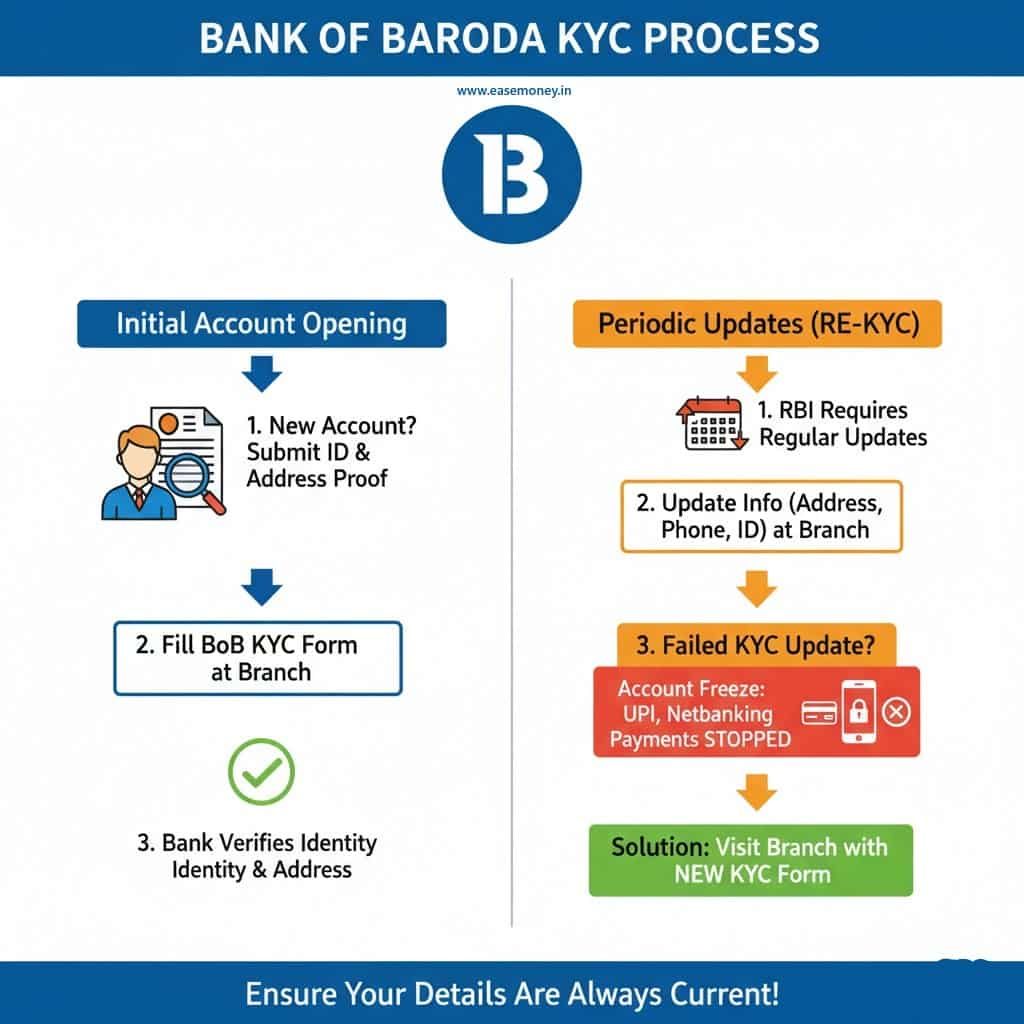

How the Bank of Baroda KYC Form Works

When you open an account for the first time, BoB asks for your documents. Your documents are required for your KYC. KYC is a process by which your bank verifies who you are and where you live. Here, you need the BoB KYC Form at the branch.

Likewise, RBI requires banks to update this information periodically, known as Re-KYC or Periodic Updation of KYC. This is done so that the bank always has your correct and latest details, especially if you have changed your address, phone number, or ID proof.

When you fail to update KYC, the BOB may stop your payments, such as UPI, block internet banking, or freeze the account until fresh documents are provided by visiting a branch with the KYC form itself.

When KYC is Usually Required via Form

Even with eKYC and Video KYC available, banks still ask you to fill out a KYC update form or Re-KYC form in certain cases –

- eKYC and video KYC depend on Aadhaar data — if it doesn’t match your bank record, form KYC is mandatory.

- eKYC may not support certain joint/minor/ NRI accounts categories; the bank usually requires form-based verification.

- If the video KYC attempt failed (due to poor video, OTP, face mismatch, etc.)

- Address or ID change (like moving to a new city)

- Periodic re-KYC failed online for any reason, such as you are not eligible.

