Lien Marked Explained for Kotak Customers

A lien balance in Kotak Mahindra Bank means a certain amount of money in your savings or current account has been frozen or put on hold by the bank. You can see the total balance in your account, but the lien-marked amount cannot be withdrawn, transferred, UPI, or used until the lien is cleared.

Unlike a simple transaction hold that disappears automatically, a lien is an official banking restriction — it’s used to secure a pending financial obligation, like an unpaid EMI, credit card bill, or recovery of service dues.

In simple words, a lien is the bank’s legal right to lock your funds until the reason behind it is resolved.

How a Lien Works

A lien acts like a safety lock. Kotak marks it to ensure that if a payment, EMI, or charge remains unpaid, the bank can recover the money directly once your account has funds.

Here’s how it typically works:

- Marking the Hold: A specific amount gets frozen — you will still see it in your “Total Balance,” but your “Available Balance” will be lower OR “Withdrawal Amount” will be less than the total balance in your Kotak Mobile Banking App.

- Purpose: The lien serves as security for the bank, ensuring recovery of any overdue payments or service-related dues.

- Loan-Linked Lien: If your PayDay Loan or Personal Loan EMI didn’t go through, the repayment amount is automatically lien-marked.

- If the balance is available later, it’s auto-debited, and the lien is removed.

- If not, the lien remains till payment is cleared.

- Service or Product-Linked Lien: Kotak may mark a lien for other reasons too — unpaid card dues, uncleared cheques, non-maintenance of minimum balance, or recovery dues for services availed.

Unlike a temporary card hold, a lien stays active until the issue is resolved or manually removed by the bank.

Why Is My Balance on Hold?

Your balance may show as “on hold” or “lien-marked” for several operational or legal reasons.

| Reason | Explanation |

|---|---|

| Unpaid EMI or Loan | Lien is marked equal to the unpaid amount until repayment. |

| Credit Card Dues | Recovery of overdue card bills or fees. |

| Service Charge Recovery | For non-maintenance of AMB or other account-related fees. |

| ECS/Auto-Debit Bounce | Penalty or due recovery from a bounced mandate. |

| IPO or Investment Application | Temporary lien until allocation is completed. |

| FD Collateral Hold | When FD is linked to a credit card or overdraft as security. |

Legal Right: The Banker’s General Lien

Under the Indian Contract Act, 1872, banks are entitled to the “Banker’s Right of General Lien.”

This gives Kotak the authority to:

“Adjust or recover any overdue amount from your savings account or any other account held under the same legal capacity.”

So, if your account says “Lien marked as per Banker’s Right of General Lien,” it means the bank legally holds that amount until the obligation is cleared — not an error or accidental freeze.

Lien Against Recovery Dues for Services Availed — Kotak Mahindra Bank

If you see the message: “Lien against recovery dues for services availed by Kotak Mahindra Bank,”

It means Kotak has blocked funds to recover service-related charges — such as non-maintenance fees, ECS bounce charges, or overdue debit card costs.

Unlike an IPO, which holds that release automatically, this lien will remain until the recovery amount is paid or adjusted by the bank.

