What is the traditional way to get a cheque book at Canara Bank?

The Canara Bank still keeps its traditional side alive when it comes to cheque book requests. As per the Canara Bank Doorstep Banking Policy data, you can request a new cheque book by submitting a Cheque Book Requisition Slip. This service is available only at the customer’s home branch.

Once the agent delivers the requisition slip to your home branch, the bank dispatches the cheque book to your residence as per the address recorded in the Core Banking System (CBS).

Offline Request Process: Visiting your Home branch

If you choose the old way for any reason, such as not having active mobile banking or a registered old inactive mobile number, just visit your Canara Bank home branch and ask for

- A Cheque Book Requisition Slip

- A Customer Request Form

— Both serve the same purpose; you can select anyone.

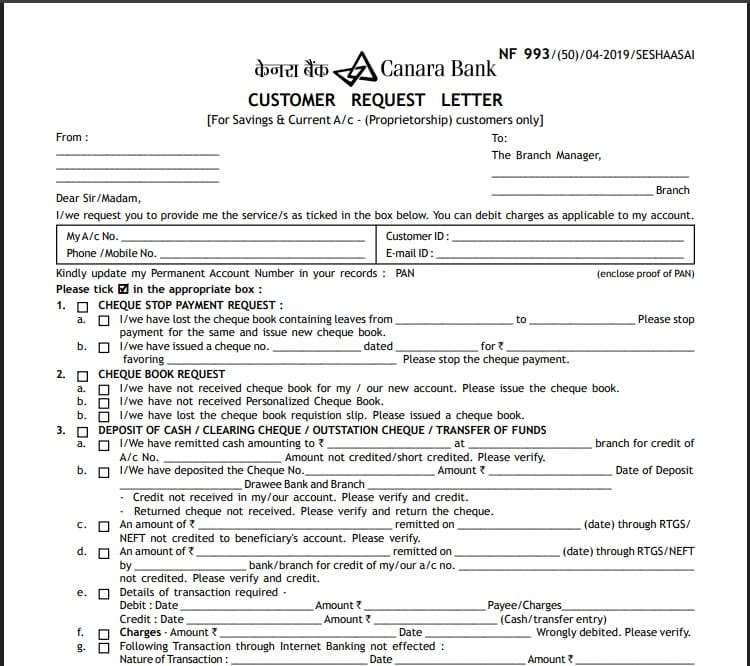

You can even download the official Customer Request Form (Form No. NF-993) from the bank’s website, print it at home, and carry it to the branch.

| Form Type | Original Download Link |

|---|---|

| Customer Request Form (English / Hindi) | Download PDF |

It’s a two-page form and works for salary, savings and current a/c holders, available in both English and Hindi, but the information required is minimal: simply your name, account number, branch, and contact details.

How to fill the Canara Bank Customer Request Form

Once you print it or after getting it from the branch:

- Enter your home branch name (as shown on your passbook).

- Write your account number, customer ID, and mobile number.

- Add your email ID. (optional)

- Some branches may ask for a scanned Aadhaar copy, just a KYC step — keep one ready.

- Now move to Section 2 or B, which is for cheque book requests.

- If you have never been issued a cheque book before, tick the first (A) option.

- If you have lost your cheque book requisition slip, or don’t have a personalised cheque book, tick the option (B) that reads:

- “I or we have lost the cheque book requisition slip. Please issue a new cheque book.”

- After ticking, sign the form. That’s it — your request is ready to submit.

- You can ignore other sections.

