Online Option to Close Bank of Baroda (BoB) Account?

Here we go again with another PSU bank; we already covered Union Bank and SBI. RBI guidelines + physical verification still rule the system. So forget the dream of opening BOB World mobile banking app = going to my profile = tapping a magical “Close Account” button. Because there is no such button. (We checked. Twice.)

Bank of Baroda doesn’t allow online account closure for Savings or Current accounts; however, these PSU banks are running towards more AI and Digital, such as BOB ASK ADI chatbot.

As per their BOB chatbot text, you must visit your home branch to make a closure request. But what if you have to change your city, such as – your home branch is in Ahmedabad, but you now live in Bengaluru?

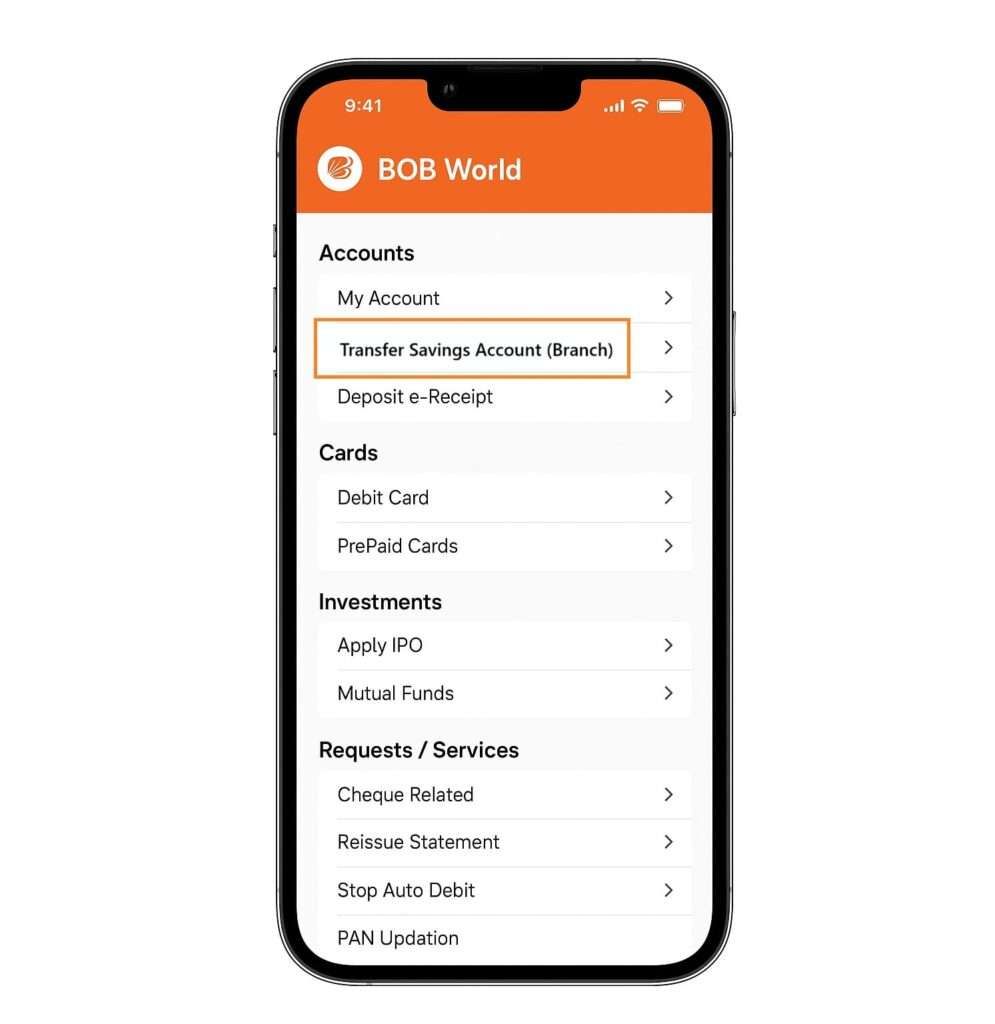

Thankfully, BoB gives you at least one digital favour. After 2024, you can now transfer your home branch online using the BOB world app.

