What Exactly Is Karnataka Bank Customer ID?

Customer ID (also known as CIF or User ID) is a special, random number assigned to each Karnataka Bank customer.

- It’s a permanent code, doesn’t change even if you open/close multiple accounts.

- This is typically a 9-digit number, as confirmed by the Karnataka Bank AI Chatbot.

- In some internal systems, it might be 11 or 12 digits.

- It is also referred to as: CIF Number, Login ID, and User ID (netbanking)

Why does Karnataka Bank allocate a Customer ID to you?

Karnataka Bank is an ‘A’ Class Scheduled Commercial Bank in India with a strong presence across the country, up to 11 million customers as of March 2025.

To manage this vast network efficiently and serve crores of customers smartly, the bank assigns a unique identifier to each customer, known as the Customer ID.

What Are the Key Differences Between Customer ID and Account Number?

| Feature | Customer ID (CIF) | Account Number |

|---|---|---|

| Uniqueness | One per customer | One per account |

| Changes over time | Never changes | Can change if you switch |

| Usage | For login, identification | For deposits and transfers |

| Visibility | Found in profile/login tools | Printed on passbook, chequebook, and Physical Statements |

Where Can You Find Your Customer ID Without Logging In?

Some methods don’t need an app login or password and require only your mobile number and account number to find –

1. Get Customer ID by SMS

Recently, the Bank launched the KBL Moneyclick Internet banking option for a better digital experience. This is one of the easiest options provided by Karnataka Bank to retrieve it.

As I already told you, Customer ID, also known as User ID, is confirmed by the KBL Moneyclick Netbanking user manual. All you need is your account number and mobile number. Here are the steps to follow –

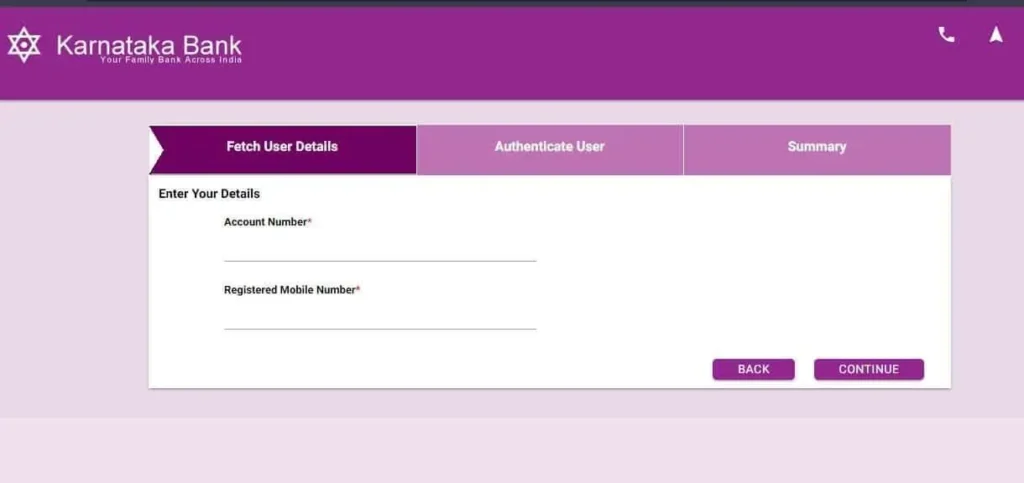

- Go to Google and search “MoneyClick Karnataka Bank Netbanking”.

- Click on the official link and hit the Login button.

- Tap on Forgot User ID?

- Here you have to enter your full Account Number.

- Enter your bank-registered phone number, and tap on submit button.

- Now, you will get a 6-digit OTP on your phone number via SMS.

- Enter the OTP and verify.

- You’ll receive your Login ID (which is your Customer ID) via:

- SMS on your mobile number

- Email on your registered Email ID

Tip: Make sure your mobile number and email are updated in your bank records. If not, visit your branch and update them.

2. Use the Karnataka Mobile App

If you have the KBL Mobile Plus app, you can easily retrieve your ID by just logging in. Here’s how:

- Download the KBL Mobile Plus App: Available on both iOS and Android platforms.

