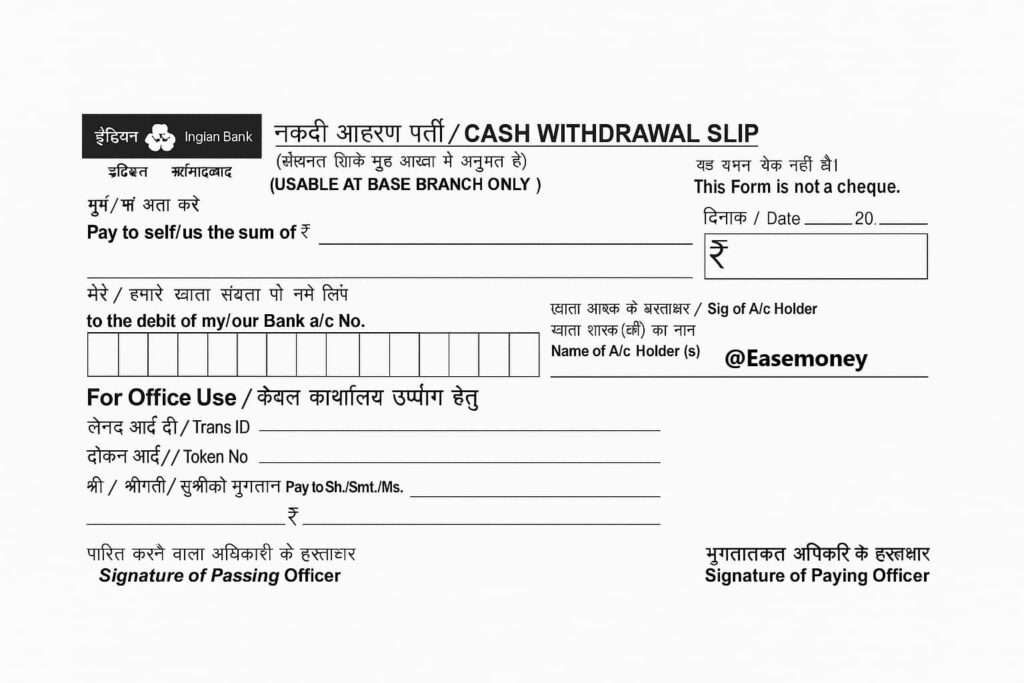

A withdrawal slip is a small paper form issued by the Indian Bank; it is quite like a cheque leaf. But it works differently; it allows you to withdraw cash from your savings or current account directly at the branch counter.

This slip is designed specifically for self-withdrawals and is generally limited to use at the base branch where the account is maintained. Also, your passbook is required while processing the withdrawal request.

It is accepted for merged bank accounts also such as Allahabad Bank.

Where to Get the Withdrawal Slip

- Usually, you can find pads of slips only at Indian Bank branches near the cash counter.

- You can ask for a slip from the cash counter or the “Customer Help” staff.

- No proper PDF or editable version is provided by the branches.

- Sample images online are for practice/reference only.

- Each slip is branch-specific, so photocopies or internet versions will not work.

