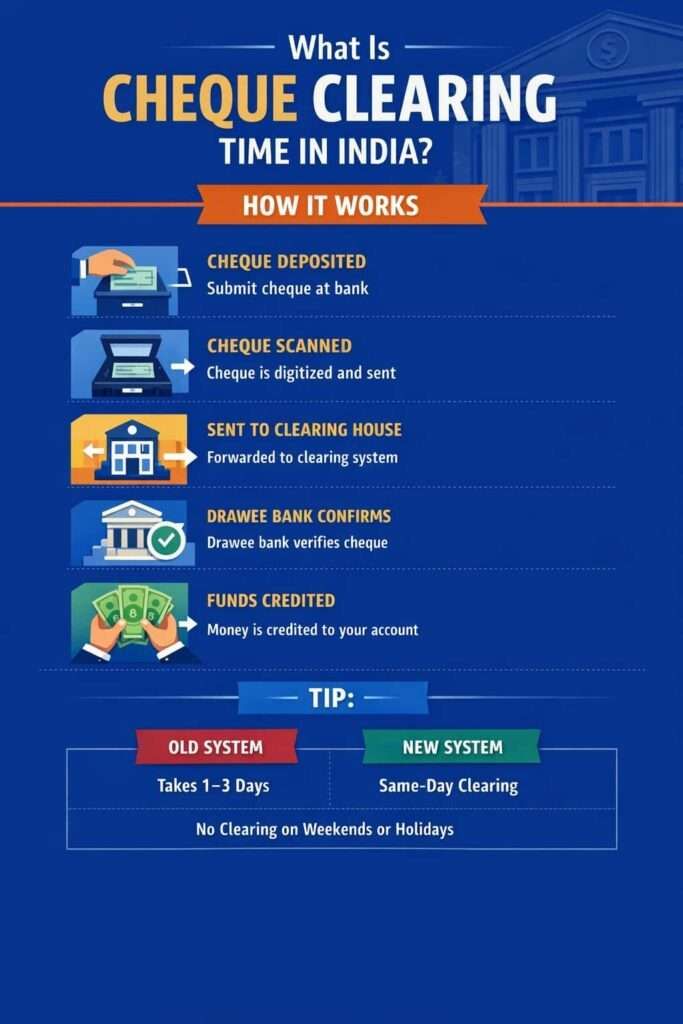

Cheque clearing time in India is the actual duration between depositing a cheque and the final credit amount after confirmation by the drawee bank. It involves the bank exchanging and verifying the cheque through a clearing house, such as CTS, launched in 2008 in Delhi. 2008 in Delhi.

This time is governed by the Cheque Truncation System (CTS) framework issued by the Reserve Bank of India. It means when you provide a cheque to the bank, any type of cheque, salary, crossed, or corporate cheque, it goes from it, and it applies uniformly to PSU banks, private banks, RRBs, cooperative banks, and commercial banks connected to CTS grids.

But, until 2025, cheque clearing time depended heavily on batch cycles, grid location, and outstation status. So, it needs a new update. Then, RBI and NPCI both launched an updated version of it, from 4 October 2025, changed this definition fundamentally with the introduction of Continuous Clearing and Settlement on Realisation (CCSR), which drastically cuts clearing from days to hours (same-day or T+3).

This system is called real-time settlement due to its nature. Let’s find out how the old system works, then what really changed now.

How Cheque Clearing Worked Before October 4, 2025 (Old System)

Before October 2025, cheque clearing operated on fixed daily batches, not real-time processing. The older system was usually processed and was highly standardised under the CTS-2010 guidelines. A batch system means, when you deposit a cheque, the bank scans it but does not send it immediately. Cheques collected till, say, 2 PM, were kept together and sent as a single batch in the evening. The clearing house then sent this batch to the payer’s bank the next working day. Because of this waiting system, even a cheque deposited at 10 AM often got credited after one or two days, not on the same day.

Key characteristics of the old system:

- Cheques collected during the day were clubbed into batches

- Clearing happened in the next working day cycles or was delayed due to holidays

- Separate timelines for local and outstation cheques

- Manual dependencies increased the delay risk

Actual Timings Under the Old System

| Cheque Type | Typical Clearing Time |

|---|---|

| Local cheque | T+1 working day |

| Outstation cheque | T+2 to T+3 working days, In some cases, it can be delayed for 7 to 10 working days |

| High-value / exception cases | Up to 4–5 days |

Even if your cheque was deposited at 10 AM, it often entered the next batch, making same-day credit almost impossible.

