ESAF Small Finance Bank started its journey as a Small Finance Bank on 10 March 2017. This date matters. By 2017, India had already seen the launch of UPI (2016), Aadhaar-based eKYC, and large-scale mobile banking adoption.

So unlike Gramin banks or many other RRBs, which were designed decades ago in the 1980s for branch-first banking, ESAF was built when digital banking was already normal. That’s why ESAF’s systems are more suitable for underbanked customers from tier-2 and tier-3 cities. even modern cities. Their digital banking, including netbanking, is simple, such as other big PSU Banks and Commercial banks.

As per the report by Whalesbook, in mid-2025, ESAF serves around 9.58 million (95.8 lakh) customers, and this number is growing fast. The growth is not accidental. It is driven by:

- PAN + Aadhaar-based account opening

- VKYC support

- Digital-first servicing

- Less dependency on physical branches

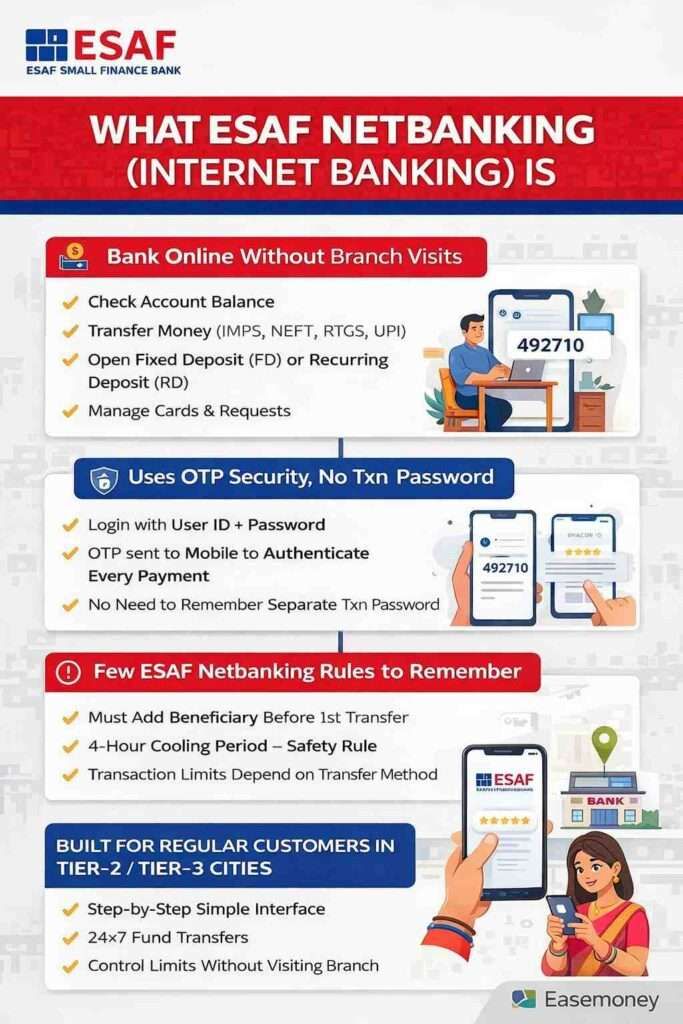

What ESAF Netbanking Is (Behind the Scenes)

ESAF Internet Banking is a full-service internet banking platform. It is not a side service; it is designed as a primary banking channel. It works for individual savings accounts and corporate netbanking as well. According to Yahoo News, they selected SugarCRM to Power Customer Relationship Management and Digital Banking for over 9 million Indian Customers.

Using netbanking, you can:

- Check balance and download statements

- Transfer money using IMPS, NEFT, RTGS and the clearing windows defined by RBI and NPCI

- You can manage your ESAF Credit card directly here.

- You can modify limits for cash deposit and, withdrawals, and fund transfers.

- Open FD and RD online

- Manage debit card and service requests

- Control transfer limits and beneficiaries

- Other service requests control, such as updating contact details, communication address, or seeding Aadhaar/PAN.