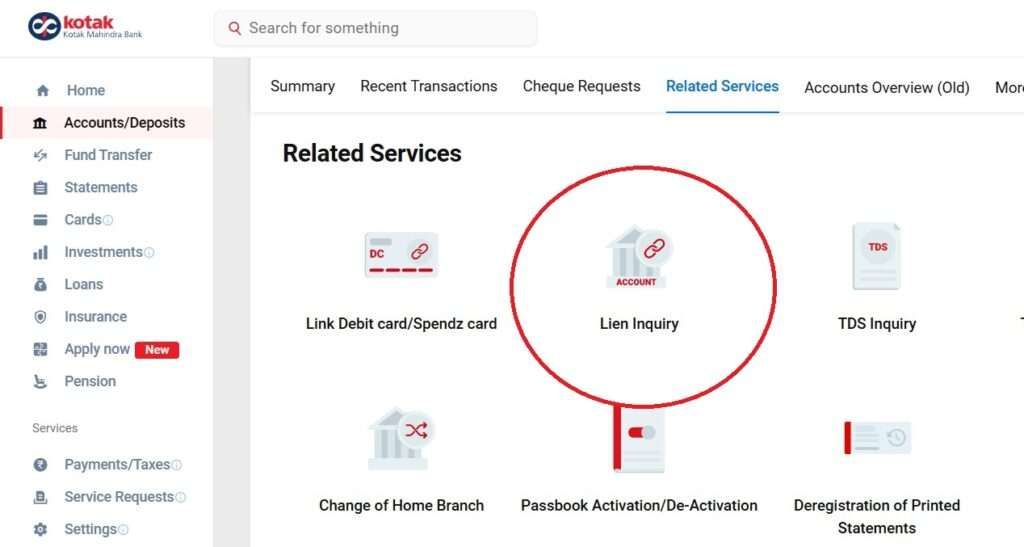

How to Check Lien Details in Kotak Bank

You can easily check lien details in Kotak NetBanking:

- First of all, you need to visit the official site – https://kotak.bank.in

- Log in with your CRN, password, and OTP.

- Go to Accounts, tap on the Deposits/Account option in the left side menu.

- Select your account number to see your balance summary.

- You will notice a line that reads: “This does not include any linked term deposit or Lien (amount on hold).”

- Scroll to the bottom and tap on Balance Details, go to the Related Services section.

- Tap Select an Account to Perform an Action → Lien Inquiry.

- View the full lien amount, date, and reason.

If no lien exists, the page will say “No Lien Found.”

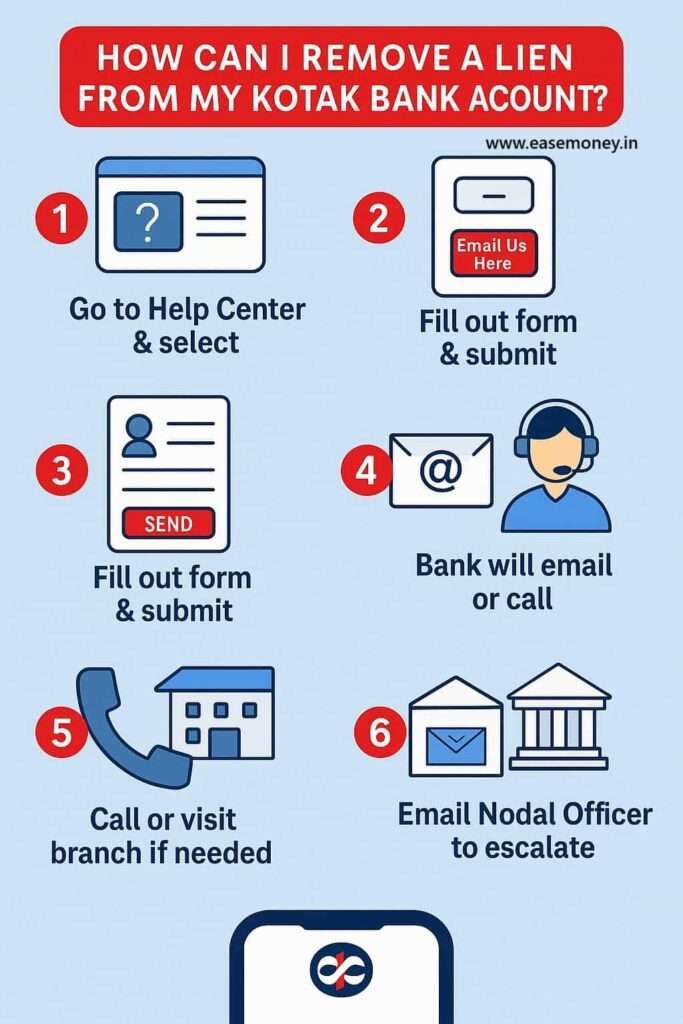

How Can I Remove a Lien from My Kotak Bank Account?

Removing a lien depends on its cause. You can start with Kotak Help Centre or Customer Care Helpline, or you can escalate it through official Nodal officers if your issue is big and solve even after a month.

Here’s the complete, verified, step-by-step process:

Here’s how you can do it:

Level 1: Start from Kotak Help Centre (Online Method)

- Go to the official Kotak site.

- Scroll to the bottom and tap Help Centre (in the footer).

- Choose Bank Accounts → Account Balance related to Bank Account.

- Tap on Why is my balance on hold?