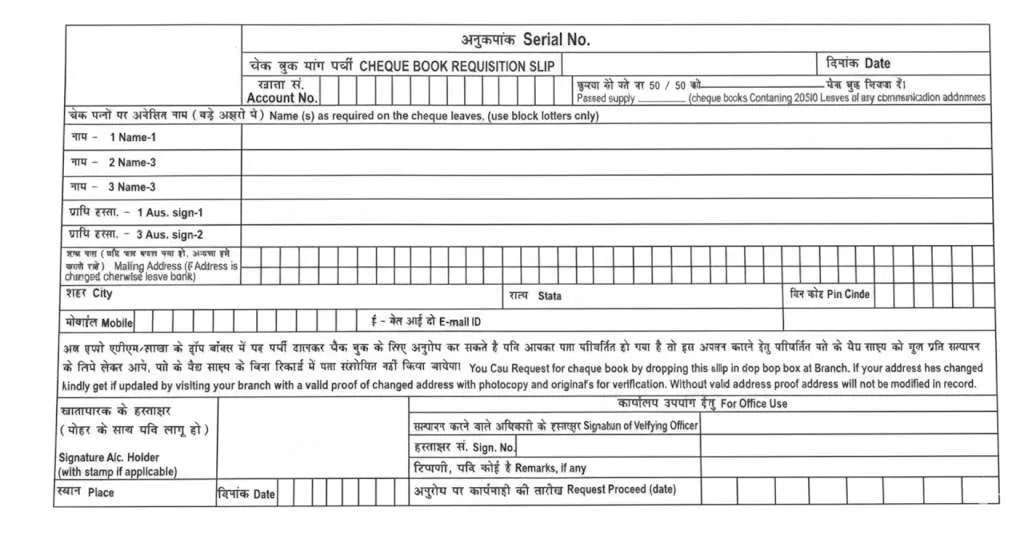

Canara Bank Cheque Book Requisition Slip

The same details apply if you are using a Cheque Book Requisition Slip instead of this form. Just make sure your account number, mobile number, and signature match your bank records.

Once submitted, the cheque book is verified and dispatched to your registered communication address through India Post.

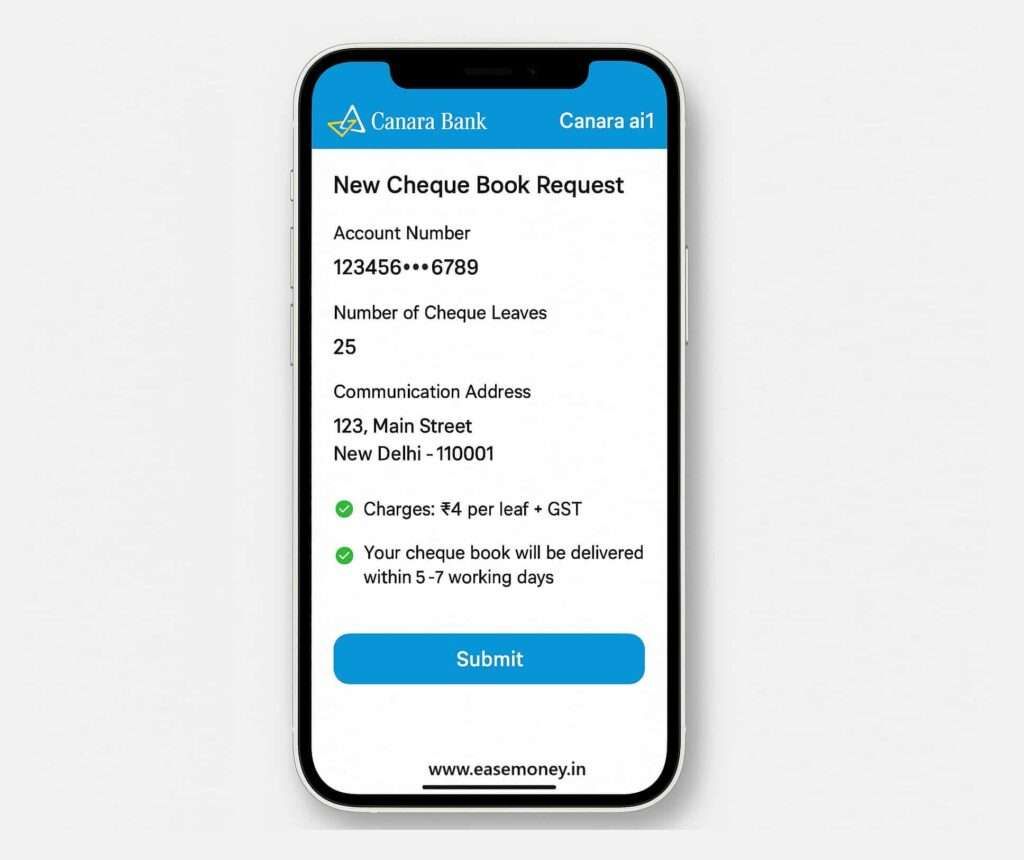

Digital Option: Canara Bank Cheque Book Request via A1 Mobile Banking App

If you want to skip the branch visit and want a quick online method, you can use the Canara AI1 mobile banking app.

This is the fastest and most convenient method — provided your mobile number is linked and the app is already activated.

Here’s how you do it:

- First of all, install or open the Canara AI1 mobile banking app.

- Log in using your 4-digit MPIN or fingerprint. For first-time users, you can use an ATM card to set 4 4-digit mpin.

- On the home screen, just scroll down to the Account/Services option and tap on the More button.

- Tap on Cheque Book Request or Track.

- Select your account from the list.

- Tap New Cheque Book Request.

- Choose the number of cheque leaves.

- For Savings or Salary Accounts, you can only choose 20–25 leaves.

- For Current Accounts, you can request more leaves.

- The address will be automatically detected as your registered communication address. You can’t change it from the app.

