What You Need to Know Before Filling the RTGS Form

By far, the Bank of Maharashtra (BOM) RTGS form is available in two types: at the branch and on the website. It usually depends on the language and purpose you choose:

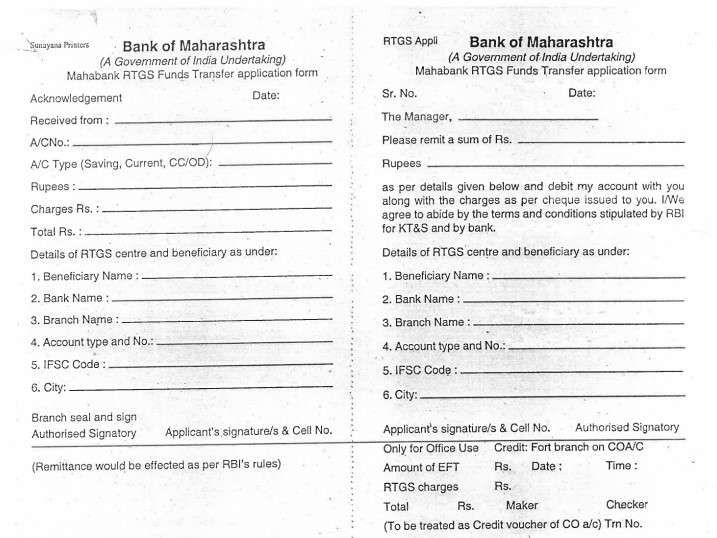

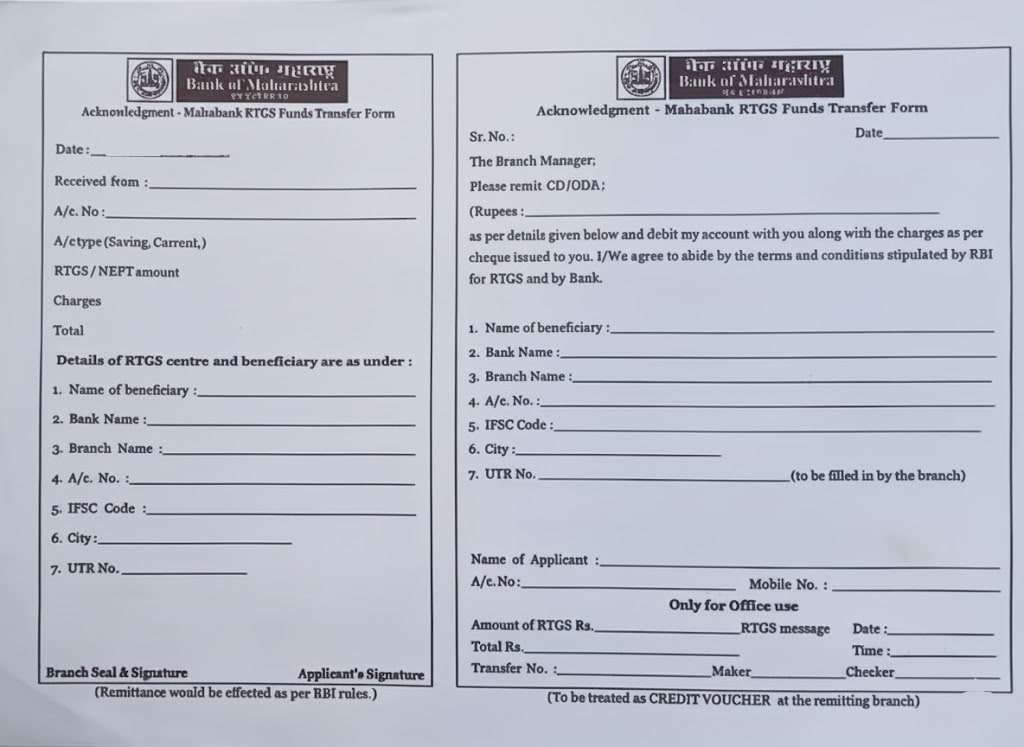

1. A “RTGS only form” (English) – this is the direct RTGS fund-transfer application form. It comes with both a customer copy and a bank copy, similar to the formats used by State Bank of India (SBI) or Bank of Baroda (BOB).