- Open the App and tap on “Register” if you haven’t registered before.

- Send an SMS: Register through the app by sending an SMS from your registered mobile number.

- Enter OTP: An OTP will be sent to your registered mobile number.

- Enter Debit Card Details: Complete the registration by entering the required details.

- Set a 4-digit MPIN: This is used for logging into the app.

- Log in and go to “My Profile”: After logging in, go to the “My Account” section, then select “Update”.

- View Your Customer ID: Your Customer ID or CIF will be displayed in this section.

Note: For this method, you must have a Karnataka Bank RuPay debit card or a branch token to log into the mobile app.

3. Call Karnataka Bank Customer Care

Calling the Karnataka bank helpline is an efficient option. They will guide you and provide your Customer ID after successful identity verification. Here’s what you can do:

- Toll-Free Numbers (India):

- 1800 425 1444

- 1800 572 8031

- For NRIs: 080-220 21555

The agent may ask you a few details –

- Your full name

- Your Account number’s last digit

- Date of birth

- Your father’s or mother’s name.

Once verified, they will repeat your customer ID number or send you via email or SMS to your registered mobile number.

When You Might Face Issues Retrieving Your ID

1. If You’re a New Account Holder (No Docs Yet)

- You may not have a passbook or letter

- Use the “Forgot User ID” online method

- Or call 1800 425 1444 with Aadhaar & account number

- You can wait for your debit card to be delivered to activate mobile banking to find your customer ID, or you can visit a branch to get a branch token to activate Netbanking instantly.

Wait for –

- Welcome Letter – Provided when you first opened the account. Usually on the KYC is received by India Post or directly to your registered email Address.

2. If Your Account Is Inactive

- Visit your Home branch or the nearest branch.

- Carry a valid government-approved document, such as your Aadhaar, PAN Card, or Passport.

- Ask the bank officer to help you retrieve your Customer ID and New Passbook mentioned with CIF.

- After verification, they’ll provide it to you on the spot or via SMS/email.

3. If You’ve Lost All Documents or Access

You can drop an email to their official email address – info@ktkbank.com

- Mention your:

- Full Name

- DOB

- Account Number

- Registered email account only

The bank will verify and reply with your ID (within 1–2 working days)

Additional Questions

What does a typical Karnataka Bank Customer ID look like (Example)?

A Customer ID usually consists of 9 digits. It is a special number that links all of your accounts with the Bank. For example, it looks like 556622123. This varies slightly based on account type and enrollment time. Keep it private and remember for use.

What if I’ve lost my phone and email access too?

Simply, carry your other remaining KBL documents and carry a valid ID proof (Pan card, Aadhar card), then visit your local branch to recover your account details, including Customer ID.

Why does Karnataka Bank sometimes call Customer ID “Login ID”?

Karnataka Bank uses one identifier internally. Branch staff say Customer ID or CIF, while digital systems label the same number as Login ID for MoneyClick and mobile banking access.

Can my Karnataka Bank Customer ID change if I close and reopen accounts?

No. Even if you close an old account and open a new one later, the bank usually reactivates your original Customer ID to maintain a single lifelong customer profile.

Why does OTP not arrive while using “Forgot User ID” online?

In most cases, the mobile number or email isn’t updated in core banking. Branch updates are mandatory before digital recovery tools work properly, even if your account is active. However, most of the time, it’s just a server issue. So, try after a few hours, not peak timing.

Can joint account holders retrieve the Customer ID digitally?

Usually no. Karnataka Bank maps Customer ID retrieval to the primary holder’s mobile number. Joint holders often need branch verification, even if they receive transaction alerts regularly.

Why is Customer ID needed before mobile banking activation?

KBL Mobile Plus verifies identity using Customer ID before MPIN creation. Without it, the app cannot link your account securely, even if debit card and OTP details are correct.

What is the fastest offline way if all digital access fails?

Visiting any Karnataka Bank branch with Aadhaar and account number works fastest. Staff can fetch your Customer ID instantly from CBS without waiting for emails or helpline callbacks.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.