This bank has been in operation since 2006 under its popular old name, Deccan Grameena Bank. Later in 2014, it got a new name, “Telangana Grameena Bank”,

It is specially designed for the Telangana semi-urban and rural areas to provide best-in-class banking facilities. It is supported by one of the biggest banks, the State Bank of India.

How 1 RRB on 1 State Policy Changed Telangana Grameena Bank

As per the Hindu BusinessLine press release, the Telangana-based branches of Andhra Pradesh Grameena Vikas Bank (APGVB) were merged into TGB on 1 January 2015. Today, the bank operates 934 branches and bank touching more than 39 million customer base across the state.

To handle this growth and meet the needs of all types of customers from rural areas to semi-urban, TGB now offers multiple balance enquiry options, both online and offline.

Let’s explore top options, including one of my favourites.

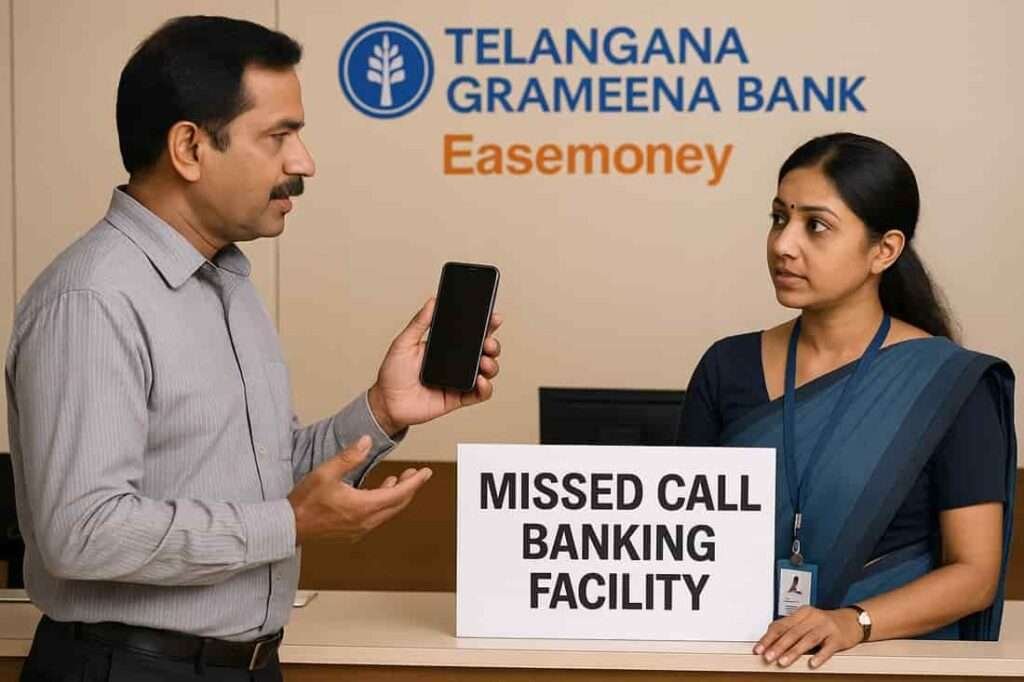

1. TGB Missed Call Banking Alert Number

Let’s start with the easiest one—missed call banking. The bank has a large customer base from all types of areas in Telangana, and a few towns have internet issues, and many customers, like farmers, older citizens, who do not use smartphones. This service is perfect for those users.

According to the AskPAi NPCI chatbot of TGB Bank, this is a 24/7 working missed call banking number 09278031313 for individual account holders to enquire.

To activate this method, follow the steps –

Step 1: Get the Registration Form

- You have to visit once to your home branch and ask for the SMS alerts and missed call banking registration form.

- Also, download the form from the official website (if available)

Step 2: Fill out the Form and submit it

Here you have to fill out the basic information about you-

- Your full name, Father’s name, CIF number

- Mobile number, Account number, Your Date of birth.

- Email ID (optional, but it’s best for the monthly statement)

- After filling up, submit to the branch staff.

- The bank will take about 24 hours to activate the missed call service in its system.

Quick Tip: Make sure the mobile number you give is the same no you use regularly and is linked to your deposit/savings bank account.

Step 3: Check Your Balance via SMS

- Once the facility is activated, you have to open your phone.

- Dial 09278031313, select your SIM, and give a missed call using your bank-linked mobile number only.

- After 2/3 rings, it will be disconnected, and you will get a text SMS on your phone.

- In the Text SMS, you will get your latest balance amount and your account’s last 4 digits.

- If multiple accounts are linked to your number, you will get multiple balances for the same SMS.

Quick Note: If you are not getting Text SMS replies, it happens due to a technical error or server delays, you can email here – tgbho@tgbhyd.in.

2. TGB WhatsApp Banking

This is my favourite method to view balance. On 27 February 2024, Telangana Grameena Bank launched official WhatsApp Banking, making banking more handy than ever. This launch was confirmed on their official Facebook post.

It allows all types of customers to use basic services like balance enquiry, mini statement, and more, all through a familiar app.