- You can access investment-related products: Insurance, Mutual funds, and Pension schemes such as NPS

- You can edit your profile, change your email, and user ID.

- You can activate or deactivate SMS Banking, Email statements, Debit cards and more.

- The ESAF dashboard also allows the Quick Pay facility for instant fund transfers without adding a beneficiary

In short, they have a wide range of services across financial transactions, enquiries, service requests, and value-added features, which you need. let’s find out you can access the netbanking easily –

First Thing You Must Understand (Very Important)

For registering first time at ESAF Netbanking, you will need your Customer ID or Number, and you will need your USER ID for login. Most importantly, they are not the same thing. Most people are confused here.

What is Customer ID?

In ESAF, the customer ID is known as Customer Number, and it is 12 digits long. It is system-generated and linked to your accounts, such as loans, credit cards, FD, and your savings. It is must required to generate your User ID.

Where You Can Find Your ESAF Customer ID

You can find the 12-digit Customer ID:

- In SMS or email received after online account opening

- On your bank statement

- In the welcome kit

- On the ATM card documents

- In the passbook

- Inside the mobile banking app (only after login)

- Your chequebook or physical statement (if you order)

- If no documents, you If no documents are available, you have to visit your home branch to retrieve.

Important truth for you: There is NO separate online option to “Forget Customer ID” if you are not already logged in to NetBanking or the mobile banking app.

What is a User ID in ESAF?

In ESAF, your user ID is used as a username for netbanking login, and you create it yourself during registration. It can be anything you like (subject to availability), and after login, you can also change it. Also, if you forget your USER ID, you need your Customer ID to retrieve it online.

In simple words, Customer ID is for verification. User ID is for login. Both are different and not interchangeable.

What You Must Have Before Using ESAF Online Banking

For first-time access, you need a few documents and details – Keep these ready:

- Active ESAF savings account

- 12-digit Customer ID (Must)

- Registered mobile number (OTP must come)

- PAN is linked to the account

- Aadhaar linked with the account

- Debit card (recommended)

Note- If your mobile + PAN + Aadhaar are linked, most users do not need to visit any branch. You can access Netbanking via mobile browser or desktop.

Browser and Device Reality (Real Experience)

From my real usage:

- ESAF netbanking works best on Chrome or Safari, both on mobile and PC

- A desktop or a laptop gives a smoother experience

- Old browsers often cause:

- Captcha errors

- OTP delay

- Page not loading

This is practical advice, not theory. Alternatively, you can download the ESAF Mobile app; the features are almost the same.

