What Does CIF Mean in Simple Terms?

CIF stands for Customer Information File. It’s also known as a customer ID, which is a unique number assigned to each customer, not each account.

It’s not the same as an account number — instead, it ties together all your relationships with the bank.

Let’s say you have a savings account, a fixed deposit, and a credit card with Indian Bank — all these are tied together using your single CIF number.

How Many Digits Are in a CIF?

Usually, the CIF number is an 11-digit number. for example: 92011345789. But here’s something interesting: due to older systems or the internal policy of Indian Bank, some account holders may have a shorter or longer CIF. So, it can be 6 to 12 digits long, depending on when and where your account was created.

Why Does Indian Bank Use CIF?

Allahabad Bank merged with Indian Bank on April 1, 2020, making it the seventh-largest public sector bank in India with a Revenue of ₹71,225 crore (~US$8.4 billion) in 2025, and the bank serves more than 100 million customers across the country and NRI.

Now, with over 100 million accounts to manage, the bank must keep track of each customer’s data in an organised way and ensure easy banking. This is where CIF comes in. It stores all your data, such as KYC, transactions, services used, and communication history.

So now that you understand what a CIF is and why it’s important, now, suppose you just opened an account and want to log in to netbanking, but your documents and login info, not been delivered yet. So, try these options to retrieve your CIF –

How to Find CIF Without a Passbook or Registering?

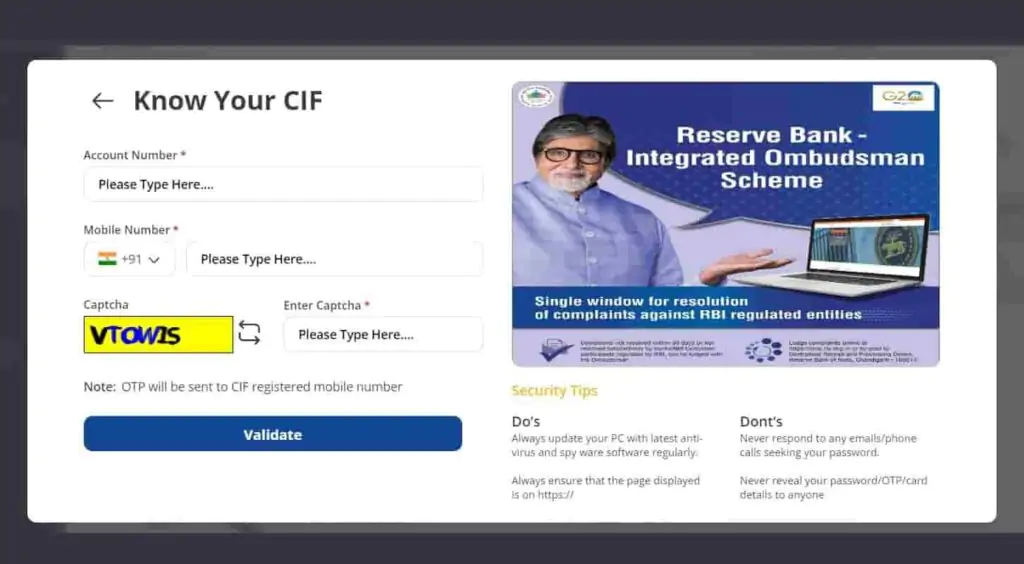

If you lost or forgot both your passbook and login details, your best and first option is to use the “Know Your CIF” official tool on Indian Bank’s INDSmart portal. This does not require a login and only needs your account number and mobile number.

Go through these steps one by one:

- First, you have to visit the official website – indianbank.net.in.

- Tap on the Internet banking option and select login via the IndSMART option.

- On the login page, find the “Register New User” option to begin a user registration setup.

- From the list of options, choose “Know Your CIF Number”.

- Here, input your full Indian Bank account number and account-registered mobile number in the form.

- Solve the captcha and tap on on “Validate” button. A 6-digit OTP will be sent to your registered mobile number.

- Type in the OTP to verify your identity.