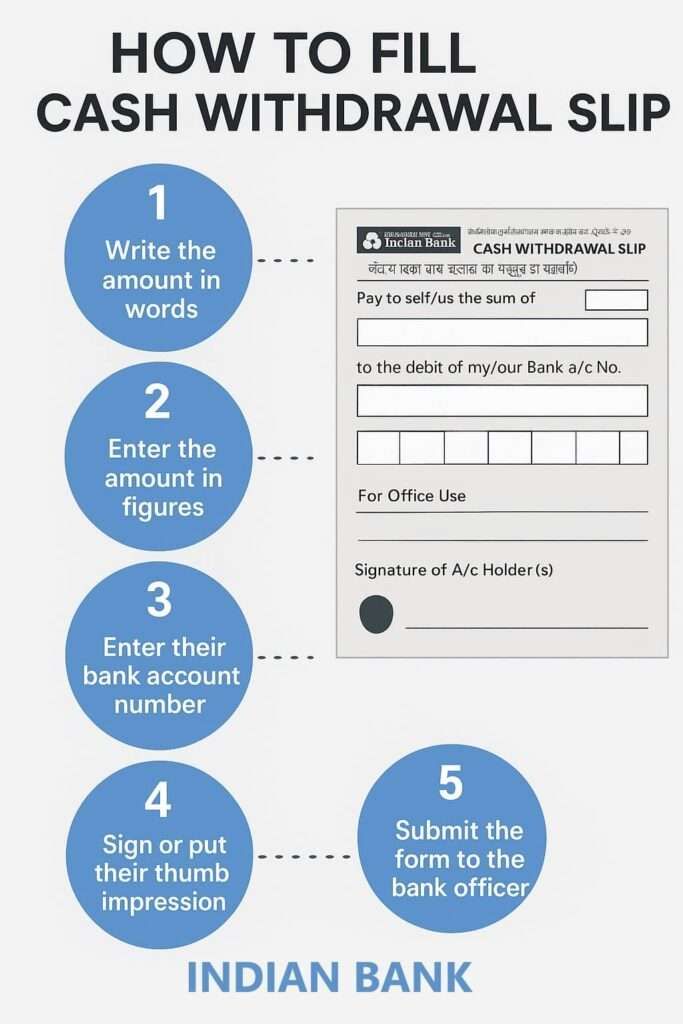

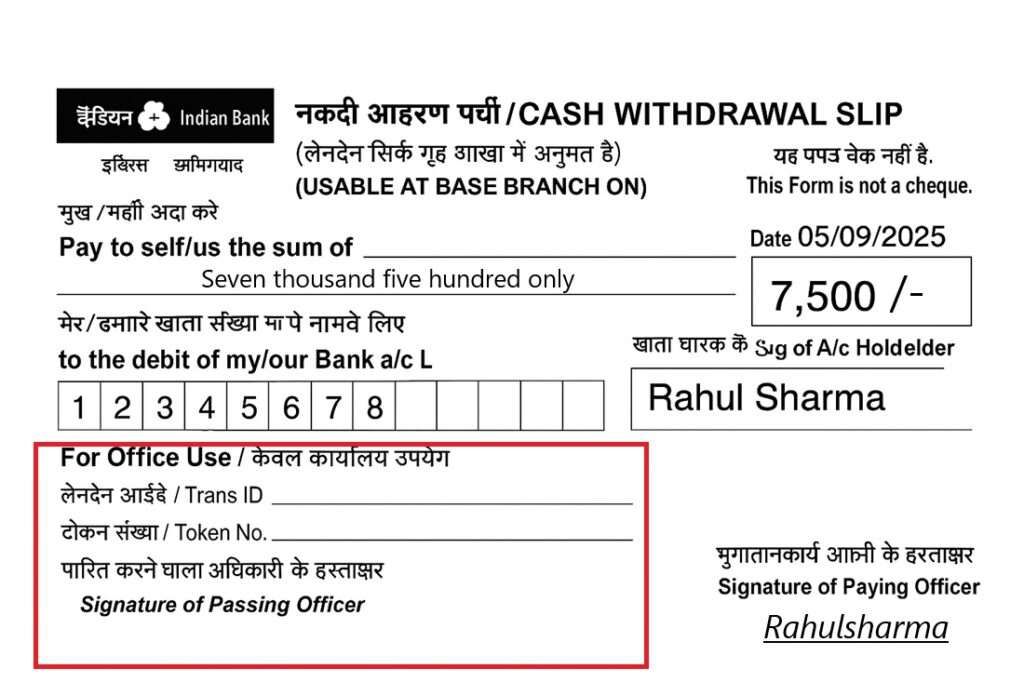

Filling the Indian Bank Cash Withdrawal Form Correctly

After you get your slip, it needs to be filled out properly so it is accepted by the cashier quickly. Here are the steps –

1: Write down the Date

You can use a regular blue or black ink ball pen and start writing from the top right corner. First of all, put the current date in the DD/MM/20YY section. Without a date, the slip will not be accepted.

