If you are holding an account with Union Bank of India and planning to request a new cheque book, either for personal banking or business transactions, first check the charges and the procedure to apply. As per the last official Union Bank of India service charge circular (notification dated 1 April 2025), cheque book issuance has now been aligned under a uniform structure for both individual and non-individual savings accounts.

| Account Type | Free Leaves Per Financial Year | Charges After Free Limit | Multi-City Cheque Book |

|---|---|---|---|

| Savings Bank (Individual & Non-Individual) | 20 leaves free | ₹5.90 per leaf (inclusive of GST) | Available |

What this means:

- You get 20 free cheque leaves every financial year, regardless of whether your account type such as individual or non-individual.

- Once you exceed this free limit, ₹5.90 (after GST) will be charged per additional cheque leaf.

- The charges are auto-deducted from your linked Union Bank account.

- You can also choose a Multi-City Cheque Book, which works seamlessly across all Union Bank branches in India.

Digital: Mobile-Based Request Options

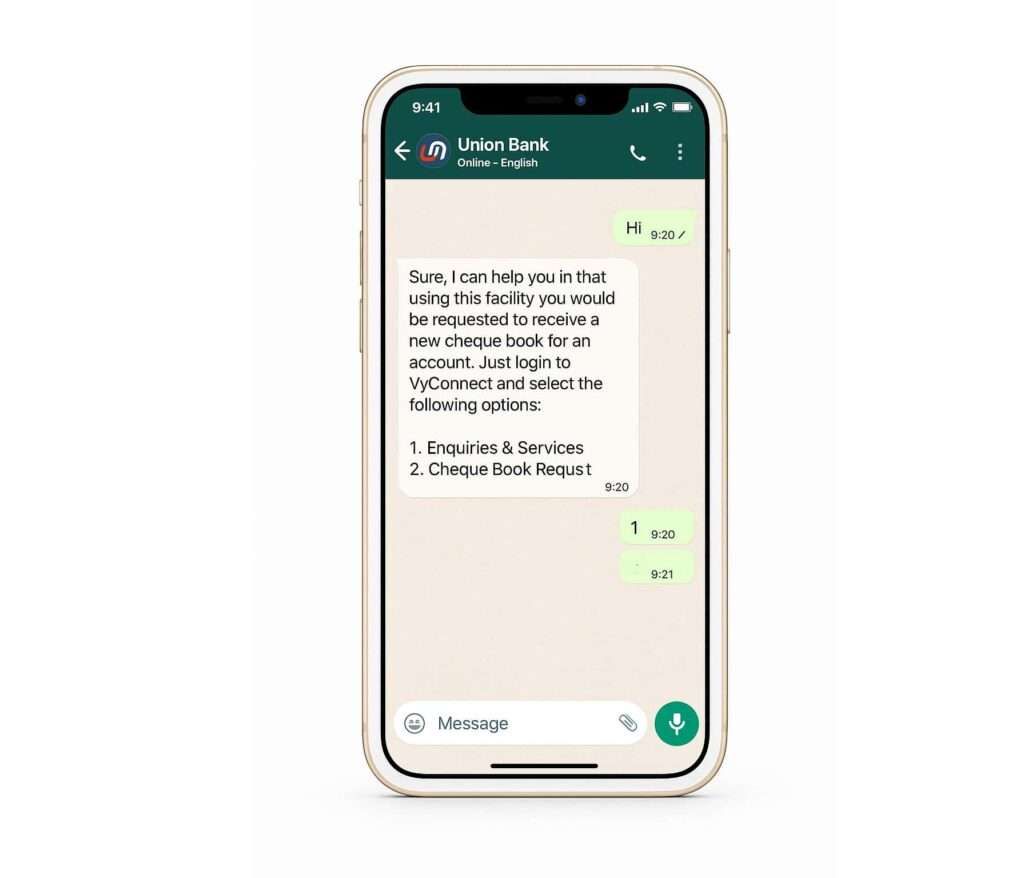

According to the AI Chatbot (UVA) launched by Union Bank, there are multiple digital channels to order your cheque book from home. For quick access, you can use WhatsApp Banking –

1. Union Bank of India WhatsApp Banking – The Simplest Way

Union Bank’s official WhatsApp Banking number, you can use 9666606060, it allows you to request a new cheque book in just a few messages.