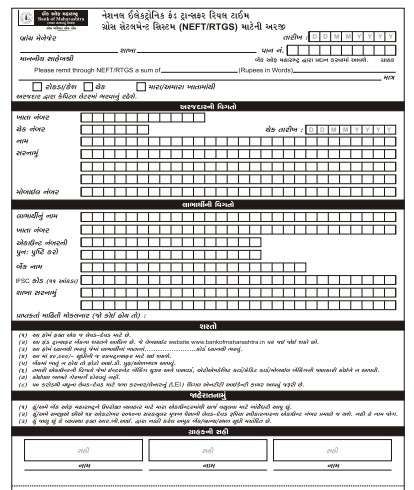

2. A “RTGS/NEFT” form – this is a combined form (RTGS and NEFT) that covers both services. Though not commonly available on the website currently for the English-only version, you can get it via a branch; it is used for branch-based transfers and appears more “modern” (in a style similar to private banks like ICICI Bank). This form is available in upto 7 other languages at the BOM official site.

Functionally, for branch RTGS transfers, both forms work the same.

Direct Download Links (English RTGS Form)

If you want the English version of the RTGS form, here are the direct links:

| Type | Description | Download Link |

|---|---|---|

| BOM RTGS Original Form | Official printed RTGS Funds Transfer Form (Sunayana Printers version) | Download Original Form (PDF) |

| Editable / Fillable PDF | Digital version of the RTGS form with editable text fields | Download Fillable Form (PDF) |

Both versions work perfectly fine. To digitally fill up, download the fillable PDF on your Laptop or PC. You have to open it using any latest web browsers, such as Firefox or Google Chrome, and start typing and printing it. Also, if you want to write with a pen, go with the original non-fillable version.

Tip: Sometimes fillable forms don’t open properly on mobile browsers and PDF Readers. If you face any issues, use PC or Adobe Acrobat Reader.

How to Download Other Language RTGS Forms

You can also get this RTGS/NEFT form in multiple languages up to 7. The process is simple. Follow these quick steps –

- Firstly, go to the official site – https://bankofmaharashtra.in/

- On the homepage, look for the floating arrow on the right side of the screen or just scroll down and find the “What You’re Looking For” section.

- Click on that section and go to Downloads forms.

- Tap on the Other forms section.

- Just choose your language you want and tap on it to get its PDF version. Currently site’s available PDF file languages are Assamese, Gujarati, Kannada, Malayalam, Odia, Punjabi, and Tamil.

- If you can’t find the language online, simply visit your nearest RTGS-enabled Bank of Maharashtra branch. Ask with staff, they provide you with a local or default language form.

Charges and Example Calculation

Before going to fill up, you must have to know the fee for RTGS and other details that you need to write in the form in the “charges Rs” and “total Amount” sections.

RTGS charges at Bank of Maharashtra (as per official site):

| Transfer Amount | Mode | Service Charge (Excl. GST) | Total (Incl. GST) |

|---|---|---|---|

| ₹2 lakh – ₹5 lakh | Branch | ₹25 + GST | ₹29.50 |

| Above ₹5 lakh | Branch | ₹50 + GST | ₹59 |

| ₹2 lakh – ₹5 lakh | Online / Internet Banking | ₹5 + GST | ₹5.90 |

| Above ₹5 lakh | Online / Internet Banking | ₹10 + GST | ₹11.80 |

Example: Let me explain to you in very simple phrases, if you are trying to make an RTGS of ₹50 lakh through a branch.

- Your Basic charge will be: ₹50

- Your GST (18%) will add on this charge: ₹9

- Total charge: ₹59

You will need to write ₹59 or ₹60 in the “Charges Rs.” box and add it to the total amount in the “Total Rs.” column.

What documents will you need?

For an RTGS transfer through a branch, you will need this list of documents. Also, you may need to carry it at the branch as well –

- Cheque Book or Leaf – A self-cheque (write “YOURSELF FOR RTGS” as the payee). Most branches for a bigger amount ask for a self-cheque without additional charges to confirm the payment.

- Valid ID proof, such as your Aadhaar or PAN, if asked for verification.

- The filled RTGS form with all beneficiary details.

How to Fill the Form (Step by Step)

The form has two main sides — the right side and the left side. You need to fill in both carefully. Let’s go through it step by step –

| Form Side / Field | What to Fill / Action | Example / Tips |

|---|---|---|

| Right Side – To, The Manager | Enter the same branch name where you are making this transfer. | Bank of Maharashtra, Shivaji Nagar Branch, Pune |

| Remit a Sum of Rs. | You have to write the amount in digits first | ₹5,00,000 |

| Rupees (in words) | Now, write the same amount in words. | Five lakh only |

| Beneficiary Section —————— | —————————– | ————————— |

| Name | Enter the exact name of the beneficiary (company or a person) | Rajesh Kumar Sharma or Asian Engineers Pvt Ltd. |

| Bank Name | What is the bank name of your Beneficiary where this fund will be credited | HDFC Bank |

| Branch Name | Name of branch of the beneficiary | MG Road Branch, Bangalore |

| Account Number | Enter the correct account number and check twice | 501234567890 |

| IFSC Code | Enter the 11-digit IFSC code of the beneficiary branch | HDFC0001234 |

| City | City of the beneficiary branch | Bangalore |

| Signature | Your signature to authorise the transaction | Use your usual bank signature. Tip: Ensure it matches the signature on your account. |

