How the BOB RTGS Form is Different from Other Banks

If you have used any other private Bank, HDFC, ICICI, or Yes Bank for Branch RTGS forms before, you are probably used to a simple top-to-bottom slip where the lower part tears off as your customer acknowledgement. Bank of Baroda (BOB) does things differently.

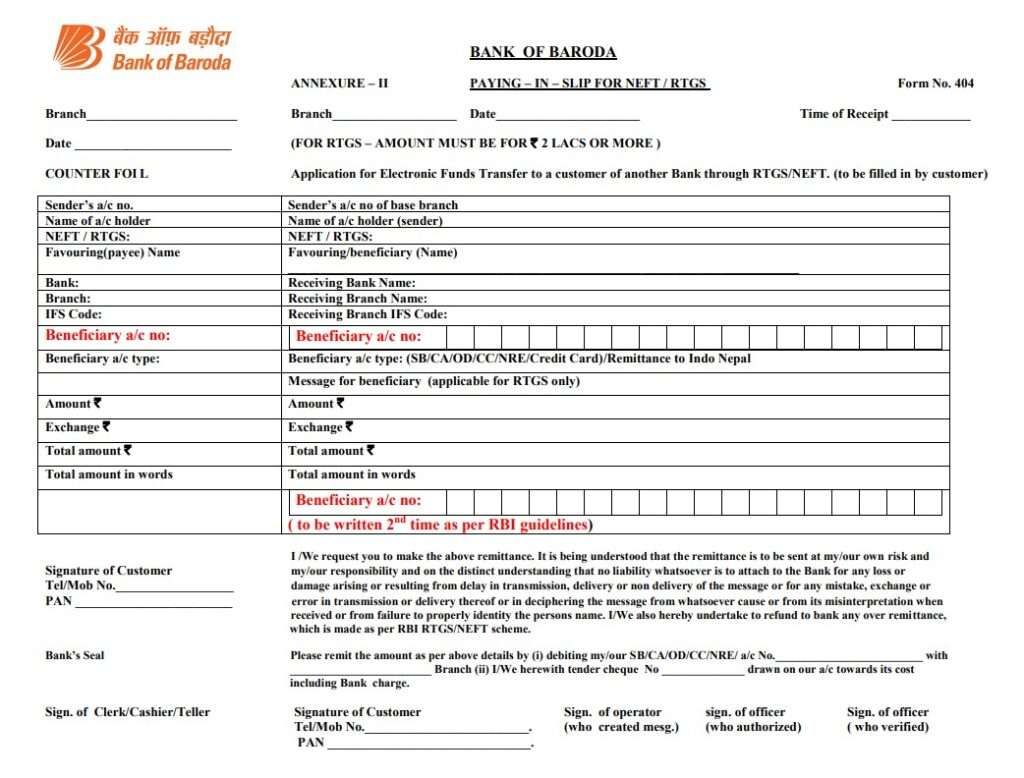

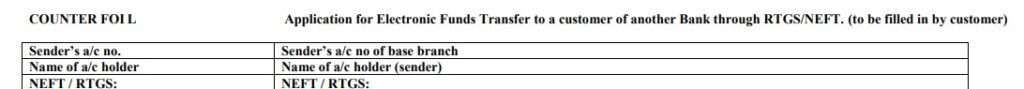

The BOB RTGS/NEFT form is side by side – the left half is your Counterfoil (customer copy) and the right half is the Bank Copy. You need to fill in both sides with exactly the same details. Also, you have to ignore the NEFT sections.

That’s what confuses most first-time users. But once you know the structure, it’s actually quite simple and foolproof.

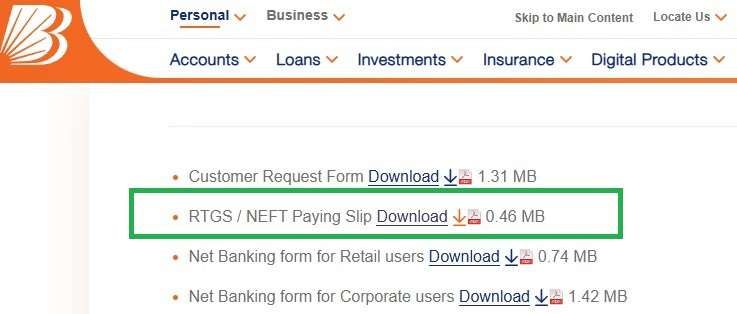

How to Download the Official Latest BOB RTGS Form PDF

The form is available only on the official Bank of Baroda website for customers. Here’s how you can get it:

- Go to the Bankofbaroda.Bank.In – this is the official site after October 2025. The bank recently changed its URL as per the RBI policy.

- Scroll down all the way to the footer section (end of it).

- In the Resources section, tap on Download Forms.

- Under the Popular Forms section, the second option you will see is for NEFT/RTGS.

- Remember: there is only one form for both NEFT and RTGS.

- If your transfer is less than ₹2 lakh, it will be processed as NEFT.

- If your transfer is ₹2 lakh or above, it goes as RTGS.

- So you don’t need a separate form.

