Let’s start with facts. According to banking reports and Airtel data, over ₹18,000 crore was held under lien for disputed banking transactions in 2024 only.

If we talk about Credit Card Defaults. As per News24, a major trigger for lien marking rose 28.42% to ₹6,742 crore in the 12 months ending December 2024.

- Mule Account Freezes: In Karnataka alone, more than 70,000 mule accounts were identified in 2024, many of which had lien marks or full freezes.

- Response Time: Banks reduced response time for police and legal lien cases from 15–20 days in 2024 to around 5–7 working days in 2025. However, the RBI policy mandates that banks resolve complaints within 90 days. The new 2025 guidelines further aim to reduce settlement times to 15 days.

Lien is not as simple as it looks. Before we talk about the process of removing it, let’s understand the type of lien exactly –

Types of Lien Used in India

A lien is asset-based, not only bank-account-based. Under RBI-regulated banking, a lien is a lawful restriction placed on funds, assets, or securities to ensure recovery of a financial or legal obligation. Different assets have different lien rules and removal processes. let’s find out –

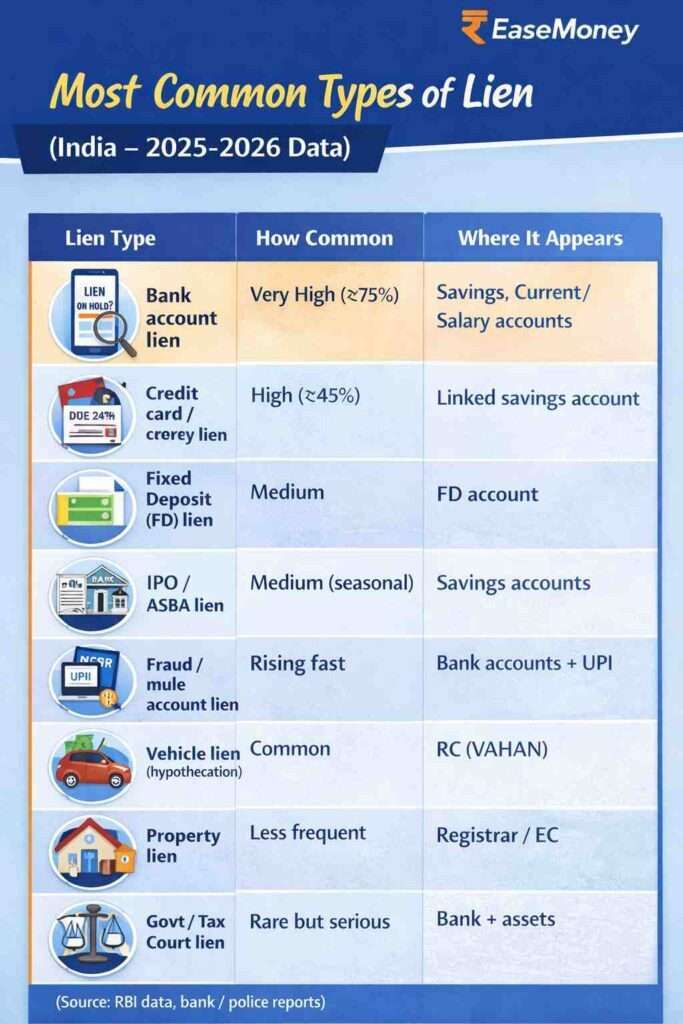

Most Common Types of Lien (India – 2025–2026 Data)

| Lien Type | How Common | Where It Appears |

|---|---|---|

| Bank account lien | Very High (≈75%) Almost daily issues in banking | It applies to savings / Current / Salary accounts |

| Credit card / EMI recovery lien | High (≈45%) | Linked savings account |

| Fixed Deposit (FD) lien | Medium | FD account (OR FD-linked savings account) |

| IPO / ASBA lien | Medium (seasonal) | Savings account |

| Fraud and mule account lien | Rising fast | Bank account + UPI |

| Vehicle lien (hypothecation) | Common | RC (VAHAN) |

| Property lien | Less frequent | Registrar / EC |

| Govt / Tax / Court lien | Rare but serious | Bank + assets |

Source: This list was pulled from RBI supervisory disclosures, bank annual reports, and police cybercrime data.

