What BOM and RBI say About Customers’ KYC or Re-KYC?

Every customer, including you of the Bank of Maharashtra (BoM), must complete KYC and then Re-KYC verification as per the Reserve Bank of India’s (RBI) rules. Without proper KYC, the bank cannot allow full access to your account.

You can do that via online video-KYC from the comfort of your own home. In case your video-KYC or E-KYC fails, or you just want to be done via visiting a branch, you will need the Bank of Maharashtra KYC Form.

In most cases, the bank will ask you to visit your branch for KYC using the form only. This usually happens when there’s a mismatch in your details, Bank servers are delayed, your account is not eligible for online KYC, or there’s some internal issue that triggers physical KYC.

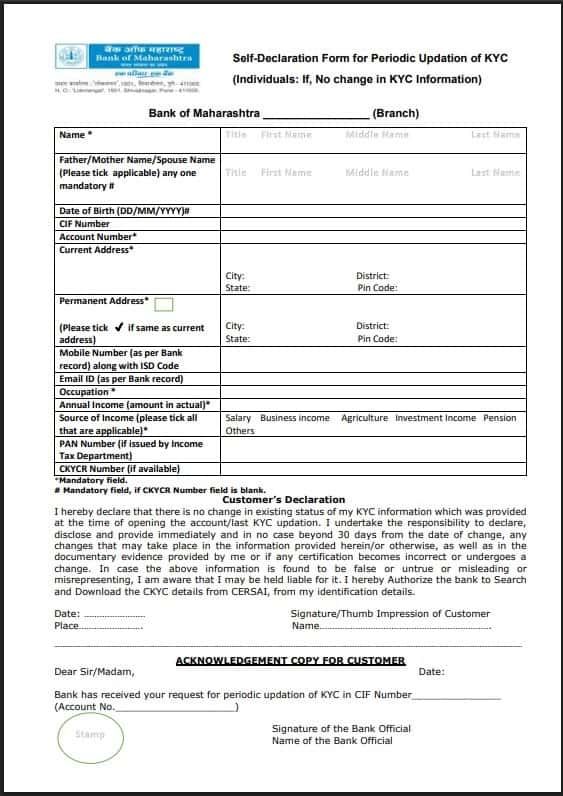

There are different KYC-related forms, but the most common one is the “Self-Declaration Form for Periodic Updation of KYC (Individuals – No Change in KYC Information)”.

This form is a standardised document used to collect and update your personal details, identity proof, and address proof for Re-KYC at BOM periodically.

How to Know It’s Time to Update Your BoM KYC

- You will usually receive an SMS, email, or notice from the bank when it’s time to update your KYC.

- It happens every 2, 8, or 10 years, depending on your bank account, RBI Risk Category eligibility.

In some cases, if the KYC process is not completed on the due date, your account may be temporarily restricted from withdrawals, UPI, ATM Card, or online transactions until the KYC is completed.

How to get the KYC forms from the BoM website

There are two main options to get the form –

- Home Branch – Visit your home branch and ask for the customer help desk officer, “Hey! I want to update my KYC The due date is coming. The branch officer will provide you with the latest KYC form; you can ask for additional forms, such as Form 60 or more.

- BOM website – You can smoothly download the KYC form PDF from the BOM Bank’s website. Here are the quick navigational steps –

- Go to the official website homepage

- Tap on the download forms button (available in the footer, menu, and Floating options)

- Go to the other forms section and use Ctrl key + F and type “KYC” to locate the correct form.

- Click on the PDF option to download the file. This file is the English version only.

- If your home branch for additional forms, you can also find them on the page.

Here are the direct links to important forms:

| Form Name | Purpose | Download Link |

|---|---|---|

| Self-Declaration Form for Periodic Updation of KYC | For individuals with no change in KYC details. | KYC Form PDF Original |

| Form No. 60 (Annexure-1) | For customers without a PAN card. | Form 60 BOM PDF |

| FATCA / CRS Declaration | For tax compliance for Indian residents and NRIs. | Download PDF |

How to fill the Self-Declaration Form correctly, step-by-step:

This form is bilingual; you can use other languages as well. However, you can ask single language form from the counter, if available.

1 Section: Basic Details (Top Header)

| Field | What to Fill |

|---|---|

| Branch | Write down the name of your home branch (such as “Pune Main Branch”). |

| Name | Your full name as per bank records, check your bank documents to find it. |

| Father/Mother/Spouse Name | Tick any one option and write the full name. (Name must be matched with aadhaar) |

| Date of Birth (DD/MM/YYYY) | Simply put your date of birth: 15/08/1998 |

| CIF Number or Customer ID | Now, mention your Customer Information File number (available on passbook or statement). |

| Account Number | Mention your bank account number. |

2 Section: Address Details

| Mandatory | Fill up |

|---|---|

| Current Address | Full address (as per bank record). You cannot change your address via this form. |

| City / District / State / Pin Code | Fill all clearly. |

| Permanent Address | If the same as current, tick (✔) in the given box. |

| Your Permanent details – Town / District / State / Pin Code | Only if different from the current address. |

