- Interest rate resets monthly

If the RBI increases or decreases the repo rate, the FD interest rate moves accordingly.

Repo-Linked FD Interest Rates (2026)

Individuals & Non-Individuals (₹10,000 to < ₹5 Cr)

| Tenure | Repo Rate | Mark-up | Effective Rate |

|---|---|---|---|

| 1 year – < 18 months | 5.25% | 1.10% | 6.35% |

| 18 months – < 3 years | 5.25% | 1.60% | 6.85% |

Senior Citizens

| Deposit Amount | Tenure | Effective Rate |

|---|---|---|

| Below ₹3 Cr | 1 year – < 18 months | 6.85% |

| Below ₹3 Cr | 18 months – < 3 years | 7.35% |

| ₹3 Cr – < ₹5 Cr | 1 year – < 18 months | 6.80% |

| ₹3 Cr – < ₹5 Cr | 18 months – < 3 years | 7.10% |

Important Points

- Only the reinvestment option is available

- Tenure limited to 1 year or less than 3 years

- Suitable for investors expecting future rate hikes

- The interest rate may also decrease if the repo rate falls

3. Tax Saver Fixed Deposit (5-Year FD)

Tax Saver Fixed Deposit is a good option if you want to save tax under Section 80C.

This FD comes with a fixed 5-year lock-in, so it is meant for people who can keep money untouched for the long term.

- Minimum amount to invest is ₹10,000

- You can invest up to ₹1.5 lakh in one financial year

- The FD has a mandatory lock-in of 5 years

- The interest rate is fixed from the day of booking (check the interest rates chart above)

- Premature withdrawal is not allowed under any condition

Tax points you should know:

- The invested amount is eligible for 80C tax deduction

- Interest earned is fully taxable as per your slab

- TDS will apply as per the income tax rules

This FD is suitable only if you are comfortable locking money for the full 5 years and want tax savings with safety.

Real example for you –

- For example, Ramesh invests ₹1,50,000 in the YES Bank Tax Saver FD for 5 years.

- Let us assume the interest rate is 7% per year.

- After 5 years, his FD value becomes around ₹2,10,000. So he earns about ₹60,000 as interest.

- Also, in the year of investment, Ramesh saves tax on ₹1.5 lakh under Section 80C. But interest earned is taxable as per his slab.

- So Ramesh gets tax savings + safe return, without market risk.

4. YES InstaFD (Digital FD for New Customers)

YES InstaFD is a fully digital Fixed Deposit made for people who are opening an FD with YES Bank for the first time.

You can book this FD online in just a few minutes, without visiting any branch or opening a savings account.

Who Can Open YES InstaFD

- Resident Indian, 18 years or above

- Should not be an existing YES Bank customer

- PAN and Aadhaar must be linked

- Mobile number should be Aadhaar-linked

- Must have a UPI-enabled bank account

Investment Details

- Minimum investment starts from ₹10,000

- Maximum investment allowed is ₹90,000

- FD tenure ranges from 7 days to 11 months, 27 days

Key Features

- No YES Bank savings account required

- FD can be booked through the IRIS mobile app only

- Payment is done via UPI apps like GPay, PhonePe, etc.

- The interest rate is fixed from the start

- Senior citizens get an extra 0.50% interest

- Maturity amount is credited to your source bank account

- Loan or overdraft available up to 90% of the FD value

5. Bulk Fixed Deposit (₹3 Crore to < ₹5 Crore)

Bulk FDs apply when the deposit amount is ₹3 crore or more. These FDs have a separate interest rate structure.

