The Process for depositing via BOB Branch

When you visit your Bank of Baroda branch to deposit cash or a cheque, the first thing the staff will say is simple, Please fill out a deposit form first,

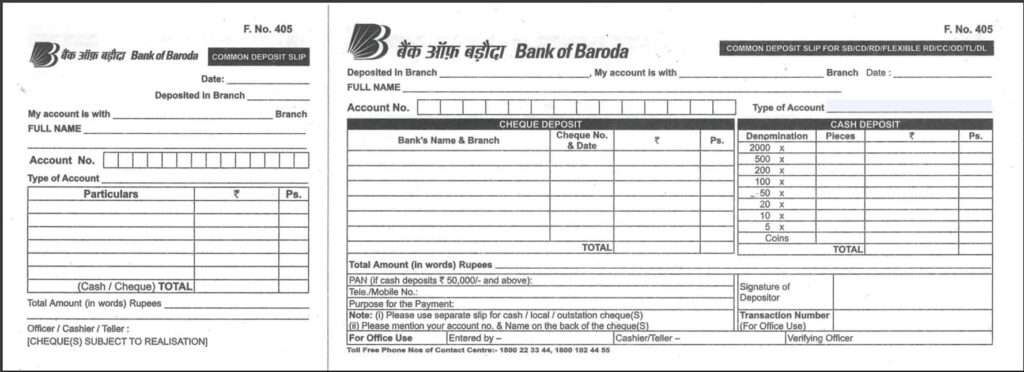

It is a small paper slip that the bank uses to record your transaction and provide you with an acknowledgement paper as proof. Every branch of the Bank of Baroda across India uses the same common deposit slip.

It works for both cash and cheque deposits — there’s no separate form for each.

You will notice two boxes printed on it — one for Cheque Deposit, another for Cash Deposit.

You just fill the one you need and ignore the other.

What Is a Bank of Baroda Deposit Slip?

It’s a simple bilingual form where you write your name, account number, branch, and amount.

It tells the teller whose account to credit and what type of deposit you’re making.

The slip comes in two identical halves — one copy stays with the bank, and the other (with the bank’s stamp) is given back to you.

Where to Get the Deposit Slip

You can get the Bank of Baroda common deposit slip in three easy ways:

| Source | Description |

|---|---|

| From the Branch | Every Bank of Baroda branch keeps a pad of deposit slips near the counters or enquiry desk. Ask the staff if you don’t see it — they will point you to the pad. |

| From the BOB Website | The official Bank of Baroda website doesn’t currently provide a downloadable pay-in slip. It may appear in the future under their “Forms” section, but for now, it’s not live. However, you can use NetBanking to find it. |

| Download and Print Here (Instant Option) | You can use these verified versions — the same design used in all branches. Download, print, and fill before visiting the branch. |

Bank of Baroda Deposit Slip Download Links

| Type | Description | Link |

|---|---|---|

| Printable version (fill by pen) | Standard PDF version, same as in branches | Download BOB original Deposit Slip (PDF) |

| Editable / Fillable version (type before printing) | You can type details on your computer and print | Download Fillable Slip (PDF) |

You can simply print off this original PDF, or you can use this editable Slip; it is a digital PDF. You will need your PC for downloading and editing, just simply tap on save it and use Google Chrome to start filling in using the keyboard. You can print the filled PDF.

Note – This may not accept all branches; most branches suggest using the branch printed on. Due to security norms, however, you can use it for basic daily practices; most first-time users get lots of help from that.

How to Fill the Deposit Slip (Simple Steps)

The slip looks long, but only a few boxes actually matter. It has two main boxes — one for cash deposits and one for cheques. Focus only on the side you are using –

1. If You Are Depositing Cash

- You can start with the Bank copy side, right side, and first enter the date.

- Full Name – Write your name clearly as per your bank account.

- Account Number – Double-check every digit. It’s the most important part.

- Deposited in Branch – The branch name where you are depositing.

- Type of Account – add your account category, such as salary, savings, loan or more. (optional)

- Cash deposit table – Count your notes in Denominations, such as how many 500rs notes you have and how many 100 Rs notes you have, also, count coins, if you have.

- Table – Mention how many notes of each you’re giving. For example, if you have Rs. 3500.

| Denomination | Pieces | Total |

|---|---|---|

| ₹500 | 4 | 2000 |

| ₹200 | 5 | 1000 |

| ₹100 | 5 | 500 |

| Total | — | ₹3,500 |

- Total in Words: Rupees Three Thousand Five Hundred Only.

- Signature: Sign in the depositor section.

- Mobile Number: Optional, but useful for SMS alert.

- PAN: Needed only if the deposit is ₹50,000 or above.

- Left side: The customer copy, here fill out the same information, your name, account number, in the particulars table, enter your cash amount and the same in total.

