Unlike most banks, SBI does not automatically issue a cheque book when you open a savings account via the YONO app or a branch visit. The bank only provides a passbook. But for a chequebook, you have to place an individual request through YONO, SMS, or your branch.

It mostly depends on your account type. For example, if you have an active (BSBDA) basic Savings Bank Deposit Account in SBI, then you are not eligible for a chequebook facility.

You can get a cheque book as you want, including how many leaves, such as you can order any 10, 25, 50, or 100, it usually depends on your account type (savings/current) and applicable charges.

SBI Bearer & Order Cheque books (Difference)

SBI provides multiple types of cheque categories –

Each leaf contains details like cheque number, account holder’s name (for personalised books), IFSC, and account number, but as per your account type, you can be eligible for these categories only –

- Bearer Cheques: Payable to the person holding the cheque. It is Useful for self-withdrawal, but risky if lost. Anyone holding it can withdraw money.

- Order Cheques: Payable only to the person named on the cheque. Safer for payments and Default in most SBI cheque books.

- Multicity Cheques: Usable at any SBI branch across India.

Tip for you – In digital zero-balance accounts opened via YONO (VKYC), only Bearer Cheques may be issued until you upgrade your account type via your home branch.

Digital Way to Request an SBI Cheque Book

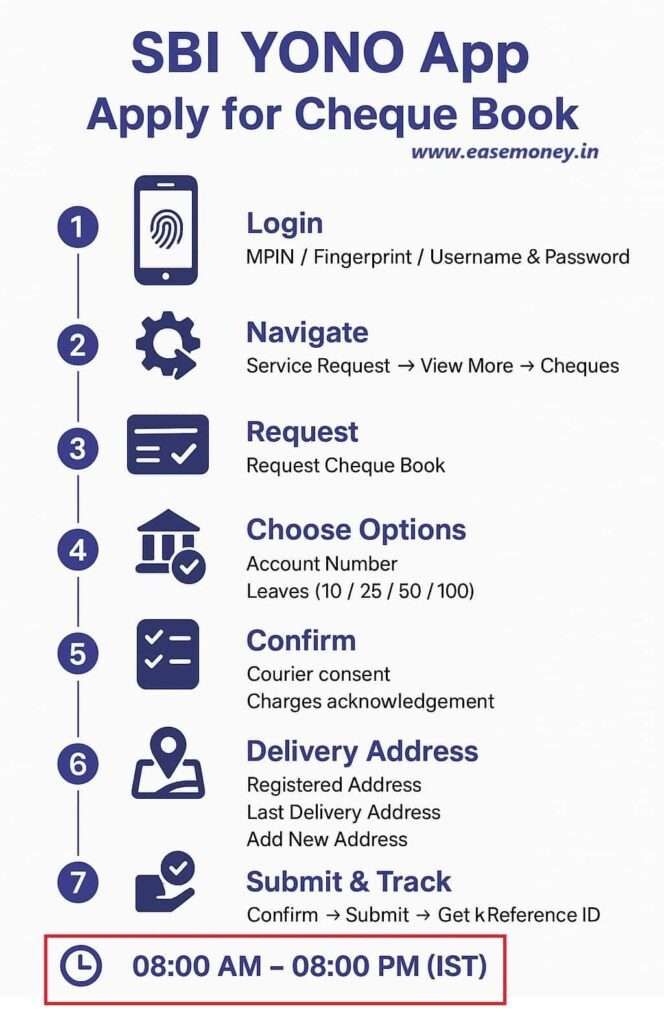

1. SBI YONO App

- First of all, this facility does not work 24/7; the timing is only between 08:00 AM – 08:00 PM IST (all weekdays)

- Open your YONO app, log in using your 6-digit mpin or fingerprint.

- If you are using first time, set your username and password using your debit card or branch token.

- After logging in, tap on Service Request (available at the bottom menu of the app).

- Tap on the view more button – you will get cheques.

- You will get multiple options, such as Stop Cheque, enquiry and more. Simply tap on the first option – Request Cheque Book.

- Select the Account for which you need the cheque book.

- Now, choose the number of cheque leaves: 10 / 25 / 50 / 100 (Charges apply depending on leaves). starts with 10, if using first time.

- Tick both options – “I agree to share my contact details with the courier” and “I am aware of applicable charges”, tap on the charges button to know the current rates.

- Here, select your delivery address. You can add a new (no document proof required), last Delivery Address, or your Registered Address (default). Select anyone and tap on Next.

- Review your details and tap Confirm.

- You will get a Reference ID (keep it safe for tracking and queries).

- Cheque book charges will be auto-debited from your account.

- All Set! You will get an SMS of confirmation when dispatched.

Bonus – for more personalisation, you can use the SBI online banking portal; the process is similar, you can also select the category of book you want, such as bearer or order cheques. multistate is by default.

What are the Direct ways to get an SBI Cheque Book without Internet?

Not everyone uses the internet or smartphone apps or finds more easier way. SBI provides offline and phone-based methods to order a cheque book easily, but with limitations of choices; for example, you cannot select how many leaves you want.

1. SMS Banking

- On your phone, you have to send an SMS and type “CHQREQ” to 917208933145 from your account-linked mobile number only.

- You will get an SMS reply with a 6-digit code. The SMS is like “your request is accepted, but pending for processing, to start the process, you have to send SMS again”

- Within 2 hours, send again and type “CHQACC <6-digit code>” to 917208933145 or 09223588888. At the end of the SMS, you will get this 6-digit number and text.

