Cheque Book Facility and Account Types

Kotak Mahindra Bank provide a cheque book across most of its account types; however, the availability and costs change and differ depending on whether the customer holds a digital 811 account, a regular savings account, or a current account.

If you have a Digital account, you have to know that Kotak does not allow cheque books at all until full KYC is completed, while premium and current accounts allow generous free cheque leaves each year.

What are the basic charges for cheque books?

As per the Kotak 1 June 2025 new charges, for most standard savings accounts in Kotak Bank, the basic cheque book charge is:

- Free up to 25 cheque leaves per year.

- After free limit: ₹3 per cheque leaf

| Account Type | Cheque Book Facility | Free Leaves | Charges (after free limit) |

|---|---|---|---|

| Everyday Savings | Yes | Only 25 Cheques (yearly) | Rs. 3 Per leaf |

| Ace Savings Account | Yes | Nil | At-par Cheque Book Fee |

| Synergy Savings | Yes | 25 leaves | Rs. 3 after that |

| Sankalp Account | Yes | 10 Leaves | ₹3 per leaf after |

| Financial Inclusion Savings | Yes | 1 free cheque book | Charges after free book |

| Professionals (savings account) | Yes | 25 | Rs 4 (normal) and senior citizens (Rs 3) |

However, the Kotak 811 product range follows a different structure. Here, cheque books are issued only on request.

Key Points to touch –

- Premium/wealth-linked variants may have higher free limits or reduced per-leaf charges.

- Some salary accounts have additional free quotas upto 25 leaves, it usually depends on the employer tie-up.

- Older discontinued variants like Pro Savings, Classic, Edge Savings, Nova, Sanman, Platina, and ACE Wealth still follow the original charge structure (usually 25 free leaves annually, then ₹3 per leaf).

For 811 How to Order Kotak 811 Cheque Book

After opening a digital account, you have to make a manual request for a cheque. After 2025, Kotak re-launched the 811 new app and closed old services and applications after that. As of Moneycontrol release on sept 2025, Kotak811 has 16 million downloads, which is a 250% growth compared to YONO and other neo-bank apps.

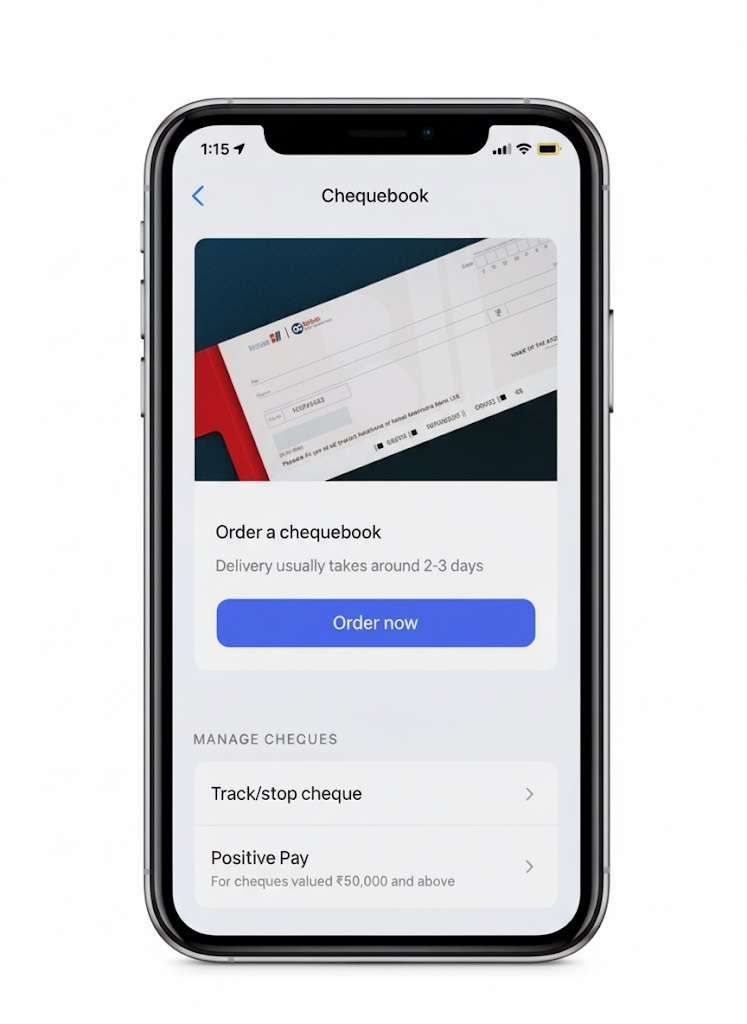

First of all, you have to download your Kotak 811 app from the Play Store or App Store. For requesting, here are the steps –

- Now, Log in with 6-digit MPIN or Face ID.