- Once verified, your Full Account CIF number will be:

- Displayed on the screen, and

- Optionally, you can select CIF via SMS or email for future reference.

Note: Let me clarify this, the old Indian Bank net banking method does not support the “Know Your Customer ID” feature. You have to select the indSMART option only.

What Are the other Digital Ways to Locate an Indian Bank CIF?

These alternatives are also better to try, if you have already logged in for these indian bank digital products, then your CIF is just a few clicks away. If not registered, don’t worry, follow these steps –

1. Using the Indian Bank IndSMART Mobile App

In 2024, the Indian bank completely discontinued IndOASIS, their old mobile banking app; however, the bank’s official launched the IndSmart Mobile banking app in 2024-2025. It is smart and supports additional features, and is Available for Android and iOS. This app also gives the facility to find the customer ID with a click. Here are the steps to retrieve it –

- Simply, go to the Play Store or App Store and install the Latest IndSmart App.

- Open a New indian mobile banking app and accept the terms.

- Tap on the register for the first-time user.

- Select the “Forget CIF” option.

- Enter your account number and registered mobile number.

- Enter the 6-digit OTP you receive on your phone.

- Your CIF will be shown on-screen. Copy or write it for future use.

Already Logged In?

If you are already using the indSmart app and looking for your ID number, it’s just a few steps away –

- Open the app and log in using a 6-digit MPIN or fingerprint.

- Tap on “Account Details,” just below your bank balance option.

- Select your account number and name, and tap on View More.

- You will see your CIF labelled as “Primary CIF” or “Customer ID.”

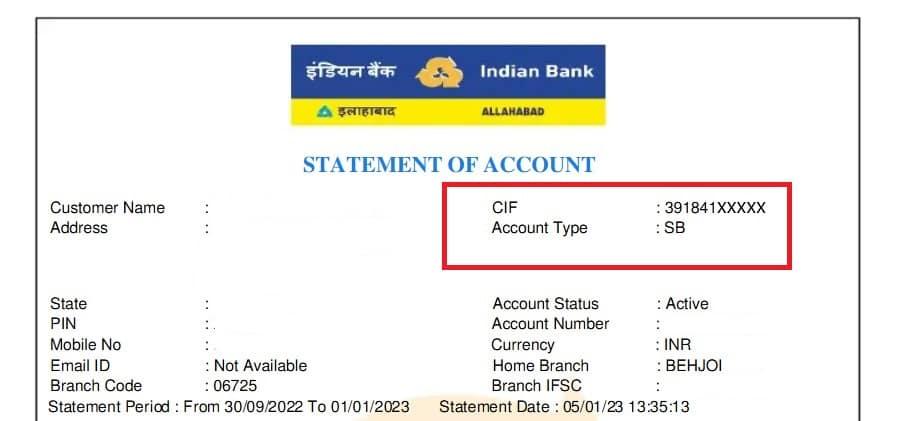

2. Indian Bank mPassbook statement

Recently, an Indian bank also removed the standalone mPassbook app; however, the feature is still working. The feature now exists inside the IndSmart app. The mpassbook is a digital version of your account passbook; it contains your CIF. To find it out, here are the steps to follow –

- Open the PDF and scroll to the top — your CIF is printed there, usually under the bank logo or customer details.

- Open the IndSmart App and log in.

- Tap on “mPassbook” just below your account balance and overview section.

- Select your account number and select month.

- Tap on the Download icon (usually PDF).

- To open the PDF file, you need to enter the password. The password is your full account number.

3. INDSmart Web Portal After Login

If you have login access, your CIF is visible inside your account dashboard.

- Go to the official site, tap on personal banking by IndSmart.

- Enter your login details: login ID, Password, Captcha, and OTP digits.

- In Profile settings, tap on edit details, and view your CIF.

- If not found, tap on View Your Statement, and find your CIF in the header.

Tips for Smooth Digital Access

- Make sure your mobile number is registered with your bank account.

