What is a Cheque Book?

A Cheque Book is a handy booklet provided by your bank, which contains multiple cheque leaves. Each leaf is like a ready-made order slip; you can use it to instruct your bank to pay money from your account to another person, business, society, or any other institution.

According to the RBI circular, Cheque forms should be printed in both Hindi and English. You can write cheques in Hindi, English, or the concerned regional language.

Unlike your digital mobile transfers, your cheque book offers physical proof of payment. For example, if you want to pay your landlord, donate to a charity, or submit post-dated cheques for a loan EMI, the cheque book becomes convenient. Once it is signed, it becomes a legally valid instrument.

How to Apply for a Cheque Book

After opening a savings account in most banks in india, they issue a small 10 to 25-page cheque book for you, it included in your welcome kit. But if you opened a digital account, most private banks ask you to request it. Also, a few accounts, such as BSBDA, do not have a chequebook facility.

If your account type is eligible for a cheque book, then requesting a book today is much easier than it used to be. Banks allow you to place a request in multiple ways – the most convenient is Netbanking or mobile banking –

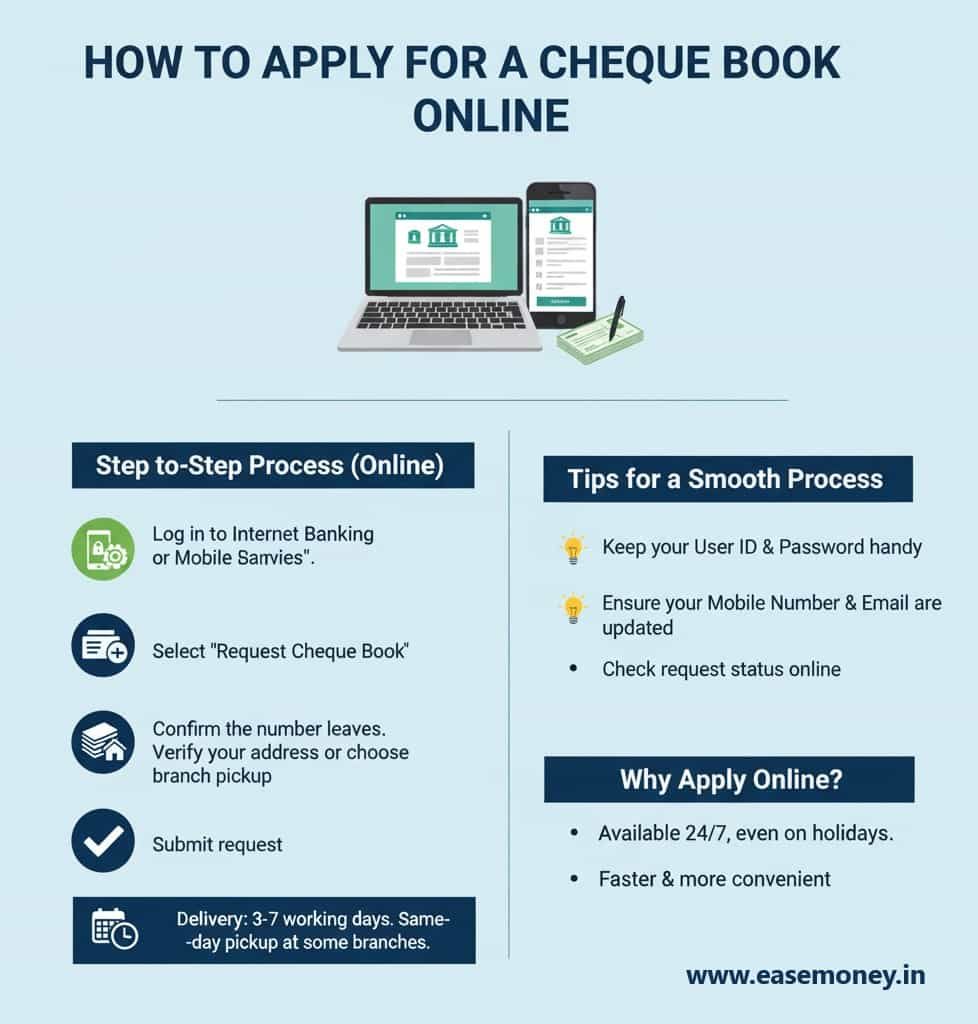

How to use Netbanking for a Chequebook Order (General)

- Log in to Internet Banking or the Mobile Banking App on your phone.

- Go to the Service Requests section.

- Select Request Cheque Book.

- Choose your account number (if multiple).

- Select how many leaves you want,

- Check the price, delivery charges, and GST of it.

- You can add a new one or choose any existing address to order it.

- Confirm the number of leaves you need.

- Verify your address or choose branch pickup.

- Submit the request.

- You will get the SR number to track it using the same netbanking method.

- All Done! It will be delivered to your address as per the estimated time.

- The deduction is automatically made from your account after delivery.