Key Characteristics

- Applicable for deposits from ₹3 Cr to < ₹5 Cr

- Fixed interest rate

- Not linked to RBI repo rate

- Higher rates for No-Premature Withdrawal FDs

Highest Applicable Rates (2026)

- Senior citizen (3–5 years, no-premature): up to 7.85%

- Non-senior citizen (same tenure): up to 7.10%

Rates vary based on:

- Deposit slab

- Senior vs non-senior

- Premature allowed vs not allowed

YES Bank Bulk FD Rates (₹3 Cr to < ₹5 Cr) – January 2026

| FD Tenure | General Public | Senior Citizen |

|---|---|---|

| 7 – 14 days | 3.25% | 3.75% |

| 15 – 45 days | 3.50% | 4.00% |

| 46 – 90 days | 4.50% | 5.00% |

| 91 – 180 days | 4.75% – 4.85% | 5.25% – 5.35% |

| 181 – 271 days | 6.00% – 6.10% | 6.50% – 6.60% |

| 272 – 335 days | 6.25% – 6.35% | 6.75% – 6.85% |

| Less than 1 year | 6.50% – 6.60% | 7.00% – 7.10% |

| 1 year | 6.65% – 6.75% | 7.15% – 7.25% |

| 18 months – <2 years | 7.00% – 7.10% | 7.50% – 7.60% |

| 2 – <3 years | 7.00% – 7.10% | 7.50% – 7.60% |

| 3 – <5 years | 7.00% – 7.10% | 7.75% – 7.85% |

| 5 years & above | 6.75% – 6.85% | 7.50% – 7.60% |

Note for You – Like Normal FD, this FD also gives an extra benefit to senior citizens. They get an additional 0.50% interest for tenure below 3 years and 0.75% extra for 3 years and above.

Premature Withdrawal Rules (Below ₹5 Crore)

| FD Held Period | Penalty |

|---|---|

| Up to 181 days | Up to 0.75% |

| Above 181 days | Up to 1.00% |

- Penalty applies to partial withdrawals

- Sweep-in withdrawals attract a penalty

- Senior citizens (post-May 2022 bookings) are exempt

How to Book YES Bank FD

1. Net Banking or Mobile App

- Log in to YES Net Banking or open the IRIS app on your phone

- Look forthe FD or Invest option, it’s easy to find

- Select the FD type, put the amount and the time period

- Choose how you want interest (monthly or maturity)

- Recheck once and confirm, FD is booked

2. Yes Bank WhatsApp Banking

- Save YES Bank WhatsApp number in contacts (+91-82912-01200)

- Open WhatsApp and send a simple Hi

- Type Fixed Deposit when the system replies

- Follow the steps shown on screen

- Finish booking without any app or login

3. AI Chatbot (YES Robot)

- Open YES Bank website or app and start chat

- Type Book FD, robot will guide you

- Enter FD amount and tenure step by step

- Confirm details at the end

- FD gets booked in few minutes

4. Bank Branch Visit

- Go to the nearest YES Bank branch when free

- Tell the counter staff you want to open the FD

- Fill form with the amount, tenure, and nominee

- Submit PAN, Aadhaar, and payment details

- Take the FD receipt and keep it safe

FAQs

Does YES Bank have a 444-day Fixed Deposit scheme?

No, YES Bank does not offer a 444-day FD scheme as of 2026. You can choose nearby tenures like 12–18 months, where interest rates are already competitive.

What are YES Bank FD rates for senior citizens in 2025–26?

Senior citizens get 0.50% to 0.75% extra interest. In 2025–26, YES Bank offers up to 7.75% p.a. on long-term retail FDs below ₹3 crore.

Which bank is giving 8% interest on Fixed Deposit right now?

Some small finance banks offer FD rates close to 8%. Big private banks like YES Bank usually offer slightly lower rates but provide better stability and services.

Is it safe to invest in a Fixed Deposit in YES Bank?

YES Bank FDs are regulated by the RBI and insured up to ₹5 lakh. For normal savings, it is considered safe, especially when money is spread across banks.

Which is better for FD: HDFC Bank or YES Bank?

HDFC Bank is known for safety, while YES Bank gives higher FD interest. If returns matter more, YES Bank is better; for long-term safety, HDFC works.

How to use YES Bank Fixed Deposit calculator properly?

Enter FD amount, tenure, and payout type. Always check maturity value twice. Quarterly compounding increases final returns, so maturity amount is higher than simple interest.

Can I open a Fixed Deposit in YES Bank for my child?

Yes, parents or guardians can open an FD for a child. Interest rates are same as regular FDs, and money is safely locked till maturity.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.