Does Bank of Baroda Issue Cheque Books Instantly at the Branch?

Bank of Baroda branches do not issue a personalised cheque book instantly. Personalised books, in simple words, come with your name and account number printed and are processed at a central facility before being dispatched to your registered address.

That’s why the branch staff usually tells you, “It will be delivered in a few days.” The printing, packing, dispatch, and speed post delivery take time — usually 3 to 7 working days in cities and 5 to 10 days in rural areas. Some branches, but not all, may provide an emergency or non-personalised cheque book at the branch counter.

This type doesn’t have your name printed and is meant for urgent work only. It’s valid mostly for your home branch or local transactions.

Charges for this emergency book are slightly higher than normal cheque leaves, and you might need to give a written request or show your passbook. Some branches still avoid this unless it’s a medical, educational, or time-sensitive reason.

How the Cheque Book Order Process Works

To order a personalised cheque book to your address, BOB offers multiple options such as –

- Through the BoB World Mobile App or Netbanking

- Using BoB’s Virtual Assistant – ADI (AI Chatbot)

- By visiting a branch and filling out the cheque book request form

- BOB Phonebanking

Once the request is placed, the bank verifies your address, prints the cheque book at their printing centre, and dispatches it via India Post or any third-party courier partner. No modification or cancellation is allowed once the request is processed.

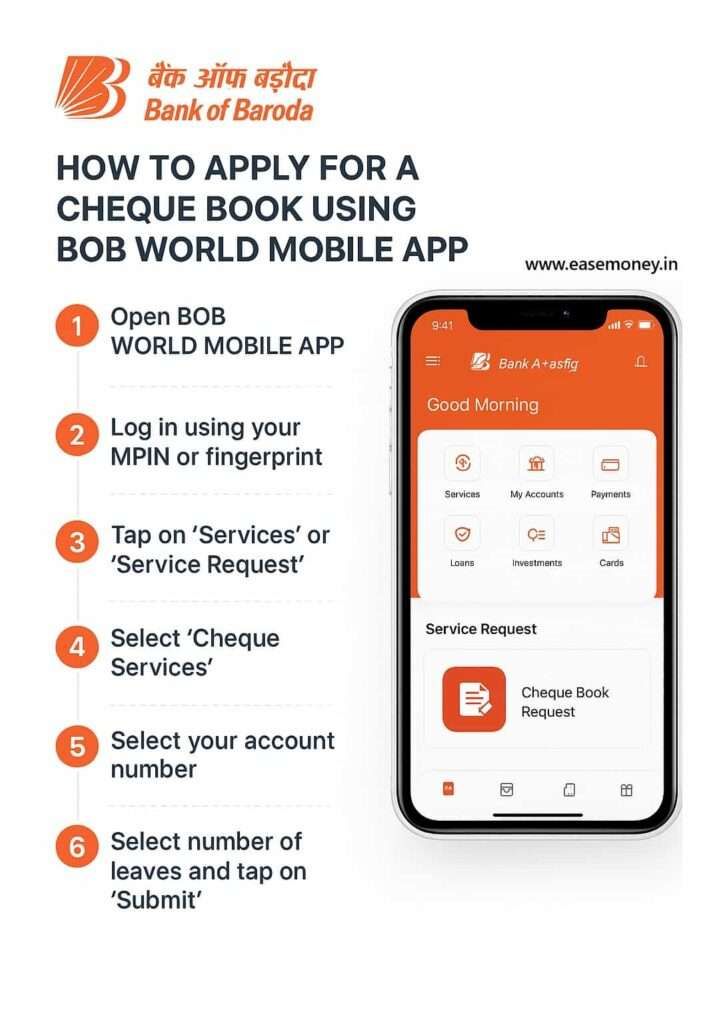

1. How to Apply for a Cheque Book Using the BoB World Mobile App

This is the easiest and fastest way if your mobile number is linked to your bank account and you have the active BOB World app on your phone. If the app is not registered, you can sign up using your customer ID and ATM card. You can use the Branch token as well to set 4 Digit MPIN and 4 Digit TPIN.