If you are an ICICI Bank, SBI, or Axis Bank customer, the request flow might vary slightly, but the idea remains the same—you’re simply telling the bank, “I need a new cheque book, please issue one linked to my account.”

Here are the common ways to apply for a cheque book in India:

- Bank Website AI Chatbot – This is one of the simplest, most private banks, such as Axis. Go to the site, chat with the bot, say I want a chequebook, it asks your mobile number and OTP to order it for you instantly.

- Mobile Banking App – Most apps like iMobile (ICICI), YONO (SBI), or Axis Mobile let you apply in just 2–3 taps.

- ATM – Some banks allow cheque book requests through their ATMs under “Other Services.”

- SMS Banking – Most banks allow SMS banking. Just check the exact code for the request on the official site, and send an SMS.

- Branch Visit – Collect from the branch counter or Download First. Fill out a customer request form or application letter at your home branch. This is useful if you want an urgent issue or same-day collection.

- Phone Banking/IVR – A few private banks let you raise a cheque book request by calling customer care.

Delivery timing – Banks usually deliver the cheque book within 3–7 working days, either by courier (Bluedart, Delhivery) or speed post (India Post). Some premium branches allow same-day collection.

How to get a cheque book immediately

Most government and private banks allow an emergency cheque book facility. In any urgency, you need a cheque. You can visit your branch, and they will issue a cheque book immediately.

The bank staff will give you hand written account number and name on it. It has higher charges than normal cheque books. You can confirm with your branch.

Bank Wise Cheque Book Request Process

| Bank | Process | Note |

|---|---|---|

| ICICI Bank | WhatsApp and SMS Banking | Free for savings accounts; leaves may vary. |

| SBI | Apply via the YONO app and SMS | Issued in 7–10 days; track online. |

| Axis Bank | Insta services and more | Choose size; home delivery available. |

| HDFC Bank | New Netbanking portal 2025 | New charges |

| Bank of Baroda (BOB) | You can use the BOB chatbot to request it | 2 Cheque book free for savings account |

| Kotak Mahindra Bank | Web portal and New mobile app | Not free for 811 Full KYC accounts. |

| Union Bank of India | WhatsApp Banking is fast option | Rs 5.90 charges per leaf. |

| Canara Bank | You can use Canara Bank A1 | The charges are starts from Rs. 4 + GST |

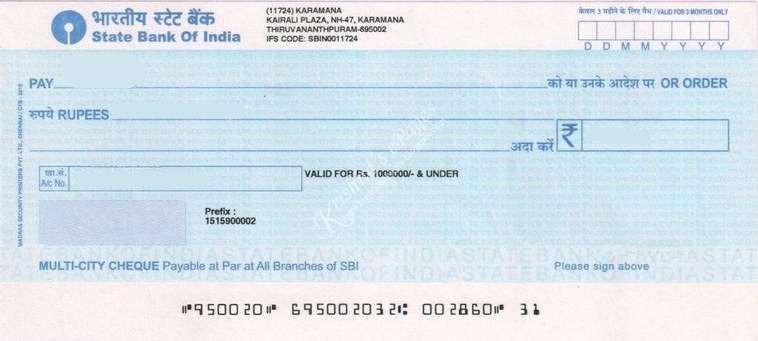

How to Fill a Cheque Book

Technically, you don’t “fill” a cheque book; the pages come pre-printed with your name, account number, MICR code, and cheque serial numbers. What you fill in are the cheque leaves whenever you issue a payment.

Here are the simple steps:

- As always, you have to start writing with the date.

- Add the payee’s name (the person or business you are paying).

- Enter the amount in words clearly without leaving gaps. After, put the “only” word at the end.

- Now, write the amount in numbers inside the box. end of it gives “/-” sign.

- Sign the cheque exactly as per your bank records.

- You have to sign twice backside of the leaf. It is required for the match.

Note – If your bank gives a transaction record sheet (common in ICICI and HDFC cheque books), note down the cheque number, date, and payee for your own tracking.

Is a Cheque Book Free or Charged?

As per the RBI policy, you are entitled to a minimum of 25 cheque leaves per year, free of charge, upon request in savings bank accounts.

Beyond that, the cost depends on bank policy:

- Public Banks (SBI, PNB, Union Bank): Generally free up to 10 or 20 leaves per year, then ₹2–5 per additional leaf.

- Private Banks (ICICI, HDFC, Axis): Free for premium accounts, but chargeable for regular accounts after a limit.

- Current Accounts: Usually get higher free limits since they’re used for business.

- Instant Cheque leaves: It goes from ₹100 to ₹150 per 5 leaves.

You can check the latest service charge on your bank issued circular. It’s available on your mobile banking app and the bank’s official website.

Cheque Book First Page: What You’ll Find

When you open a new cheque book, the first page is more than just a cover. It usually contains:

- Account Details: Your account name, address, and branch details.

- Customer CIF: Your customer ID or CIF number is usually not printed on individual cheques, but sometimes appears on the first page of your cheque book.