- Use the latest version of the IndSMART app

- Don’t search CIF in email statements — it’s not included due to security policies

- Browser access via laptop or desktop using the INDSmart portal

How to Retrieve CIF Without Internet or Passbook?

If you lost your documents and want direct support from the bank, you can simply call them. Here are the working 24/7 helpline numbers available by Indian Bank for users.

- National Toll-Free Number: 1800 425 00 000

- Available: 24/7, but to connect with a bank executive, call 9 AM to 6 PM on working days only.

What You Will Need:

- The last few digits of your account number

- Your mother’s name

- Date of birth or PAN (for verification)

Once verified, the bank representative will tell you your CIF over the call or guide you on how to get it securely.

Visit the Nearest Indian Bank Branch

Still can’t find it? Just visit your branch.

You have to carry:

- Your PAN card, aadhaar copy, or any government-issued ID

- Your account number (if you remember it) or your Debit card

- Any supporting documents you have, such as a driving license, a Passport, or government-approved papers.

Pro Tip: If you’ve lost your passbook or the CIF isn’t printed on it, request a new passbook at the branch. They usually print the CIF on the new one automatically.

Are Allahabad Bank Customers Assigned a New CIF After the Merger?

After the 2020 merger of Allahabad Bank with Indian Bank:

- Most customers retained their original CIF

- In some cases, a new CIF was issued when systems were integrated

If your login doesn’t work or you see a mismatch, contact your branch to confirm your current CIF.

Frequently Asked Questions

Can I get the Indian Bank CIF number via SMS directly?

No, for now, there is no direct SMS banking method to recover your CIF via SMS. But you can view or receive it via SMS through net banking.

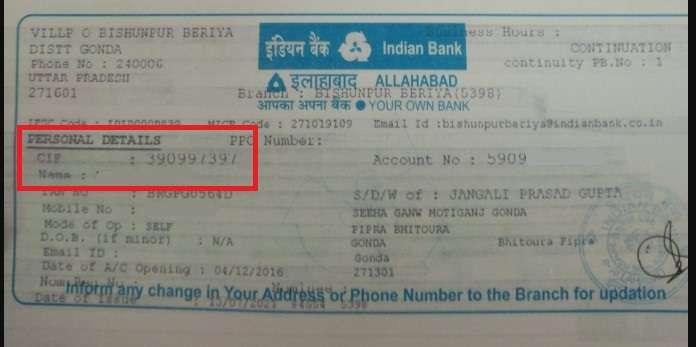

Where Else Can You Find Your Indian Bank CIF offline without visiting the branch?

Check your old passbook, usually printed on the first page, near the account info and a Stamp from the bank. Furthermore, try a chequebook, a Welcome letter, a credit card kit, and any older physical duplicate statement copies you have.

Is the Indian Bank CIF number the same for savings and FD accounts?

Yes. One CIF links all your relationships with Indian Bank, including savings, fixed deposits, loans, and other services. Your credit card or any personal loan also comes in it to track it.

Can two joint account holders have different CIF numbers?

Yes. Each joint holder has their own CIF. The account is linked to multiple CIFs, but one primary CIF is usually marked for operations.

Does the CIF number change if I change my branch or city?

No. Your CIF remains the same even if you transfer your account to another branch or relocate to a different city.

Is CIF required for pension or government benefit accounts?

Yes. Pension, DBT, and government scheme accounts are also linked to CIF for identity verification and benefit tracking.

What happens to CIF after closing all accounts in the Indian Bank?

Your CIF stays in the bank’s records but becomes inactive. If you open a new account later, the same CIF may be reactivated.

Can CIF be blocked or frozen by the Indian bank?

Yes. CIF can be restricted if KYC is incomplete, documents expire, or suspicious activity is detected. Updating KYC usually restores access.

Is CIF required to activate Indian Bank debit card?

In many cases, yes. CIF is used during net banking or mobile banking registration, which is required for debit card PIN generation.

Can CIF be misused if someone else knows it?

On its own, CIF is not enough for fraud. But combined with account details or OTP access, it can be risky. Keep it confidential.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.