- First of all, open the BOB world app on your phone and log in using fingerprint, face ID, or your 4-digit MPIN.

- On the Home screen, tap “More”.

- Scroll to the Explore Services section and tap “Service Requests”.

- You will see a Cheque Services option – tap it.

- Choose “Cheque Book Request”.

- Select the account number for which you want the cheque book. You cannot order more than 2 at a time.

- Here, you have to choose the number of leaves you want – 15, 20, 30, or 50 (optional) – most of the time, the bank does not ask you.

- Tap on the Proceed button.

- To complete the order, you have to enter the 4-digit TPIN, which you used for money transfer; no mobile OTP or MPIN is required.

- Now, done, write down the reference number, you can use it to track in future via phone banking.

The cheque book is always sent to your registered address. You cannot change the address during the request. If the address is old or incorrect, update it first through the branch, KYC Update, or mobile banking before placing the request.

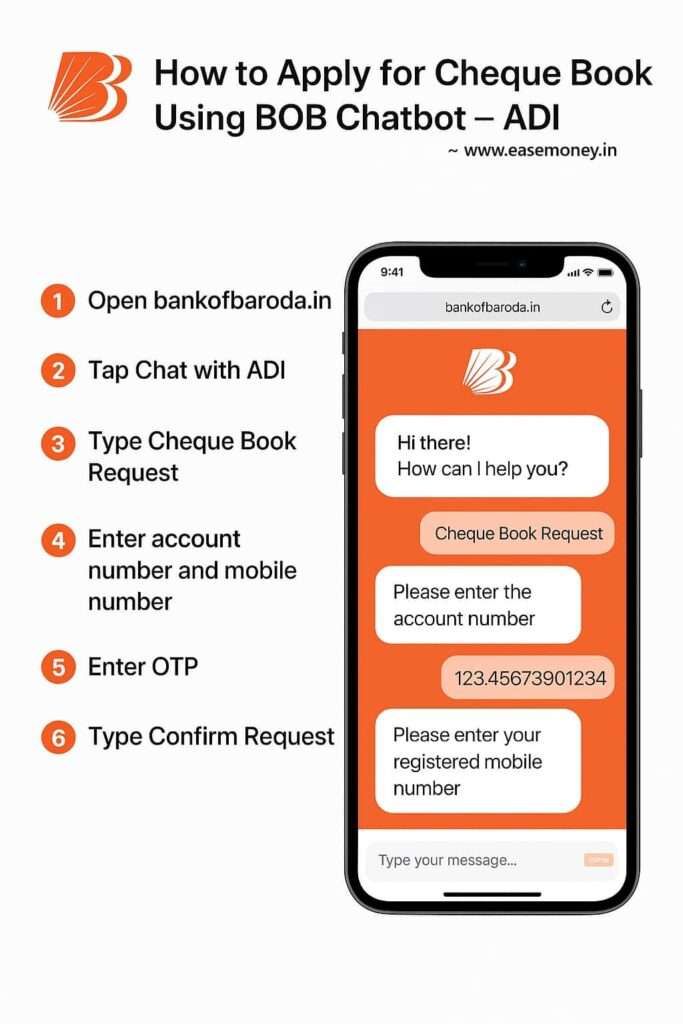

2. How to use BOB AI Chatbot to get a ChequeBook

Bank of Baroda’s virtual assistant ADI works on both mobile and desktop; you just need a web browser such as Google Chrome or Safari. It’s helpful and a good alternative if you are not using the BOB mobile banking app.

- First, go to the new portal – bankofbaroda.bank.in and tap on the “Chat with ADI” bubble.

- OR directly go to https://adi.bankofbaroda.in (if it’s open).

- Type “Cheque Book Request” or “Hi”.

- ADI will ask for:

- Your Account Number

- Registered Mobile Number

- Enter the captcha on your screen.