- Instructions: Guidelines on how to issue cheques properly.

- Requisition Slip: A detachable slip that you can use to request a new cheque book in the future.

Who is Eligible for a Cheque Book?

Almost every bank customer is eligible for a cheque book.

- Savings account holders get a personal cheque book.

- Current account holders receive a business cheque book with more leaves.

- Salary accounts often come with a standard 25-leaf cheque book.

- Minor accounts and basic savings accounts may have restrictions.

- Most zero-balance digital accounts do not have a facility.

If your account is active and KYC is complete, you can request one anytime.

How Many Leaves Does a Cheque Book Usually Have?

The number of cheque leaves in a cheque book depends on your account type and bank policy:

- Savings Account Holders: Typically receive 10 or 25 leaves in one cheque book.

- Current Account Holders: Often get 50 or 100 leaves, since businesses use them more frequently.

- Premium Customers: Some banks issue personalised cheque books with even larger sets, depending on account privileges.

For example, if you request a cheque book via YONO – SBI allow upto 100-leaf cheque books for savings accounts.

Who Uses a Cheque Book in 2025?

- Business owners who prefer physical proof of payments.

- Senior-citizens who find digital banking difficult.

- Government offices where payments are still processed via cheques.

- Property transactions and legal settlements that demand written, signed instruments.

- Corporate accounts where bulk cheque payments are issued.

Even though mobile payments dominate, cheque books aren’t disappearing anytime soon.

Can a Cheque Be Rejected?

Yes, and it happens more often than people expect. Cheques can be rejected due to:

- Signature mismatch with bank records.

- Overwriting or correcting on the cheque.

- Insufficient balance in the account.

- Using a stale cheque (older than 3 months).

- Damaged or tampered cheque.

To avoid this, always write carefully, keep enough funds in your account, and issue cheques only when necessary.

How Long is a Cheque Valid For?

As per RBI rules, your cheque leaves are only valid for 3 months, timing is usually printed just at the top. For example, if you write 15th July on a cheque, it remains valid till 14th October. After that, it becomes stale and will be rejected.

What Are the Types of Cheques?

Cheques are not all the same. Based on their usage, there are several types:

- Bearer Cheque: Payable to the person holding it, without needing ID proof.

- Order Cheque: Payable only to the person whose name is written.

- Crossed Cheque: As per its name, it usually has two slanting parallel lines, which makes it payable only through a bank account, not in cash.

- Post-Dated Cheque: A cheque with a future date; it cannot be cashed until that date.

- Stale Cheque: A cheque older than 3 months, automatically invalid.

- Banker’s Cheque: Issued by the bank itself, guaranteeing payment.

Knowing these types helps you use the right cheque for the right situation.

Customer Additional Queries

Can I track my cheque book delivery online?

Yes, you can, when you apply for a chequebook by any method, SMS, online or branch, they provide you a SR number, you can use it to track. Also, after 48 hours of applying, most banks share courier tracking details via SMS.

How can I cancel a cheque book request?

If requested online, you can cancel through mobile or net banking, go to services, tap on the cheque stop facility. For branch requests, contact the manager to stop processing.

What happens if the cheque book is lost?

You have to immediately report the loss to your bank via customer care or the Mobile app, block the unused leaves, and request a new cheque book to prevent misuse.

What is the MICR Code in a Cheque Book?

The line of numbers at the bottom of each cheque is your MICR code. If your MICR is 400229001, the digits point to a Mumbai-based branch of a particular bank.

What’s the Difference Between a Check and a Cheque?

The difference is only spelling; typically, “cheque” is used in British English for India or the UK, but check is an American English word; however, both refer to a banking booklet.

Do banks still issue cheque books automatically in 2026?

Mostly no. Branch experience shows banks now issue cheque books only on request, especially for digital accounts. Welcome kits rarely include them unless it’s a salary or premium account.

What is the fastest way to get a cheque book urgently?

Visit your home branch early morning. Many branches issue an instant emergency cheque book (5 leaves) on the same day, but charges are higher, usually ₹100–₹150.

Why do banks prefer customers not to use cheques anymore?

Cheques involve manual clearing, fraud risk, and delays. Data point: digital transfers settle within minutes, while cheques take 1–3 days and increase operational cost for banks.

Can a cheque bounce even if money is available?

Yes. Common reasons include signature mismatch, overwriting, or stale date. Branch tip: always sign exactly as per bank records and avoid even small corrections.

Is it safe to keep unused cheque books for long periods?

Yes, but store securely. Smart idea: keep a photo of unused cheque numbers. If lost, banks can instantly block only those specific leaves.

Why do cheque books arrive faster in tier-2 or tier-3 cities?

Courier load is lower. Branch data shows metros face delivery delays due to volume, while smaller cities often receive cheque books within 3–4 working days.

Is the RBI rule of free 25 cheque leaves applicable everywhere?

It applies broadly to savings accounts, but banks set conditions. Many now give 25 free leaves per year only on request, not automatically.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.