Omni Web-App is a workflow application developed for ICICI Bank employees. If you are a Branch staff or a Direct Selling Agent, then this portal is for you. It is an internal system that powers ICICI Bank’s loan operations, also quite popular as the RLOS (Retail Loan Origination System).

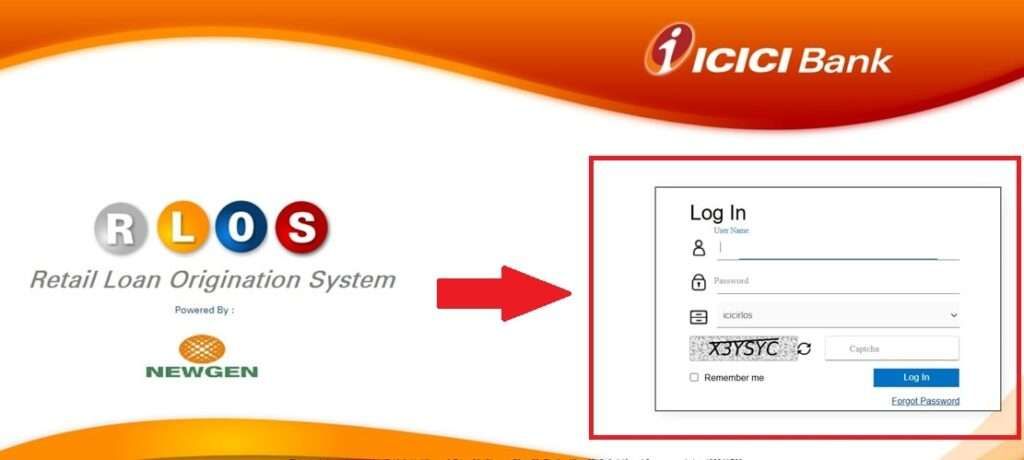

As per the Finextra press release, it’s powered by Newgen Software Technologies. ICICI also launched several internal software solutions, including OmniDocs, in collaboration with Newgen.

It works like the backbone of ICICI’s retail lending business. Back in time, when employees needed to manage files manually, this system allowed everything to move digitally: from the moment a customer applies for a loan, till the time the loan is approved or rejected, and eventually disbursed.

If you have ever taken a personal loan, auto loan, or home loan from ICICI as a regular customer or account holder, chances are your application was processed inside this Omni system.

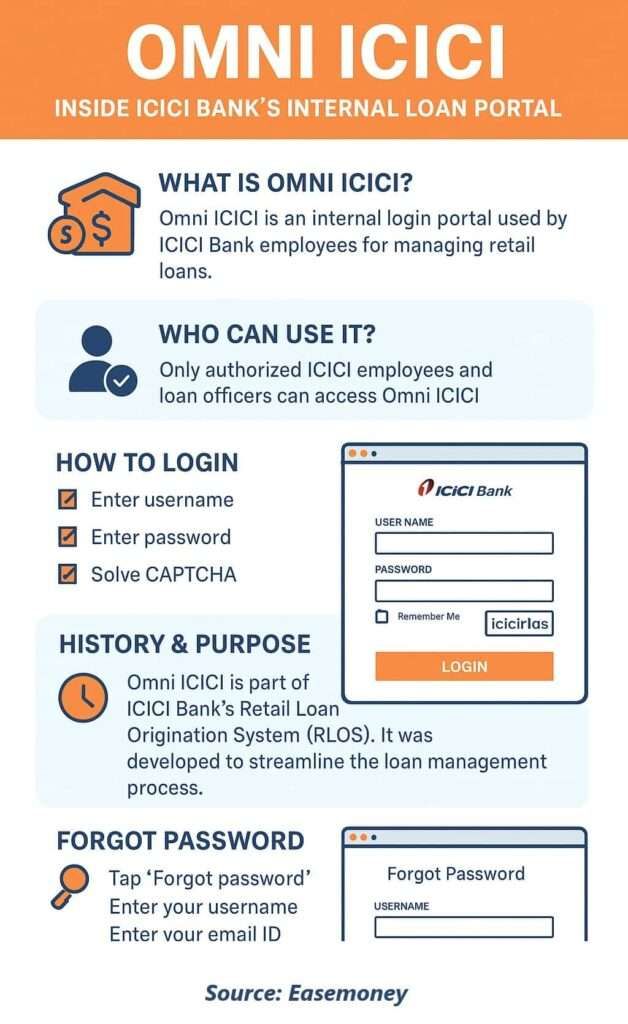

How Login Works – Step by Step

Many employees search directly using the search engines such as BING or Google. However, make sure it’s a genuine and official page. The login page looks plain but requires a few fields:

- Your Username – Employee ID or Specified Account or DSA code.

- Password – provided by the bank’s system on your registered email ID only.

- Cabinet – you can typically choose “icicirlos,” which directs them to the Retail Loan Origination System environment.

- Captcha – it ensures security against bots.

- Login button – opens the dashboard if everything is correct.

Also, there is a forgot password section for resetting it –

- You have to enter your username.

- Registered email address for getting the link to reset it.