How to Transfer Your Home Branch Online via BOB World App

This must be done before account closure if your home branch is far away.

Steps:

- Open the BOB World app

- Tap More

- Go to Service Requests

- Scroll to Miscellaneous

- Select Transfer Savings Account

- Choose your new branch address

- Verify and approve using 4-digit TPIN

You will receive a Reference Number, and it works only for 30 days. (take a screenshot or save the number)

Next step, just visit your new branch physically that you selected, also take your:

- Aadhaar/PAN (any KYC proof) Original or Photocopy

- Your existing passbook

- The reference number shown in the app

The branch will issue a new passbook with the new IFSC code. Now your account officially belongs to the new branch.

And only now, you can start the closure process with your nearest branch.

What Documents Will You Need for BoB Account Closure

This is an important part, you have to pick a few documents, take a paper and pen, write an application and take a photocopy of your Address proof and Identity proof. Below, we clear a few required item tables, which really helps you –

| Required Item | Why It’s Needed |

|---|---|

| Closure request letter (handwritten) | Mandatory — this is your formal request |

| Passbook | Must be surrendered |

| Debit/ATM Card | You can return (you can also destroy it) a formal practice |

| Cheque Book or Unused leaves | Returned (only if older than 3 months) |

| ID Proof (Aadhaar/PAN) | Verification if needed |

| Zero pending transactions | No cheque under clearing |

| All joint holders present/sign their signatures or thumbprints | must be required to confirm the closure and declare (all account types) |

If you miss anything here = closure may be delayed.

What Are the Charges for Closing a Bank of Baroda Account?

Charges have conditions, the major condition is only when you close it, and what your account type is, such as PMJDY Accounts, BSBDA accounts, students, minor, and senior citizens accounts usually have lower charges or NIL. Below, we give when charges apply and how it works with an example –

| Scenario | Charges | Example |

|---|---|---|

| Closure within 14 days of first deposit | ₹0 | Opened a new account = decided not to use |

| If you are closing after 14 days but within 1 year | There an charges- ₹300 + GST for metro cities and ₹275 + GST for others. | First deposit on 1 March 2025 → closed within Feb 2026, just wait 1 month more for NIL charges. |

| Closure after 1 year | ₹0 in most cases | 2+ years old account → no closure fee |

| Deactivating the account due to the death of the holder | ₹0 | Nominee closes the account after settlement |

| Current Accounts closure (within the first year) | Higher charges around Rs. 800 + GST – the branch will confirm | Because current accounts come with business benefits |

Your Charges are deducted directly from the account balance. So always keep a minimum balance until closed. If you are closing within 12 months, then you have to keep the charges on account; if more than 12, then settle it with Zero. Remember, in the BOB account closure form (if the branch provides), you still have to provide another bank account number, even if your account balance is zero.

