What are the rules of the PNB deposit slip at the branch?

At any Punjab National Bank branch, the deposit slip comes with its own set of rules, limits and dos or don’ts that customers usually don’t notice. The slip looks simple, but PNB follows strict norms depending on the branch type (Your Home Branch vs. Other Branch), amount, and who is depositing. Understanding these rules saves time and avoids unnecessary rejection at the counter.

The first rule is for high-value cash deposits:

- For any cash deposit of ₹50,000 or above, you must write your PAN on the slip or attach a signed Form 60.

- If you are depositing cash into someone else’s account, the maximum you can deposit is ₹25,000 per person per day.

- The bank never asks for a passbook during a cash deposit — you can ignore that part.

- ATM deposits: There is a cash deposit limit of ₹1 lakh per transaction through PNB ATMs.

For self-deposit at your Home Base Branch, there is no maximum limit. You can deposit ₹1 lakh, ₹5 lakh or more; the branch only checks PAN, Form 60 and KYC if needed. But as per the PNB official site data, Charges apply for cash deposits above ₹1 lakh per day, even at home branches. These charges are separate from GST. The charges are 1 or 2 Rs per 1000 deposit.

At Non-Base Branches, the rules change. Self-drawn cheque can be deposited at non-home branches. However, there is a limit of ₹5 lakh for a single cash payment transaction against a self-drawn cheque.

Here is a quick overview before moving ahead:

| Transaction Type | Limit |

|---|---|

| Cash deposit to own account at Base Branch | No limit (charges may apply after reaching 1 lakh Rs per day, confirm with the branch officer first) |

| Cash deposit to someone else’s account | ₹25,000/day |

| Cash withdrawal via self-cheque at a non-base branch | ₹5,00,000 |

| Third-party cash payment (Savings Account) | ₹50,000/day |

| Third-party cash payment (Current Account) | ₹1,00,000/day |

PNB uses these rules to protect customer accounts and avoid fraud at non-parent branches. You will need a deposit slip for both cash and cheque deposits at any branch of the bank.

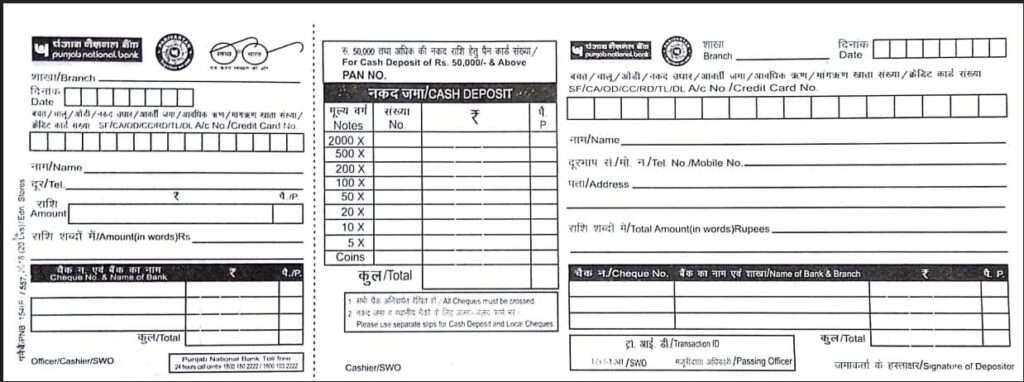

Overview of PNB Deposit Slip

PNB’s deposit slip is bilingual. At most branches, the default is English + one local language. For example:

- Rajasthan, Delhi NCR, UP, MP → English + Hindi

- Punjab → English + Punjabi

- Tamil Nadu → English + Tamil

- Gujarat → English + Gujarati

- West Bengal → English + Bengali

The layout remains the same across India. Only the language changes.

The deposit slip uses the same format used by other PSU Banks like SBI, Canara Bank or Bank of Baroda — but PNB’s is slightly simpler because it uses a separate box for Cash and Cheque. You can ignore the cheque box simply if you choose the deposit form for cash only.

It works for multiple account types, and the slip even mentions it clearly: SF/CA/OD/CC/RD/TL/DL/A/c No./Credit Card No.

This means you can deposit money into:

- Savings (SF)

- Current (CA)

- Overdraft (OD/CC)

- Recurring Deposit (RD)

- Term Loan (TL)

- Demand Loan (DL)

- Even Credit Card accounts

The process is the same — enter the number, amount and mode of deposit.

How to get the PNB deposit slip (offline & digital)

The process is simple and the same as all banks in india. Walk into any PNB branch → ask the guard or bank officers → they keep bundles of slips near the entrance or cash counter. Mostly free and unlimited. Some branches keep them near the passbook printer. If you want, you can download it as well. Here is the direct link –

Digital (Download Options)

Below is the download table for Hindi, English and Punjabi versions.

| Language | Download Link |

|---|---|

| Hindi + English | Official PDF Link |

| Punjabi + English | Official PNB Website Slip |

| English Only | Available at many metro branches |

Download PDF slips in your local languages (15 options)

To get Gujarati, Tamil, Telugu, Marathi, Kannada, Malayalam, Bengali and more up to 10+ languages:

- Open the PNB official website

- Go to Go Online Services

- Tap Download Forms or directly go Punjab Bank form centre.

- Select Deposit Related Forms

- Tap Language-Wise Forms

- Choose your language and find your deposit slip option.

- Download the PDF

- Done

Pro Tip:

To edit and type directly on the slip before printing, use Sejda, PDFescape, Adobe, or any online PDF editor.