- Tap on Bank (header top)→ scroll down to Activity Zone section → pick Cheque Book.

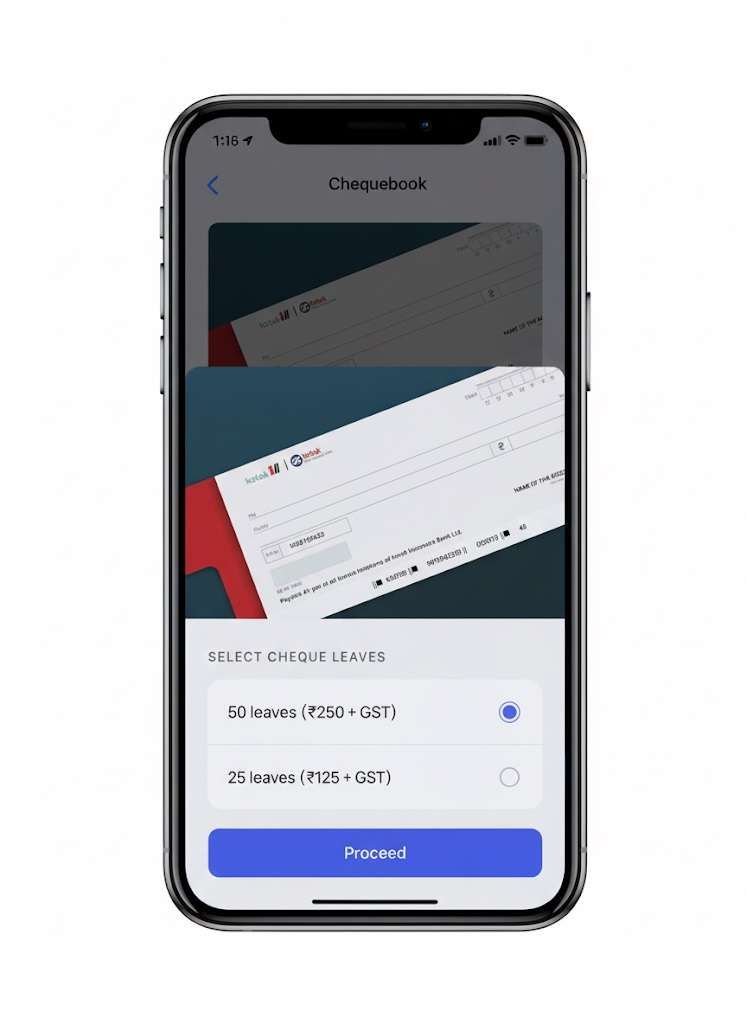

- Tap Order Now and choose the number of leaves (25 or 50).