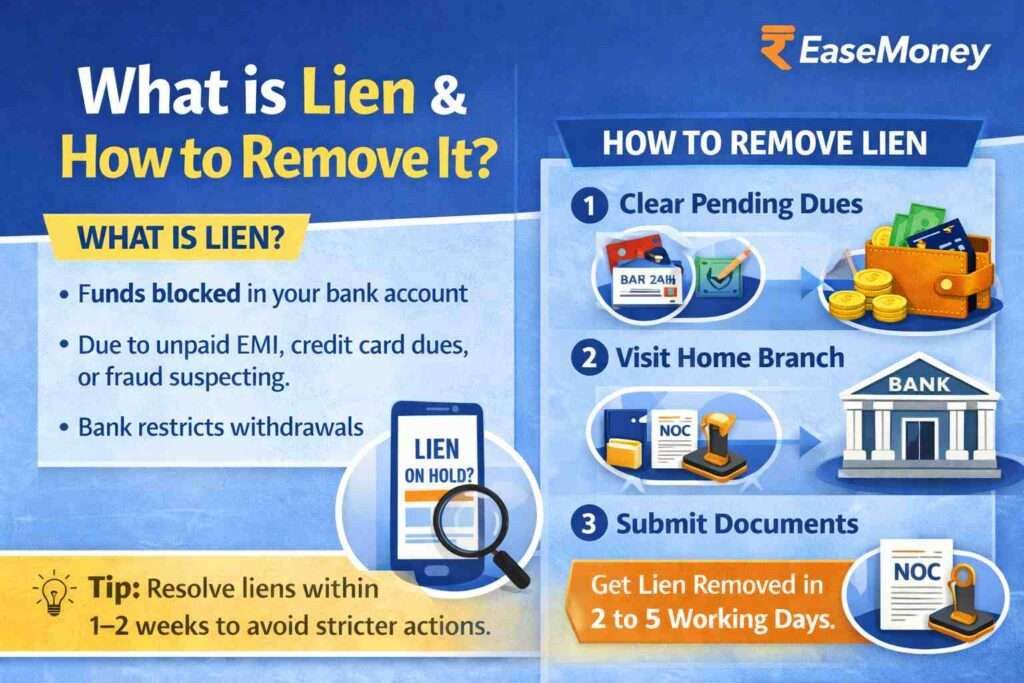

How to Remove a Lien Amount from a Bank Account (Most Common Case)

bank-account-based In Lien marked removal, this process applies to SBI, Axis, Kotak, HDFC, Union Bank, ICICI, BoB, and most Indian banks. No matter what, your bank is a PSU, a Small Finance bank, or a private commercial bank.

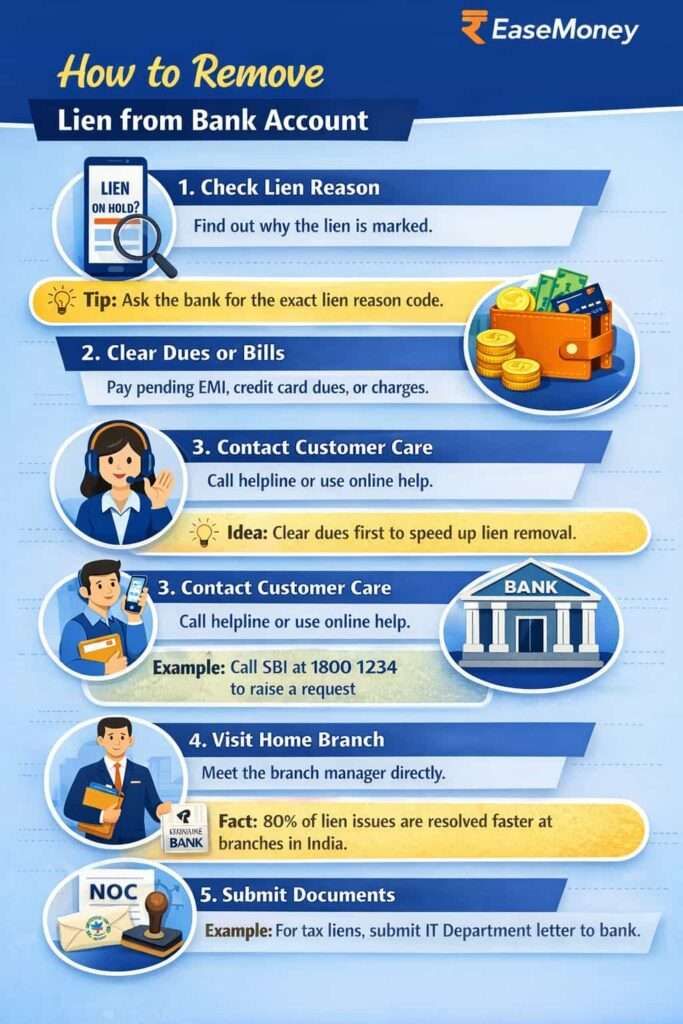

Step 1: Find the Exact Reason (Most Important Step)

Do not make your own assumptions, but use these options-

- Mobile banking app → account summary → lien/hold

- NetBanking – Open your Dashboard, tap on Account overview, and find out how much lien.