- Aadhaar Digital KYC failed – Bank server / UIDAI downtime or Aadhaar mobile number not linked.

How to Choose the Right BOB KYC Form for Updation

Bank of Baroda provides three main types of forms for individual customers (savings accounts or similar), all PDFs work for different purposes; however main focus is the same, KYC update. Which one you need depends on what information has changed in your account while doing KYC.

- Remember: you need only a single form for KYC depending on your situation. If everything is updated, nothing wants to change; just go with the first form. If not, choose others.

Here is the form list + required documents –

| Type of KYC Form | When to Use | Required Documents |

|---|---|---|

| Self-Declaration (No Change in KYC Info) | In simple words, you just want to confirm with the bank that everything is the same as before. Just do basic ReKYC without changing any information. | Photocopy of Aadhaar + Your PAN or Form 60 + One recent photograph and your signature on all forms. |

| Self-Declaration (Change of Address Only) | This Form works when you just want to change your address when updating KYC. Nothing else. | Photocopy of new Address Proof (Aadhaar, Voter ID, Utility Bill, (Electricity or water or Gas) OR Driving Licence) + One photo. (Additional documents are also required) |

| Re-KYC Form for Individuals (Other Cases) | When there is any major change in your details, such as name, ID proof, a mismatch between Aadhaar and bank record, or when the bank requests a branch visit. | Photocopy of Aadhaar + Photocopy of PAN or Form 60 + One photograph – FATCA-CRS Form + Citizen Integrity Pledge (if asked) |

Note: if you are providing any utility bills, they must not be older than 2 or 3 months. You can also provide a rent agreement as proof. If Aadhaar is used as both POI and POA, you do not need any other document; however, PAN or Form 60 is still needed. Here is a list of KYC documents that BOB accept.

Download The PDF Quick Links Here

| Form Name | Download Link (PDF) | Language |

|---|---|---|

| BOB Self-Declaration (No Change in KYC Information) – | Download PDF (618 KB) | English And Hindi |

| Self-Declaration A(Change of Address Only) | Download PDF (337 KB) | Bilingual Language |

| Re-KYC Form for Individuals or Savings (Other Cases) | Download PDF (892 KB) | English or Hindi |

| Self-Declaration (Non-Individuals) | Get PDF (343 KB) | Both |

| Re-KYC Form (Non-Individuals) | Download PDF (1.07 MB) | Both |

You can request Hindi/English/Tamil printed copies directly from your home branch, or you can print this out also.

Additional Forms That May Be Required

Depending on your case and what the branch officer requests when you visit the branch, you might have to submit one or more additional forms along with the main KYC or Re-KYC form.

| Additional Form | Purpose | When Required | Download Link |

|---|---|---|---|

| FATCA-CRS Annexure for Individual Accounts | FATCA means the Foreign Account Tax Compliance Act. It collects tax residency details of customers who may have connections outside India. | Required if you are an NRI, have a foreign address, or hold tax residency in another country. It is also required for Indian residents. | Download PDF |

| Form 60 | A Declaration physical paper is used when you do not have a PAN card or an application under process. | Required if PAN is not submitted or not allotted. | BOB Form 60 Download PDF |

If FATCA or Form 60 is needed, attach them along with your Re-KYC Form for Individuals (Other Cases).

How to Fill and Submit the BOB KYC Form

The documents are mostly the same, the information you have to fill little bit different, let’s check form by form what to fill in and what not –

