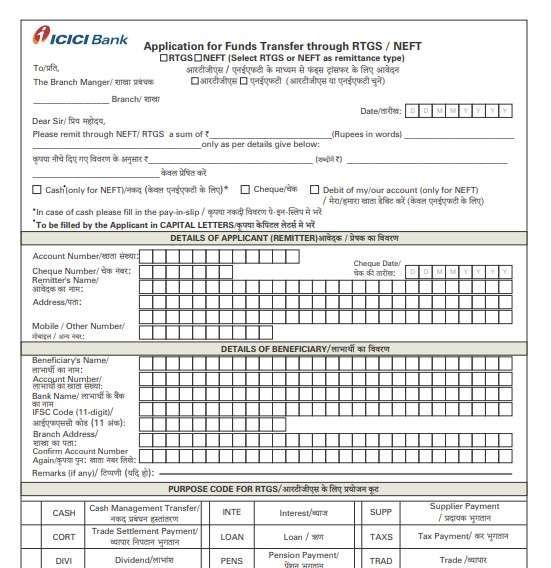

Unlike other government banks, ICICI uses a single bilingual (Hindi/English) form for customers like you. This form is like a paper slip for branch-based money transfers. works for both RTGS and NEFT transactions.

All you have to do is – At the very top of the form, you must simply tick RTGS or NEFT, depending on the type of transfer.

This design avoids confusion for you. ICICI also provide account holders the forms in their city’s local language, such as Tamil, Kannada, and Malayalam.

Where to Get the Blank RTGS/NEFT Form

- At Branch Counters – If your branch is RTGS-enabled, you can get an RTGS form at the stand near the deposit counter. You can also ask for the form at the enquiry counter.

- Download PDF – You can get a digital version of the form at the money transfer section in the ICICI Netbanking portal. You can download and fill it up using PDF editors like Sejda and submit it to the branch; however, make sure your branch accepts digital copies of forms.

- Multiple languages PDF – Many ICICI branches, such as the southern states of Tamil Nadu, Karnataka, and Kerala, provide forms in local languages.

- Branch Restrictions – Not all ICICI branches are RTGS-enabled. Smaller branches may only process NEFT. Please confirm with your branch if you plan to transfer an amount above ₹2 lakh.

Steps to Download ICICI Bank RTGS/NEFT Form

You will get the official PDF file only at the form centre of the ICICI website; however, for general practices, you can download it here –

| Download |

It may accepted on branches but depending on your branch rules; it is just for knowledge purposes only.

How to Fill the Form Correctly (Step by Step)

When you look at the ICICI RTGS/NEFT form for the first time, you may feel hundreds of boxes and bilingual text. To make it simple for you, here is a clear step-by-step guide:

The form has two sides, you have to fill out both, start with the front –

1. Write Date and Branch

- Use good handwriting, only Capital words (ABC), and start with your current date.

- Mention your ICICI Bank branch name.

2. Choose Transaction Type

- Now, Tick RTGS or NEFT at the top.

- You can only use RTGS if the transfer amount is more than ₹2 lakh.

3. Put Down Amount and Payment Mode

- After the Dear Sir section, enter your amount in Rs. digits and words. For example, Rs. 200000/- and Two Lakh only.

- Select your payment mode – Cheque works for RTGS/NEFT. But Cash and my account debit work only for NEFT fund transfer.

- Cash for NEFT is allowed only up to ₹49,999. Also, you may fill up a pay-in-slip.

4. Details of Applicant box (Your banking Information)

- Remitter Name: Write down your full name as per your passbook.

- Account Number: Your ICICI Bank account from which funds will be debited.

- Address: Fill in your complete residential or business address.

- Mobile Number: For SMS alerts and UTR tracking.

- Cheque – put down your 6-7 digit cheque number and date, if paying via cheque for RTGS only.

5. Beneficiary Details box (Receiver’s Information)

- Name: Full name of the beneficiary.

- Account Number: Enter carefully, then confirm it again in the box below. where your money will be credited.

- IFSC Code: It is important, write only the correct IFSC for no delay.

- Bank Name: Provide your Receiver bank’s full name in boxes.

- Branch Address: City and branch.

- Remarks: It is optional, but you can fill it in as “Invoice Payment”, “Loan Repayment”, or “Fees”.

6. Purpose Code (Optional, ask with your branch if required)

- Select from the codes printed on the form (e.g., SALA = Salary, LOAN = Loan, SUPP = Supplier Payment).

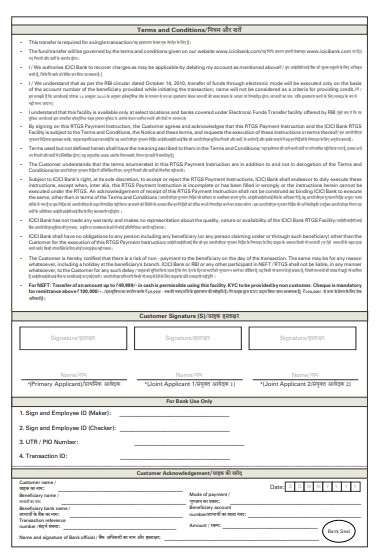

7. Back side of your form – Your Signature

- In the Customer Signature section, write down your name and sign.