Now hand it over with the cash. The teller will count, stamp your slip, and give your copy back. The money usually appears in your account instantly; if it takes longer, it takes 45 minutes.

2. Is a Deposit Slip Required for Cheques in the Bank of Baroda?

Yes, in almost every branch.

Bank of Baroda still uses physical deposit slips for cheque deposits. Some metro branches have new machines for digital cheque deposits, but they’re rare.

If you drop a cheque without a slip, it might not be processed until staff trace the account manually — which can delay credit. So always attach your slip; it’s safer and faster.

If You Are Depositing a Cheque

Now ignore the cash deposit and denomination box completely. Fill only the Cheque Deposit section.

- Full Name & Account Number – Same as per your account where the cheque should be credited.

- Fill out the cheque box section.

- Bank Name & Branch – The bank printed on the cheque (example: HDFC Bank, Fort Branch).

- Cheque Number, Date & Amount – As written on the cheque. Then enter the same in total.

- Total in Words: Rupees Ten Thousand Only (for example).

- Signature of Depositor.

- Write your account number on the back of the cheque.

- Attach the cheque behind the slip neatly with a pin or staple.

- Also, the same information goes in the customer copy, just in a particular section, enter the cheque details and amount.

Hand it to the Cheque Counter. Local cheques and outstation cheques usually clear within one working day after the RBI’s new policy from October 4, 2025.

What to Do After Filling — Real-Life Branch Experience

Here’s what usually happens once you’re ready with your filled slip:

- Join the queue.

Branches often have separate counters for cash and cheque deposits.

If unsure, ask the guard — he knows. - Submit your slip and cash or cheque.

The teller will check your account number and verify the total. - Get your stamped copy.

This is your proof of deposit — keep it safe until the money appears in your account. - Processing time:

- Cash deposits: credited instantly.

- Cheques: take 1 working day, depending on cheque giving timings.

That’s it. It’s not fancy or digital, but it’s simple and reliable.

What You Can Safely Ignore on the Slip

Once you understand what to ignore, the fill-up becomes so easy. The deposit slip has extra boxes that most people don’t need to fill. Here’s what you can skip to save time.

| Field | Why You Can Ignore It |

|---|---|

| “My account is with” | Only for deposits made at a different city or branch. |

| “Type of Account” (SB/CD/RD/OD, etc.) | Teller can see this from your account number. |

| “Purpose for Payment” | Only used for loans or EMI deposits. |

| “Officer/Cashier/Verifying Officer” | For bank staff only. |

| “Transaction Number/Entered by” | Filled later by staff. |

| “Coins or Paise” fields | Not required unless you’re depositing coins. |

In short, only fill in what matters: Name, Account Number, Amount, Date, and Signature. Everything else can be left blank.

FAQs

How long does it take for a cheque to clear in the Bank of Baroda?

Thanks to RBI’s Continuous Clearing System, most cheques now clear the same day if deposited before the branch cut-off time (usually 4 p.m.).

Settlement happens hourly from 11 a.m., and funds are generally credited within one hour after successful clearing.What will change in January 2026 for cheque clearance?

From January 3, 2026, the RBI’s Phase 2 upgrade will enforce a 3-hour confirmation window for banks. This means cheque processing will be almost as fast as UPI, making same-day clearance standard everywhere.

Can I print and use a deposit slip from home?

Yes, you can print it if it’s the same format used in branches. Some branches may reject unclear photocopies, so use a clean print on A4 paper. However, first confirm with your local branch.

What is the rule for cheque deposit in the Bank of Baroda?

You must attach a filled deposit slip with every cheque and drop it before the branch cut-off time—usually 4 p.m.—to ensure same-day clearing under RBI’s new system.

Can someone else deposit cash into my Bank of Baroda account using a slip?

Yes. Anyone can deposit cash using your deposit slip. Only your correct account number and name matter. The signature of the depositor is enough; the account holder’s presence isn’t required.

Is PAN mandatory for every cash deposit at Bank of Baroda?

No. PAN is required only if the cash deposit is ₹50,000 or more in a day. Below that, the PAN column can be left blank without any issue at the counter.

How long should I keep the stamped deposit slip safely?

Keep it until funds reflect in your account, plus 2–3 extra days. For cheques, retain them until clearance completes. It’s your only physical proof if disputes arise.

Can I deposit mixed cash and cheque using one slip?

No. Even though it’s a common slip, you must use only one section per transaction. Mixing cash and cheque in a single submission can confuse processing and cause rejection.

What is the safest time to deposit cheques for same-day clearing?

Deposit before 2:30–3:00 PM, even if cut-off shows 4 PM. Early submission improves same-day clearing chances under RBI’s CTS, especially during month-end rush.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.