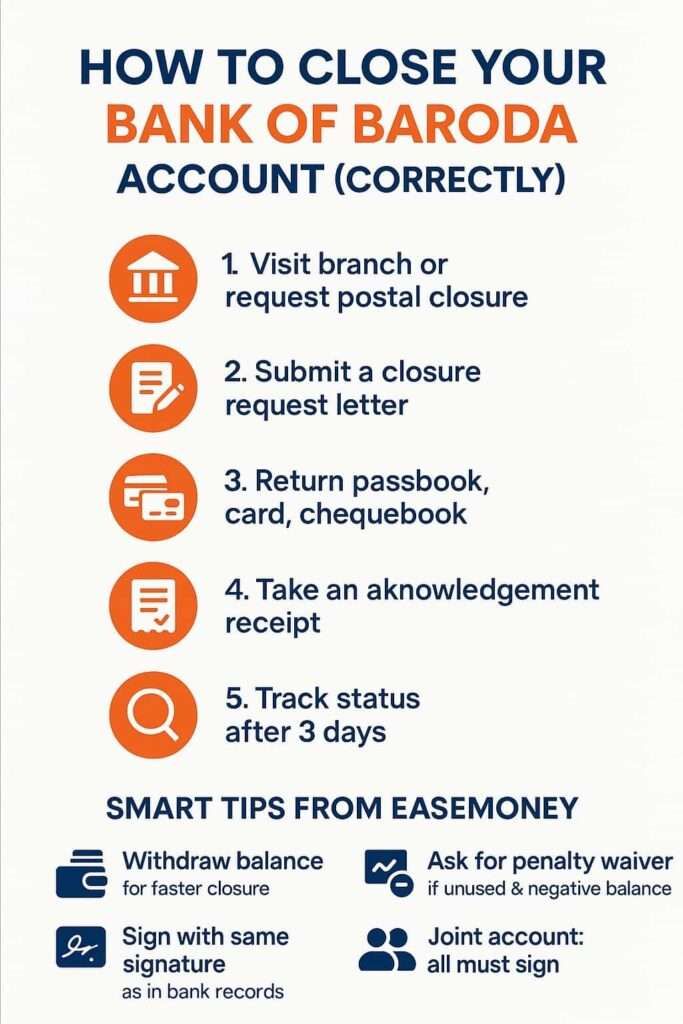

How to Close a Bank of Baroda Account Correctly

As I already told you, you have to visit the home branch, if far, change it via the BOB mobile app, or you can choose post mail, but confirm with your branch. In most cases, BOB allow that also. Now, the next steps are –

- Carry Passbook + ATM card + Chequebook = If your chequebook or any document is lost, you have to write “chequebook lost, unused leaves blocked” in your letter

- Write a closure request letter = This is your legal request for closure. You have to maintain neat writing, the same signature as in the bank records. You can check below the format, which you can use and write the same.

- Choose a balance settlement method = if your account has a balance, you have to mention the transfer of my balance to my another account number with IFSC.

- Submit documents & sign in front of staff = Simply attach your photocopy of address and ID proof, put a sign on all of the photocopies, and the application as well.

- Ask for an acknowledgement receipt – This is your Proof that your closure is in process. You can take a photo of the stamped letter as a backup.

- Track closure status – You can confirm with BOB customer care or your same branch. Also, check SMS/Email or try the mini statement after 3 days.

Smart Tips from Easemoney (Before closure)

- Withdraw remaining balance before closure = Faster closure + no confusion about fees

- Cancel UPI apps linked to the BoB account = Prevent failed payments later

- If negative balance = politely ask for a waiver, especially if the account was unused or the charges are too high

- Joint Account = All holders must be present or sign in advance

- If the cheque was recently issued = Wait 2–3 days for clearing, or it may delay closure

Is there any official BOB closure printed application form?

As per our research, we found that the BOB CDSL closure form floating on the internet is for demat accounts, not savings/current accounts. There is no official downloadable BoB account closure form for resident Indians.

However, what we found:

- BoB abroad (UK/UAE) does have a printed form, so it will not work for indian branches.

- BoB also offer a Service Request Form in India, but it does not include a closure section for savings or current accounts.

So, you can confirm with your home branch; banks usually provide a printed version form. The handwritten application is still an option for you.

Download And Write a Closure Application for the Bank of Baroda

You can take A4 paper and use a normal blue or black pen, and use your passbook to write information. Here, you can download the Sample of the handwritten application, both in English and Hindi versions.

| Item | Download Link |

|---|---|

| BOB Handwritten Application Sample (AI-generated) | Original PDF version |

Just make sure your letter includes these points:

- Your full name (same as passbook or cheque)

- Account number you want to close

- Branch name and location

- Registered mobile number

- A simple request like: “Please close my savings/current account.”

- Mention you are submitting: Passbook, debit card and unused cheque leaves

- How do you want the remaining money:

- Cash (if a small amount)

- Transfer to your other bank account (write account number + IFSC)

- Or get a cheque/DD in your name

- A short reason for closure (like “Not using account”)

- Your signature (and all holders if a joint account)

- Date and place

Note: BOB accept payment modes – Cash/DD/Cheque/RTGS/NEFT), Balance must go to your own account, not someone else’s.