- You have to select your cabinet (usually pre-selected – icicirlos)

Once these are entered, a new password is sent to the employee’s email.

Note: This login structure makes it clear: Omni ICICI is not for retail customers and account holders; it’s locked to ICICI staff and agents.

Who Uses Omni ICICI Every Day

Omni ICICI strictly for internal users. The main groups who rely on it include:

- Branch staff – They usually enter loan applications received at branches.

- DSAs (agents) – Agents do upload details from customers sourced in the field.

- Operations teams – The internal teams do multiple checks on customer documents.

- Credit officers and underwriters – yes, it required them to review applications and approve or decline them.

- Audit teams – use Omni’s records to ensure compliance.

Across India, it’s estimated that over 50,000 employees and partners use this platform daily.

Why Omni Workflow Matters

ICICI is among India’s largest banks. Every single month, it receives lakhs of loan applications from across the country. Handling such volume without automation would be impossible.

That’s where Omni Workflow plays its role:

- Faster approvals – You can use it for processing applications without shuffling files between branches.

- Accuracy – each step is digitally logged, leaving little room for error.

- Compliance – the system maintains an audit trail for regulators.

- Scale – It can hold from 1,000 applications or 1 lakh; the system is built to manage it.

For customers, this means loans get approved much faster. For employees, it means less manual work and more efficiency.

What Happens Inside the System

The moment a user logs in, they are welcomed by a dashboard displaying their assigned jobs and available programs. A basic interaction usually goes like this:

- Application entry – details of the loan seeker are recorded.

- Document upload – KYC documents, salary slips, bank statements.

- Verification – It goes from multiple checks, such as credit score checks, employment verification, and background checks.

- Credit officer review – a decision is made based on eligibility and the basis of internal policies.

- Underwriter approval – final step before disbursal.

- Disbursement – money is transferred to the customer’s account.

Every step is digital. This not only saves time but ensures no file goes “missing” in the process.

Related ICICI Internal Systems

Employees searching for Omni ICICI also come across other ICICI portals. Here’s how they connect:

APS (Application Processing System)

- The first stage is where loan applications are captured.

- Front-end system optimised for quick data entry.

- Feeds into Omni ICICI for further processing.

OmniDocs

- ICICI’s document management system.

- Stores, retrieves, and secures loan-related documents.

- Works alongside Omni ICICI to confirm every application has verified paperwork.

iLens

- A newer platform, launched at the end of November 2022 with TCS.

- Unlike Omni, it’s not just work on internally; it allows connecting employees, agents, and customers in one place.

- Used for housing loans first, now expanding to personal, auto, and credit cards.

- Offers paperless onboarding, instant sanction, video KYC, property appraisal, and digital disbursement.

- Login options include:

- Bank Employees (Emp ID)

- Non-Employees (BAN ID)

- Agents (User ID, Email, or Mobile)

The Myth of APKs and App Downloads

If you do a Google search and find something “Omni ICICI APK”, you will see many shady websites and a few misleading blogs. These are fake.

The truth:

- Omni ICICI has no mobile app or APK. It is only a secure web-based system.

- Official ICICI apps include:

- iMobile Pay – customer banking app.

- InstaBIZ – for business banking.

- iLens App – for digital loans (customer + agent + employee HRMS logins).

Employees should always use the official login portals and never download random APKs online.

Other Questions

Is Omni ICICI the same as iLens for ICICI loans?

Not really, Omni ICICI is internal for staff, while iLens is a digital lending platform that also lets customers and agents apply for loans.

What kind of loans are processed inside the Omni ICICI system?

The Omni Workflow portal handles retail loans and unsecured credit for users, like personal, auto, home, education, and credit cards, guiding applications from entry to final disbursement.

What changed in the OMNI ICICI workflow in 2025–26?

In 2025–26, OMNI became faster and more stable. Branch users report quicker page loads and smoother document uploads, reducing application stuck cases by nearly 20–25% compared to older versions.

Is OMNI ICICI still only web-based in 2026?

Yes. Even in 2026, OMNI remains a secure web-only system. Tip from IT teams: any website offering “OMNI ICICI app download” is fake and should be avoided immediately.

How many internal users depend on OMNI daily?

Branch and partner data shows 50,000+ employees and DSAs log in daily. Idea: OMNI acts like a central control room for ICICI’s retail lending across India.

Why does OMNI ask for “Cabinet” during login?

Cabinet selection routes users to the correct environment like icicirlos. Tip: wrong cabinet selection is a common reason for login failure reported by new DSAs.

How does OMNI reduce loan approval delays for customers?

OMNI removes physical file movement. Digital routing between branch, ops, and credit teams cuts approval time by 30–40%, especially for personal and auto loans.

Can customers see or track their loan inside OMNI?

No. Customers never access OMNI. Idea: customers track loans via iLens or Axis-style apps, while OMNI silently handles backend checks and approvals.

What is the biggest operational risk if OMNI is used wrongly?

Incorrect document upload or skipping mandatory checks. Branch audits show most rejections happen due to incomplete KYC uploads, not credit score issues. Always double-check before submission.

- Related System – Tallyman Axis

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.