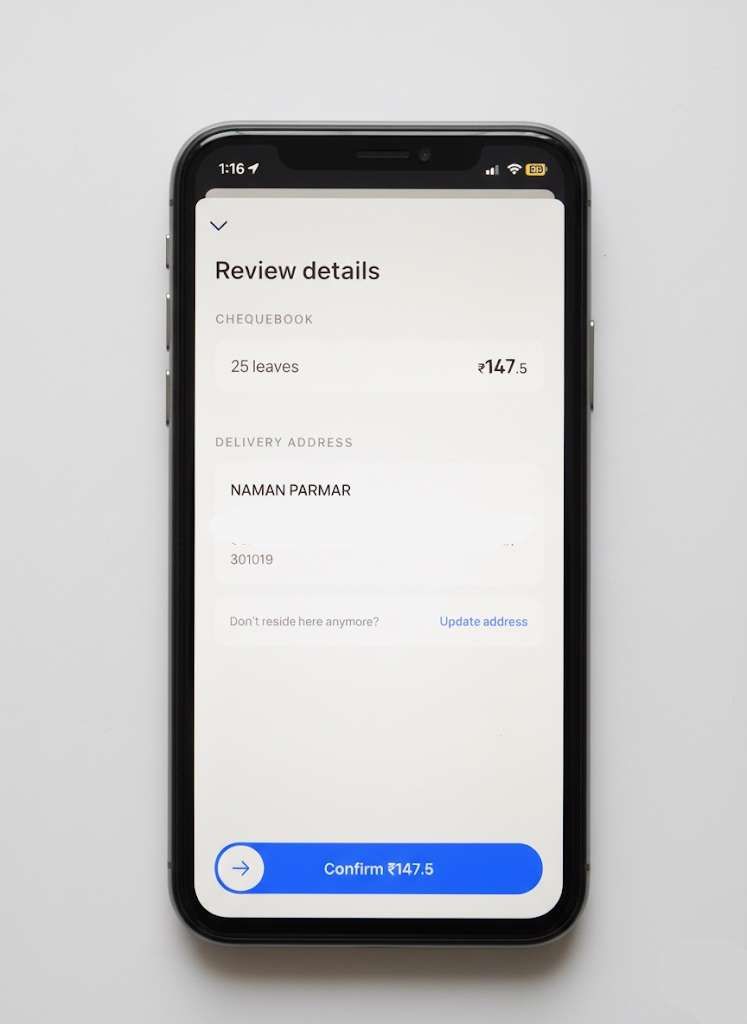

- Confirm delivery address (you can update using Aadhaar OTP).

- Swipe to the right side for Confirm.

- The charges are deducted within 5 minutes.

- A reference number is generated to track the order.

- It also shows estimated delivery timing as per your address.

Kotak 811 Cheque Book Charges

This 1 October 2025, Kotak rescheduled charges for all types of accounts of 811, the new rates are here –

| 811 Account Type | Free Leaves | Charges |

|---|---|---|

| Kotak 811 Lite | No cheque book | — |

| Kotak 811 Limited KYC | No cheque book until Full KYC | — |

| Kotak 811 Full KYC (Classic) | None free | 25 leaves → ₹125 + GST (₹147.5) 50 leaves → ₹250 + GST (₹295) |

| Kotak 811 Super | 10 free leaves per year | Beyond limit: ₹5 per cheque leaf (min. 25 leaves per book) |

| Kotak 811 Edge | 25 free leaves per year | Beyond limit: ₹5 per cheque leaf (min. 25 leaves per book) |

What is the option to request a Kotak Cheque Book for All Accounts

If you have any savings or a current account in Kotak, you can use these options –

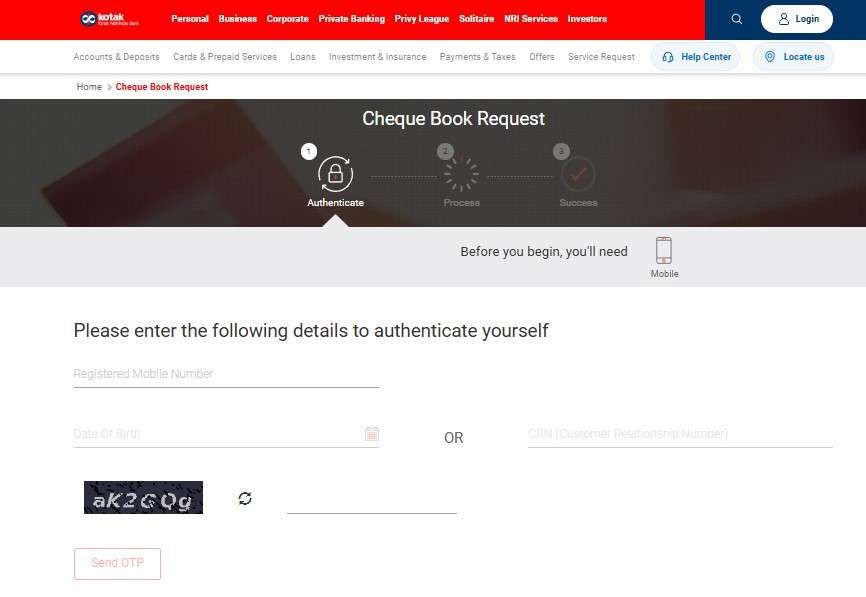

1. Website Request

- Visit the official Kotak Cheque Book Request Page. (always verified site first)

- Enter your registered mobile number along with your Date of Birth or CRN. If you forget the CRN, choose the DOB option.

- Fill the random captcha and tap on proceed.

- Select cheque book size (usually 25 leaves).

- Confirm registered address (cannot be changed online or do Re-KYC).

- Accept charges → verify via OTP.

- Request completed, you will get an SMS with the Service Request Number.

2. SMS Request

Another simple method for you, you just need your registered mobile number and an active SMS pack, no internet required; however, it has limited facilities, you cannot choose leaves.

- Open Your SMS App, Send at 9971056767 or 5676788.

- SMS format – type – “CHEQUEBOOK Last 4 digits of Account Number”

- charges for SMS apply as per your mobile operator (Jio, Airtel, VI, BSNL)

3. Kotak WhatsApp Banking

Now, Kotak WhatsApp is more helpful than other options; they have extended their digital banking services. Follow this –

- Save Kotak’s official WhatsApp number 7710811811.