- Tap on Download. The form is available in PDF format in both Hindi and English. You can print any language you want.

Tip – For quick access, here’s the latest direct download link:

| File | Latest link |

|---|---|

| Original BOB RTGS Form PDF | Download It via BOB |

How to Get the Physical RTGS Form at a Branch

Not everyone wants to download and print. You can also pick up the form directly at your branch.

Here’s how it works in real life:

- Walk into any BOB RTGS-enabled branch. You can use the Bob Branch locator for that.

- Near the cash counter or enquiry desk, you’ll usually see a rack of forms.

- Ask for the RTGS/NEFT Pay-in Slip.

- The staff may hand it to you or point to the stack.

- Collect the slip and fill both sides before approaching the teller.

Note: Not every branch does RTGS Fund Transfer. Smaller branches may only handle NEFT. Always confirm first that your branch is RTGS-enabled before visiting.

Filling Process: Step-by-Step Bank of Baroda RTGS Form

To make it uncomplicated for you, here is a breakdown of each section. You can use any blue ink regular pen and start writing left and right.

1. Simple Header Fill up

- Write your branch name, for example – “Rewari”.

- Enter the date, demo – 25/12/2025

- Time of Receipt – leave it blank; bank staff may fill this (they use it because charges depend on the timing of RTGS via branch).

2. Sender’s Account Information

- Sender’s A/c No. – your account number (from which money will be deducted).

- Name of A/c Holder – your full name.

- NEFT / RTGS – write clearly depending on your transfer size.

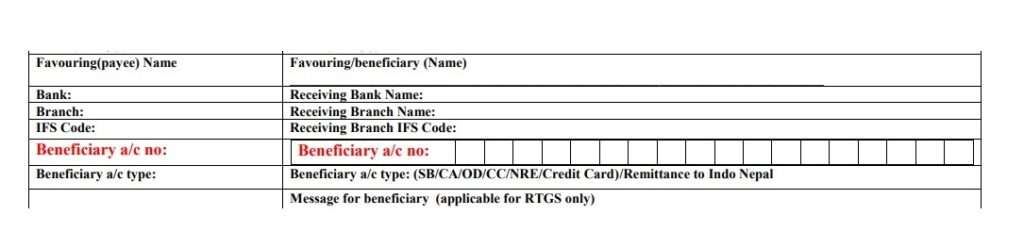

3. Beneficiary Details (Where your money goes)

- Favouring (Payee) Name – the receiver’s name. Example: “RAVI KUMAR”.

- Receiving Bank Name – such as “HDFC Bank”.

- Branch – write location. “Rewari City”.

- IFS Code – the exact IFSC in capital letters. Example: “HDFC0001234”.

- Beneficiary A/c No. – the receiver’s account number.

- Beneficiary A/c Type – select SB (Savings), CA (Current), OD (Overdraft), CC (Cash Credit), or NRE (Non-Resident External).

- Message for Beneficiary – For RTGS, you can enter a note such as “Rent” or “Flat Down Payment”. Optional for NEFT.

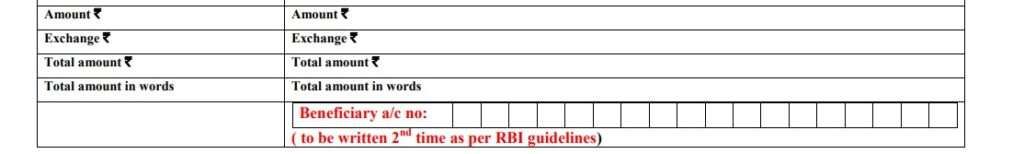

4. Amount & Exchange

- Amount – Enter your amount in Digits, then add the “/-” sign.

- Exchange ₹ – this is where BOB’s RTGS/NEFT charges are filled.

- Total Amount ₹ – add both together. Example: *3,00,029/- or ask the branch for the fill-up only amount or not.

- Total in Words – write the same in words, e.g. “Three Lakh and Twenty-Nine Only.”

- Beneficiary A/C – Again, A/c put it.

Important: As per RBI, the beneficiary account number must be written twice – once in this section, and once again after “Total Amount in Words.” Transfers are executed only on the account number, not the name and other details.

How the Exchange section Works:

- Exchange = BOB’s service fee.

- The transfer amount is either debited directly or through your self-cheque.

- The “exchange” fee is debited separately.

- So if you wrote a self-cheque for ₹3,00,000, the bank will also debit ₹29 automatically from your balance.

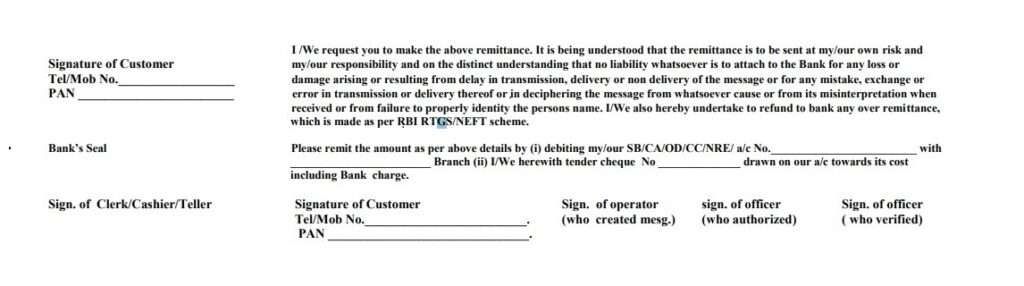

- PAN – write your PAN card number (safe to always fill it).