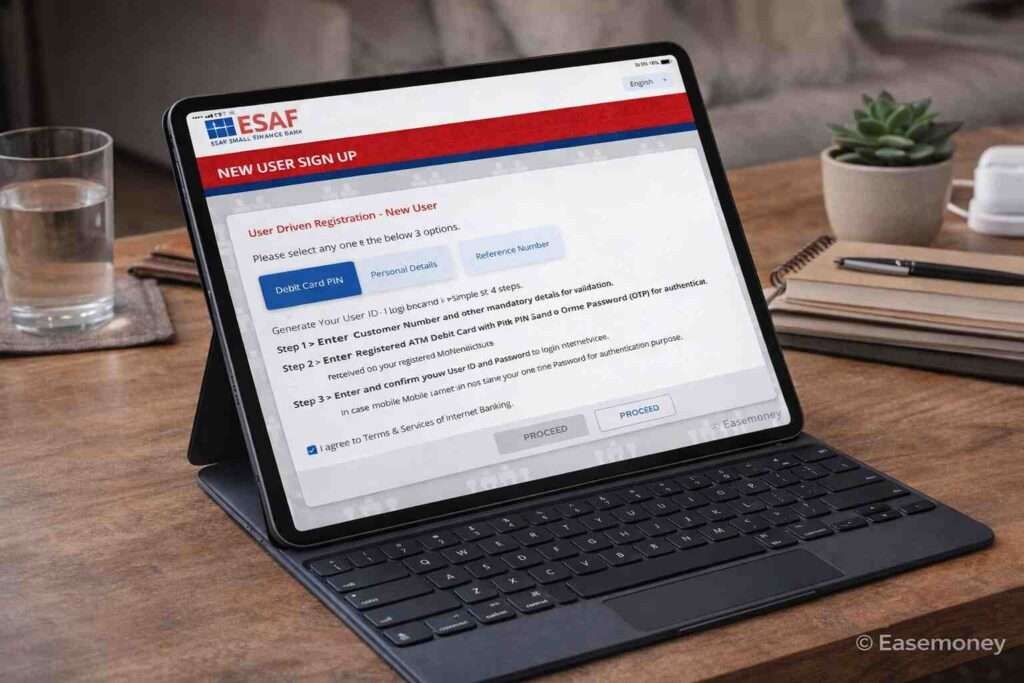

How to Register ESAF Netbanking (First Time)

ESAF provides User-Driven Registration with three methods. But in real life, all three do not work equally for many users. However, as per RBI rules for digital banking, ESAF really did well in providing smooth options to access it with safety.

To register, first of all, visit the official site – https://www.esaf.bank.in/ and tap on login (at the header), select Personal, and now tap on New User Enrollment.

Here, you have multiple options. Let me tell you the simplest option for you –

1 Method: Debit Card + PIN (Best Method)

- Select the Debit card option and tap on proceed.

- In the customer details section –

- Enter your 12-digit customer number or ID

- Select your Date of birth (as per bank records only)

- Put your debit card full number

- Select your Debit card expiry month and year

- Fill out the captcha fully and tap on proceed.

- Enter your debit card OR ATM PIN. (the same pin you use for withdrawing cash)

- After PIN, you will receive an OTP on your account-linked mobile number or Email ID.

- Simply, enter the 6-digit mobile OTP and tap on continue

- In the User details section –

- Create a user ID as per your choice (must be strong, and it depends on the availability)

- Set a strong login password.

- Registration usually activates immediately or within a few hours. You will get an SMS instantly for activation, and you can access NetBanking anytime now.

- Why this works best: It confirms identity, card ownership, and mobile number together.

Important design choice: ESAF does not use a transaction password. Every financial transaction is approved using the OTP sent to your registered mobile number. This reduces confusion for first-time digital users.

Method 2: Personal Details

In this method, the most important thing is that your Aadhaar linkage with the Account is mandatory; if not, you have to proceed with the other registration option. If linked, the process is really simple.

- You must match any 3 details from –

- DOB

- PAN

- Mother’s maiden name

- Mobile number

- Email ID

- After selecting any of the three, such as DOB, PAN, or your mobile number.

- Submit the customer ID, and fill in these 3 details correctly as per the bank records and aadhaar records.

- Enter your aadhaar number and enter your mobile OTP. Most importantly, your account-linked mobile number must be linked with your Aadhaar as well.

- After OTP confirmation, set your user ID and confirm it.

Real issue:

- Bank KYC data may be old

- Aadhaar data may be updated later

- Mother’s name spelling mismatch is very common

Even if Aadhaar is correct, the system checks bank records, not Aadhaar. This failed a lot due to a mismatch of information, so choose the debit card method if it does not work.

Method 3: Reference Number (Branch Assisted)

This is a basic branch token-based ESAF net banking option. However, a customer ID is still required for this method. The process is –

- Visit your home branch and from the help counter ask to generate a branch token or reference number for you. (You do not have atm card, and the application form is not required here)

- This branch token only works for 24 hour so, so once you got, open the NetBanking portal and register it.

- Simply enter it and put your mobile OTP.

- Done, set your details.

This method fixes backend data mismatch issues.

Steps to First-Time ESAF Account Login Flow (Happens Only Once)

Once you get the User ID and password, you can log in via the same portal –

- Go to the netbanking login page – https://www.esaf.bank.in/channel/personal-net-banking/

- First, put your User ID + Captcha and tap on continue to log in

- Enter Login Password

- Enter 6-digit OTP

- Select one security image (e.g., travel, flowers, nature) and enter its name; this step only occurs the first time.