Why RBI Replaced the Old Cheque Clearing Model

RBI find out the top 4 systemic issues

- Slow clearing cycle – Physical transportation meant that local cheques typically took 2-3 days to clear, but other outstation cheques could take anywhere from 4 to 10 days, creating a “float period” where funds were unavailable. In 2025, when UPI takes 1 or 2 seconds, this is really slow for NPCI.

- Liquidity inefficiency – Businesses and individuals lost 1–3 days of usable funds in the same cities or connected states despite digital banking growth.

- Mismatch with modern payment rails – This is a new era for NPCI – UPI, NEFT (24×7), and RTGS made cheque delays look structurally outdated.

- Operational risk concentration – Batch processing meant that one failure delayed thousands of cheques together.

As per the Economic Times, the policy decision was announced in 2024 but implemented from 4 October 2025. In one word, the biggest change RBI made with this new system, they removed the batches completely. RBI has also given a role to NPCI to operationalise CTS and the Continuous Cheque Clearing System. NPCI will act as a Cheque Processing Centre (CPC) and will process electronic cheques and images received from member banks.

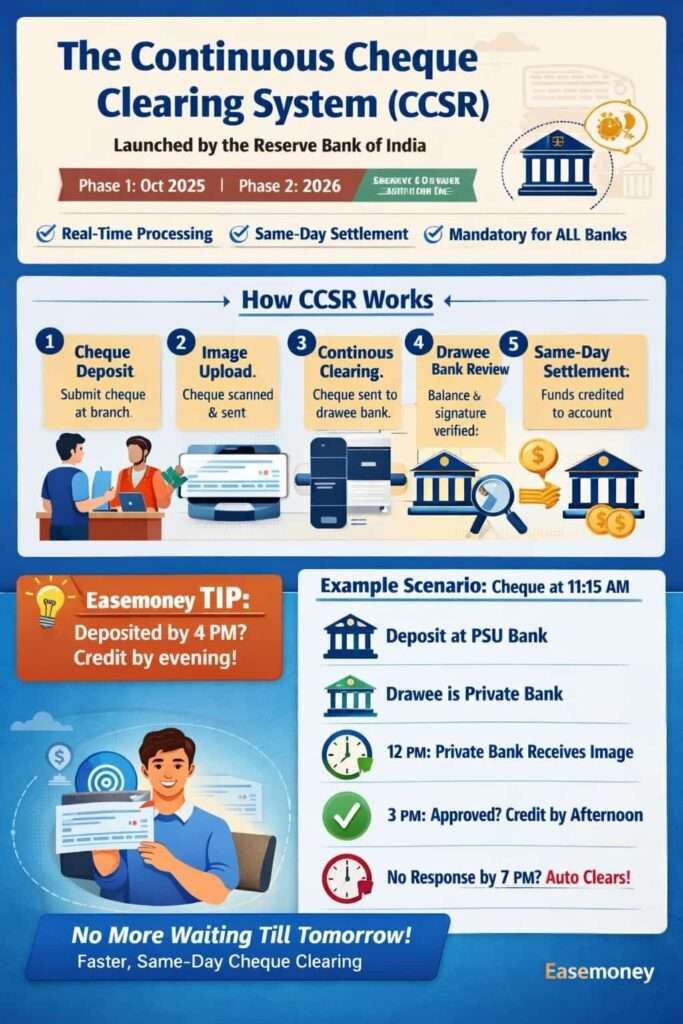

What Is the Continuous Cheque Clearing System (CCSR)?

Continuous Clearing and Settlement on Realisation, as per its name, it also works continuously. Cheques are processed as and when they are deposited, unlike waiting for batch cycles. It launched in late 2025. As per RBI, it has 2 phases, the first phase beginning on October 4, and 2nd phase will roll out in 2026.

The real-life difference is here, also the core principle of it –

- It works on Image-based cheque data transmitted continuously to clearing houses

- Drawee banks receive items throughout the business day

- Settlement happens on the same day, not the next day (holidays still count as no CTS days)

This system is mandatory for:

- PSU banks

- Private sector banks

- Regional Rural Banks (RRBs) – Gramin Banks

- Cooperative & commercial banks

No bank category is exempt.

New Cheque Clearing Timings (Applicable in 2026)

As per the news, the official RBI Time Windows (Phase-1 Active)

Cheque Presentation Window

- 10:00 AM to 4:00 PM on working days – (same as the branch opening and closing timings, lunch timing can be different)

Drawee Bank Confirmation Deadline

- Up to 7:00 PM on the same day

If a cheque is deposited within the presentation window, it must be:

- Scanned

- Transmitted

- Presented to the drawee bank the same day

Real-Life Example (2026 Scenario)

Scenario

- Cheque deposited at 11:15 AM in a PSU bank branch

- Drawee bank is a private bank

What Happens

- Cheque image uploaded immediately

- Drawee bank receives the item by ~12 PM

- If approved by 3 PM → credit reflects same afternoon

- If no response till 7 PM → cheque auto-clears

Under the old system, this same cheque would likely credit next day or later.