- BOB will send you an OTP to verify your account.

- Now, you can select your account number and charge details.

- To order, you have to provide another OTP, which is also sent to your account-linked mobile number.

After this, the cheque book request is successfully placed. It will be delivered to your registered address within a few working days.

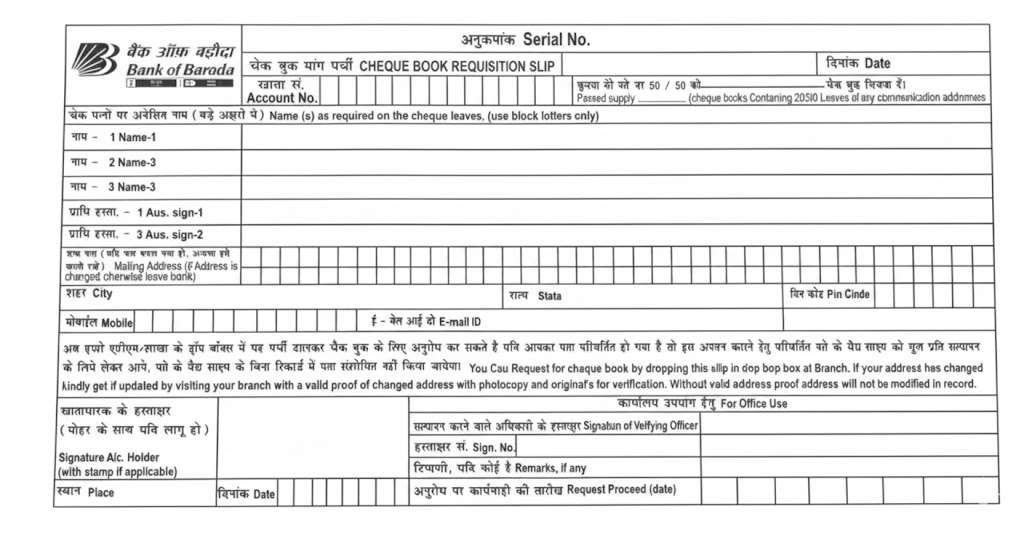

3. Offline Method – Cheque Book Request at Branch (Customer Request Form)

Still in india, people love branch banking due to multiple beliefs, such as they find more trust and are not comfortable with online methods. No worry, BOB offer a direct option via branch, you can use the Customer request form or the Cheque book requisition slip. Both forms need your basic information. Both form work for the same.

- Apply via Customer Request Form

- You can download the Form PDF from the BOB official website, you can ask at the branch counter, OR it is usually available near the cash counter desk.

- Fill the form with your name, date, account number, customer ID, mobile number, and aadhaar.

- Go to the section named “Cheque Related Services” and tick the Cheque Book Facility.

- Write down the number of leaves you want (like 20, 50).

- Write how you want your name printed on cheque leaves.

- Enter the address. You can write an existing or even a new address as well, but it only works for cheque book delivery.

- Attach a photocopy of Aadhaar, PAN, Voter ID, or Driving License.

- Submit at the counter or drop it in the cheque book request box.

- Request via BOB Cheque book requisition slip

- The slip is not available online right now. You can collect it via your BOB home branch.

- The form is English or hindi, the information you have to provide is –

- Your Date, Sign, number of leaves, your email id (Digital statements)

- Your address only if different than already registered.

- Account number and CIF.

How to Track Cheque Book Status in BoB World App

Once your request is made, tracking is easy:

- Open BoB World App → More → Service Requests.

- On the “Cheque Services” section.

- Select “Track Cheque Book Request”.

- Choose your account number.

- Status appears — Requested or Printed, or Dispatched.

If the book is dispatched, tap on the reference number. You will get details like:

- Request date

- Dispatch date

- Consignment number (Speed Post tracking number)

How to Track with India Post

Once you get the consignment number:

- Go to the official portal – indiapost.gov.in → Track Consignment.

- Enter the tracking number.