- Joint account holders must all sign.

- You can also read the terms and conditions.

Tip for you – Use a regular pen and avoid overwriting if you enter any wrong information, such as the account number or IFSC, ask for a new form.

Charges for RTGS and NEFT at ICICI Bank (2025)

The form is offered free of cost; however, the mode of payment attracts charges + GST depending on the amount being transferred. For example-

NEFT (Branch)

If you transfer –

- Rs. 10,000 or above = The charges are Rs. 2.65 including GST.

- If Amount – Rs. 10,001 – Rs. 1,00,000 = Rs 5.60

- Rs. 1,00,001 – Rs.2,00,000 = Rs. 17.40

- Above Rs. 2,00,000 = Charges Rs. 29.20

RTGS (Branch)

- For amounts above 5 Lac = the charges are ₹53.10 including GST.

- 2 Lac to 5 lac = the fee is Rs. 23.60.

Insight – if you do an online money transfer using NEFT/RTGS methods, the transaction fee is zero. You can use the ICICI iMobile App or Netbanking for that.

How much Processing and Settlement Time does it take?

- RTGS Transfer timing – As per ICICI, the settlements of amounts usually happen within 30 minutes of submission at the branch. However, it may take a maximum of 2 hours, depending on the branch’s heavy load scenarios.

- NEFT timing – Generally, it takes up to two hours to reach to the beneficiary successfully, but in most cases, it takes upto 4 hours.

How to Track RTGS/NEFT Transactions

Every transaction generates a UTR (Unique Transaction Reference) number; you can ask for this number from the ICICI counter; it is usually printed on your acknowledgement slip on the back side of your form you filled up.

Ways to use the UTR:

- Branch Tracking: You have to provide your UTR at your branch to check the status.

- Customer Care: Call ICICI support and quote the UTR.

- Beneficiary Bank: The Recipient can use the UTR with their bank to trace funds.

- SMS Alerts: Debit and confirmation alerts are usually sent automatically.

In case your fund is not credited within the expected timeframe, the UTR is the only reliable reference to trace the transfer.

ICICI RTGS and NEFT – Branch Timings for transfer & Limits

| Service Type | Branch Timings | Minimum Limit | Maximum Limit (per day, branch) |

|---|---|---|---|

| RTGS | Monday–Saturday (not included 2nd & 4th Saturdays): 9:30 AM – 4:30 PM | ₹2,00,000 | ₹10,00,000 |

| NEFT | Monday–Friday: 9:00 AM – 5:30 PM; Saturdays (not on 2nd & 4th): 8:00 AM – 6:30 PM | ₹1 | ₹10,00,000 |

Add-on Questions for ICICI transactions

What documents are required if I deposit cash for NEFT at ICICI Bank?

You only need to fill out the NEFT form with the beneficiary’s details. However, for cash deposit upto Rs. 50,000, the branch counter may ask you to fill out your PAN number.

Can I transfer 20 lakhs through RTGS ICICI?

Yes, you can, but only from the iMobile Banking App and branches; by default, ICICI Netbanking is capped at 10 lac only for RTGS. Also, it mostly depends on your account type.

Do ICICI branches still verify RTGS/NEFT forms manually in 2026?

Yes. Even in 2026, branch staff manually verify beneficiary account and IFSC before processing. Tip: clear handwriting reduces re-verification delays, especially during peak hours like 12–3 PM.

What happens if the IFSC is correct but the branch name is wrong on the form?

Money still credits correctly because IFSC and account number matter most. Idea: branch name mismatch rarely stops transactions but may slow manual checks at counters.

Can RTGS/NEFT forms be rejected due to a signature mismatch?

Yes. Signature mismatch with bank records is a silent rejection reason. Branch experience shows updating signature beforehand avoids delays, especially for joint accounts and senior citizen customers.

Why do some ICICI branches stop accepting RTGS forms early?

Due to internal cut-off and settlement batching. Idea: submitting RTGS before 2:30 PM gives the best chance of same-hour settlement on busy banking days.

Can mistakes on RTGS/NEFT forms be corrected with overwriting?

No. Overwriting is usually rejected. Branch practice: take a fresh form if the account number or IFSC is wrong—this avoids audit flags and processing holds.

Is UTR always generated immediately for branch RTGS/NEFT?

Not always. UTR is generated after system posting. Tip: wait 10–15 minutes post-submission before asking counter staff for the UTR reference.

Branches help trace failed transactions faster. Idea: for large or urgent payments, branch RTGS gives human follow-up support, which online channels can’t always provide.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.