Tip for you: You can ask for a valid document or bank statement from your beneficiary (Corporate or individual) to double-check the account number, IFSC, and branch details that you filled. Accuracy here is very important in the beneficiary section — mistakes may cause delay or reversal of funds.

| Left Side – Customer Copy | What to Fill / Action | Example / Tips |

|---|---|---|

| Received From | Your full name | Naman Parmar |

| Account Number | Your Bank of Maharashtra account | 123456789012 |

| Account Type | Simply, you have to tick your account category: Savings / Current / CC / OD | Savings or Salary account = SB; Current = CA; CC = Cash Credit; OD = Overdraft |

| Rupees (in words) | Repeat the amount in words from the right side | Five lakh only |

| Amount (in figures) | Repeat amount in digits | ₹5,00,000 |

| Charges Rs. | Enter the RTGS charge (incl. GST if applicable) | ₹59 after GST |

| Total Rs. | Total amount including charges | ₹5,00,059 after Charges or fee |

| Beneficiary section again | Repeat the details that you have already written | Same as above |

| Signature & Mobile Number | Sign in and enter your contact number | Signature + 9876543210 |

Limits, Timings, and Processing

- Minimum amount – RTGS starts from 2 Lakh, not even 1,99,500.

- Maximum amount – As per the BOM RTGS portal, there is no upper limit, but it always depends available amount in your account and is subject to your account type limitations and branch-capped rules.

- Timing – The branch timing is 10:00 AM to 5:00 PM. You can only initiate an RTGS transaction during the branch’s working hours, which typically close in the late afternoon on weekdays and even earlier on Saturdays. You will find the bank closed on Saturdays except the 2nd and 4th Saturdays and on public holidays.

- RTGS Transfer timing – Once your RTGS is processed, the beneficiary’s account usually gets credited within 30 minutes. Delays can occur if:

- The branch submits after the cut-off time.

- An incorrect account or IFSC is entered.

- RBI or beneficiary bank server delays occur.

So, try to submit your form before noon for the same-day processing. If you submit after the cut-off timings, your payment may be processed successfully on the next working day.

Important Notes & Customer Care

- RTGS transfers are based only on the account number, not the name — so even if the name is slightly wrong, the money will go to the account number you entered.

Customer Care for RTGS/NEFT

- RTGS Cell Phone: 020-24504005

- RTGS Cell Email: cmrtgs@mahabank.co.in

Additional Required Questions

Are RTGS charges different for online vs branch?

Yes, BOM Bank has a policy where online transfers carry minimal charges of ₹5–₹10 + GST, whereas the branch submissions would cost more in terms of fees ranging from ₹25–₹50 + GST.

Do I need to provide ID proof (PAN or Aadhaar) with the RTGS form?

You don’t always need to provide ID proof (PAN or Aadhaar) with an RTGS form, but BOM may require it for big transfers or as part of their (KYC) policy. However, as per the RBI, it is not mandatory.

Which RTGS form should I use in Bank of Maharashtra?

Bank of Maharashtra accepts both RTGS-only and RTGS/NEFT combined forms. Functionally, both work the same. Use whichever your branch provides or the English RTGS form for clarity.

Can I use the fillable RTGS PDF instead of the printed form?

Yes. Fillable PDFs are accepted if details are clear and signatures are original. However, some branches still prefer handwritten forms for audit comfort, especially for high-value transfers above ₹10 lakh.

Is a self-cheque compulsory for BOM RTGS?

In most branches, yes. A self-cheque confirms debit authorisation. For large amounts, BOM staff almost always ask for a cheque even if your account supports direct debit.

Why do I need to write charges separately in the form?

Because BOM RTGS forms require manual total calculation. You must add charges (₹29.50 or ₹59) to the transfer amount so the teller can debit the correct final amount.

Will RTGS fail if the beneficiary name is slightly wrong?

Usually no. RTGS is account-number driven, not name-driven. But large mismatches may trigger branch verification, so always match the name from a cancelled cheque.

What happens if RTGS is delayed or not credited?

Wait 30–60 minutes first. If still pending, contact the BOM RTGS cell with your customer copy. Failed transactions usually auto-reverse by the end of the same working day.

How long should I keep the BOM RTGS customer copy?

Keep it for at least 6 months. It contains amount, branch seal, and reference number, which are required for complaints, property transactions, vendor proof, or audit confirmation.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.