How to do it:

- Save 9666606060 in your contacts (please double-check it, from Union Bank’s official website, before use).

- Simply, Send “Hi” on WhatsApp.

- From the menu, choose Enquiries & Services or Cheque Services section, Option 4: Cheque Book Request.

- Select your account number.

- Choose a delivery address; you can use your registered home address or branch address as a delivery point.

- Confirm the request via mpin or TPIN., most cases, you can generate a request using mobile OTP.

Note: You may be required to enter your mpin, TPIN or mobile OTP for using WhatsApp Banking first time in Union Bank.

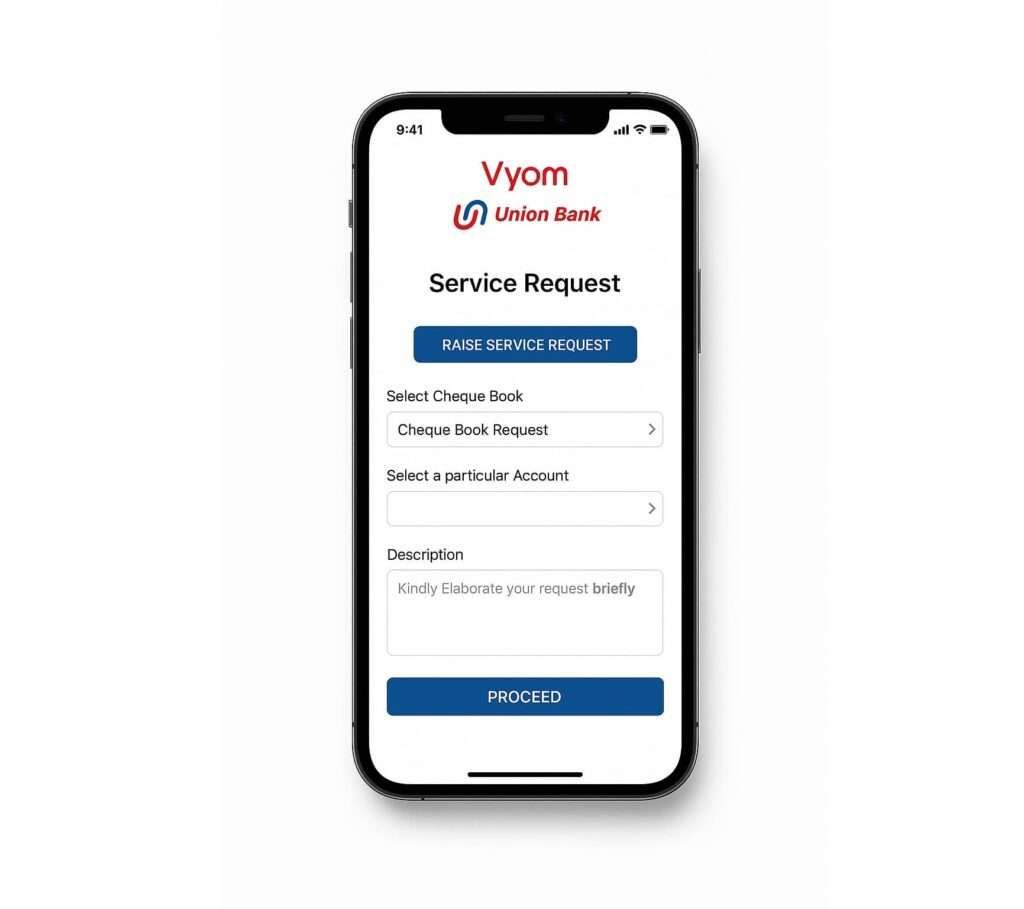

2. Vyom Mobile App

If you have the active Vyom mobile banking app on your smartphone, you can generate a request directly using the app. However, if not, you can use a branch token or a Debit card to activate the app. Here are the steps to learn –

- Download or update and open the Vyom app from the Play Store or App Store.

- Log in using your 4-digit MPIN or fingerprint (for first-time users, you will need your ATM card and Customer ID to set up MPIN/TPIN).

- On the home screen, tap on Service Request → Raise Service Request.

- From the drop-down, select Cheque Book Request.

- Choose your account number.

- Enter a short description — for example, “Requesting 20-leaf multi-city cheque book” or just write Give me a free cheque book if eligible”

- Click Proceed, verify via OTP or TPIN, and submit.