What Happens Step-by-Step Under the New System

Step 1: Cheque Deposit

You visit a branch and deposit a cheque at the counter or drop box before 4 PM.

Step 2: Image Capture & Upload

Presenting bank captures the CTS-compliant cheque image and uploads it immediately, not end-of-day.

Step 3: Continuous Presentation

Cheque enters the clearing stream instantly instead of waiting for batch cut-offs. Here, the NPCI CTS did its job.

Step 4: Drawee Bank Action

A drawee bank, such as SBI or HDFC, must:

- Verify your current balance

- Verify account holder signature

- Check stop-payment or lien

- Confirm honour or dishonour

Step 5: Settlement

- If confirmed → funds move to the beneficiary bank

- Credit is posted the same day, often within hours

What is the Auto-Approval Rule in this New Cheque clearing system 2025?

Under the new system, the key feature in the first phase is that if the drawee bank does not respond by 7:00 PM and does not confirm or reject the cheque, the cheque is deemed approved and settlement proceeds automatically. This rule never existed before in india.

It is a matter because Banks can no longer delay confirmations casually, Liquidity float for drawee banks is reduced, and Beneficiary banks gain settlement certainty.

This single rule is why cheque clearing time has effectively moved from days → hours. In the second phase, it will improve faster, which means if a cheque is presented by 11 AM must be confirmed by 2 PM.

What About the 3-Hour Cheque Clearing Rule? (The phase 2)

The RBI originally planned Phase-2 from 3 January 2026, and the major change here is the Drawee bank confirmation within 3 hours of presentation.

But on December 26, 2025, the RBI postponed Phase-2 indefinitely; however, NPCI gave the green flag for teething issues in most banks, including commercial or gramin banks. Few, RBI cited operational readiness issues across banks, not confirmed. However, you can read this news – Why RBI Postponed Instant Cheque Clearing Phase 2

As of 2026, there is no legally enforceable 3-hour clearing rule as of now. Any bank claiming “guaranteed 3-hour clearance” is misrepresenting RBI policy. but Phase 1 active and working all banks of india, however, practical reality mostly depends on Branch-level scanning delays, Staff training issues, and Legacy core banking systems. But timing obligations are identical across bank categories.

Where Delays Can Still Occur

Even under the new system, delays can happen due to:

- Poor image quality

- Signature mismatch

- Insufficient funds

- Technical outages

- Manual exception handling

The system reduces time; it does not remove banking checks.

Why Cheques Still Matter in a digital world, such as UPI Growth

In 2024 alone:

- 62+ crore cheques were processed in India

- High-value business transactions still rely on cheques

- Legal, audit, and documentary acceptance remains strong

RBI’s actions is not about reviving cheques, but about eliminating inefficiency in a still-relevant instrument.

FAQs

If cheque clearing is same day now, why does my bank still say “processing”?

Because “same day” does not mean instant. The cheque still has to be scanned, sent, checked by the payer’s bank, and confirmed. Many branches use internal systems that update status only after settlement, so customers see “processing” even when the cheque is already moving in the system.

I deposited the cheque at 3:45 PM. Will it clear the same day?

Not guaranteed. RBI allows continuous clearing only within the presentation window (usually up to 4 PM). Cheques deposited close to the cut-off may get scanned late and move to the next working day, especially in busy branches.

Does same-day cheque clearing work on Saturdays?

Only on working Saturdays, and even then, timelines are shorter. On bank holidays, Sundays, or non-working Saturdays, cheque clearing does not run at all. Any cheque deposited on those days starts processing on the next working day.

Is cheque clearing faster in private banks than PSU banks?

The rule is the same for all banks, but execution could be differerent due to reasons. Private banks usually scan and upload cheques faster due to better systems. PSU and RRB branches may face delays because of staff load or manual steps — not because RBI rules are different.

Can a cheque still bounce after same-day credit?

Yes, in rare cases. If there is later proof of issues like signature mismatch, stop-payment, or fraud, banks can reverse the credit. Same-day clearing reduces delay, but it does not remove legal and banking checks.

Why does cheque clearing feel slow in small towns or RRB branches?

The clearing system is central, but branch operations are local. In smaller towns, scanning may happen only once or twice a day due to staff constraints. The delay is usually operational, not because the system is old.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.