Understanding both sides: Bank Copy vs Customer Copy

PNB slips come with two sides:

1. Bank Copy

This stays with the bank. It has full fields:

- Branch name

- Account number

- Name

- Cash/Cheque details

- Denomination table

- Mobile number

- PAN (if needed)

- Signature

2. Customer Copy

This is the small perforated part you take home. It contains only the essentials:

- Branch

- Name

- 12–16 digit PNB account number

- Amount deposited

- Mobile number

There’s a single deposit box for both cash and cheque — you just enter the amount for cash or cheque details accordingly. The bank stamps this copy and hands it to you as proof.

How to use the deposit slip for Cash deposit (Fill Up process)

Using the slip for cash is very straightforward:

- Write the date and branch

- Enter the account number (double-check digits)

- Write your name

- Select Cash (or leave box as cash)

- Enter the amount in numbers and words

- Fill the denomination table (optional, but helpful)

- Add your mobile number

- Sign

- Attach PAN/Form 60 if you deposit cash of more than ₹50,000.

- You have to write the same information in the bank copy also, use a box to write the cash amount.

How to Use the Cash Denomination Table

| Step | What to Do |

|---|---|

| 1. Sort Cash | Separate notes by ₹500, ₹200, ₹100, ₹50, ₹20, ₹10 and coins. |

| 2. Count Notes | Count how many notes you have for each denomination. |

| 3. Fill Note Count | Write the number of notes in the respective denomination row. |

| 4. Calculate Amount | Multiply notes × denomination and enter the total. |

| 5. Add Final Total | Add all row amounts; it must match the total cash you are depositing. |

| 6. Recheck Once | Quickly recount to avoid mismatch at the counter. |

Tips

- Always fill amount in words clearly.

- If depositing into someone else’s account, keep it below ₹25,000.

- For very large cash deposits, carry an ID even if not asked.

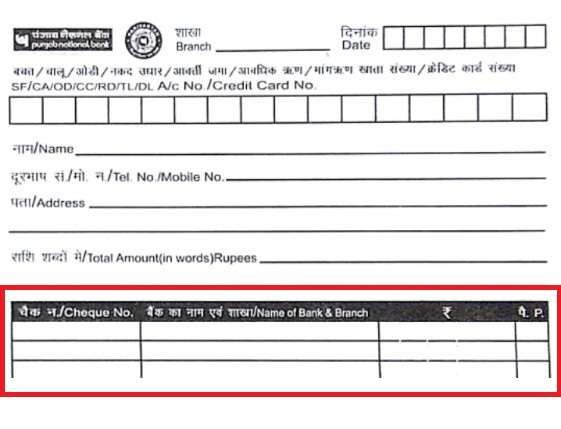

How to fill the deposit slip for a Cheque deposit

When depositing a cheque, the process is slightly different:

- Write date, branch, account number and name

- Enter the 6-digit cheque number in the remarks box

- Write the bank name & branch of the cheque (recommended)

- If multiple cheques, use a different row for that (optional)

- Enter the amount in numbers and words

- Sign

- Turn the cheque → write your account number on the backside

- Staple the cheque + slip together

- Submit at the cash counter or drop box with this slip and cheque.

Small tips

- Always endorse the cheque on the back with your signature.

What is the Processing Time for Deposits?

1. Cash Deposit

- Credited instantly at most branches

- Some counters take 15–30 minutes during rush hours

- Customer copy gets stamped immediately

2. Cheque Deposit — New RBI Rule

RBI has changed the entire cheque clearing system in India:

From January 3, 2026:

- All cheques deposited between 10 AM and 4 PM must be cleared or returned within 3 hours.

- If the bank does NOT respond within 3 hours, the cheque is automatically approved.

and the amount is credited the same day.

This rule applies to all banks, including PNB.

Result: Cheque deposits now take hours, not days, anywhere in India.

Example: Deposit a cheque at 11 AM → must clear by 2 PM → if not, funds will still be credited automatically.

FAQs

Can I ask my PNB bank for a deposit slip?

Yes, every PNB branch provides free deposit slips at the counter. You can ask security staff or take them from the public form rack.

Is a PNB deposit slip required for small cash amounts?

Yes, even for ₹100 deposits, you must fill a slip. PNB does not accept any cash without a properly filled deposit form.

Can someone else submit my PNB deposit slip?

Yes, but only up to ₹25,000 per day for third-party deposits. Higher amounts require the account holder or proper authorisation.

Do all PNB branches use the same deposit slip format?

Yes, the layout is the same nationwide. Only the second language changes based on the state—Hindi, Punjabi, Tamil, Gujarati, etc.

Can I deposit cash in PNB without filling out the denomination table?

Yes, but it’s risky. Cashiers prefer filled denomination tables for faster verification. Skipping it may delay counting by 5–10 minutes, especially for deposits above ₹10,000 or during rush hours.

Will PNB reject my deposit slip if the branch name is wrong?

Usually no. If the account number is correct, the staff member corrects the branch name internally. However, at non-base branches, wrong details can slow processing or trigger manual verification.

Is there a best time of day to deposit cash at PNB branches?

Yes. Before 1 PM is ideal. After lunch, queues grow, and verification slows. Early deposits are processed faster and reduce the risk of counter cut-off delays.

How long should I keep the PNB customer copy safely?

Keep it until the money reflects, plus at least 2 working days. For cheques, retain them until clearance completes. It’s your only physical proof if disputes arise later.

What happens if my customer copy is not stamped properly?

Ask immediately. An unstamped slip has no legal proof value. Once you leave the counter, resolving missing stamps can take days and may require CCTV or counter log verification.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.