- Send message: “chequebook”.

- Verify with 6-digit OTP.

- Menu will open, select Apply

- Confirm account details and cheque book size.

- Check prices and give OTP again to complete the order.

- Request is processed instantly; delivery follows standard timeline.

5. Download and fill out the cheque book request Form PDF

If you want to apply via a branch, Kotak offers an offline method using a request form.

- Download the Common Request Form (PDF).

- Fill in using pen: CRN, Account Number, Full Name, Date, PAN or Aadhaar number.

- In the “Account Related Section, first service” tick Cheque Book Issue.

- Write down the required leaves (25 or 50).

- Sign the form and attach an Aadhaar copy if asked.

- Submit at the branch counter.

- Collect an acknowledgement slip with the SR. Number.

- Cheque book delivered to the registered address or collected at the branch after about 10 working days.

Cheque Book Tracking and Delivery Time

After placing a request, Kotak provides multiple ways to track status:

- Mobile App → Track via reference number in the Activity Zone or service request section.

- WhatsApp Banking → Save 7710811811, send “cheque book track”, verify via OTP, and see status.

- Customer Care → Call 1860 266 2666 with CRN and Service Request Number.

- Branch Visit → Provide an acknowledgement slip and check status.

After ordering 3/4 days, you will receive a Tracking ID, which you can use at the courier company to track the current dispatch status. Mostly, Kotak use Bluedart, Speed Post, and Delhivery as a courier service.

How long does it take to get a cheque book from Kotak?

After ordering, it just takes 5 to 7 working days, but it usually depends on the courier partner and your house location. If speed post, they may extend to more hours or days.

If the cheque book is not delivered within this time, you can request re-dispatch by calling the kotak help care center.

How to Cancel a Cheque Book Request

If you order a cheque book by mistake, cancellation must be done quickly, preferably within a couple of hours of placing the order.

Ways to cancel:

- WhatsApp Banking → Send “stop cheque book” to 7710811811 (works before dispatch).

- Website Grievance Form → Go to “Write to Us” section, enter CRN, email, and request cancellation.

- Customer Care Call → Dial 1860 266 0811 or 1860 266 2666, give CRN and reference number.

- Branch Request → Submit a written cancellation before dispatch.

FAQs

Where can I download the Kotak cheque book request form in PDF format?

You can download the Kotak cheque book request form PDF by visiting the Kotak downloads centre using a web browser. You can find it in the footer of the site.

Do I need to visit a Kotak branch to submit the cheque book request form?

Yes, you can visit the branch and collect a customer request form; it works for cheque requests. Fill it out and submit the nearest branch. Also, you can courier to your Kotak home branch.

Can I update my address on the Kotak cheque book request form before submission?

Yes, you can update your registered address in the form, but the bank may verify it using Aadhaar OTP or other KYC documents.

Why does Kotak insist on Full KYC before issuing a cheque book?

Cheque misuse risk is higher in incomplete KYC accounts. Branch insight: once Full KYC is done, cheque book approval is instant, and delivery usually starts within 24 hours automatically.

Can Kotak 811 customers avoid cheque book charges legally?

Yes. Use UPI, IMPS, or NEFT instead. Tip: many 811 users avoid cheque costs completely by shifting bill payments to UPI, which stays 100% free.

What is the most reliable way to request a cheque book in 2026?

The Kotak mobile app and WhatsApp Banking show the highest success rate. Branch staff say SMS requests fail more often due to format errors or inactive SMS packs.

Why does Kotak charge per cheque leaf after free limits?

Cheque processing involves clearing, fraud checks, and logistics. Data point: banks globally discourage cheque usage by pricing it, pushing customers toward faster digital payment systems.

How long does cheque book delivery really take on ground?

Official timeline is 5–7 working days, but tier-2 and tier-3 cities often receive it faster via Speed Post. Metro delays mostly happen due to courier congestion.

Can I change the delivery address after placing a request?

Usually no. Once dispatched, address changes are blocked. Tip: always update Aadhaar-linked address before ordering to avoid re-dispatch delays and extra calls to customer care.

What is the biggest mistake customers make while cancelling cheque books?

They cancel after dispatch. Branch experience shows cancellation works only within 1–2 hours of request. After courier pickup, charges are rarely refunded.

Is it safe to keep unused cheque books at home?

Yes, but store securely. Idea: write “Account Closed if Lost” lightly on cheque backs. It helps banks act faster if cheques are misplaced or stolen.

Bonus: Similarly, if you want a Kotak 811 passbook, check charges, and the new 2026 applying process.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.