- To update your address, you’ll have to visit your home branch.

- Confirm your request. You will see a message saying:

- “Congratulations! Your personalised cheque book request has been accepted.”

Delivery timings: The cheque book will be delivered to your registered address only via Speed Post or the bank’s delivery partners within 5 to 7 working days. You can use the SR number or consignment number to track directly using the India Post website. You can also collect it from your city post office or your home branch after 7 to 10 working days.

Cheque Book Charges at Canara Bank

Unlike some banks that silently deduct after your free limit, Canara Bank keeps it transparent.

Here’s the full picture of cheque book charges according to the latest fee circular:

| Account Type | Free Leaves | Charges Beyond Free Limit | GST | Remarks |

|---|---|---|---|---|

| Savings Account (SB) | First 25 leaves free per calendar year | ₹4 per leaf + GST | 18% | You can request only after 3 months. |

| Current Account (CA) / OD / OCC | No free leaves | ₹5 per leaf + GST | 18% | ≈ ₹5.90 per leaf |

| Senior Citizens / Staff / Ex-Staff | All cheque books are free | Nil | Nil | Subject to the account scheme |

| Canara SB General | Free limit subjective (may be 10 leaves only) | ₹4 + GST per leaf | 18% | Confirm with your home branch |

| Canara SB Power Plus | Free up to 300 cheque leaves per year | Nil | Nil | Ideal for active users |

If you have a Savings Account, the first 25 cheque leaves in a calendar year are free.

Beyond that, each additional cheque leaf costs ₹4 + 18% GST, which equals ₹4.72 per leaf.

So, for another 25-leaf cheque book, the total charge will be roughly ₹118.

For Current Account holders, the per-leaf charge is ₹5 + GST, which brings the total to ₹147.5 for 25 leaves.

Canara Bank Minimum Balance with Cheque Book (Updated June 2025)

No balance required. After the date of June 1, 2025, Canara Bank has completely removed the minimum balance requirement for all Savings Bank accounts, including those with a cheque book facility.

That means:

- No penalties for not maintaining a minimum balance.

- No restrictions on cheque book availability, even with a zero balance, but if you are applying after the free limit expires, you may have to add balance for charges to your account.

- This applies to all savings accounts, such as regular, salary, and even NRI savings accounts.

The change was rolled out across all Canara Bank branches in line with their inclusion and ease-of-banking policy.

Even with a zero balance, the cheque book will still be issued.

However, it is a good idea to maintain at least ₹500 in your account to avoid any accidental charges, cheque book fee, or ECS return issues.

- Example: If your account is a Canara regular savings account, and you request your first cheque book of 25 leaves in 2026.

- You will get it free of cost.

- If you later request another cheque book within the same year, you will be charged ₹4 + GST per leaf — that’s ₹4.72 × 25 = ₹118 total.

- The amount is auto-debited from your account at the time of issuance or account statement date.

FAQs

How to track Canara Bank cheque book delivery?

You can track it using the Speed Post tracking link sent by SMS once dispatched. Or, open the Canara AI1 app → Services → Cheque Book → Track.

Where to find the Customer ID in a Canara Bank cheque book?

Your Customer ID is only printed on the cheque book’s first page, not on the leaves. Furthermore, you will find it inside your passbook or on Canara NetBanking / ai1 app → Profile → Account Details.

Can I request a Canara Bank cheque book through SMS?

No, Canara Bank doesn’t support cheque book requests via SMS. You can use the Canara ai1 app, Internet Banking, or ATM to place a request instead.

How to get a cheque book from Canara Bank immediately?

You can’t get it instantly anymore. Most banks, including Canara, have stopped issuing non-personalised cheque books. Requests now go through dispatch and take 3–5 working days.

Can Canara Bank reject a cheque book request even after submitting the form?

Yes. If your signature, inactive account status, or incomplete KYC exists, the request gets paused. Branch staff usually flags this within 24–48 hours before dispatch approval.

Is cheque book delivery faster if I apply through the branch instead of the AI1 app?

Not really. Both routes go through the same backend. Real-world average delivery is 5–7 working days. Branch requests feel slower only because submission and verification happen separately.

Can I change the delivery address for my cheque book request?

No. Canara Bank sends cheque books only to your CBS-registered address. Address change requires a separate branch visit and usually takes 2–3 working days to update before the request.

What happens if I’m not at home when the cheque book is delivered?

India Post usually attempts delivery twice. If missed, the cheque book is held at the local post office for around 7 days before returning to your home branch.

Is there any cooling period before requesting a second cheque book?

Yes. Most branches enforce a 2–3 month gap after issuing a cheque book, especially for savings accounts, to prevent misuse or bulk requests within the same calendar year.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.