- Scroll to the bottom and under “Was this information helpful?”, select No, need more help.

- Tap on Email us here.

- Select your type: Existing Customer or Non-Customer.

- Enter:

- Your Full Name

- Linked Mobile Number

- Email ID

- CRN Number

- Attach a screenshot or PDF proof showing the lien message

- Write a short description about your issue and add a few details about your account (you can use ChatGPT or Gemini for a short and clear message).

- Once submitted, you will receive an email confirmation. Kotak’s backend team may call or reply via email to you to generate a ticket and solve your issue.

- Processing time: 3 to 5 working days.

Contact Kotak Customer Support

If you’ve already cleared the dues but the lien remains, call customer service to initiate lien removal.

- Helpline:

- 1860 266 2666 (It is toll-free)

- Mon–Sat, 9:00 AM – 7:00 PM

- For Kotak 811 users:

- 1860 266 0811 (The active time usually – 8:00 AM – 8:00 PM, The working days are Mon–Sat)

If the issue is still not solved in this phase, move to Level 2.

Level 2: Escalate to the Nodal Officer

If there’s no action after 5 days, escalate your concern to Kotak’s Nodal Officer.

- First Email Them: nodalofficer@kotak.com

- Telephone: 022-62042110

- The normal timing: Monday to Friday, 10:00 AM to 6:00 PM (Not bank holidays)

Level 3: Escalate Further (If Still Unresolved)

If your lien issue still is not resolved after contacting the Nodal Officer, proceed to the Level 3 Grievance Redressal via the Kotak website:

Here you can raise the matter with higher authorities for final redressal.

What Happens If the Lien Amount Is Not Paid?

If you don’t clear the lien-marked amount:

- Auto Recovery: The bank may auto-debit it as soon as your account receives funds.

- Transaction Block: Withdrawals and transfers may stay disabled.

- Credit Impact: If linked to unpaid loans or cards, it can affect your CIBIL score.

- Prolonged Restriction: The lien remains active indefinitely until resolved.

So, always clear the due or connect with Kotak’s grievance channels quickly.

Additional Questions

My balance is showing, but the lien is marked due to a notice from government bodies — what does that mean?

It means the lien isn’t from Kotak but was placed at the instruction of government authorities, such as the Income Tax department or a court order. You’ll need to contact the concerned department directly.

My lien got marked after a refund from an online transaction — why did this happen?

Sometimes, if a refund is under verification or flagged for a chargeback, Kotak temporarily places a lien till the settlement clears. It usually gets auto-removed in a few days.

My FD is showing “lien marked”, but I never applied for any loan — should I worry?

No need to panic. It’s usually a system hold for linked products like overdraft or card verification. If unlinked, Kotak can release it upon confirmation.

I don’t have any KOTAK loans or credit cards, still lien marked — why?

It can happen due to pending service charges, failed ECS mandates, or account-level verification. Check with customer care to identify the exact internal reason.

Can Kotak Bank mark a lien without sending SMS or email?

Yes. Most Kotak liens are system-triggered, not manually approved. Customers usually notice only after checking the available balance. Tip: Review “Balance Details” whenever EMIs, refunds, or large credits occur.

Does lien-marked money earn interest in Kotak savings accounts?

No. Lien funds do not earn savings interest while blocked. Even though the balance appears intact, Kotak treats it as non-operational until lien removal or auto-adjustment.

Why does the lien remain even after I paid my EMI or dues?

Because Kotak systems take 24–72 hours to sync payments. If the lien stays beyond three working days, raise a ticket with payment proof to trigger manual reconciliation.

Can Kotak adjust the lien amount automatically without my approval?

Yes. If the lien is marked for recovery, Kotak can auto-debit the exact lien amount once sufficient funds arrive. Customers often notice reduction without any separate debit SMS.

Does a lien affect UPI, IMPS, and debit card usage equally?

Yes. Lien reduces available balance, so UPI and card transactions fail if funds fall below usable amount. Pro tip: check “withdrawable balance,” not total balance.

Can Kotak place a lien on FD-linked savings accounts?

Yes. If FD is used as collateral for card, OD, or loan, lien applies automatically. Even unused facilities can trigger holds until linkage is removed by the bank.

Join 60,000 readers who get exclusive credit and banking deals, RBI updates, and investment insights from Easemoney.