- Confirm and log out again.

That selected image becomes your secure login image.

Why this exists:

- Helps detect phishing pages

- Confirms you’re on the genuine ESAF portal

From next login onwards:

- You must tick the image

- Then enter the password

- OTP still applies

Forgot ESAF User ID – How to Get It Back

If you forget your User ID, ESAF allows recovery using:

- Debit Card + PIN + OTP –

- Personal Details + OTP

- Reference Number + OTP

Note – Your Customer ID is required in all cases. In simple terms, the process is identical as you do while activating the NetBanking.

ESAF Forgot Password – How to Reset

If User ID is known, it is simpler than –

- Go to the login page and enter your USER ID and Captcha.

- Tap Forgot Password (Below in the password section)

- Choose verification method – there are three options to do that, including a branch visit.

- Verify via OTP

- Set a new login password

There is no transaction password to reset. Only the login password exists.

When You Must Visit a Branch (And When Not)

No Branch Visit Needed If:

- Mobile number linked

- PAN linked

- Aadhaar linked

- OTP comes properly

Branch Visit Needed If:

- Mobile number not registered

- Aadhaar not seeded

- PAN mismatch

- The personal details method keeps failing

Most “Invalid Information” errors happen because of old KYC data, not user mistakes.

How Netbanking Money Transfer Works in ESAF (Real Rules & Limits)

In ESAF Small Finance Bank, netbanking money transfer is simple to use but controlled with clear safety rules. The idea is fast banking, but with limits that protect customers from fraud.

How the transfer flow works

First, you add a beneficiary (payee). After adding, an OTP comes to your registered mobile number. Once verified, the beneficiary is added, but you cannot send money immediately. ESAF applies a cooling period of 30 minutes to 4 hours. In many cases, new beneficiaries are restricted to about ₹50,000 for the first 24 hours. This is a security rule, not a technical issue.

Transfer limits you should know

- NEFT: Generally allowed up to ₹2 lakh per day for regular savings accounts.

- IMPS: Also commonly up to ₹2 lakh per day, instant and available 24×7.

- RTGS: Used for big transfers. No fixed upper limit, apart from your available balance and bank controls. Minimum is ₹2 lakh.

- UPI (BHIM ESAF or linked apps): Usually ₹1 lakh per day. In some accounts, it may be lower (around ₹40,000).

- Own ESAF accounts: No specific limit, only your available balance.

Important reality

Limits can change based on account type (savings or current), beneficiary status, and bank settings. Always check limits inside NetBanking or confirm with customer care for exact numbers.

FAQs

Why does ESAF netbanking show “Invalid Information” even when details are correct?

Most times, bank KYC data doesn’t match Aadhaar or PAN exactly. Small spelling or format differences cause failure. It’s a backend issue, not user error.

Is the ESAF Customer ID the same as the User ID for netbanking login?

No. Customer ID is a 12-digit bank number for verification. User ID is created by you for login. Both are separate and used differently.

Why can’t I transfer money immediately after adding a new beneficiary?

ESAF applies a mandatory cooling period. New beneficiaries are temporarily restricted to reduce fraud risk, even though OTP verification is already completed. However, you can use the quick pay option or UPI for immediate transfer.

Do I need to visit the branch for ESAF netbanking activation?

Only if the mobile number, PAN, or Aadhaar is not linked. If all three are mapped correctly, netbanking registration and reset usually work fully online.

Why does personal-details registration fail more than the debit card method?

The personal details option depends on old bank records. The debit card method verifies real ownership, so it succeeds more often without data-mismatch issues.

Why are transfer limits different for IMPS, NEFT, RTGS, and UPI in ESAF Small Finance Bank?

Each method follows RBI and bank-level risk rules. Limits also depend on account type, beneficiary status, and your self-set netbanking controls.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.