- You’ll see where your cheque book is — city, dispatch centre, delivery office.

- If the status shows “Out for Delivery” and is still not delivered, you can call the local post office and collect it manually.

If delivery fails or the address is not correct, the cheque book goes back to your home branch. Only the account holder with ID proof can collect it. You can collect it after 12 working days.

Cheque Book Delivery Time

| Location | Delivery Time |

|---|---|

| Metro Cities | 3–5 working days |

| Tier 2 / Semi-Urban | 5–7 days |

| Rural Areas | 7–11 days |

| If returned to your base branch | Collect after 12-15 working days with ID |

Cheque Book Charges & Free Limits in Bank of Baroda

| Account Type | Free Leaves | Charges After Limit |

|---|---|---|

| Savings (Metro/Urban) | 30 leaves/year | ₹4 per leaf + 18% GST |

| Savings (Rural/Semi-Urban) | 30 leaves/year | ₹2.50 per leaf + GST |

| Senior Citizens & Pensioners | Same limit | ₹2.50 per leaf + GST |

| Current/CC/OD Accounts | First 50 leaves free | ₹5 per leaf + GST |

| Jan Dhan (PMJDY) | 15 leaves per book | First 2 books free per year than charges starts |

| Emergency Cheque Book | Not free | ₹5–₹7 per leaf + GST |

Note: Only 2 cheque books can be requested at a time for savings accounts.

Example: Cost for a 30-Leaf Cheque Book (After Free Limit in Metro City Savings Account)

| Description | Amount |

|---|---|

| Number of cheque leaves | 30 |

| Cost per leaf (Metro Savings A/c) | ₹4 |

| Total base cost | 30 × ₹4 = ₹120 |

| Add 18% GST | ₹21.60 |

| Total payable amount | ₹141.60 |

FAQs

Does Bank of Baroda offer a cheque book request by SMS?

No, BoB does not provide a cheque book request via SMS service anymore; now BoB has shifted more to the Mobile app or the BOB chatbot banking system. You can use BOB WhatsApp Banking as well.

Can I request a cheque book via missed call in Bank of Baroda?

No, cheque book requests through missed call are not available in Bank of Baroda at present. However, you can visit your home branch for an offline request.

What is the Bank of Baroda cheque book request toll-free number?

To generate a request, you can call 1800 5700 or 1800 5000 (24×7) and speak to BOB customer care. They can help you provide you cheque book directly using the phone.

Can NRI account holders apply for cheque books online?

Yes, NRI account holders can request a cheque book online, but only if their NRE/NRO account and Indian address are updated.

Can I collect my Bank of Baroda cheque book from the branch instead of home delivery?

Generally no. BoB dispatches personalised cheque books only to the registered address. Branch collection happens only if delivery fails. Tip: Ensure address accuracy to avoid 10–15 day delays.

Why does Bank of Baroda charge even after free cheque leaves?

Free limits are annual, not lifetime. Once 30 leaves are exhausted, charges apply automatically. Many customers miss this reset cycle. Pro tip: Track issued leaves in the BoB World app yearly.

Does BoB verify the address again before printing a cheque book?

Yes. If the address or KYC looks outdated, printing may pause silently. Branch experience shows that address mismatch causes 2–3 day delays. Always update KYC before placing the cheque book request.

Is TPIN mandatory for cheque book request in BoB World app?

Yes. Unlike balance enquiry, cheque book ordering requires TPIN authentication, not MPIN. If TPIN is blocked, request fails. Reset TPIN first to avoid repeated unsuccessful attempts.

Can someone else receive my cheque book on my behalf?

No. Delivery is strictly to the account holder or a family member at the registered address. Couriers may refuse if ID isn’t shown. If returned, only you can collect it from the branch with the ID.

Why do some cheque book requests show “Printed” but not “Dispatched”?

Printing and dispatch are separate stages. During the postal backlog, books remain printed for 1–3 working days. Tip: wait for the consignment number before raising complaints or visiting the branch.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.