Why Axis Credit Card Digital Statements Are More Than Just Paperless Bills

As per the report of the Card Insider Infographics and the Reserve Bank of India February 2024 report, Axis Bank is one of India’s Top 10 Credit card issuers with a 13.82% credit card market share alone. To manage the security for crores of customers, they offer a digital statement with a Password.

For document submission, if you prefer a physical copy of your statement, yes! Axis Bank does provide that, but with a duplicate statement fee of ₹50–₹100 beyond a certain limit.

Quote for you:

Go digital and save trees. Opt for e-statements to reduce paper waste and contribute to a greener planet.

RBI Kehta Hai (rbi.org.in)

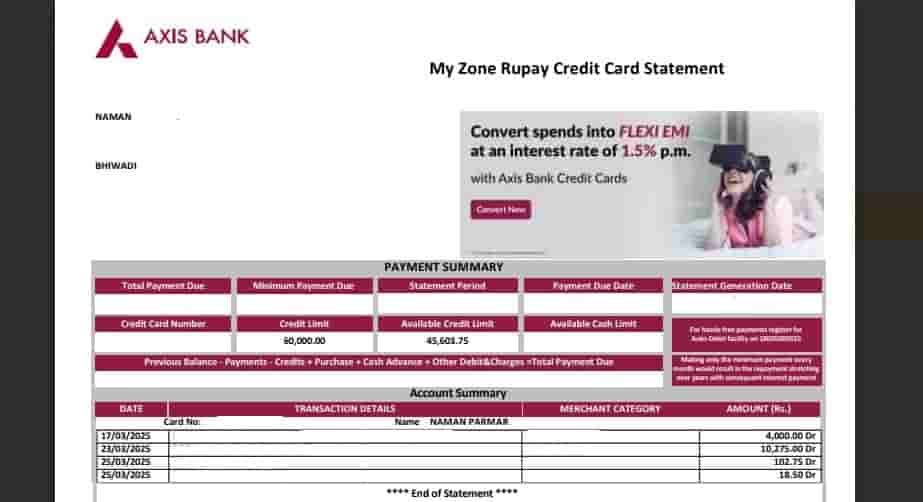

What You Need Before Viewing Axis Bank Credit Card Statement

Registered Email & Updated Mobile Number

Ensure your email ID is registered with the bank for receiving statements. Also, keep your mobile number updated for MPIN/OTP login.

Axis Bank Credit Card Holder Name

You’ll need the name (as printed on the card) to decode the password format for the PDF.

Date of Birth or Last 4 Digits of Card

Used in password generation to open the e-Statement PDF securely.

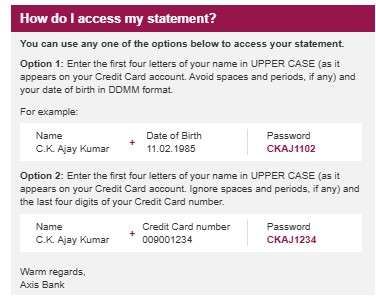

How to Unlock Axis Credit Card Statement PDF

- Get Your Email: Look for a PDF attachment from Axis Bank in your inbox. Search “Card name + statement + pdf + month”. In case you can’t find it, check the spam/junk folder of your email app.

- Open the PDF: Save the PDF to your device and open it using a PDF reader. Axis Bank suggests the latest version of Adobe Acrobat Reader for better safety and convenience.

- Enter the Password:

According to the Axis Bank Aha AI Chatbot, the bank sets the password format as the First four letters of your name in UPPERCASE (as printed on your credit card) followed by your Date of birth in Date + month in DDMM simple format.

Let me give a clear example: Suppose your Name is AMAN KUMAR, and your Date of Birth in DDMMYYYY is 15082000, then your password will be AMAN1508.

Alternatively, you can choose another password format:

- First 4 letters of your name in UPPERCASE + Last 4 digits of your credit card

Example: Name: AKASH SINGH, Card: xxxx xxxx xxxx 1234 → Password: AKAS1234

Tips:

- Use UPPERCASE letters for the name in both password formats

- Remember, please do not include any dots, spaces, or symbols

What if not receive Statements on your Email ID?

If you’re not receiving your credit card statement in your inbox, follow the steps to activate e-statement and join RBI’s digital mission.

- As always, First, download or update the Axis Mobile Banking App.

- Log in using your credit card number and Mobile OTP to set a 6-digit MPIN for login.

- Tap on the Credit Cards icon to access services

- Tap on the menu bar (top-left corner)

- Select Services & Support > E-Statement Activation

- Tap on Email ID, then tap Activate

- Enter your 6-digit MPIN

- Done! You will get a message: “The e-statement facility has been activated for your credit card number XXX43.”

What to Do If the Axis PDF Statement Won’t Open

- Download failed: Please make a storage space in your email app and device space of at least 500 mb and download using a good internet connection.

- Wrong password error: As I already said, double-check the format, name spelling, DOB, or card number. Keep your credit card while entering the name and number.

- PDF won’t open: Go to the app store and update your PDF reader or use an alternative one like Foxit Reader.

- Missing email: Ensure your registered email is up-to-date with Axis Bank.

- Old device issues: Try opening it on a desktop or an updated mobile device.

Sometimes, the issue can be a technical or Server issue, not the bank’s, and your fault; however, you can contact the Axis Bank helpline team available 24/7.

- Call: 1-860-419-5555 or 1-860-500-5555 (Toll-free*)

- Visit: axisbank.com/support

They are available to assist with unlocking issues, email problems, and activation support.

Users’ FAQs

How do I open an Axis credit card statement without a password?

Currently, there is no option to bypass the password. Use the provided format only. However, you can try Axis Bank internet banking to access statements without a password.

How do I download an e-statement using the Axis Bank App?

Yes! Log in to the 6-digit mpin in the axis mobile banking app, go to credit cards, tap on get statement, select month, tap on download, you will get a password-protected pdf in your downloads folder.

Can I get older Axis Bank credit card statements?

Yes, you can request up to 3 years of past statements via the Axis app or net banking.

Can I receive both an e-statement and a paper statement?

Yes, but paper statements may incur extra charges beyond the free limits. Read the Charges above.

Can card reissuance or upgrade affect my statement password?

Yes, sometimes. After upgrades, the name embossing may change slightly. New statements follow updated card details, while customers often keep using the old name format unknowingly.

Does Axis stop statements if I don’t use the card in a month?

No. Even with zero spending, Axis sends a monthly statement. Branch teams clarify this often confuses customers who think inactive cards won’t generate statements.

Is an Axis credit card e-statement accepted for reimbursements and audits?

Yes. It’s a system-generated document accepted by employers and auditors. Card desks advise saving at least 12 months, as disputes or claims often refer to older billing cycles.

Why do some users get statements late despite bills being generated?

Billing and email dispatch run on separate systems. During holidays or maintenance, statement emails may arrive 1–2 days late, but due dates and penalties remain unchanged.

Should I trust the DOB format or the last-4-digits format first?

Branch card desks suggest trying the DOB format first. If it fails twice, immediately switch to the last four card digits to avoid lockout frustration or repeated wrong-password attempts.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.