Your request will be generated instantly, and you will get an SMS from Union Bank.

Alternatively, if your MPIN or TPIN doesn’t work temporarily, you can switch to Vyom NetBanking, Login to Union Bank Internet Banking. Simply, navigate to General Services → Service Requests → Operative Accounts → Cheque Book Request. Select your account and confirm the address.

3. Union Bank Customer Care Request (Toll-Free Numbers)

If you want to directly order with bank officers, you can call at 1800222244 OR 18002082244 (In India-Toll Free)

- Just use your phone and dial only the account-linked mobile number.

- Select language via IVR

- Choose the account and press 9 to talk to bank officers to generate a request directly. You can also ask for charges and delivery timings.

- After the token, your cheque book will be dispatched to your registered address. If you want to update your address, you may have to update your KYC address via a branch or online.

Union Bank Home Branch Request Method with Form (Offline Option)

If you are visiting the branch, you can still apply for a cheque book the traditional way using the Service Request Form (SRF-1).

Here’s how it works:

| Step | Description |

|---|---|

| Form Download | Download Service Request Form (SRF-1). |

| Language | The form is bilingual — available in both Hindi and English. you can write using black or blue pen. |

| Details to Fill | Name, Account Number, Date, Customer ID (CIF), and Address. |

| Section to Tick | Go to Section 6 → Tick “Please issue SB Cheque Book/s with 20 leaves each” (or CD Cheque Book with 50/100 leaves). |

| Signature | Sign in the Application 1 section, add place and date. |

| Documents | Attach Aadhaar copy or ID proof if requested. |

| Charges | If you have used up your free leaves, the cheque book fee will be auto-deducted from your account. |

After submission, the branch processes the request internally, and your cheque book is typically ready for dispatch to your address. If you wish, you can collect it directly from the same branch after about 10 to 15 days — just mention this preference while submitting your form.

Delivery Timings and Tracking

Union Bank uses both courier services and India Post for cheque book delivery. Here’s what you should expect:

| City Type | Estimated Delivery Time | Tracking Update |

|---|---|---|

| Tier 1 Cities | 5–7 working days | SMS update in 3–4 days |

| Tier 2 & Tier 3 Cities | 7–10 working days | SMS update in 5 days |

You will usually receive a dispatch SMS containing the tracking ID within 3–5 days after the request. You can track it through the courier link or tracking Code in the SMS or by calling customer care with your account details.

If no SMS is received after a week, you can:

- Call customer care and quote your account number, or

- Visit the branch to verify the dispatch status.

FAQs

Can a cheque book be issued to an illiterate person in Union Bank?

No, Union Bank generally doesn’t issue cheque books to illiterate customers, unless in joint accounts with a literate co-holder or for specific authorized transactions.

How to find the MICR code in the Union Bank cheque book?

The MICR code is printed at the bottom of each cheque, beside the cheque number — it’s a 9-digit number unique to your branch.

How to stop the cheque book in the Union Bank of India?

You can stop a cheque book or specific cheque payment via the Vyom app, customer care, Internet Banking, or by visiting your home branch.

How to get the first cheque book for free in Union Bank?

Union Bank provides the first 20 cheque leaves free each financial year for all savings accounts — available automatically upon your first request.

Can I request a free cheque book twice in the same financial year?

No. Union Bank allows only 20 free leaves per financial year, not per request. If you already used them, even one extra leaf triggers a ₹5.90 per-leaf charge automatically.

Does the free cheque book rule apply to joint savings accounts?

Yes. Joint savings accounts also get 20 free leaves per year, shared across holders. It’s counted per account, not per person, which many customers wrongly assume at branch counters.

Will Union Bank issue a cheque book if my account has a zero balance?

Yes. There’s no minimum balance condition for requesting a cheque book. But if you exceed free leaves, keep a ₹150–₹200 balance ready so charges don’t cause request rejection.

What’s the most common reason cheque book requests fail in Union Bank?

Mismatch in mobile number or inactive CIF details. Even small KYC mismatches pause requests. Updating the mobile number or CIF at the branch usually resolves it within one working day.

What happens if the cheque book gets lost during delivery?

Inform customer care or branch immediately. The dispatched cheque book is auto-blocked internally, and a fresh one is issued after verification—usually within 7–10 working days.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.