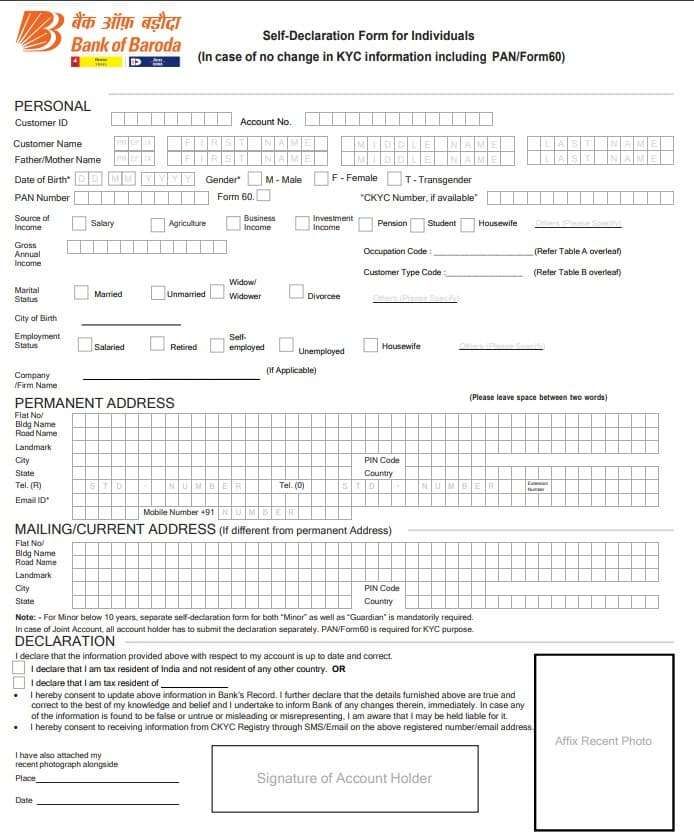

1. Form – BOB Self-Declaration (No Change in KYC Information)

- Personal Information section

- Your Customer ID – find on your passbook or send sms “CUST” to 8422009988 from your mobile number.

- Account number – write it down, find it on your statement, cheque book, or passbook, anywhere.

- Customer Name – Your full name – first, middle, last – same as aadhaar or passbook.

- Father/mother name – enter the same as the aadhaar card printed. (anyone’s name)

- Date of Birth – same as the aadhaar or PAN.

- Enter your Gender and enter your PAN Card Number; if not, tick on Form 60.

- CKYC number – enter it if you have it, if not, download the CKYC card online and check the number. (optional)

- Source of income – enter how your money came, or just tick on student or dependent if no income.

- Gross Annual income – Enter your yearly income, such as 3 lakh, 4 lakh or higher, after calculating all sources of income.

- Enter Occupation and customer Type Code – it is available on Table A or B overleaf, you can ignore it as well.

- Marital Status – tick your status or if something special, write it on the other.

- City of Birth – Where were you born? Enter it.

- Employment status – tell how you earn salaried or other.

- Enter your company name.

- Permanent Address – As per your provided address, enter it, give space in the boxes and enter your mobile number, email ID if you have one, and your City PIN Code. You can put your aadhar or Voter ID address here; it counts as a permanent address, but make sure it same as before. No changed address accepted.

- Mailing address – when you opened an account and provided a different address, enter another one; if not, just leave it.

- Declaration – simply put your photo, accept the declaration about whether I am indian or not, and sign your signature the same as before.

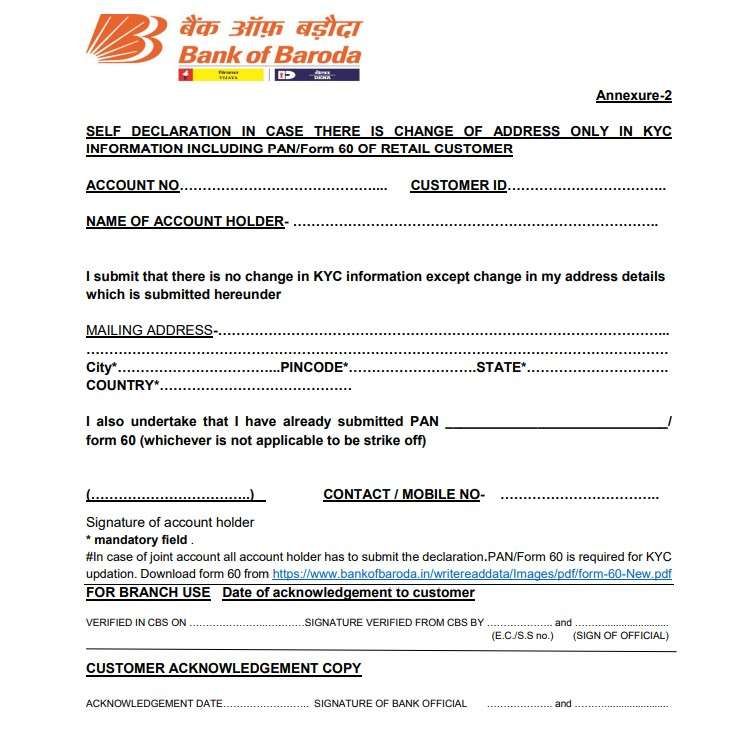

2. Form – BOB KYC in case there is a change of address

- Enter your account number and customer ID.

- Your full name.

- Enter your new mailing address, including PIN Code, and Country. (Ready a photocopy for this address proof)

- Enter your PAN.

- Your mobile number and signature.

- It’s done.