- Mobile No. – ideally, your registered number for SMS updates.

- Signature of Customer – sign clearly.

Then:

- Please remit… by debiting my A/c No. ____ with ____ branch – fill in your account number again (sender only) and branch name.

- Cheque Section – enter 6-digit cheque number if paying via cheque. If direct debit, leave it blank. (Confirm with the branch at last)

About Cheque Requirement for RTGS

- Not Mandatory: You can simply allow the bank to debit your account.

- When Required: Some branches may ask for a self-cheque for internal proof.

- Write a cheque in your name or “Self.”

- Amount = only transfer amount (e.g. ₹3,00,000).

- Do not include charges in the cheque.

- Attach a cheque with the form if asked.

If not asked, you can submit the form without a cheque.

What Happens After Submission, And When the settlement of RTGS

- Submit the form (and cheque if applicable) to the teller.

- The teller checks details, stamps the Customer Copy (left side), and returns it to you.

- The Bank Copy (right side) is retained for processing.

- The normal timing is just 30 minutes; however, in some cases, it takes about 2 hours, and your money is transferred through RTGS.

- You can use your stamped customer copy to track or query at the branch.

RTGS Charges at Bank of Baroda (Branch)

- ₹2 lakh to ₹5 lakh

- 9:00–12:00 hrs → ₹28

- 12:00–15:30 hrs → ₹29

- 15:30–17:30 hrs → ₹33

- After 17:30 hrs → ₹33

- Above ₹5 lakh

- 9:00–12:00 hrs → ₹55

- 12:00–15:30 hrs → ₹56

- 15:30–17:30 hrs → ₹61

- After 17:30 hrs → ₹61

Note – charges include GST. This information is not updated because, government changed the timing of banks in 2025.

Govt. of India adjusted office hours for BOB for RTGS 2025

- Official working hours: 10:00 AM to 4:00 PM (Monday–Saturday, 2nd & 4th Saturdays closed).

- Lunch break generally between 1:30 PM to 2:15 PM (timing may vary by branch).

- During lunch:

- Some counters may be fully closed.

- Others may run with limited staff, so processing is slower.

- If you submit an RTGS/NEFT form during this time, expect a waiting period.

- Best practice:

- Submit forms before 1:30 PM for smooth processing.

- Or wait until after 2:15 PM when all counters are back.

RTGS via Baroda Connect (Online 24/7, Free)

If you are using Baroda Connect net banking, the process is faster:

- Add a beneficiary online (one-time registration and 30-minute cool period for each new beneficiary).

- Initiate RTGS within the allowed time window.

- Once submitted, you will get an SMS with a Tracker ID.

- You can use this ID to check the status of your transfer in real time.

- The settlement timing is lesser than branch.

Add-on Queries for customers

What are the RTGS transfer minimum and maximum limits at BOB?

The minimum RTGS amount is ₹2 lakh. However, there is no maximum limit, but it depends on your account type and channel, usually ₹10 lakh per day for retail via branch.

Can I do BOB RTGS without a cheque?

Yes, RTGS can be done without a cheque. The bank will directly debit your account, while still some branches may request a self-cheque to cover the transaction limit of your account type.

What happens if RTGS is done but not credited?

If RTGS isn’t credited, funds are usually reversed within one working day. If delayed, you can raise a complaint with BOB’s grievance portal.

How to complain if RTGS is delayed in BOB?

Simply visit the Bank of Baroda Grievance Redressal portal, tap on online complain form, Select Remittances – RTGS and enter your account details, and submit your complaint online with transaction details.

Why does the BOB RTGS form need to be filled out on both sides?

Bank of Baroda uses a dual-copy layout. Left is the customer counterfoil, right is the bank copy. Both must match exactly, or the teller pauses processing for manual verification.

Is the BOB RTGS form different for NEFT and RTGS transfers?

No. BOB uses one combined NEFT/RTGS form. Amount decides routing automatically—below ₹2 lakh becomes NEFT, ₹2 lakh or more goes via RTGS without a separate slip.

Why does BOB ask for the beneficiary account number twice on the form?

As per the RBI process flow, RTGS executes only on the account number, not the name. Writing it twice reduces digit-error risk and protects customers from irreversible wrong credits.

Is submitting a cheque compulsory for RTGS at the Bank of Baroda?

Not mandatory. Most branches directly debit your account. Some may ask for a self-cheque for the internal audit. If used, write only the transfer amount; never include charges.

When should branch RTGS be avoided and online RTGS preferred?

You can avoid branch RTGS during 1:30–2:15 PM lunch or late evenings. Baroda Connect online RTGS is 24×7, usually free, and gives instant SMS tracking IDs.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.