- Download your Bank statement and take a screenshot of any lien amount.

- Call your Bank customer care or use Live Agent chat banking (from registered number only)

- Visit the home branch (fastest clarity) – Most PSU branches ask to write a quick letter.

- Ask clearly: “Please tell me the internal lien reason code and date.”

7 out of 10 users waste time because they assume a loan issue when it’s actually a charge or system hold.

Tip – sometimes, just by the lien amount, most people got idea what it’s all about, such as if the lien is around Rs. 550, it can be your debit card fee, that lien due to a low balance.

Step 2: Identify Which Category the Lien Falls Into

Once you get the idea, why is your lien marked, the major problem is solved. Now, lien removal goes into two most common categories: when you have to settle the money and another where you need patience to settle without paying anything.

Category A – No payment required

- Failed UPI payment/ your ATM/card transaction

- Refund under process

- Autopay delay

- System reconciliation

- IPO ASBA block

These clear automatically. Sometimes, the server and banking system delay, but it settles after a few days. For example, recently, one of our clients, Mr Rajesh, he pay loan EMI manually at same date as when the autopay happens. So, Bank lien the same EMI amount and settle after 3 days without any penalty. It happens because the system finds double payment at the same time. In that case, you need patience for at least a week. The solution here, make a payment before the due date OR don’t do anything. Autopay will settle it.

Category B – Payment required

- EMI overdue

- Credit card bill pending

- Minimum balance penalty

- Debit card AMC / cheque bounce fee

These are clear only after dues are settled. You have to pay the unsettled amount. If you find this amount mistaken, contact your bank to settle it.

Category C – Investigation or legal (Rare and special)

- Cybercrime/mule account

- Income tax/court order

- Online Gaming or Betting Fraud account found

- Chinese Scam App or Loan App Fraud

- Other Govt special cases toward your account

The bank cannot be removed without authority clearance. These cases take longer to settle it.

Step 3: If Payment Is Required, Clear Dues First

- Pay Your EMI, any pending card bill, any charges – such as processing fee or foreclosure loan charges.

- Save a screenshot or a receipt

- Do not raise a lien removal request before payment

Most banks lift the lien within 24–72 hours after payment.

Step 4: Raise a Lien Removal Request (If Still Not Cleared)

After payment or special request, you can use:

- Customer care

- Bank help centre

- Email support

- You can create a ticket via the online portal. A few banks, such as Axis Bank or IDFC Allow that.

- Branch (best for stuck cases)

If the lien stays beyond 5 working days, escalate to the nodal officer. However, as per the RBI Fair Practice Code, your bank must explain the lien reason on request and fix the issue within 7 working days, if all is clear.

Bank-Wise Lien Removal Time (Realistic Data)

| Bank | Where Lien Shows | Normal Removal Time |

|---|---|---|

| SBI | YONO / NetBanking | 24 hrs – 7 days |

| Axis Bank | Mobile app / Help Centre | 2 – 5 days |

| Kotak Bank | NetBanking → Lien Inquiry | 3 – 7 days |

| HDFC Bank | “Amount on Hold” | 24 – 72 hrs |

| Union Bank | NetBanking / Branch | 3 – 10 days |

Tip: Open your mobile banking app, check the lien section and always check the Available Balance, not the total balance.

Removal Process for Other Types of Lien (Non-Bank Account)

If your lien does not count in savings or a current account, here other lien, and what is the real solution to remove it?

1. Fixed Deposit (FD) Lien – Loan or Credit Card Against FD

An FD lien is placed when your fixed deposit is used as security, not because of a mistake.

Common reasons:

- Loan against your FD (very common in SBI, HDFC, Axis)

- Secured credit card issued on FD

- Overdraft facility linked to FD

As per RBI deposit rules, banks are allowed to mark a lien on an FD when the customer gives consent at the time of loan or card issuance.

Important for you: FD lien is voluntary, not a penalty.

How to remove FD lien

- Close your FD loan or overdraft completely

- Clear all your linked credit card dues, even small ₹100–₹200 amounts

- Bank system releases the lien automatically

- FD becomes breakable or withdrawable again

Timeline: Same day to 3 working days

Interest: FD continues earning interest during lien period

Real example: If you took a ₹60,000 secured credit card on a ₹80,000 FD, the FD stays lien-marked until the card is closed, even if you never used the card.