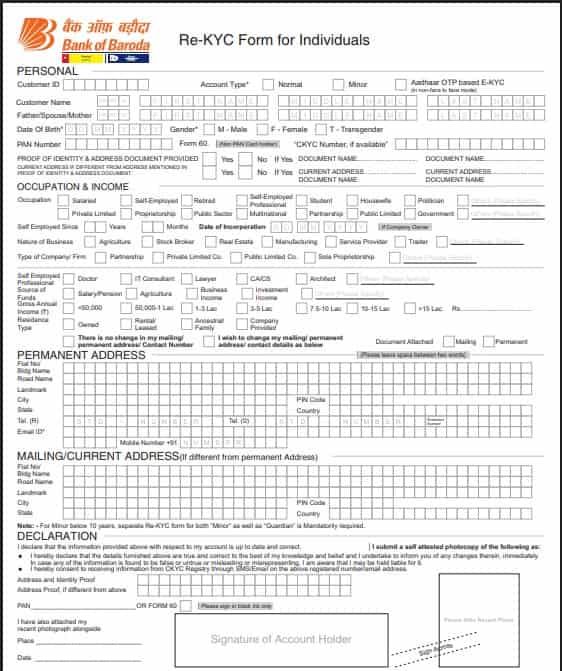

3. Form – BOB Re-KYC Form for Individuals (Other Cases)

This form works for editing the account details, including PAN –

- Personal info –

- Your customer ID

- Your Account type – Normal or Minor (for minor type form required)

- Tick for Aadhaar OTP Based E-KYC for future use.

- Your name and your father/spouse/mother’s name (anyone)

- Your DOB + Gender

- Your PAN or Form 60

- If your current address is different from you provided Aadhaar or other OVDs, then tick and enter the document you want to provide – for example, a rent agreement or utility bills

- Proof of identity – enter your OVD name + number

- Occupation + Income

- Your occupation – salaried, self-employed, or other.

- Enter details depending nature of the occupation and leave blank the other boxes.

- Permanent Address

- If you have changed your permanent address, give details and attach an address proof photocopy.

- Mailing or Current address (where you get bank documents or ATM Card)

- Leave blank if same, if not, put new with proof.

- Declaration – same as other forms, your PAN, proof of identity and address, your photo, and signature.

Note: take this form only when you want to change any major information, such as your aadhaar name, which does not match your bank-registered Name.

What are the Processing Time via the Branch

After you submit your KYC form, the update usually takes 3 to 5 working days; however, in most cases, it happens within 48 hours. You can confirm with customer care as well. If any holiday in between, it may take longer.

- After successful submission, you will get an SMS on your account-linked mobile number or email only.

- You can check on the BOB World mobile banking app or the BOB KYC portal as well.

- After activation, you can use the services.

BOB Customers FAQs

Do I need to visit the same BOB branch for KYC where I opened the account?

Ideally, yes, but you can also submit the form at another BoB branch if your account is fully digital or you have officially transferred your home branch.

What if I’m a senior citizen or unable to visit the BOB branch for KYC?

You can authorise someone to deliver your signed form and documents, or use the email/post method if allowed by your BOB branch. You can call customer care for help. They enable doorstep banking for a few special cases.

How do I complete Re-KYC for a joint account in Bank of Baroda?

You will need to get the separate Re-KYC form for each joint holder. BOB needs your individual Aadhaar, PAN/Form 60, and photo.

Can Re-KYC be done for BOB minor accounts online?

No, minor accounts (below 18 years) cannot be updated through online or video KYC. Both the minor and guardian must submit physical Re-KYC forms separately at the branch.

Is the FATCA-CRS form mandatory for all BOB Re-KYC updates?

Yes, a FATCA-CRS form is mandatory for Re-KYC updates, it helps to collect new or existing information for any international tax agreements.

Why does Bank of Baroda provide multiple Re-KYC forms instead of one?

Because BoB separates risk-free confirmation and data-change cases. Using the wrong form often delays approval by 2–4 working days, even when documents are correct.

What is the biggest mistake customers make while choosing a BOB KYC form?

Selecting “No Change” when the Aadhaar address actually differs. This causes automatic rejection during verification. Always cross-check the Aadhaar address before picking the form.

Is FATCA-CRS really checked for normal Indian savings accounts?

Yes. BoB treats FATCA as mandatory compliance, even for residents. Missing FATCA details can keep KYC stuck as “Under Process” without any visible error message.

Can I submit BOB Re-KYC forms through email and still get approval?

Yes, if documents are clear, self-attested, and sent from your registered email. However, branch uploads usually take 1–2 extra days compared to an in-person submission.

What’s the fastest way to get BOB Re-KYC approved at the branch?

Visit before 12:30 PM or lunch time, carry originals + self-attested copies, and ask staff to upload same day. Morning submissions often reflect approval within 24–48 hours.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.