2: The Amount in Words

On the line beginning, you will see “Pay to self/us the sum of Rs.” Here, you have to enter your withdrawal amount in words and put “only” at the last. such as – “seven thousand only”

Depending on the branches, languages are accepted – Hindi, English, Tamil, and other local languages.

3: Write the Amount in Digits

Just right side, there is a box marked with the ₹ symbol. Enter your amount in digits. for example – 5000 or 10000 and add “/-” at the end = 5000/-

4: Your Account Number

Now, write down your 9 to 15-digit account number in the squares provided without missing any boxes in between.

5: Mention the Account Holder’s Name

in the space provided. Note down the name of the account holder. You can check your passbook for the exact name. If you have a joint account, follow the format recorded with the bank.

6: Sign or Use Thumb Impression

Sign within the designated signature box exactly as recorded in bank records. If the customer cannot sign, a thumb impression is accepted: left thumb for men and right thumb for women.

A bank officer may ask for ID proof, such as an aadhaar, when a thumb impression is used.

Also, your sign must require the back side of the slip.

7. Fill the Reverse Side (Optional)

Now, just flip your slip and here you will get a cash denomination table, which allows you can specify the type of bank notes or coins you want, for example:

- ₹100 × 10

- ₹2000 × 2

- ₹500 × 6

- ₹10 OR 20 Coints x 50

However, this is not mandatory because the cashier will ultimately give denominations based on the availability of the branch.

8: Leave the “For Office Use” Blank

Don’t worry, most of the stuff is handled by staff, not you. Simply, you can ignore the token number, the Transaction ID, officer’s signature fields.

9: Submit with Passbook

If asked at the withdrawal counter, you also have to attach your passbook and hand it to the cashier. The cashier will verify the details, update the passbook, and issue a token for cash payment.

10: Collect Cash Safely

You may have to wait for 10 to 20 minutes. When your token is called, count the notes at the counter before leaving. If you requested denominations, check if they were provided as per availability.

Differences Between an Indian Bank Slip and a Cheque

- Withdrawal Slip: Restricted to home branch, lower limits, requires a passbook, quicker for routine amounts.

- Cheque: Usable at any branch, suitable for higher amounts, requires only signature verification, and no passbook is needed.

- Practical Use: You can use both options, a withdrawal slip for small cash withdrawals and a cheque for large withdrawals.

Cash Withdrawal Range and Limits in India Bank Branches

The minimum amount starts from Rs. 1000 from the branch, usually the lowest accepted through a slip.

- Practical Range: You can withdraw anywhere between ₹1000 and ₹10000, but the actual payout depends on:

- The type of account (savings, current, overdraft).

- Daily withdrawal limits are set by the bank (₹10,000 is common for basic zero balance savings accounts).

- Cash availability in the branch on that day.

- Prior arrangement with branch officials for larger sums.

- client urgency, if any emergency, health, or marriage urgent amount required.

- If you have a premium account, you may be permitted higher withdrawals, sometimes up to ₹50,000 or more in a single transaction.

- Beyond Standard Limit: Requires advance notice, approval, and in some cases, a cheque instead of a slip.

What if I’m at a non-home branch of Indian Bank, still make a cash withdrawal?

The slip itself says “USABLE AT BASE BRANCH ONLY.” However, yes, you can withdraw a basic, limited amount as per the branch norms. You will have to provide your bank passbook.

How to download a PDF of the Indian Bank withdrawal slip?

According to the database of the Indian Bank site, they do not provide an official PDF download of withdrawal slips. There are only a few duplicate samples for practices available online that do not work on branches.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.