How to use WhatsApp Banking:

- Save this number: 09278031313

- Open WhatsApp and send Hi

- Enter the OTP you received on your phone

- Select your language (English or Telugu)

- Tap View > Account Services

- Enter the last 4 digits of your account number

- Tap Balance Enquiry to see your current balance. Also, you can get a mini-statement here.

Tips:

- Make sure your WhatsApp number is the same as the one linked to your TGB account to receive replies and verify your account with the bank.

- No need to install any extra app—WhatsApp is enough

Note: This service works at any time of day and is very user-friendly.

3. TGB Mobile Banking App

This TGB Bank is way more digital than a top bank all over india. You can also use their TGB mBanking App. it is available for Android users and iPhone users and provides access to balance info, transactions, mini statements, and more.

Steps to use the TGB App:

- First, you have to download TGB mBanking from the Google Play Store or the Apple App Store.

- Now, open the app, select your language, and tap on Let’s go.

- Here, tap on verify my SIM, select your SIM, and send a text SMS to find your account that is linked to your phone number.

- Enter Account number, CIF Number, and DOB.

- Verify via OTP

- Set your 6-digit login PIN and transaction PIN.

- Log in using your PIN and tap on the eye button to view the available balance in your account number.

Note: if having issues while registering for the first time, please make sure you have activated your mobile banking through the branch. if not, visit your home branch, ask the staff to activate your mobile banking to set mpin and login. Also, you can file a complaint on their official website for any technical error in the mobile app.

4. UPI Apps (BHIM, Google Pay, Paytm)

According to the NPCI and TGB official websites, they are actively operating in UPI Banking. So, you don’t need to visit the branch for any activation; however, you only need your ATM Card, Smartphone and UPI-based app. Follow the steps to view your balance –

- Open your UPI app (PhonePe, Paytm, Google Pay, etc.)

- If using first time, enter your mobile number and OTP to log in.

- Go to Bank Account Settings and search or scroll down to find Telangana Grameena Bank.

- Here, your ATM card is required. Simply, type your last 6 digits of your card number, expiry, CVV, and ATM PIN. (Also, you can use your Aadhaar card to verify it.)

- Enter your received 6-digit OTP SMS, and set your UPI PIN

- Back to the home of the app, select Check Balance, enter UPI PIN to view your balance

Few Tips:

- Make sure your SIM is in the phone while verifying and setting up your UPI PIN.

- You must have a valid ATM/Debit card or aadhar card details to use this feature

TGB Internet Banking

If you’re comfortable using a browser, Internet Banking is a full-service option.

How to register:

- Visit your home branch and fill out an Internet Banking registration form

- After activation, you will receive a starter kit with a User ID and a temporary Password just for login and start.

How to log in and check the balance:

- First, visit the official website here – tgbhyd.in

- Click on Net Banking in the header menu.

- Enter your User ID and temporary password

- Set your new password on your first login

- Go to Account Summary and select your account to see the balance

Tips:

- Use a personal device and strong passwords

- Never access net banking from a cyber café or shared computer

Note: Your CIF number (Customer ID) is required—it’s printed on your passbook.

What to Do if You Don’t Have Internet and Digital Banking Access?

1. Use the ATM or the Passbook Machine

If you’re near a branch or ATM, use your TGB RUPAY Debit Card to check your balance.

Steps:

- Insert the card in any ATM (TGB or other RUPAY-enabled ATMs)

- Select Balance Enquiry

- Enter your 4-digit PIN

- Your balance will be shown and printed if you choose

Alternatively, you can update your passbook at a passbook printing machine in the branch.

Note: This is a good offline option for those who prefer physical records.

2. Call Customer Care or Visit a Branch

If you’re still unable to track your account balance in TGB or need help updating your mobile number, and a technical error report:

Customer Care Toll-Free Numbers:

- 1800 532 7444

- 1800 833 1004

Email: tgbho@tgbhyd.in

Or visit your home branch with your passbook and ID. The staff can help with mobile registration, app issues, or balance verification.

Note: If your Passbook is stolen, lost, or your account is inactive, please ask bank staff to activate it and issue a new passbook. The staff will ask you to fill form to verify your KYC in the system.

FAQs

Why is TGB missed call banking still popular in rural Telangana?

Because it works without internet or smartphones. Farmers and senior citizens prefer it. One missed call gives balance via SMS within seconds, even on basic keypad phones.

Why do some customers not receive balance SMS after a missed call?

Most cases involve unregistered or recently changed mobile numbers. Sometimes server delays happen. Tip: wait 24 hours after registration and retry during non-peak hours like mornings.

Is WhatsApp banking safer than calling or SMS balance enquiry?

Yes, when used from the registered mobile number only. It uses OTP verification and shows limited details. Never forward OTPs or click links outside the official WhatsApp flow.

Why does TGB mobile banking registration fail for first-time users?

Usually, because mobile banking isn’t activated at the branch. App setup works only after backend approval. One branch visit can save hours of repeated OTP or SIM errors.

What mistake causes most TGB balance enquiry issues long-term?

Ignoring mobile number updates. Even SIM replacement breaks SMS, WhatsApp, and UPI services. Always update your number at branch immediately after changing SIM.

What is the best balance-check method if my phone has no network?

Use an ATM or passbook printing machine. These work fully offline and give instant balance. Many branches still encourage passbooks for record clarity and dispute safety.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.