- Your request is confirmed once the consent SMS is sent.

- A 20-leaf cheque book will be issued and delivered via speed post.

2. Call SBI Contact Centre

- You have to call at SBI’s toll-free number 1800 1234 (from a registered mobile and only from 8:00 AM to 9:00 PM; however, it works 24/7)

- Select the language of choice – Hindi, English, Tamil, and more.

- Press 2 = “ATM Card & Cheque Book Related Services”.

- Press 4 = “Cheque Book Issuance”.

- Enter the last 4 digits of your account number if asked.

- A cheque book will be issued and sent to your bank-registered address, or you can collect the branch as well.

3. Branch Request Form

- You have to visit your home branch first and ask for a customer request form.

- Now, you have to fill up the SBI customer request form to issue a new cheque book-

- Use a blue pen and write down –

- Your branch name and date in the header.

- Enter your Full name in the applicate section and your full account number.

- Your mobile number and PAN card.

- Back side of the form, on 29 point (cheque related services) – tick the cheque book facility, enter your name, select how many leaves.

- Tick your address – registered, if not, add a new address.

- Your signature in the checkboxes.

- You also have to attach a scanned Aadhaar copy and a PAN copy.

- Submit to the branch counter.

How to get a cheque book from SBI immediately (Emergency)

If you urgently need cheques and cannot wait for a regular cheque book dispatch, SBI provides an instant 5-leaf emergency cheque book at the branch.

- Visit your home branch only and request for emergency cheque book.

- It is non-personalised (your name may not appear).

- Staff writes your account number manually.

- Issued within 30 minutes.

- Charges: ₹50 + GST for 10 leaves or part thereof.

What are the charges on SBI Cheque books

| Account Type | Free Cheque Leaves / Year | Charges After Free Limit | Special Notes |

|---|---|---|---|

| Savings A/c (Quarterly Minimum Balance of ₹25,000) | 10 | ₹3 per leaf | Based on the previous quarter’s balance |

| Savings A/c (QAB ≥ ₹25,000) | 10 | ₹2 per leaf | |

| Senior Citizen Savings A/c | 50 | ₹2–₹3 per leaf | Higher limit for seniors |

| Salary Package A/c | 50 | ₹2–₹3 per leaf | Bulk (>25/month) → ₹75 + GST |

| P-Segment/AGL Savings A/c | 20 | ₹2–₹3 per leaf | Limited concession |

| Current A/c (P-Segment) | 100 | ₹2 per leaf | Bulk (>25/month) → ₹75 + GST |

Notice: GST is applied extra on all charges.

What is the Cheque Book Delivery Time after ordering?

When you request a new cheque book from the State Bank of India, the processing and delivery are handled centrally. As per SBI rules, the delivery handled by India Post and the estimated time of delivery is 3 to 7 working days in metro and urban areas. For semi-urban and rural locations, it can take up to 10 days, depending on postal timelines.

This timing works for all book requesting options of SBI.

Where to Track SBI Cheque Book in YONO

- Open your Yono and tap the ☰ Menu (top left corner).

- Go to Service Request.

- Select Cheques.

- Tap on Cheque Book Dispatch Status.

- Choose Last 15 Days or set a Custom Date Range.

- The app will display your Cheque Book Tracking ID and dispatch estimated status.

- But you can copy this tracking ID and paste it on the India Post Site

- Here you can view live delivery updates of your cheque book.

Last tip – If your request is less than 48 hours old, the status may not appear; you have to wait.

Last Questions

How to download the SBI cheque book PDF?

Currently, SBI does not provide a cheque book PDF or any leaf download options. You have to order it physical book only.

What is the minimum balance in an SBI savings account with a cheque book?

For the cheque book facility, most SBI savings accounts require a minimum quarterly average balance of ₹25,000 to enjoy lower cheque leaf charges. However, you can apply it with no minimum balance required.

Can SBI stop cheque book facility if my account becomes inactive?

Yes. If your savings account stays inactive for long, State Bank of India may temporarily restrict cheque usage until reactivation through branch or YONO login. Even your cheque can be failed if SBI ask for Re-KYC or your KYC pending.

Is cheque book available for SBI digital banking accounts opened on YONO?

Yes, but not automatically. YONO-opened accounts must place a separate request, and some basic digital accounts may need branch upgrade before full cheque book access.

Does SBI allow choosing bearer or order cheques online?

Mostly no. Online requests usually issue order cheques by default. Bearer cheque options are limited and may require branch-level verification depending on account profile.

Can I cancel an SBI cheque book request after applying?

No. Once the request is confirmed and processing starts, it cannot be cancelled. You can only stop individual cheques later using YONO or internet banking.

Are SBI cheque books usable for business or commercial payments?

Yes, but only if issued from a current account. Savings account cheque books should not be used for regular business transactions as per banking and tax rules.

Will SBI issue a cheque book if my KYC is partial or pending?

No. Full KYC is mandatory. Accounts with limited or incomplete KYC may face rejection until documents are updated through branch or digital verification.

Does SBI provide digital cheque or e-cheque facility?

No. SBI does not support digital cheques or downloadable cheque PDFs. All cheque books are physical and centrally printed for security and compliance reasons.

Is cheque book usage still relevant in digital banking era?

Yes. Cheques are still required for legal payments, rentals, education fees, and mandates where digital transfers are restricted or not accepted.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.