How Long Does it Take to Close a BoB Account?

| Situation | Approx Time |

|---|---|

| Everything correct, zero issues | 24 hours (working days only) |

| Average case | 3–5 business days |

| Joint holders unavailable | Delay |

| Cheque under clearing | Closure only after settlement |

| Identity/KYC mismatch | Delay till resolved |

| Negative balance | Closure blocked |

So yes → quick closure is possible, but not guaranteed every time.

What About Negative Balance?

Some customers find:

- They stopped using the account

- Minimum balance charges kept applying

- The debit card renewal fee is also deducted

- Account became negative

Now, branch officers will tell you –

“First clear the negative balance. Then we will close the account.”

Why does this happen?

| Charge Type | Hint |

|---|---|

| Minimum Balance Penalty | ₹2,000–₹3,000 average monthly requirement not met |

| Debit Card Annual Fee | Auto-deducted even in inactive accounts |

Solutions (Real & Practical)

| What You Can Do | Result |

|---|---|

| Request waiver citing non-usage + financial hardship | The manager may reduce or remove dues |

| Convert into a BSBDA zero-balance account first | Charges vanish once converted |

| Provide a written request to settle & close at a minimum fee | Faster approval |

| If charges look wrong → escalate to the Regional Office or RBI CMS | Many waivers happen after a complaint |

Tip for You: Don’t leave the account inactive, if negative balance or trigger dormant → bigger headache later.

Special Account Types — Extra Rules to Know

| Account Type | Extra Requirement |

|---|---|

| Joint Account | All holders must sign |

| Minor Account | Guardian signature / KYC of major |

| NRI Accounts | Passport + Visa + Overseas proof |

| Business/Corporate | Board Resolution / Seal |

| HUF Account | Karta declaration |

| Deceased Holder | Nominee claim documents |

| Dormant/Frozen | Reactivation/KYC first |

Questions

Do I need my old passbook if it is lost or damaged?

Tell your base branch. They will block the items and take a loss declaration with ID proof. Closure still continues without extra problem.

Can BoB refuse to close my account? What if they delay it?

If dues or pending cheques exist, they can pause. Otherwise, take stamped acknowledgment and escalate to the branch manager or regional team.

How long does it take to receive the remaining balance after closure?

If cash or internal transfer, same day. For external NEFT/RTGS or cheque, it may take 1–3 working days, depending on processing time. if bank choose provide refund via DD or cheque, it may takes 12 to 15 working days.

What happens to linked UPI or auto-debits after I close the account?

They stop immediately. Remove UPI from apps, cancel mandates earlier to avoid failed payments, penalties, or confusion after closure.

If I have a joint account, can only one holder visit for closure?

No. All account holders must sign the closure request. If someone is unavailable, collect signed authorization and ID proofs beforehand.

Can I convert my BoB account into a zero-balance account before closing it?

Yes. Request conversion to a BSBDA account but here eligibility applies so confirm with the branch first, settle negative charges, then close. This helps remove minimum balance penalties and makes closure easier.

Does Bank of Baroda send any final confirmation after account closure?

Yes. Bank of Baroda sends an SMS to your registered mobile once the backend closure is completed. If you don’t receive it within 5–7 working days, revisit the branch with the acknowledgement.

Is returning the passbook compulsory for Bank of Baroda account closure?

Mostly yes. BoB prefers collecting the passbook to mark the final closure. If it’s lost, you must sign a loss declaration; closure still proceeds without penalty in most branches.

Will my BoB-linked UPI apps stop immediately after closure?

Yes. Once the account is closed, all UPI IDs linked to it stop working instantly. It’s still smart to remove the account manually from apps to avoid failed-payment confusion.

How can I verify that my Bank of Baroda account is permanently closed, not dormant?

A closed account stops showing balance inquiries and transaction SMS alerts. Dormant accounts still exist internally. You can confirm final closure by requesting written confirmation from the branch.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.