3 Section: Contact Details

| Your communication | Steps |

|---|---|

| Mobile Number | Here, you have to provide your account-linked mobile number only. It must be linked with aadhaar as well |

| Email ID | Enter your email as per your bank record. if not have an email, just leave it blank. |

4 Section: Financial Information

| Your income and Career | How to fill |

|---|---|

| Occupation | You have to mention your current occupation (such as “Salaried”, “Business”, “Student”, “Retired”). If you are unemployed, simply put – seeking for job. |

| Annual Income | Write the approximate annual income after calculating all sources of your income (for example, Rs. 5,00,000). If you student, put the average below 1 lac. |

| Source of Income | Tick all applicable boxes (Salary, Business income, etc.). |

| PAN Number | Write your valid PAN. If you are a student and have no PAN, you can get Form 60 from the branch or the website. |

| CKYCR Number | If you have it, else leave blank. OR you find it at the Central KYC Records Registry website – https://www.ckycindia.in/kyc/getkyccard |

5 Step: Customer Declaration

At the end:

- Write Your Date and Place.

- Sign or put Thumb Impression – same as you do on your cheque leaf or PAN.

- Write your Full Name clearly again.

Acknowledgement Copy (for customer)

- Leave this blank — the bank official will fill and stamp it when you submit the form.

What to Attach to the KYC Form

Attach photocopies (Xerox) of the Basic documents along with the filled form:

1. Proof of Identity (any one)

- PAN Card

- Aadhaar Card

- Passport

- Voter ID Card

- Driving Licence

2. Proof of Address (any one, not older than 3 months)

- Aadhaar Card

- Electricity Bill

- Telephone Bill

- Bank account statement from another bank

- Letter from the employer or recognised public authority

3. Additional Document (if applicable)

- Form No. 60: Required if you do not have a PAN card. You will need this form for a declaration that you don’t possess a PAN or that your PAN Application is pending, and that your income is below the taxable limit, or you have included an alternative document.

4. FATCA / CRS Form

The bank branch may ask you to fill out this form for a tax residency declaration. This form also counts as a mandatory rule in RBI KYC guidelines. It is mostly for certain accounts, especially NRI or high-value accounts,

How to Submit the KYC Form by Visiting the Branch

Once your form and documents are ready, follow these steps:

- Visit home branch only – The BOM requires that KYC updation be done at your home branch, where you opened your account or recently changed your home branch. If you live different city, you can talk to customer care to request a change of branch or mailing address to the home branch for the KYC form. Other branches generally cannot process KYC forms, especially for retail accounts.

- Attach a scanned copy if submitting digitally: Some branches allow KYC submission through email. In that case, scan all pages (form + documents) clearly and send them from your registered email ID to the branch’s official email address. Confirm the email with your branch before sending.

- Submit the form: You can hand over the form and documents to the KYC desk or the concerned officer. They will verify and queue for updation.

- Processing time: Your KYC update is usually completed within 24–48 hours; sometimes it takes 6 working days. You will get an SMS or email confirmation once it’s done.

Additional Customer FAQs

Do I need to visit the BOM branch if I’ve done Video KYC?

If you have completed the BOM Scheduled Video KYC successfully and received an SMS from the bank, you don’t need to visit the branch, but if your BOM Video KYC or online KYC failed due to any reasons, such as a delayed Video Call or an OTP not working, you will need to visit the branch for updation.

What happens if I don’t update KYC even after reminders?

If you ignore repeated reminders, your account can be temporarily frozen, and you won’t be able to make UPI, ATM, or online transactions.

Why does Bank of Maharashtra mostly insist on branch-based KYC instead of online?

Because BoM has stricter manual verification. In many cases, video or e-KYC fails due to data mismatch, so branch-based KYC ensures identity accuracy and faster internal approval.

Can I change my address using the BOM Self-Declaration KYC form?

No. That form is strictly for “No Change” cases. If your address changed, the branch will reject it and ask for a different KYC updation process.

What is the most common mistake customers make in the BOM KYC form?

Writing an address different from the bank records. Even a small variation—like missing a flat number—can delay approval by 2–4 working days due to manual verification.

Is PAN compulsory for BOM KYC if my income is very low?

PAN is preferred, but Form 60 is accepted. Many students and retirees complete KYC smoothly using Form 60, as long as the income and occupation fields are filled clearly.

How strict is Bank of Maharashtra about mobile number linking during KYC?

Very strict. Your mobile must be account-linked and Aadhaar-linked. Wrong or inactive numbers often stop OTP verification, causing KYC to remain pending without a clear error.

Do senior citizens get any relaxation during BOM KYC submission?

Yes. Seniors can use thumb impression with staff verification, and branches often assist with form-filling. Morning visits usually result in a same-day document upload.

Why does BOM ask for income details even if nothing has changed?

Income helps decide your RBI risk category. Approximate figures are acceptable. Leaving income blank is a common reason forms are sent back for correction.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.