Tip: Ask the bank to confirm “FD lien released” in writing or SMS.

2. IPO or ASBA Lien

When you apply for an IPO through ASBA, the bank blocks your money so you cannot spend it until allotment is decided. This is not a recovery lien; it is a temporary system block approved by SEBI and RBI.

How it is removed

- Shares not allotted → money is auto-refunded

- Shares allotted → required amount is deducted

You cannot manually remove an IPO lien.

Timeline: Usually 7–10 working days after allotment (In busy IPO seasons, it may take up to 12 days)

2024 data: During major IPOs, banks blocked over ₹1.2 lakh crore under ASBA liens.

Tip for you: If IPO refund crosses 10 days, contact your bank — not the registrar.

3. Fraud or Mule Account Lien (Fast Growing in 2024–2025)

Why it happens

Banks place this lien when your account is linked to suspicious money flow.

Common triggers:

- Unknown UPI credits

- Gaming or betting app withdrawals

- Money received from scam-linked accounts

As per RBI AML (Anti-Money Laundering) guidelines, banks must immediately restrict funds.

How to remove it

- Firstly, visit your home branch (online requests don’t work here)

- Submit source-of-funds proof (salary slip, invoice, winnings receipt)

- Police or cyber cell verification may be done

- Bank removes lien only after clearance

Timeline: 7–30 days. Sometimes, serious cases can take longer.

Warning: Ignoring this lien can convert it into a full account freeze, blocking even deposits.

Tip: Never accept money from unknown people, even “by mistake”.

4. Vehicle Lien (Car / Bike Hypothecation)

Vehicle lien does not show in bank apps. It exists on your RC in the VAHAN portal.

How to remove it

- Close the vehicle loan fully

- Ask and Collect:

- Bank NOC

- Form 35 (usually 2 copies)

- Apply via:

- Parivahan portal, or

- Local RTO

- RC updated to “No Hypothecation”

Timeline: It takes around 7–20 days depending on RTO speed

Important reality: Loan closure alone is not enough. If RC is not updated, lien legally still exists.

Tip: Always download updated RC from Digilocker after removal.

5. Property Lien (Home / Land)

Property lien is placed for:

- Home loan

- Loan against property

- Court or tax attachment

This lien is recorded in government land records, not just bank systems.

How to remove it

- Clear the loan or dues fully

- Get from bank:

- NOC

- Loan closure certificate

- Visit Sub-Registrar Office

- Register lien release or mortgage satisfaction

- Update Encumbrance Certificate (EC)

Timeline: 15–30 days. Legal or tax cases may take longer.

Quick Fact: Property liens never auto-remove, even after loan closure.

Tip For You: Always check EC before selling or buying property.

6. Government/Tax/Court Lien

Placed due to:

- Income tax dues

- GST recovery

- Court decree or attachment order

This is a statutory lien, stronger than bank lien.

Remove process

- Clear dues with the issuing authority

- Obtain official release order

- Submit order to bank

- Bank updates records and releases funds

Timeline: Depends on authority response

(15 days to several months)

Important: Banks cannot override this lien even if you request.

Example: If Income Tax places a ₹3 lakh attachment, the bank must follow it even if your balance is ₹10 lakh.

FAQs

Why does my bank show a lien even after I paid my EMI?

This happens due to backend delay. In most banks, EMI payments sync within 24–72 hours. Tip: keep payment proof and ask branch staff to check the system lien remark.

Can a bank place a lien without informing me by SMS or email?

Yes. Around 60–70% lien cases have no alerts. Banks usually notify only during transactions. Idea: always check available balance, not ledger balance, before UPI or ATM use.

How long should I wait before escalating a lien issue?

Wait 5 working days after clearing dues. If not resolved, escalate to nodal officer. Branch experience shows early escalation reduces resolution time by 40–50%.

Do I need to submit a lien removal letter to the bank?

Yes, in stuck cases. A simple lien removal request letter with account details and payment proof helps branches act faster. Branch managers often insist on it for manual clearance.

What happens if I ignore a lien for many weeks?

Ignoring lien risks auto-debit, credit score impact, or full account freeze in fraud cases. Tip: unresolved liens beyond 30 days often trigger compliance or recovery escalation automatically.

Can a small unpaid charge like ₹300 really cause a lien?

Yes. Banks routinely place liens for ₹200–₹500 charges like AMB penalty or debit card fees. Idea: review quarterly statements to avoid surprise lien marks later.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.